TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Citi ThankYou points are one of the three major transferable currencies that I make sure I collect on a frequent basis (the others being Chase Ultimate Rewards points and Amex Membership Rewards points) as these are the currencies that are most flexible, that I find I can use with relative ease, and which (mostly) insulate me from individual program devaluations. I love all three.

Like all the major transferable currencies Citi ThankYou points are relatively easy to earn (if you have the right credit cards) and because they can be transferred to an impressive number of airline loyalty programs, they’re a key element to most people’s miles & points strategy.

Earning Citi ThankYou Points

I earn my ThankYou points from the spending that I put on my Citi® Double Cash Card (review) which earns me 2% back (2 points/dollar) in all spending categories, and on my Citi Premier Card which earns me 3 points/dollar on dining, at supermarkets at gas stations and on spending on air travel and hotels.

Transfer ThankYou Points To Airline Loyalty Programs

Once you’ve built up a good balance of ThankYou points you can use them to book travel through Citi’s ThankYou portal or, like I’ve recently done, transfer them over to one or more of the ThankYou program’s transfer partners.

Here’s a simple step-by-step guide to transferring ThankYou points to an airline loyalty program:

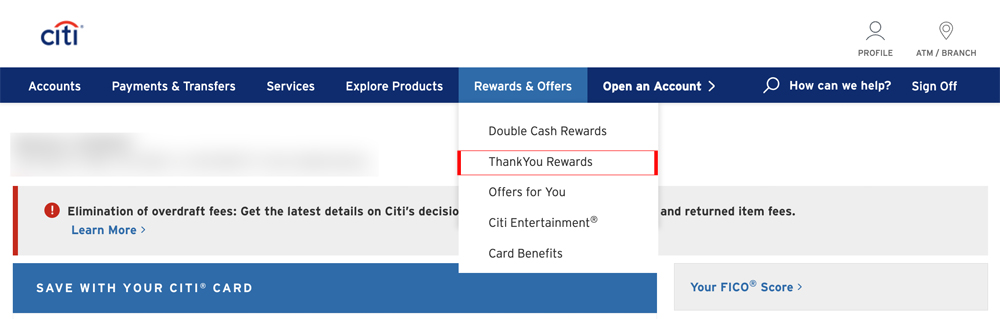

Step 1

Log in to your Citi account.

There’s actually more than one way to get to the ThankYou Rewards portal but for the sake of simplicity, I’m going to focus on just one.

At the top of the Citi account page click on “Rewards & Offers” and then select “ThankYou Rewards”

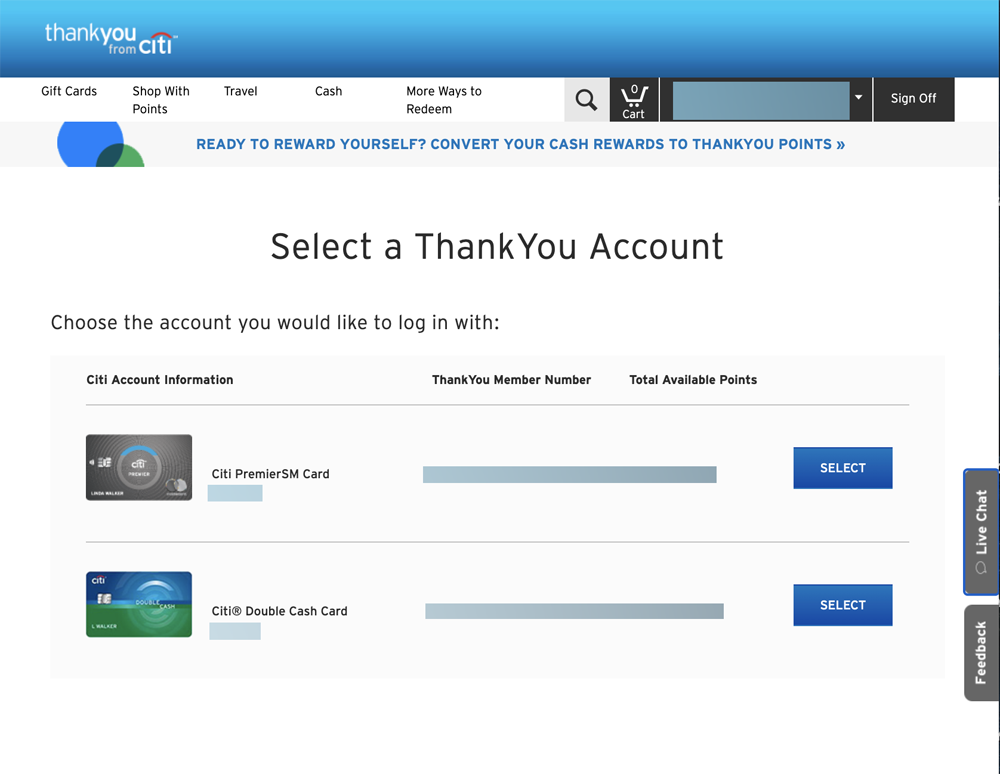

Step 2

If you have more than one ThankYou account, the page which now opens up will ask you to confirm the account you’d like to use to log in to the ThankYou Rewards portal. Make your selection.

If only have one account, you’ll see a page similar to the one in Step 3.

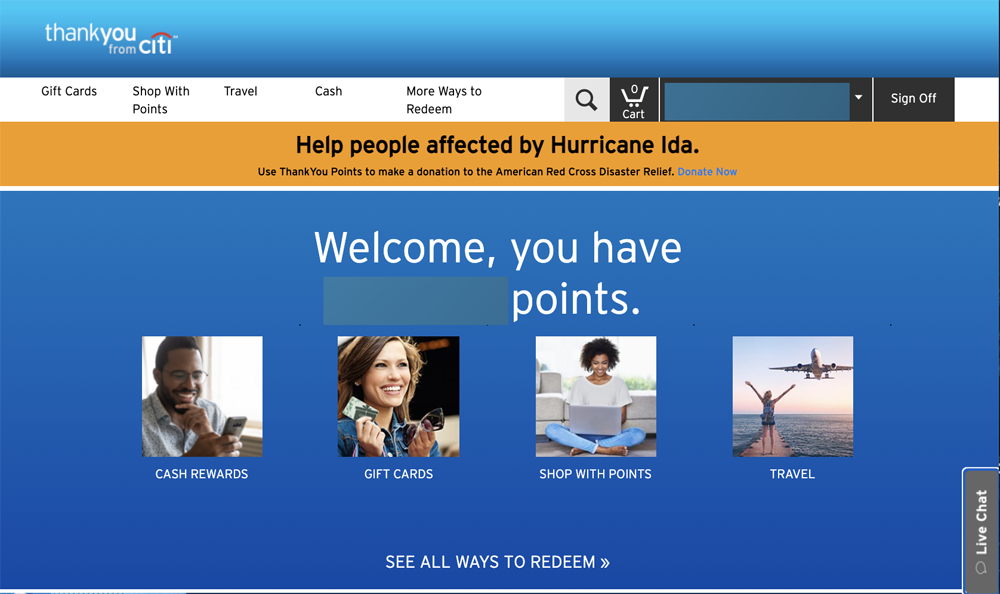

Step 3

You should now be in the ThankYou Rewards portal and faced with a page that looks something like this:

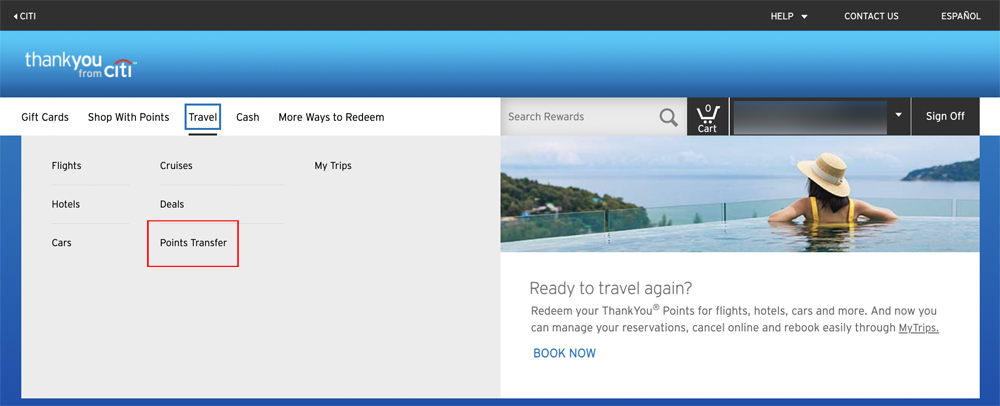

Using the menu bar at the top of the page, click on “Travel” (to open a drop-down menu) and then click on “Points Transfer“.

Step 4

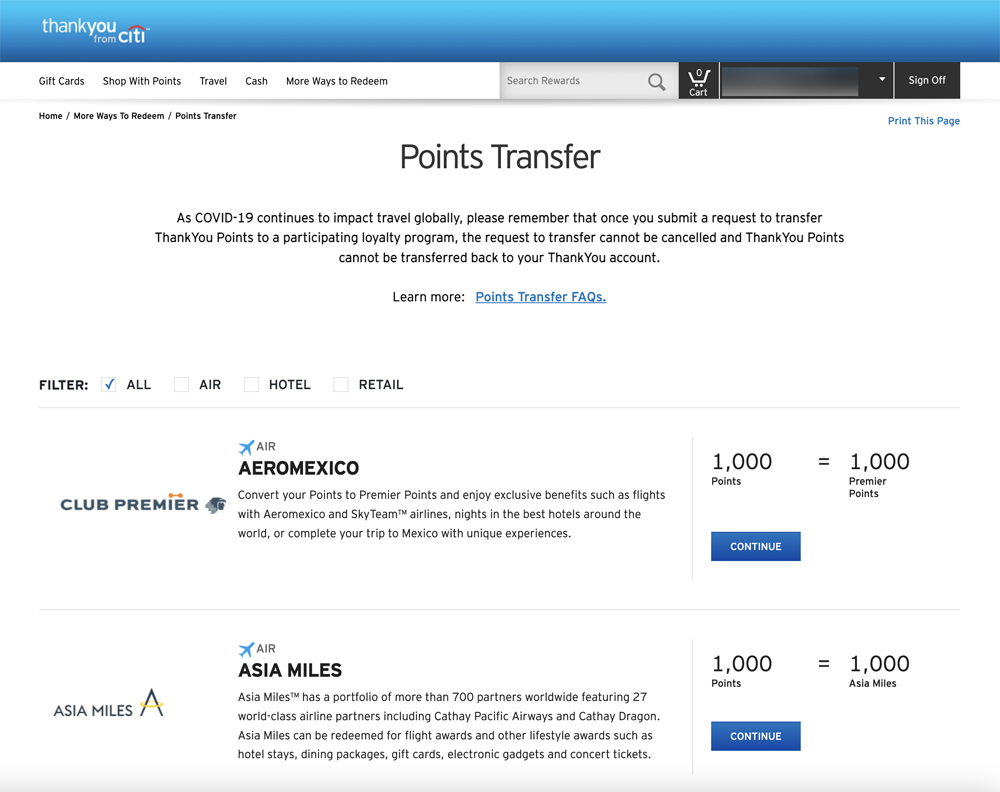

You should now be on the Points Transfer page and from here things are pretty self-explanatory.

You may have to scroll down the page until you see the airline program to which you’ll be transferring points…

…and when you reach the airline program of your choice, click the “Continue” button.

Step 5

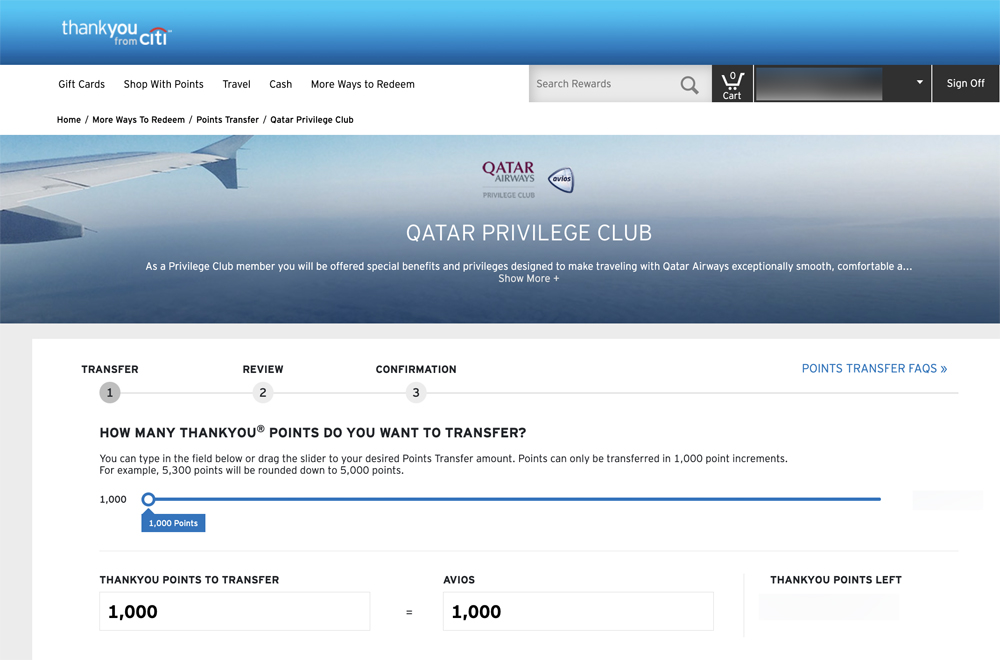

On this page, you can either use the slider to choose how many points to transfer across or you can simply type in the number of points manually.

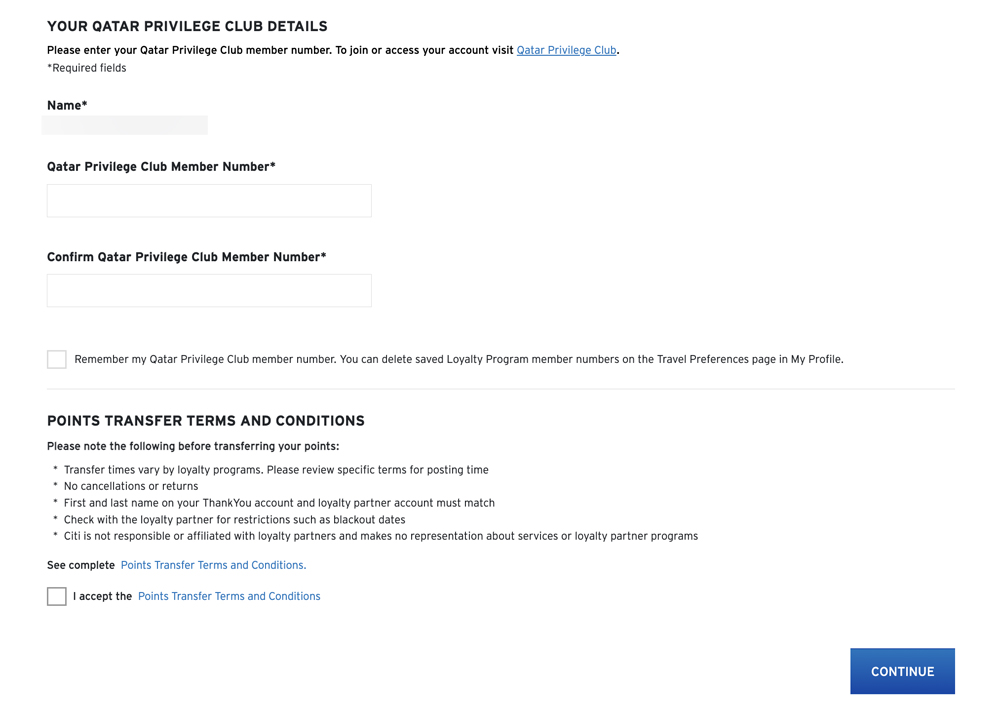

Be aware that you’ll have to scroll down this page to input your airline loyalty program account details (if they haven’t been saved before) as well as to confirm that you accept the terms and conditions of the transfer process.

Once you’re happy that you’ve entered all your details correctly and that you accept the terms and conditions of the transfer process, click the “Continue” button.

Step 6

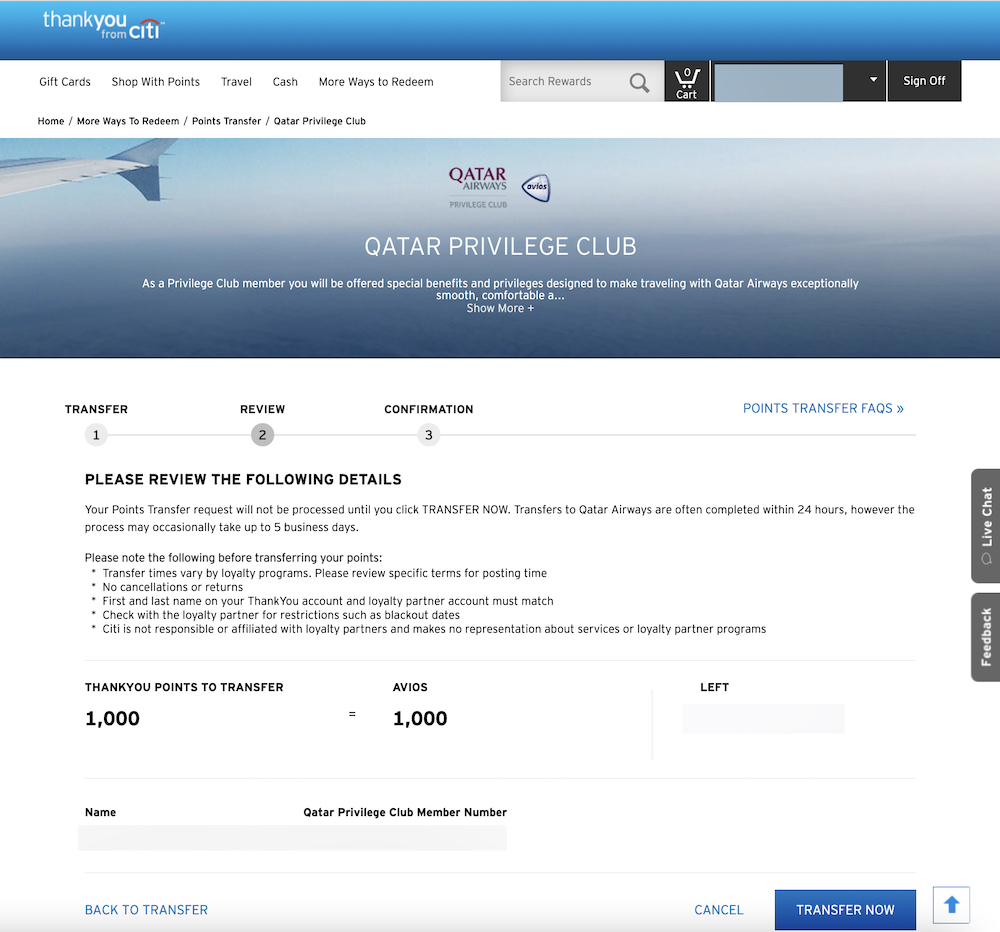

This is the last point at which you can change your mind or the details of your transfer. The page you should now see will simply be a confirmation of what you have already entered so, assuming all is in order, go ahead and click on the “Transfer Now” button.

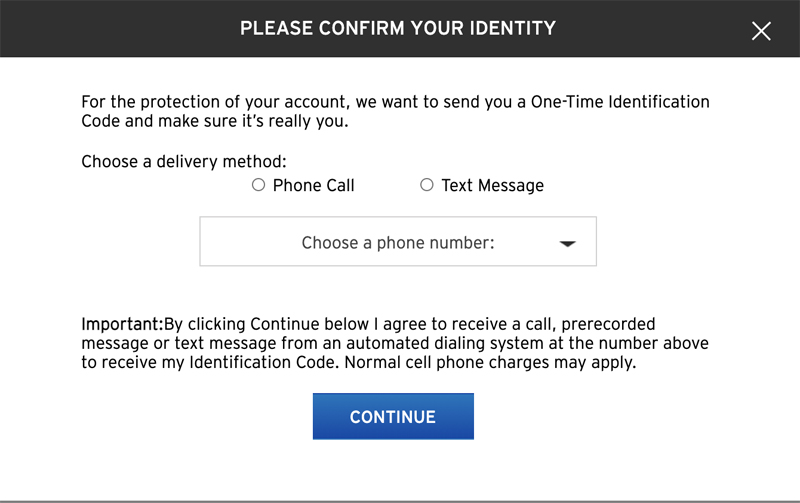

You may now see a screen that asks you to confirm your identity by having a code sent to the phone registered to your Citi account…

…but aside from that, your work is now done.

You’ll get a message on the screen to tell you that your transfer is being processed and you’ll get an email confirmation too, but all that’s left for you to do is to sit back and wait for your transfer to take place (which can be instantaneous or which may take up to 3 days).

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)