TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Chase Ultimate Rewards offers holders of select Chase credit cards the opportunity to earn one of the four big transferable currencies in the miles & points world – Ultimate Rewards points – and these points can be transferred across to a variety of other loyalty programs affiliated to major airlines and hotel chains.

In this article, we take a look at these airline and hotel partners.

While Chase’s transfer partner lineup may not be as strong as the lineup offered by American Express, the earning rates on some of Chase’s Ultimate rewards cards and a number of unique partners make the Ultimate Rewards program very compelling.

Chase Ultimate Rewards

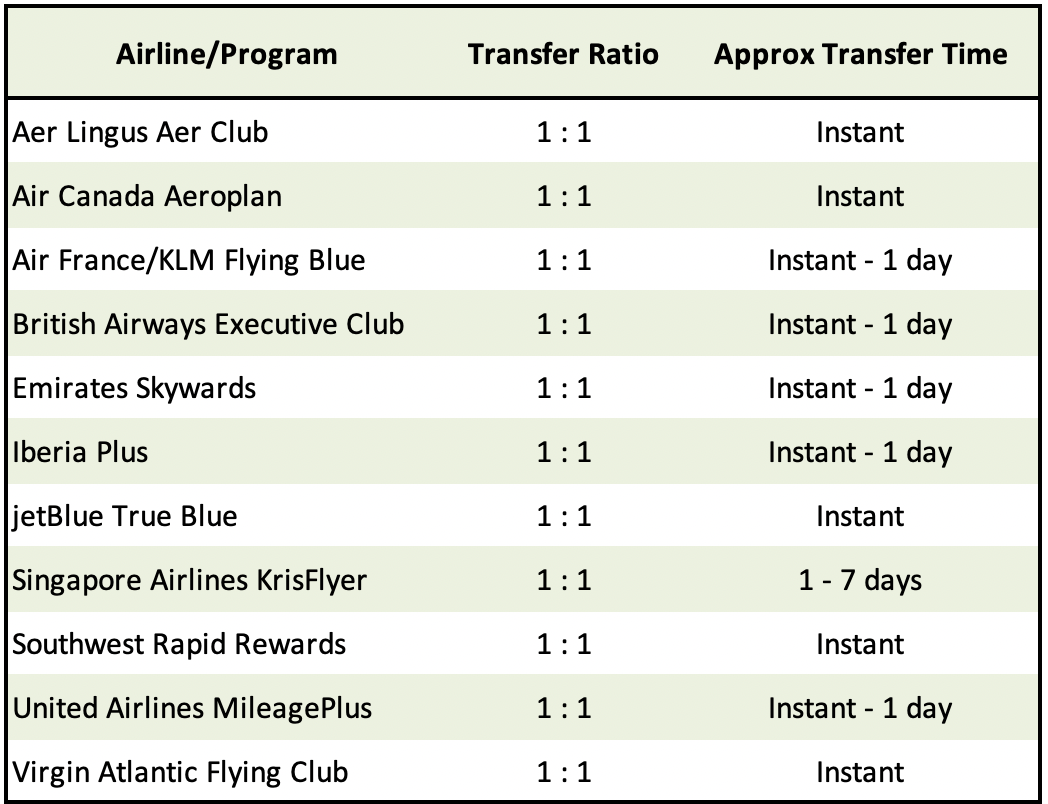

At the time of writing, Chase Ultimate Rewards has 14 transfer partners which are split into 11 airline partners and 3 hotel partners – that’s noticeably fewer partners than American Express and fewer partners than Citi, but it’s quality, not quantity that’s paramount here.

Chase Airline Transfer Partners

The list of Chase airline transfer partners isn’t bad, but it’s not exactly stellar either, although the addition of Air Canada’s Aeroplan program as a partner back in August 2021 definitely gave the list a stronger look.

The big positive for Chase is that it is the only credit card issuer whose points can be transferred over to United Airlines – for a US bank issuing cards to US customers that’s quite a big deal.

As Avios can be easily transferred between Aer Lingus, British Airways, and Iberia accounts, it’s hard not to view these three as one big transfer partner rather than three separate ones, but with Avios being a great way to save on short-haul flights, with Iberia offering some very good value long haul awards, and with Avios now useable on Qatar Airways (transfer to BA and from there to Qatar Airways), these are very good options to have.

As always, the value that each person gets from transferring Ultimate Rewards points to these airlines/airline programs will vary depending on what the points are eventually used for, but with United miles and Aeroplan points valid for bookings across the Star Alliance family, Flying Blue offering monthly discounted awards to multiple regions of the world, and Singapore Airlines offering some of the best premium cabins in the sky (as well as monthly discounted awards), you don’t have to look too hard to find some very good uses for Ultimate Rewards points when booking airline awards.

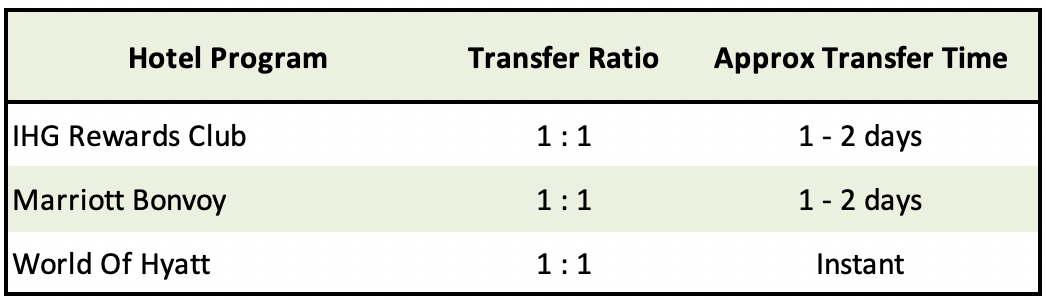

Chase Hotel Transfer Partners

Chase may only have three hotel transfer partners, but that’s no worse than Amex or Capital One and it’s one more than Citi.

One of the three hotel transfer partners is one of the biggest hotel chains in the world (Marriott) and one, arguably, offers some of the best value hotel redemptions that you can find (Hyatt), so these are transfer partners to be reckoned with.

On the whole, I’m not a fan of using transferable currencies for transfers to hotel programs as I generally find that I don’t get as much value as I get when I transfer points over to airlines, but with Chase I make an exception.

I transfer a significant proportion of my Chase Ultimate Rewards points over to the World of Hyatt every year as I find that Hyatt offers good value redemptions across all its hotel categories – from the Park Hyatt Abu Dhabi to the Andaz 5th Avenue to the Hyatt Regency Tokyo, I’ve used Ultimate Rewards points to save myself a considerable amount of money at properties across the comfort spectrum.

Transfer times

As far as transfer times go, the information you see in the tables above is a guideline only – some transfers can be reliably instantaneous, while with others the time taken to transfer points can vary significantly

I generally avoid moving points across to an airline program that doesn’t reliably offer instantaneous transfers unless I can place the award(s) I want to book on hold – the last thing I want to happen is for award availability to disappear in the time between actioning a transfer and the points arriving in my airline account.

Transfer fees

Unlike American Express, Chase doesn’t charge a fee for transfers to any of its partners.

Transfers to other people’s loyalty accounts

Chase allows its cardholders to transfer points to a loyalty program belonging to the cardholder or to a loyalty program in the name of an authorized user who shares the same address as the primary cardholder.

Note: Once a transfer has been enacted to a loyalty account of an eligible authorized user, that person becomes the only authorized user to whose accounts points can be transferred.

Transfers to other people’s Ultimate Rewards accounts

You can transfer Ultimate Rewards points to the account of someone who shares your address, but be very aware that Chase monitors these transfers carefully – abusing this benefit is a great way to get your account shut down.

Here’s the official Chase policy:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

You have been warned!

Favorite cards that earn Chase Ultimate Rewards points

Consumer cards

- Chase Sapphire Reserve® (3 points/dollar on dining and travel + a great list of benefits)

- Chase Sapphire Preferred® Card (3 points/dollar on dining, 2 points/dollar on travel, and + great rental car insurance)

- Chase Freedom Flex® Credit Card (5% cash back in revolving quarterly categories + travel purchased through Chase, and 3% cash back on dining and at drugstores*.

- Chase Freedom Unlimited® (5% cash back on travel purchased through Chase, 3% cash back in dining and at drugstores, and 1.5% cash back on all other eligible purchases*.

*This cash back can be converted to Ultimate Rewards points (1% = 1 point) when paired with a premium Ultimate Rewards card e.g. the card_name).

Business Cards

- Ink Business Preferred® Credit Card (3 points/dollar on on the first $150,000 spent in combined purchases on travel & other select business categories).

- Ink Business Cash® Credit Card (5% cash back on up to $25,000 of spending in select business categories)*.

- Ink Business Unlimited® Credit Card (1.5% cash back on all eligible purchases)*.

*This cash back can be converted to Ultimate Rewards points (1% = 1 point) when paired with a premium Ultimate Rewards card e.g. the card_name).

Related Reading: This Is Why You Should Have A Chase Sapphire Card

Bottom line

Chase Ultimate Rewards may not have the strongest lineup of transfer partners out of the four main transferable currency programs (that crown belongs to American Express Membership Rewards), but the earnings that its Ultimate Rewards cards offer (and the fact that some popular loyalty programs are transfer partners with Chase alone) make Ultimate Rewards a major player in the miles and points world.

Add to that the fact that Chase has, in recent times, shown a willingness to offer transfer bonuses and you start to see why credit cards like the Chase Sapphire Preferred® Card, the Chase Freedom Flex® Credit Card, and the Ink Business Preferred® Credit Card are so incredibly popular.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)