TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Update 4 June 2020: Citi has brought forward the timing for some of the changes discussed below (more details here).

I’m new to the card_name. I’ve had it for less than two months and it’s only in my credit card portfolio because I’d had enough of the Citi Prestige® Card but didn’t want to give up on Citi’s ThankYou program entirely. Now we’re hearing news that the card_name is changing and that it’s changing significantly enough to affect most cardholders.

card_name changes & timings

Citi is adding a new bonus category, changing the qualifying criteria in a bonus category, improving earnings in a bonus category and reducing earnings in a bonus category and, just in case that wasn’t complicated enough, the changes take place at different times depending on if you’re a cardholder or not and when you’re approved for the card.

The changes

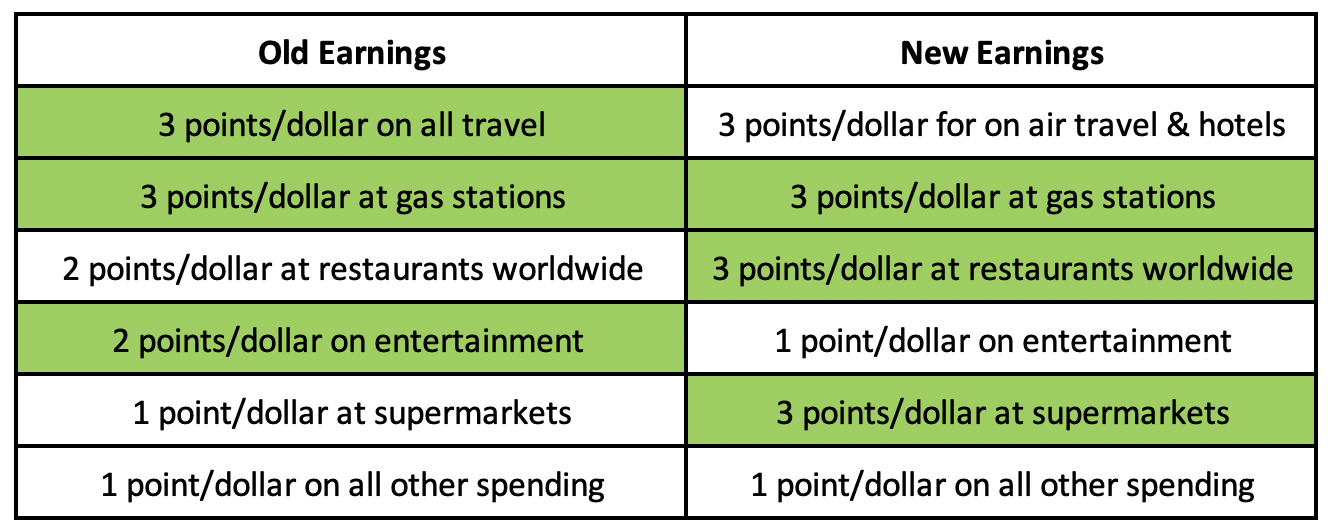

Here’s how things are changing (the green highlights show the good aspects of the current earning rates and the new earning rates):

- The card_name will no longer earn 3x points on all travel (so taxis, ridesharing services, trains, buses, transit, tolls, parking fees, etc… will no longer earn bonus points) but it will continue to offer 3x points on airfare and hotel spending.

- The 3x points at gas stations remains in place.

- Spending at restaurants will earn at an improved rate of 3 points/dollar.

- Entertainment spending will no longer earn bonus points.

- Supermarket spending is being introduced as a new bonus category and will earn 3 points/dollar.

Furthermore…

- Points earned by the card_name will no longer be redeemable for 1.25 cents when used for air travel booked through ThankYou.com.

- A new annual benefit is being introduced which gives cardholders a $100 discount on one hotel booking of $500 or more (excluding taxes and fees) when the booking is made through the ThankYou portal.

The Timings

Update 4 June 2020: Citi has brought forward the timing for some of the changes discussed below (more details here).

This is where things get a little complicated.

The changes are kicking in as of 23 August 2020…but not for everybody.

Current card_name holders:

- If you currently hold the card_name you will continue to earn points based on the current earnings rates through 10 April 2021 and you’ll earn 3 points/dollar at grocery stores and restaurants from 23 August 2020. From 10 April 2021 only the new earning rates will apply.

New applicants approved today (10 April 2020):

- If you successfully apply for the card_name today (10 April 2020) you will be grandfathered into the current earnings rates through 10 April 2021 and you’ll earn 3 points/dollar at grocery stores and restaurants from 23 August 2020. From 10 April 2021 only the new earning rates will apply.

New applicants approved after 10 April 2020:

- If you successfully apply for the card_name after 10 April 2020 you will earn points based on the current earnings rates until 23 August 2020 after which point you will earn points based on the new earnings rates.

All card_name Holders:

- All card_name holders (regardless of application date) will be able to use the new $100 hotel booking benefit from 23 August 2020.

- All card_name holders will be able to get 1.25 cents of value out of each point when booking airfare via the ThankYou portal until 10 April 2021. From 10 April onwards the redemption value will be 1.0 cents/point.

Thoughts

This is one of the more difficult sets of benefit changes to critique because some people will love them while others will not.

The positives

Being able to earn 3 points/dollar at supermarkets without a cap is a very nice benefit to have and this will be the first credit card which will offer bonus points on earnings on supermarkets worldwide (this is an especially big bonus if you’re a heavy Airbnb user when you travel abroad or if you spend time in timeshares outside of the US).

The fact that the 3 points/dollar earning rate at gas stations isn’t going away is very good news as this maintains the card_name‘s position on the list of the best credit cards to use when filling up your vehicle(s).

The 3 points/dollar earning rate at restaurants worldwide is a good improvement to the card’s offering and it brings it in line with the earnings rate offered by the more expensive card_name.

The negatives

Cardholders will lose the ability to earn 3 points/dollar on all travel-related purchases outside of air travel and hotels…and that’s annoying. Citi could have made the card_name a huge threat to the card_name had it maintained the 3 points/dollar earnings on all travel and added the 3 points/dollar earnings for worldwide dining, but it chose to pass on that opportunity. I’m not sure why.

There aren’t all that many cards that offer 2 points/dollar (or more) on entertainment spending so this has been a nice niche aspect of the card_name for some time (especially after the Citi Prestige® Card culled this benefit). It’s disappointing to see this earning rate cut and it now means that the Citi® Double Cash Card is the obvious choice for entertainment spending.

I have to confess that I can’t remember the last time I redeemed Citi ThankYou points for flights through the ThankYou portal, but I know that the 1.25 cents/point redemption rate has long been a much-loved option for a lot of cardholders. A lot of people downgraded to the card_name when the Citi Prestige® Card stopped offering a 1.25 cents/point redemption rate on airfare bookings so the fact that the card_name is now also losing this option will be seen as a big blow by many.

How this will affect me

From a personal point of view, there are two key takeaways for me:

- The card_name has now had its place in my everyday wallet firmed up. It may cost more (I consider it to have a net annual fee of $250) but it’s a card that will earn me 3 points/dollar on day-to-day travel spending and on dining too. The card_name could have taken the place of the card_name, but now that it won’t offer more than 1 point/dollar in most travels categories, the card’s 3 points/dollar earnings at restaurants is irrelevant – I’m not going to hold two cards in my wallet when I can hold one.

- The card_name will probably get an outing when I need to do the household groceries and when I need to fill the car up with gas. The fact that the card_name will offer me 3 points/dollar on supermarket spending made abroad as well as spending made in the US is a huge bonus as I spend almost half of my life outside the US.

Overall the changes are probably a net positive for me.

I’m not too disappointed that the card_name won’t offer 3 points/dollar on all travel spending as I have the card_name to cover that category, but the 3 points/dollar earning rate at all supermarkets now makes this the best card for me to use when I’m doing the grocery shopping, and the 3 points/dollar the card continues to offer at gas stations is still a category leader in my portfolio.

Bottom line

If your main reasons for holding the card_name revolved around the fact that the card offered strong earnings in all travel categories and because you liked redeeming ThankYou points for airfare purchases these changes are bad news for you.

If, on the other hand, you eat out a lot and spend quite a bit at supermarkets the card_name just got a lot more valuable. It’s now the cheapest card on the market to offer at least 3 valuable points/dollar on dining, and the fact that the card offers 3 points/dollar on supermarket spending worldwide with no cap on earnings, means that it will appeal to quite a broad audience.

How do you feel about these changes? Net positive or net negative?

I have this card for the bonus earnings on entertainment and other travel expenses, and to a lesser extent gas, since I don’t drive much and own a hybrid. I use the Amex Gold for its higher and more valuable earnings on groceries and restaurants. So these changes will prompt me to cancel this card next year. Thanks for the FYI.

I like the changes. I was going to cancel my Amex Gold (too hard to use the credits) and keep my Amex Blue Cash Preferred for groceries, and my Citi Premier for gas and to pool my Citi Double Cash points. Now I am going to cancel both my Gold and BCP and going forward use my Sapphire Reserve for all travel and dining, my Chase Freedom for the quarterly bonus categories, and my Premier for gas, groceries and Double Cash points pooling. The loss of 2x for entertainment is really meaningless since the Double Cash offers 2x for all spend if you transfer your cash back to TY points.

I too keep this card for entertainment purchases (event tickets) and miscellaneous travel-related stuff (parking meters, etc.) and the elimination of those two means I’m outta here. That effectively places Citi at peril of losing my business entirely…. I have the $450 AA card for lounge access, but I charge next to nothing on it anymore and can’t see using it ever anymore, given AA’s stingy premium class availability on my mega-stash points from 30-year-loyalty (unreciprocated).

The Citi cash back card is nice, so maybe I’ll use that until they screw it up, too. But Chase’s cards will now fit toward the front of the wallet, along with Amex Gold (for restaurants and groceries) and Amex Blue For Business (for everyday spend at 2x points, up to $50k annually,)