TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

Towards the middle of last month, we started getting reports that Barclays was stripping away a number of protection benefits from some of its credit cards and it soon became apparent that it wasn’t only one or two cards that were losing out.

Initial reports said that the Uber Visa card and the Arrival+ credit card would see their extended warranty and price protection benefits removed from 1 November 2019 and, shortly after that, we found out that similar benefits were being cut from other Barclays-issued cards like the AAdvantage Aviator Red and Silver cards.

It now looks like Barclays has finally updated the rewards and benefits section of its Aviator website so we can finally see what benefits have been left in place for holders of the Red Card (Silver cardholders may see slightly different benefits).

AAdvantage Aviator Red Credit Card Benefits

Click on a link to move to the appropriate section:

- Mastercard ID Theft Protection

- Cellphone Protection

- Travel Assistance

- Trip Cancellation & Trip Interruption Insurance

- Travel Accident Insurance

- Auto Rental Collision Damage Waiver

The headline earnings and American Airlines benefits of the Aviator Red credit card are not changing…

- Earn 2 AAdvantage Miles for every dollar spent with American Airlines

- Earn 1 AAdvantage Mile for every dollar spent elsewhere

- Preferred boarding

- The first checked bag is free for the cardholder and up to 4 companions on the same reservation.

- Cardholders get a 25% discount on in-flight food and drink purchases

- Cardholders get an annual credit of up to $25/year towards in-flight Wi-Fi costs.

- Cardholders spending $20,000 in a year are given a certificate offering a companion fare for $99 + taxes and fees.

…but the other benefits offered are now essentially the same benefits that Mastercard offers on all its “World Mastercard” cards.

Mastercard ID Theft Protection

This is a service that combines credit monitoring and theft resolution services (in the event that a cardholder is a victim of identity theft). The service includes:

- An online monitoring dashboard (registration required)

- A monthly risk alert/newsletter

- Identity monitoring

- Resolution services

- Lost wallet assistance

- TransUnion credit file monitoring

- Financial account takeover (monitoring of other bank, brokerage and card accounts)

- Business URL and domain monitoring

Cellphone Protection

This is provided to cardholders who pay their entire monthly cellphone bill with their covered credit card.

What is reimbursed?

The actual cost to replace or repair a stolen or damaged eligible cellphone.

What are the coverage limits and limitations?

- Maximum liability is $600 per claim for World Mastercard and $1,000 per Covered Card per 12 month period.

- Each claim is subject to a $50 deductible.

- Coverage is limited to two (2) claims per Covered Card per 12 month period.

- Coverage is excess of any other applicable insurance or indemnity available to you.

- Coverage is limited only to those amounts not covered by any other insurance or indemnity.

Examples of items not covered:

- Accessories

- Phones purchased for resale or commercial use

- Lost phones

- Phones under the care and control of a common carrier (e.g. airlines, USPS, etc…)

- Phones purchased as part of a pre-paid plan

Travel Assistance

This is a service which provides pre-trip destination information (e.g.

information on visa/passport requirements and immunizations), help with lost/stolen travel documents and luggage.

The service also provides referrals to physicians, hospitals, attorneys, local embassies and consulates for cardholders traveling more than 100 miles from home.

Trip Cancellation & Trip Interruption Insurance

As an eligible Cardholder, You, your Spouse or Domestic Partner and your Dependent Children are eligible for Trip Cancellation and Trip Interruption Insurance. Coverage is provided automatically when a portion of the cost of the trip is charged to your account.

What is covered?

Losses suffered from a cancellation or interruption of a trip due to a covered Loss, Trip Cancellation and Trip Interruption insurance will reimburse for the non-refundable passenger fare charged by an airline, cruise line, railroad, or any other Common Carrier (this includes any change fees).

What are covered losses?

- Accidental bodily injury or loss of life or sickness of either the covered person or traveling companion, which prevents the covered person or traveling companion from traveling on the trip; or

- Accidental bodily injury or loss of life or sickness of an immediate family member of the covered person or traveling companion when the accidental bodily injury or sickness is considered life-threatening, requires hospitalization, or such immediate family member requires the care of the covered person or traveling companion; or

- An organized strike affecting public transportation that impacts the covered person’s ability to commence or continue on a covered trip.

Maximum coverage

- Trip cancellation – $1,500/trip

- Trip interruption – $1,500/trip

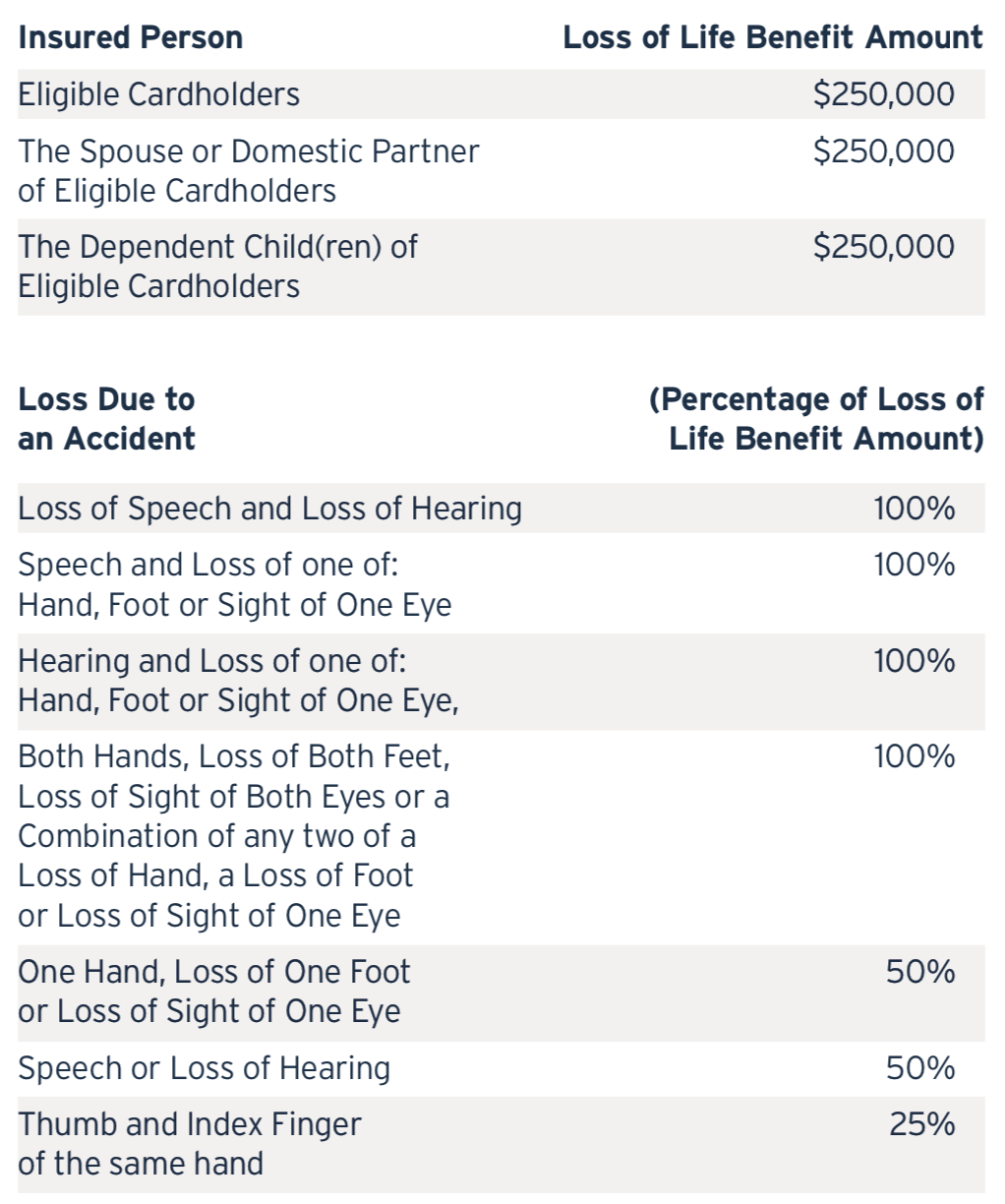

Travel Accident Insurance

Per Mastercard (abbreviated version):

Travel Accident Insurance provides coverage against accidental loss of life, limb, sight, speech or hearing while riding as a passenger in, entering or exiting any licensed Common Carrier while the Insured Person is on a Covered Trip.

If the entire cost of the passenger fare has not been charged to an eligible Account prior to your arrival at the airport, terminal or station, coverage begins at the time the entire cost of the travel passenger fare is charged to an eligible Account.

Coverage

Auto Rental Collision Damage Waiver

This is secondary coverage within the renter’s country of residence so it will only kick in after a cardholder’s personal auto insurance has been used to its limit.

Coverage is primary outside an Eligible Renter’s country of residence. Primary coverage means that the Eligible Renter does not have to file a claim with any other source of insurance before receiving coverage under this benefit.

What Has Been Removed

In brief, these are the benefits that have been stripped out:

- Extended warranty protection

- Price protection

- Purchase assurance

- Satisfaction guarantee

- World Mastercard Concierge

- Baggage delay insurance

Some AAdvantage Aviator Red cardholders have been informed that their Trip Delay insurance is being removed to but, to the best of my knowledge, my Aviator Red card has never offered that protection and it doesn’t currently show in my online account (all the other outgoing benefits are still showing in my account).

Link to full World Mastercard benefits (.pdf)

Bottom Line

Not that this is going to be much of a surprise to anyone but these are clearly very negative changes by Barclays and the value of the AAdvantage Aviator Red card has been devalued once again.

Unless you specifically need to earn AAdvantage Miles for your travels you will almost certainly be better off by putting your travel spending on credit cards like the Chase Sapphire Reserve card, the Chase Sapphire Preferred card or even the Platinum Card from American Express (from 1 January 2020).

All of those cards offer superior earning rates for travel/airfare purchases and most of the travel coverages they offer are noticeably superior to what the Aviator Red card offers too.

So a number of negative changes with zero corresponding improvements. I think it’s time to reconsider their AA cards.