TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Citi ThankYou points are one of the four big transferable currencies in the miles & points world and can be earned by using select Citi credit cards (e.g. the Citi Strata Premier® Card), and these points can be transferred across to a variety of other travel loyalty programs.

Citi ThankYou Rewards Program

At the time of writing, the Citi ThankYou program has 19 travel transfer partners – 14 airline partners and 5 hotel partners – which means that it has more transfer partners than Chase but slightly fewer than American Express and Capital One.

If you have a premium Citi ThankYou card (e.g. the Citi Prestige® Card or the the Citi Strata Premier® Card) you can transfer points to any ThankYou travel partner at a 1:1 ratio, except Choice Privileges, where you get a 1:2 rate.

Most other Citi ThankYou cards earn restricted ThankYou points that are only transferable to three loyalty programs (Choice Privileges, JetBlue TrueBlue, and Wyndham Rewards) and at lower rates.

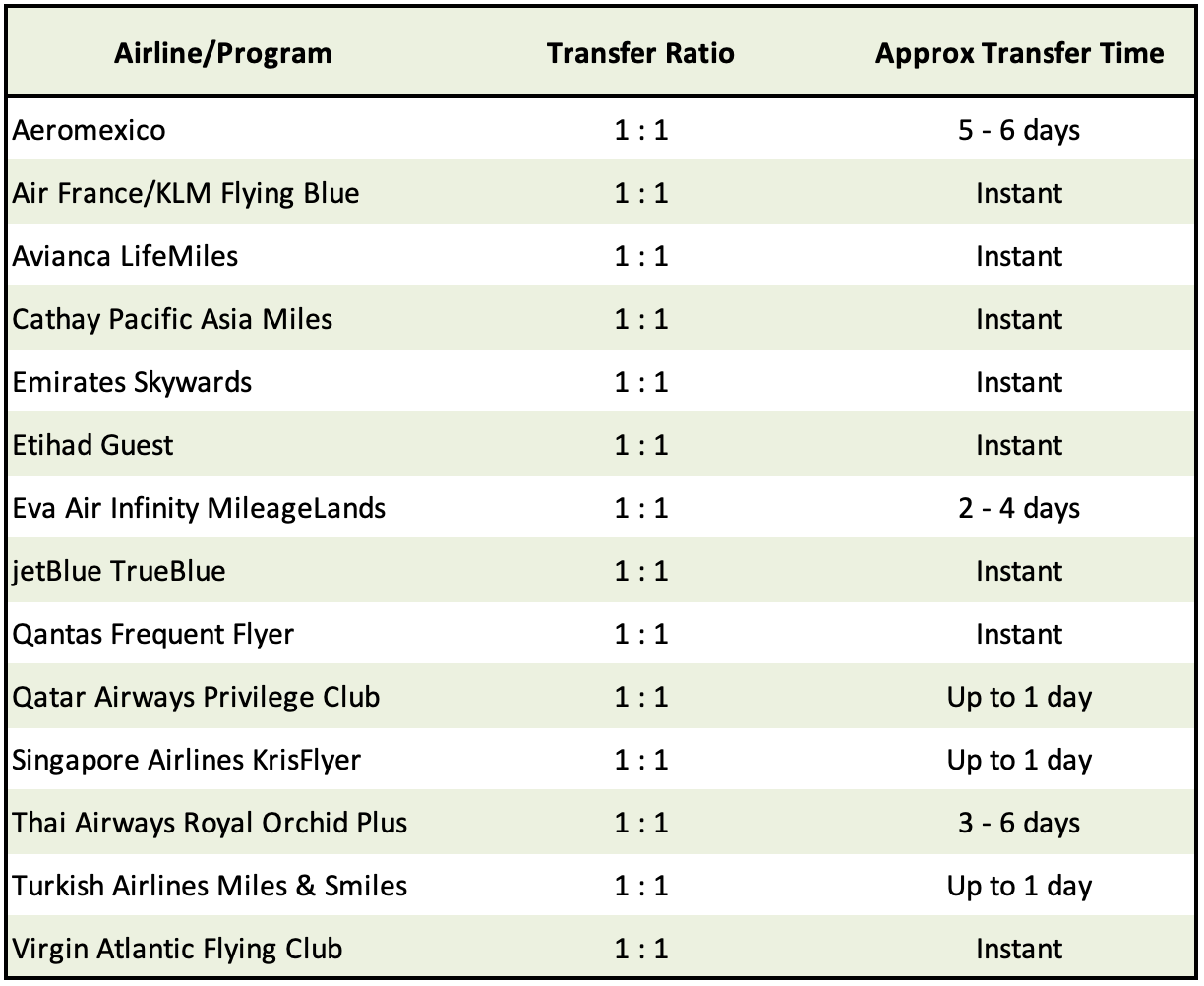

Airline transfer partners

Note: The transfer ratio for JetBlue shown above is for the transfer of points from accounts linked to a premium Citi ThankYou card. Most other ThankYou cards can only transfer points to JetBlue TrueBlue at a ratio of 5:4.

The list of Citi ThankYou airline transfer partners covers airlines across all three major alliances (which should keep most people happy) and includes favorites like Singapore Airlines KrisFlyer (useful for great quality premium cabin awards and good value awards via the Spontaneous Escapes program), Etihad Guest, and Flying Blue (useful for discounted deals via Flying Blue’s monthly Promo Awards).

Citi’s ThankYou program offers a number of transfer options that you won’t find offered by Chase or American Express and these include Turkish Airlines Miles & Smiles, EVA Air, and Thai Airways Royal Orchid Plus … but it’s the partners that the ThankYou program shares with other programs that are often the most useful.

The loyalty programs of airlines like Air France/KLM, Cathay Pacific, Etihad, Qatar Airways, and Singapore Airlines (amongst others) partner with at least one (often more) of the other major transferable currency programs (as well as with Citi’s ThankYou program) so this offers up a great opportunity for miles & points enthusiasts to pool points from more than one source to allow them to build up enough miles & points to book whatever great award they’ve found.

Also, it’s important to remember that as Qatar Airways uses Avios as its currency and as Qatar Airways Avios can be moved to other Avios-using programs, the likes of British Airway, Aer Lingus, Iberia and Finnair are all, effectively, Citi ThankYou Rewards transfer partners.

Overall, the value that each person gets from transferring ThankYou points to these airlines will vary depending on what the points are eventually used for (premium cabin awards mostly offer better value than Economy Class awards and some airlines add surcharges to their awards while others don’t), but Citi has more than enough great transfer partners to make it reasonably easy to find a good-value use for its ThankYou points.

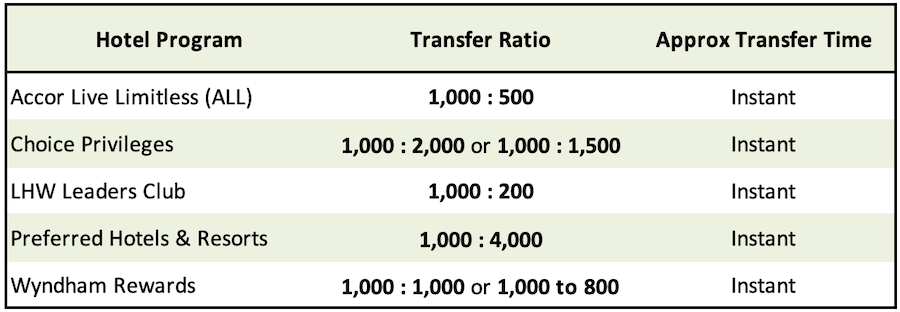

Hotel Transfer Partners

Note: The better ratios shown above are for transfers from premium ThankYou cards. The weaker transfer ratios are for transfers from the remaining ThankYou cards.

The list of hotel partners can be seen as a weakness of the Citi ThankYou program as is doesn’t partner with any of the four major miles & points chains and the chains that it partners with aren’t usually high on the list of most miles & points fans.

It should be noted, however, that the addition of Preferred Hotels & Resorts in October 2024 made things considerably more interesting as Preferred Hotels has some great properties around the world and many of them have considerably more character than the cookie cutter buildings often associated with Marriott, IHG, Hilton and Hyatt.

Personally, as I value the ThankYou points that I earn at 1.5 cents each (based on the value that I know I can get out of them with ease), and as I value the points issued by Accor, Choice, LHW Leaders Club and Wyndham at less than that, Preferred Hotels and Resorts is the only one of Citi’s hotel partners to which I’m likely to transfer points.

Sure, some will be able to find value in transfers to Choice and Wyndham (especially of there’s a transfer bonus available), but the sweets spot for me is the option to transfer to Preferred Hotels at a ratio of 1:4.

Transfer times

As far as transfer times go, the information you see in the tables above is a guideline only – some transfers can be reliably instantaneous while with others, the time taken to transfer Membership Rewards points can vary significantly

I generally avoid moving points across to an airline program that doesn’t reliably offer instantaneous transfers unless I can place the award(s) I want to book on hold – the last thing I want to happen is for award availability to disappear in the time between actioning a transfer and the points arriving in my airline loyalty account.

Transfer Fees

Unlike American Express, Citi, like Chase and Capital One, doesn’t charge a fee for transfers to any of its partners.

Transfers To Other People’s Loyalty Accounts

Citi prohibits users from transferring ThankYou points into loyalty accounts where the details on the recipient account don’t match with the details on the Citi ThankYou account.

Transfers To Other People’s ThankYou Accounts

Citi allows cardholders to transfer ThankYou points to any other ThankYou account they choose … but there are some important restrictions you should be very aware of:

- A maximum of 100,000 points can be shared with other ThankYou accounts each calendar year.

- A maximum of 100,000 points can be received from other ThankYou accounts each calendar year.

- Points transferred to/from another ThankYou account will expire 90 days after the transfer has taken place and there’s no way to extend their validity period.

- Once points have been transferred to a new ThankYou account they cannot be re-shared.

Transfers to other ThankYou accounts can be useful in circumventing the restriction on transferring points to other people’s loyalty program accounts, but, bearing in mind the points will expire within 90 days of a transfer, the recipient of the points should always have a solid plan for the points before a transfer is enacted.

Popular Cards That Earn ThankYou Points

- Citi Prestige® Card (5 points/dollar on dining & on air travel, 3 points/dollar with hotels and cruise lines) – no longer open to new applicants

- Citi Strata Premier® Card (3 points/dollar on groceries, dining, air travel & hotels and 10 points/dollar on hotels, rental cars, and attractions booked through the Citi Travel portal)

- Citi® Double Cash Card (No annual fee 2% cash back on all purchases which can be converted to 2 ThankYou points/dollar when paired with a Prestige or Strata Premier Card)*

Bottom Line

Citi’s ThankYou program may not have the strongest lineup of transfer partners out of the four main transferable currency programs, but it still has a lot of very good uses.

With various ThankYou cards offering great earnings rates on travel, dining, and gas, it can be easy to build up an impressive balance of ThankYou points quite quickly, and with Citi occasionally offering transfer bonuses as well, it doesn’t have to take much effort to earn enough points for a valuable airline award.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

[…] points issued by Chase, Citi, and American Express mostly convert to other loyalty programs in a ratio of 1:1, Capital One miles […]

[…] on the Citi Double Cash Card can be converted to Citi’s ThankYou points which, in turn, can be converted to any one of 13 airline loyalty currencies if the cardholder also holds the Citi Prestige or Citi ThankYou Premier […]

[…] forget that if you’re fortunate enough to have a healthy balance of Citi ThankYou points these can be transferred over to Qatar Airways Privilege Club in a ratio of 1:1 – that may help get your Qmiles balance high enough to allow you to snap up whatever award […]

[…] miles in the current sale for all of those awards but as Etihad is a transfer partner for Chase, Citi, and American Express it shouldn’t be too hard to top up an Etihad Guest […]