TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Over the past month, I’ve been reviewing my credit card portfolio and the result of the review has been that I’ve canceled once credit card, upgraded two and downgraded one and, in the process, I confirmed (re-confirmed may be a better term) something about the Citi Prestige card that I think is worth passing on.

Citi Annual Fee Rebates

In a list of things that can be described as “difficult to get your head around” Citi’s annual fee rebate policy sits somewhere between Quantum Mechanics and String Theory.

The policy can change from year to year, it’s not consistent across all the cards Citi issues, it varies depending on whether a card is being canceled or if it’s being upgraded/downgraded and Citi’s phone agents often give out information that doesn’t appear to tally with reality. In short, the policy is a hot mess.

Speaking generally:

- Citi will offer a full refund on any of its cards if they’re canceled within 30 days of the annual fee posting to the account.

- For some cards, a full refund may be offered if they’re closed within 60 days of the annual fee posting.

- If a card is closed in the middle of a cardholder year, Citi will rebate a prorated amount based on the time elapsed between the annual fee posting and the date the card was canceled.

- Citi’s phone agents have been known to tell cardholders that no prorated rebate will be offered once 60 days have passed from the annual fee posting but you just have to do a quick Gooogle search to find multiple datapoints of this being disproved.

- I have no idea how Citi decides what to do with the annual fees when a card is downgraded because the data points that I’ve seen don’t offer up a clear picture.

Downgrading My Citi Prestige Card

It was October last year when I decided that it was time to get rid of my Citi Prestige Card because I could no longer justify its annual fee, but I didn’t actually call in to do anything about this decision until the beginning of this year…and that’s because I had a plan.

My Citi Prestige cardholder year starts towards the beginning of the calendar year so my plan was as follows:

- Wait until a new cardholder year starts in January (which would mean that the $250/year travel credit that the card offers would also renew)

- Use the $250 travel credit as soon as possible

- Cancel or downgrade the card as soon as the $250 travel credit hits my account

- Hope to get a good annual fee rebate

As soon as my new cardholder year started I put my plan into action (I upgraded a British Airways flight for $260.58) and, based on my experience with the Citi Prestige Card in 2019, I expected the $250 travel credit to hit my account in a matter of days.

It didn’t.

After a couple of weeks had passed and there was still no sign of the rebate, I called the number on the back of my card to see if the phone agents could fast-track the credit so that I could finally be rid of the card. No dice.

I was told to hold tight and that the credit “may post” at the end of the billing cycle.

It did. In the second week of February, I saw the $250 travel credit finally appear in my account and I immediately called Citi up to downgrade to the Premier Card.

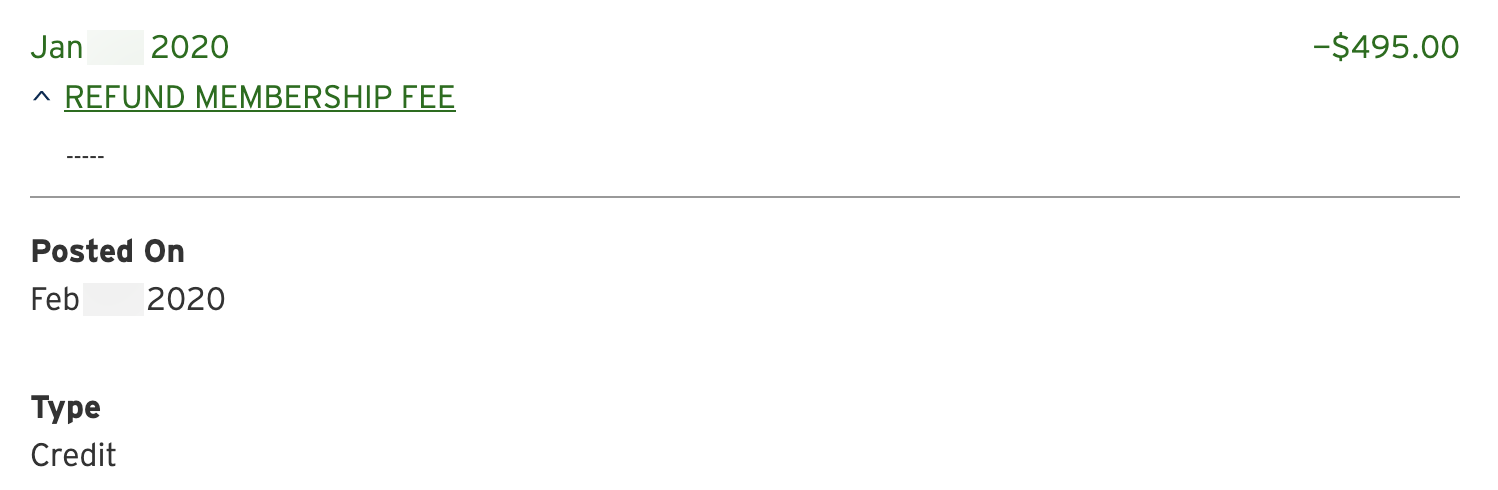

At this point, I had no firm idea what to expect Citi to do with the annual fee. 39 days had passed between the $495 annual fee appearing in my account and the call to cancel the card and, on top of that, I had used up a $250 travel credit.

The internet had told me that Citi would not claw back the travel credit (something I was banking on when I had decided to wait until my new cardholder year before downgrading) but what would happen to the annual fee?

I saw the answer today – Citi refunded the full $495 annual fee.

I still haven’t seen the annual fee for the Citi Premier card post to my account (I think that can take up to 60 days to appear) but my experience confirmed two things:

- You can downgrade the Citi Prestige Card for a full refund even after 30 days have passed since the annual fee posted.

- Citi will not claw back the Prestige’s $250 travel credit even if you downgrade the card within hours of the credit posting.

A Cash Positive Result

Because I didn’t cancel or downgrade my Prestige Card when the thought first occurred to me I paid, at most, 3 months worth of annual fee that I may have been able to avoid if I had downgraded in October 2019 and Citi had agreed to give me a prorated annual fee refund.

3 months of the Citi Prestige’s annual fee is equal to $123.75 and it would have been nice to get that back (assuming Citi would even offer a prorated refund) but, by waiting until a new cardmember year and then using the travel credit before I downgraded, I actually gained $250. So I’ve come out ahead by over $125.

Bottom Line

It’s nice to have re-confirmed that the Citi Prestige Card can be canceled or downgraded for a full annual fee refund even after 30 days have passed since the annual fee posted and it’s nice to have confirmed that Citi still isn’t clawing back the travel credit if you cancel or downgraded that card after having used it.

After all the annoyances the Citi Prestige has foisted upon us in the past few years it’s nice to actually come out a little ahead for a change.

Prestige travel credit always posts at the end of the billing cycle. Citi IT is not like Amex.

Based on my 2019 experience that’s not the case – in Jan 2019 my travel credit posted within 3 days

My fee was also March 1 st. I spend money on hotels end of February and when my billing statement closed I had revived the credit and the fee. I called them to downgrade it on March 4 and I have already received my refund for the fee and I kept the credit.

Received*

[…] I Downgraded My Citi Prestige Card And Confirmed Something Good […]

[…] I’ve had it for less than two months and it’s only in my credit card portfolio because I’d had enough of the Citi Prestige Card but didn’t want to give up on Citi’s ThankYou program entirely. Now we’re hearing […]