TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

The Citi Prestige credit card may not yet be open to new applicants (we’re expecting an announcement on that any day now) but current cardholders can start to make the most of some of the card’s new benefits from today – 4 January 2019.

Citi Prestige Card Changes Kicking In Today

Citi is rolling out a number of changes to the Prestige card this year (across three phases) and the first phase sees the card earnings increased for spending in three categories.

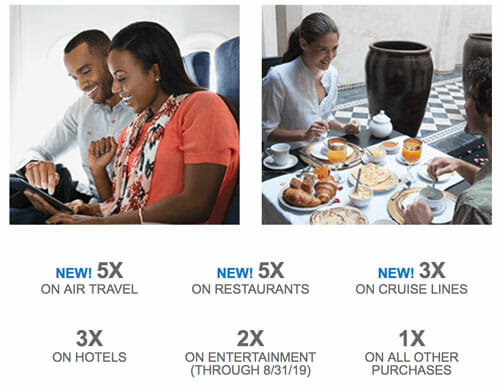

From today the Citi Prestige credit card will earn….

- 5x ThankYou points at restaurants worldwide (up from 3x)

- 5x ThankYou points on air travel booked directly with an airline (up from 3x)

- 3x ThankYou points for spending with cruise lines (up from 1x)

- 3x ThankYou points for spending on hotels (no change)

- 2x ThankYou points on entertainment (through 31 August 2019 – then reverts to 1x)

- 1x ThankYou points on all other purchases (no change)

These earning rates should now make the Prestige card a considerably more popular card to use (for some) and reposition it as a better card to use in a number of popular categories.

Essentially the changes to the earning rates mean that….

- The Citi Prestige card is now the best earning credit card in the dining category

- The card now matches the Platinum Card from American Express for earnings from airfares booked directly with airlines

- The card now earns noticeably more points on airfares booked directly with airlines than the Chase Sapphire Reserve credit card (which only offers 3 points/dollar)

- The card now matches the Chase Sapphire Reserve card for earnings from spending with cruise lines.

- The card continues to match the Chase Sapphire Reserve card for spending with hotels

In addition to the changes to earnings, the $250 air credit that the Citi Prestige has historically only offered on air fares is now expanded to include all eligible travel purchases. This brings it in line with how the travel credit offered by the Chase Sapphire Reserve card works (although the Sapphire Reserve card continues to offer a $300 travel credit).

Note: ”eligible travel purchases” include purchases from/through: airlines, hotels, car rental agencies, travel agencies/travel aggregators/tour operators, commuter transportation, ferries, commuter railways, subways, taxis/limousines/car services, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, and bus lines.

Bottom Line

There are a few negative changes coming to the Citi Prestige card later in the year but, for now, the enhanced earnings on dining and airfare coupled with the improved travel credit make the card a noticeably improved proposition.

I’ll post a fuller comparison of the three major transferable currency premium credit cards in the coming days but for now I’ll leave you with these thoughts:

The Citi Prestige credit card is now the highest earning credit card for anyone eating out and, thanks to its travel protection benefits, it’s probably the best credit card to use when booking flights directly with airlines.

Naturally consideration should be given to how Citi ThankYou points compare to the other transferable currencies (i.e where the points can be transferred to) but, as I assign similar valuations to all three currencies, the Citi Prestige card just got a lot more interesting….for now.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

Is there an article published about that chronicles the best ways to use ThankYou points? It seems your current strategy is to gain a ton of TY points. I’m interested to learn how you plan to use them.

My MR points & UR points are constantly used, but my thankyou points more/less sit there. I have the Citi Premier card and roughly 30K points currently banked. I moved 90K TY points to SQ for award travel about 6 months ago, so there’s that, but overall it still seems the ability to get value out of TY points (compared to MR & UR) is still a bit light. Am I missing something?

Thanks for the idea for a blog post (which I’ll do my best to write within the next few days).

Like you I’m a big fan of UR points (I love using them for Hyatt stays) but I definitely have uses for all three of the major convertible currencies despite the fact that there is quite a bit of overlap between the programs to which each can transfer points.

I wouldn’t say that my strategy is to gain a ton of ThankYou points but rather to make sure that I’m maximising my earnings whenever I take a credit card out of my wallet – I may now use the Prestige Card for air fare and my Reserve Card for other travel and end up using both currencies to top up one airline program.

I’ll explain in more detail in the post I’ll publish next week.

[…] Still, with the Citi Prestige card now offering 5 points/dollar at all restaurants worldwide (significantly overshadowing the Amex Gold’s offering in that department) anything could be possible. […]