TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

In 2018 Chase announced that it was removing the price protection and returns protection benefits from most of the credit cards it issues, AMEX hasn’t offered price protection for years (but it does offer returns protection) and back in June Citi shocked a lot of people when it announced (without any warning) that it would be stripping out most of the protection benefits that cardholders have become accustomed to across most of its credit card portfolio….and now another credit card issuer appears to be following this trend.

DoctorOfCredit has reported that Barclays is sending out warnings on select credit card statements to let cardholders know that it will be removing extended warranty and price protection benefits from 1 November 2019.

The exact wording is as follows:

Your extended warranty and price protection benefits are being removed, however claims can be submitted for eligible purchases made through October 31, 2019.

So far these notices have been sent out to Arrival+ and Uber Visa cardholders…but it’s unlikely that the benefit cuts will stop there.

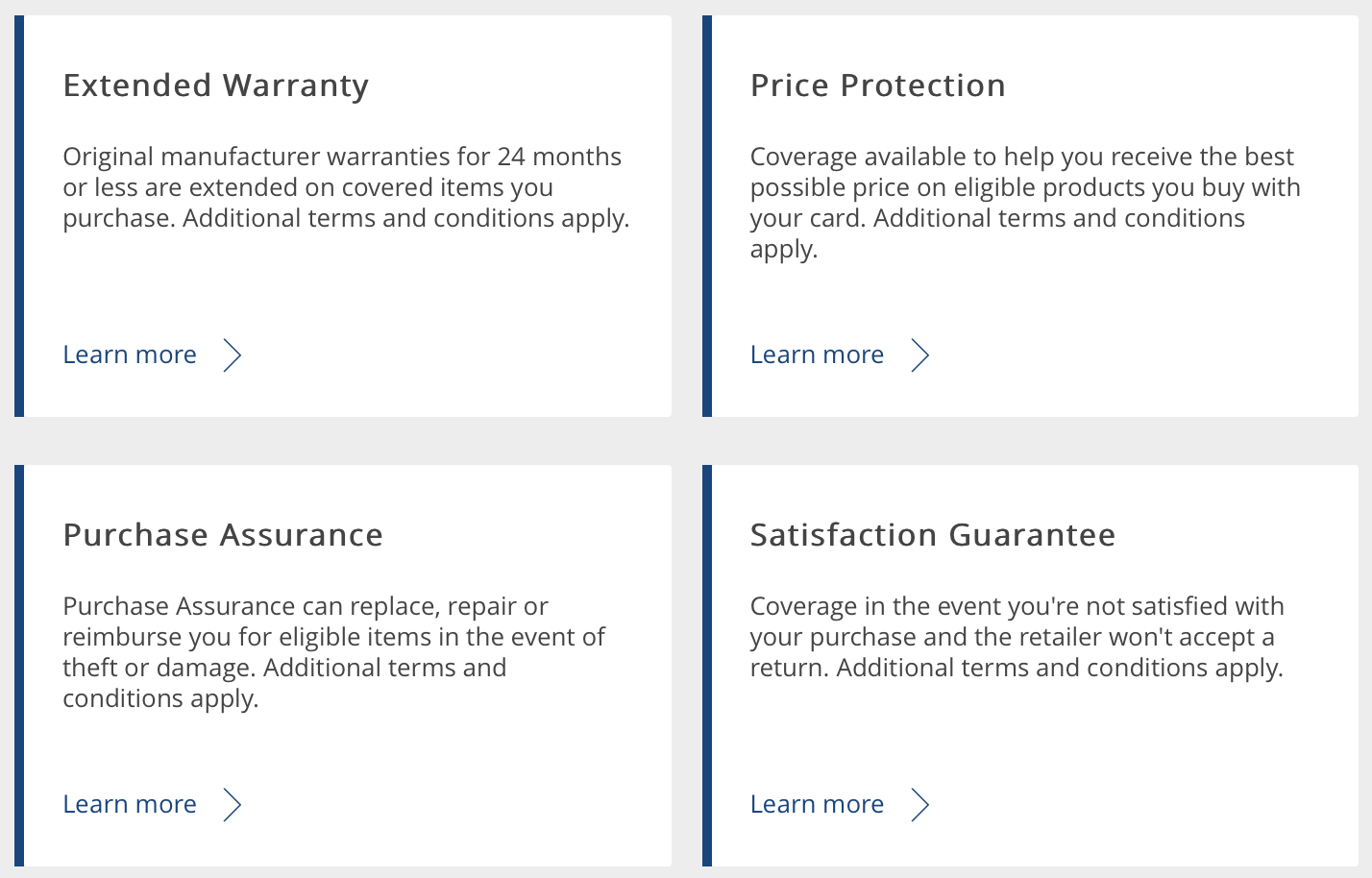

The only Barclays-issued credit card I hold is the AAdvantage Aviator Red card and my online account is still showing that the card comes with 4 important shopping benefits that are becoming increasingly hard to find…

…but I haven’t had a statement from Barclays in months (I rarely use the card and should probably get rid of it) so for all I know this card’s benefits are on the chopping block too.

…but I haven’t had a statement from Barclays in months (I rarely use the card and should probably get rid of it) so for all I know this card’s benefits are on the chopping block too.

Presumably the AAdvantage Aviator Silver card currently offers the same protections as the Red card (it is, after all, more expensive) and presumably there are other Barclays-issued credit cards out there that currently offer one or more of these protections too (I can’t say for sure because Barclays’ credit card page doesn’t tell me!) so it will be interesting to see where this story goes from here.

Bottom Line

I’d be very surprised if the decision to remove the extended warranty and price protection benefits was limited to just the two credit cards we know about right now so I fully expect to get a message from Barclays (probably in the next week or two) to let me know that my Aviator Red card has just become even more useless than it already is.

If any readers have a Barclays-issued credit card it would be very helpful if you would check your most recent statement to see if Barclays has buried any bad news in it – let me know in the comments and I’ll update this post where appropriate.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

I heard this change was initiated by MasterCard, so issuers would have to provide any desired benefits — which obviously many will not.

Barclays’ Uber card is a Visa card so, while it may be true that Mastercard has something to do with this, that’s not the whole story.

Yes, its definitely being removed. I just received an email today for AAdvantge Aviator Red stating:

“We’re making changes to the benefits you receive with your AAdvantage® Aviator® Red Mastercard® effective November 1, 2019. Your Auto Rental Collision Damage Waiver and Identity Theft benefits will be enhanced. For example, you will now have access to an online monitoring dashboard and resolution features that scour the internet and Dark Web for compromised credentials and financial account takeover. Also, you will be eligible to receive Cellular Telephone Protection, which provides coverage for certain damage to or theft of your cell phone effective November 1, 2019. Your Extended Warranty, Price Protection, Purchase Assurance, Satisfaction Guarantee and Concierge benefits will be removed; however, claims can be submitted for eligible purchases made through October 31, 2019. Restrictions, limitations and exclusions apply. Please go to the Rewards and Benefits section of the website for specific information about benefits that are being removed and added. You can also refer to your Guide to Benefits effective 11/1/19 at http://www.AviatorMastercard.com, which includes a full explanation of your updated coverages and details regarding specific time limits, eligibility and documentation requirements”

Thanks for the info – very useful.

[…] There have also been indications that Barclays was starting to make negative changes to at least some of the cards it issues and, at the time that news broke, I suggested that it was unlikely that Barclays would be limiting its cutbacks to just the two cards we had been hearing about. […]

[…] the middle of last month, we started getting reports that Barclays was stripping away a number of protection benefits from some of its credit cards and it soon became apparent that it wasn’t only one or two […]

[…] the drastic cuts made by Citi, the changes being made by Barclays and the recently announced benefit reshuffle at American Express I think I’m entitled to feel […]