TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

UPDATED 28 September 2019 – I have now received an email from Barclays confirming benefit changes AND a reader has confirmed a similar email was received for the Aviator Silver Card.

Something big is going on in the world of credit cards right now with a number of major card issuers making some serious changes to the benefits they’re prepared to offer their customers.

Back in June Citi made the spectacular announcement that it would be removing most insurance and protection benefits from just about every card it issues (yes, that includes cards that cost $495/year!), and just a few days ago American Express announced a big shakeup in the benefits it offers on various cards (there was good news and bad news from AMEX).

There have also been indications that Barclays was starting to make negative changes to at least some of the cards it issues and, at the time that news broke, I suggested that it was unlikely that Barclays would be limiting its cutbacks to just the two cards we had been hearing about.

That suspicion turns out to have been well-founded.

Reader Shakira left a comment on my post covering the moves that Barclays was making to let us know that she’d had an email from Barclays confirming some significant changes to her AAdvantage Aviator Red credit card:

“We’re making changes to the benefits you receive with your AAdvantage® Aviator® Red Mastercard® effective November 1, 2019.

Your Auto Rental Collision Damage Waiver and Identity Theft benefits will be enhanced. For example, you will now have access to an online monitoring dashboard and resolution features that scour the internet and Dark Web for compromised credentials and financial account takeover.

Also, you will be eligible to receive Cellular Telephone Protection, which provides coverage for certain damage to or theft of your cell phone effective November 1, 2019.

Your Extended Warranty, Price Protection, Purchase Assurance, Satisfaction Guarantee and Concierge benefits will be removed; however, claims can be submitted for eligible purchases made through October 31, 2019.

Restrictions, limitations and exclusions apply. Please go to the Rewards and Benefits section of the website for specific information about benefits that are being removed and added. You can also refer to your Guide to Benefits effective 11/1/19 at http://www.AviatorMastercard.com, which includes a full explanation of your updated coverages and details regarding specific time limits, eligibility and documentation requirements”

I happen to be an AAdvantage Aviator Red cardholder myself and I revived the exact same email from Barclays 2 days later but I’m still not seeing any changes to what my online account shows.

The phrasing in the email from Barclays is a little unclear so it may be that the changes will only be reflected online from 11/1/19…but that would seem to be more than a little underhand if that’s the case.

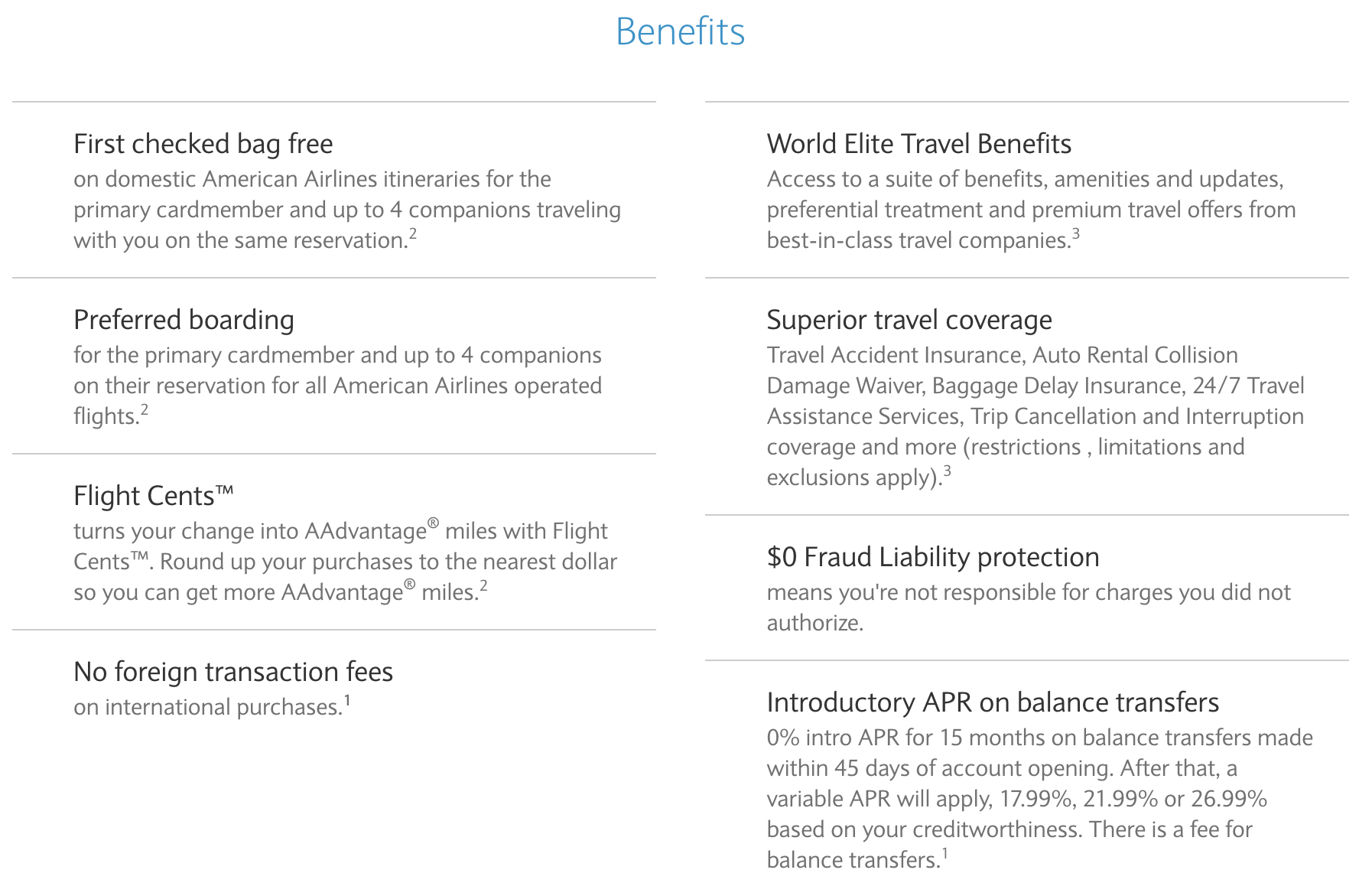

The Aviator Red application page no longer shows the card as offering any purchase protection benefits or extended warranty (so at least anyone signing up for the card won’t be signing up with incorrect expectations)…

…but, as I mentioned, my online account still shows all the benefits that are supposedly going away very in place:

…but, as I mentioned, my online account still shows all the benefits that are supposedly going away very in place:

The Positive News

The Positive News

There’s quite a bit of ambiguity right now so there may or may not be positive news here.

The email I’ve been sent (and the one that Shakira was sent) makes no mention of trip cancellation & interruption insurance or baggage delay insurance but two other readers have contacted me to say that their emails specifically mention that these benefits are also being removed – I guess we’ll have to wait a bit longer to see if we have positive news on this (benefits staying) or this is more negative news (benefits being cut).

It will be interesting to see what the “enhanced” auto rental collision damage waiver will look like (I’d be amazed if it became primary insurance but I guess anything is possible) and I’m eager to understand what kind of cell phone insurance is being introduced and to see how it compares to the cell phone insurances currently offered by the Citi Prestige card and the Chase Ink Business Preferred card.

The Negative News

I doubt too many people will be annoyed at the loss of their concierge benefit (most people probably never used that benefit anyway) but the loss of the extended warranty, price protection, purchase assurance, and satisfaction guarantee benefits is unlikely to be well received.

These benefits are starting to get scarce in the credit card world so it may be worth holding on to any of your cards that still offer them.

Bottom Line

For the time being we’re going to have to wait and see what Barclay announces with regards the enhanced auto insurance and the new cell phone cover and we need a bit more clarity around what’s happening with trip cancellation/interruption insurance and baggage delay insurance but, coming on top of the net negative changes to the AAdvantage Aviator Red card that were announced in February of this year, this doesn’t look like good news for cardholders….and if you hold the more expensive Silver version of this card it looks like your benefits are being cut too.

I’ve been meaning to do something about my AAvantage Red Aviator card (downgrade it if possible or get rid of it completely) but I haven’t got around to doing that so far.

These benefits changes may just be the reminder I needed to make that call but I’ll probably wait to get the full details of the changes (officially) before I pull the trigger.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

The Aviator Red is a World Elite card, no? If it is, the separate Mastercard benefit is in force since July 1. I think there’s an $800 limit and a $50 deductible.

Seems like the shakeups on Citi and Barclay’s Mastercards partially mirror Mastercard’s own changes to World and World Elite cards – adding cell phone insurance and identity theft benefits and removing extended warranty and price protection. The fact that those are often provided by different companies (e.g. Price Rewind by Citibank vs. Price Protection by …not Citi) is interesting. I wonder if Mastercard removed them in response to Citi (to prevent being flooded with claims that would’ve gone to Citi before), and Barclay just followed suit because… they don’t think it’d give them a leg up on Citi, I guess. But that drops them down a notch vs. BoA, who, as far as I can tell, is keeping at least the Extended Warranty.

I received the same email today regarding my Aviator Silver card, and that includes trip delay coverage bring removed.

I just got the Aviator Red card because of the recent reductions in some of those same benefits on the Citi Aadvantage Platinum Select card (the almost free 60,000 miles bonus was nice). My email on the 27th noted the following cuts (this is exact cut and paste):

“Your Extended Warranty, Price Protection, Purchase Assurance, Satisfaction Guarantee and Trip Delay benefits will be removed; however, claims can be submitted for eligible purchases made through October 31, 2019.”

So, seems like they need to get their act together in notifying customers as to just what coverage they will be providing.

we use these (and other) cards for travel benefits, car rental protection, and warranty/purchase coverage. It’s getting difficult to know which one will cover what, and under what terms (if part of trip paid with card, some portion, … etc. ?). Probably need to make a spreadsheet to determine which to use for what purchase.

I asked them to notify me by email anytime a charge is made on my card. They do so but it’s a few days later. My Amazon Prime card notified me almost immediately. I wonder why the red card has a few days delay.

Don’t use this card while traveling, we and my sister-in-law, had huge fraudulent charges against us in Mexico. Merchant submitted charges for 10 times the amount, we discovered it and called AViator card within 1 hour. They said the charge would be removed. It was, then another charge for more appeared 2 days later while the card was locked. We contacted Aviator again, they “investigated it” supposedly, I never got a call, and said we were responsible since the chip was involved, there was no chip reader at the store, they write down your number and call the bank. Rediculous, cards cancelled! Take your miles and run.