TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

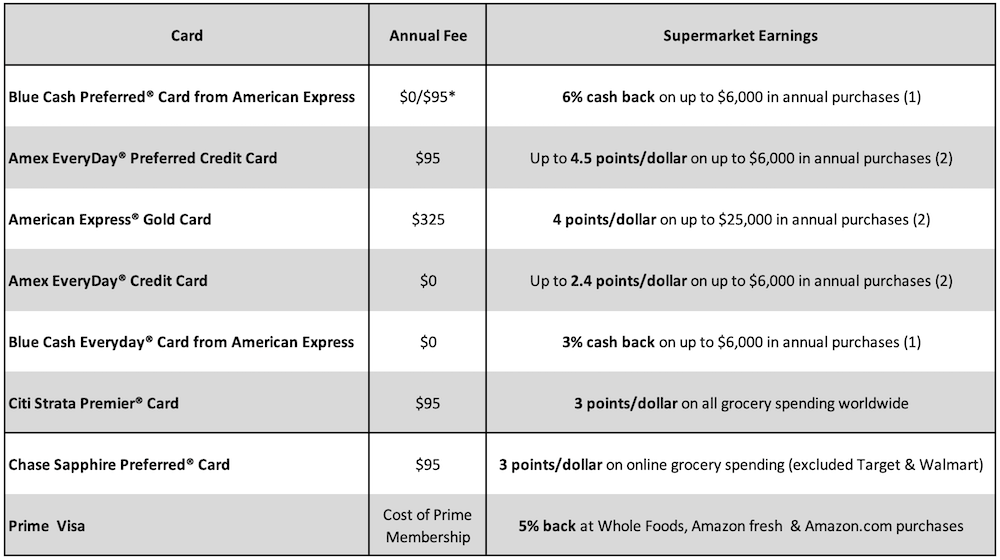

Grocery spending is often one of the biggest monthly costs that you can pay with a credit card, so it makes sense to make sure that any grocery spending that you make, is paid for with a credit card that gives you the best return (either in cash back or in points).

With that in mind, this article takes a look at 8 of the best mainstream credit cards you can hold if you’re looking to maximize your return every time you go to your local supermarket or neighborhood grocery store.

Cards for general supermarket spending

- Blue Cash Preferred® Card from American Express

- The Amex EveryDay® Preferred Credit Card

- American Express® Gold Card

- The Amex EveryDay® Credit Card

- Blue Cash Everyday® Card from American Express

- Citi Strata Premier℠ Card

Note: All information about the Amex EveryDay® Preferred Credit Card and the Amex EveryDay® Credit Card has been collected independently by Traveling For Miles. The Amex EveryDay® Preferred Credit Card and the Amex EveryDay® Credit Card are not currently available through Traveling For Miles.

Cards for online groceries

- Chase Sapphire Preferred® Card

- Prime Visa

As you’ll see, American Express is dominant when it comes to cards that offer bonuses or enhanced cash back for shopping at supermarkets, but Chase and Citi both also have cards that are worth considering.

In summary

*$0 annual fee for the first year then $95/year after that.

(1) 1% cash back thereafter (terms apply) – all bonus earnings only applicable to spending at U.S. supermarkets.

(2) 1 point/dollar thereafter (terms apply) – all bonus earnings only applicable to spending at U.S. supermarkets.

Cards for general supermarket spending

Blue Cash Preferred® Card from American Express

Annual fee:

- $0 intro annual fee for the first year, then $95.

Earnings (terms apply):

- 6% cash back at US supermarkets on up to $6,000 in annual purchases (1% thereafter)

- 6% cash back on select U.S. streaming services

- 3% cash back on transit purchases

- 3% cash back at US gas stations

- 1% cash back on all other eligible purchases

Key benefits (terms apply and enrollment may be required):

- Secondary rental car coverage

- Returns protection

Important to know (terms apply):

- Cash back is earned in the form of reward dollars which can be redeemed as a statement credit or at Amazon.com checkout.

- Once you have reached the $6,000/year spending limit at US supermarkets you’ll earn 1% cash back on all US supermarket spending for the rest of the year.

- Superstores, convenience stores, and warehouse clubs are not considered supermarkets (see here for more details)

- At the time of writing, 30 U.S. streaming services are eligible for 6% cash back including Apple Music, Spotify, MLB.TV, Max, and Pandora (see here for more details).

In summary:

The Blue Cash Preferred® Card from American Express offers a higher rate of cash back at US supermarkets than any other mainstream card and the highest rate of cash back on streaming services too.

With cash back best used as statement credits, this card would suit someone who prefers not to have to worry about maximizing value from points currencies and enjoys getting a very good return on their supermarket spending.

Amex EveryDay® Preferred Credit Card

Annual fee:

- $95 (rates & fees)

Earnings (terms apply):

- 3 points/dollar at US supermarkets on up to $6,000 in annual purchases (1 point/dollar thereafter)

- 2 points/dollar at US gas stations

- 2 points/dollar on eligible spending at AmexTravel.com

- 1 point/dollar on all other purchases

Key benefits (terms apply and enrollment may be required):

- Earn 50% more points in each billing cycle in which you use your card 30 or more times.

- Secondary rental car cover

- Returns protection

- Access to Membership Rewards transfer partners (more details)

Important to know (terms apply):

- Once you have reached the $6,000/year spending limit at US supermarkets you’ll earn 1 point/dollar on all US supermarket spending for the rest of the year.

- Superstores, convenience stores, and warehouse clubs are not considered supermarkets (see here for more details).

In summary:

The key to unlocking this card’s value is to ensure you make at least 30 transactions on this card every billing cycle (net of returns/refunds) as that will see you earn 50% more points on all your Amex EveryDay® Preferred spending (not just US supermarket spending).

Assuming you make at least 30 transactions with this card in a billing period, the Amex EveryDay Preferred Card’s earnings shoot up to 4.5 points/dollar (on the first $6,000 of spending at US supermarkets).

As I value Amex Membership Rewards Points at 1.5 cents each (based on what value I can get out of them with ease), I view the Amex EveryDay Preferred card as a card that offers a rebate of up to 6.75% … and that’s a rate no other mainstream card can match.

Note: All information about the Amex EveryDay® Preferred Credit Card has been collected independently by Traveling For Miles. The Amex EveryDay Preferred Credit Card is not currently available through Traveling For Miles.

American Express® Gold Card

Annual fee:

- $325

Earnings (terms apply):

- 4 points/dollar at US supermarkets on up to $25,000 in annual purchases (1 point/dollar thereafter)

- 4 points/dollar at restaurants, plus takeout and delivery in the U.S. on up to $50,000 in annual purchases (1 point/dollar thereafter)

- 3 points/dollar on flights booked directly with airlines or on amextravel.com

- 1 point/dollar on all other eligible purchases

Key benefits (terms apply & enrollment required for some):

- Up to $120/year in dining credits at select eateries (comes as a $10/month credit)

- $100/year Resy credit (split into two $50 credits for Jan-Jun & Jul-Dec)

- $100/year Hotel Collection credit (a 2 night stay is required to trigger this credit)

- $10/month Uber Cash Credit useable in the US only (Gold Card must be added to Uber App)

- No foreign transaction fees

- Access to Membership Rewards transfer partners (more details)

Important to know (terms apply):

- Once you hit the $25,000/year spending limit at US supermarkets you’ll earn 1 point/dollar on all US supermarket spending for the rest of the year.

- Once you hit the $50,000/year spending limit on restaurant dining and takeout & delivery in the US, you’ll earn 1 point/dollar on all spending in those categories for the rest of the year.

- The $120/year in dining credits are offered as $10 credits/month which can be used at Five Guys, the Cheesecake Factory, Grubhub, Seamless, Goldbelly, and Wine.com.

- Superstores, convenience stores, warehouse clubs, and meal-kit delivery services are not considered supermarkets (see here for more details).

In summary:

The American Express® Gold Card offers one of the highest rates of return at US supermarkets and using my valuation of Membership Rewards points (1.5 cents/point), the card essentially offers me an effective rebate of 6% on US supermarket shopping (on up to $25,000 in purchases – 1 points/dollar thereafter) … and that’s a great rebate to have.

This card comes with a higher annual fee than any of the other cards in this article, but that’s because it also offers cardholders more benefits and, if you’re someone who travels, better earnings rates in categories where spending is likely to be high (restaurants and flights booked directly with airlines).

Amex EveryDay® Credit Card

Annual fee:

- $0 (rates & fees)

Earnings (terms apply):

- 2 points/dollar at US supermarkets on up to $6,000 in annual purchase (1 point/dollar thereafter)

- 2 points/dollar on eligible spending at AmexTravel.com

- 1 point/dollar on all other purchases

Key benefits (terms apply and enrollment may be required):

- Earn 20% more points in each billing cycle in which you use your card 20 or more times.

- Secondary rental car cover

- Access to Membership Rewards transfer partners (more details)

Important to know (terms apply):

- Once you have reached the $6,000/year spending limit at US supermarkets you’ll earn 1 point/dollar on all US supermarket spending for the rest of the year.

- Superstores, convenience stores, warehouse clubs, and meal-kit delivery services are not considered supermarkets (see here for more details).

In summary:

The key to unlocking this card’s value is to ensure you make at least 20 transactions on this card every billing cycle (net of returns/refunds) as that will see you earn 20% more points on all your Amex EveryDay® spending (not just US supermarket spending).

Assuming you make at least 20 transactions with this card in a billing period, the Amex EveryDay Preferred Card’s earnings will be 2.4 points/dollar (on the first $6,000 of spending at US supermarkets).

As I value Amex Membership Rewards Points at 1.5 cents each (based on what value I can get out of them with ease) the Amex EveryDay Card essentially offers me a rebate of up to 3.6% and, for a card that costs nothing to hold, that’s not bad going.

As credit cards go the Amex EveryDay® Card is pretty basic, but that’s not a bad thing. For no annual fee, you can earn a 10,000 point welcome bonus (worth, to me, $150), get a good rebate on US supermarket spending, and get access to Amex offers which can save you a significant amount of money or earn you a significant number of American Express Membership Rewards points which can be transferred over to a wide variety of loyalty programs.

Note: All information about the Amex EveryDay Credit Card has been collected independently by Traveling For Miles. The Amex EveryDay Credit Card is not currently available through Traveling For Miles.

Blue Cash Everyday® Card from American Express

Annual fee:

- $0

Earnings (terms apply):

- 3% cash back at US supermarkets on up to $6,000 in annual purchases (1% cash back thereafter)

- 3% cash back at US gas stations on up to $6,000 in annual purchases (1% cash back thereafter)

- 3% cash back on up to $6,000 of US online retail purchases (1% cash back thereafter)

- 1% cash back on eligible spending in all other categories

Key benefits (terms apply and enrollment may be required):

- Up to $15 in monthly statement credits* for online meal kit purchases from Home Chef.

- A $7 monthly statement credit* for spending $9.99 or more (each month) on an eligible Disney Bundle subscription.

- Returns protection

*Terms & conditions apply and enrollment may be required

Important to know (terms apply):

- Cash back is earned in the form of reward dollars which can be redeemed as a statement credit or at Amazon.com checkout.

- Once a cardholder reaches the $6,000/year limit imposed on spending in select shopping categories, they’ll earn 1% cash back on all further eligible spending in those categories.

- Superstores, convenience stores, warehouse clubs, and meal-kit delivery services are not considered supermarkets (see here for more details).

In summary:

The Blue Cash Everyday® Card from American Express has a $0 annual fee and offers a very good rate of return for spending made at US supermarkets.

As an added bonus, it offers 3% cash back on up to $6,000 of spending/year at US gas stations (1% thereafter) and 3% cash back on up to $6,000 of US online retail purchases (1% thereafter) and, as with all American Express cards, it gives cardholders access to valuable Amex Offers which can save them even more money.

With no points currency to worry about (just pure cash back), the card_name would best suit someone who prefers to focus on getting a good return on their supermarket purchases rather than trying to maximize value out of a Membership Rewards points balance.

Citi Strata Premier℠ Card

Annual fee:

- $95

Earnings:

- 10 points/dollar on hotels, rental cars, and attractions booked through the Citi Travel portal.

- 3 points/dollar at supermarkets (no cap)

- 3 points/dollar at restaurants worldwide

- 3 points/dollar at gas stations worldwide

- 3 points/dollar on air travel

- 3 points/dollar on hotel bookings

- 1 point/dollar on all other spending

Key benefits:

- Get a once-per-year $100 statement credit for hotel bookings of $500 or more made through the Citi Travel portal (excludes taxes and fees).

- Transfer points to a variety of loyalty programs in a ratio of 1:1

- No foreign transaction fees

In summary:

The Citi Strata Premier℠ Card is the most premium of the Citi ThankYou cards still open to new applicants following Citi’s decision to remove the Prestige Card from circulation.

This is one of the best all-around cards to use for grocery spending as the bonus points on offer are not limited to spending in the US or to establishments viewed as supermarkets by the credit card companies – spending at supermarkets worldwide will earn 3 points/dollar and my personal experiences suggest that even small grocery stores around the world will trigger the bonus.

Cards for online groceries

Chase Sapphire Preferred® Card

Annual fee:

- $95

Earnings:

- 3 points/dollar on online grocery store purchases*

- 5 points/dollar on travel purchased through Chase Travel℠

- 3 points/dollar on dining worldwide

- 3 points/dollar on select streaming services

- 2 points/dollar on travel that isn’t booked through Chase Travel℠

- 1 point/dollar on all other spending

*Excludes Target, Walmart, and wholesale clubs

Key benefits:

- Redeem points at 1.25 cents each when booking travel through Chase.

- Transfer points to a variety of loyalty programs in a ratio of 1:1

- Earn up to $50 in statement credits each card anniversary year for hotel stays purchased through Chase Travel℠.

- 10% anniversary points bonus

- Primary auto rental cover

- No foreign transaction fees

In summary:

The Chase Sapphire Preferred® Card is a mid-tier card that offers access to Chase’s highly regarded Ultimate Rewards program from where cardholders can transfer their hard-earned points to a variety of airline and hotel loyalty programs in a 1:1 ratio.

As a card for grocery spending its uses are limited to online shopping, so this isn’t a card that’s going to help out if you buy most of your groceries at bricks and mortar stores.

For anyone who does a lot of grocery shopping online, however, the 3 points/dollar that this car earns would represent a very good return on spending.

Prime Visa

Annual fee:

- This card is exclusively for eligible Amazon Prime customers so although its annual fee is $0, an Amazon Prime membership is required.

Earnings:

- 5% back at Amazon.com

- 5% back at Amazon Fresh

- 5% back at Whole Foods Market

- 5% back on Chase Travel℠ Purchases

- 2% back at gas stations

- 2% back at restaurants

- 2% back on local transit spending (includes rideshare)

- 1% back on all other eligible purchases

Key benefits:

- Access to exclusive Prime cardmember offers (get an extra 5% – 20% back in rewards at Amazon.com)

- Travel accident insurance

- Lost luggage reimbursement

- Baggage delay insurance

- Secondary rental car cover

- Extended warranty protection

- Purchase protection

- Access to Visa Signature Luxury Hotels

- No foreign transaction fees

Important to know (terms apply):

- All earnings from from the Prime Visa are paid in the form of Amazon rewards points which can be used to offset the cost of purchases made on Amazon.com or which can be redeemed for cash. 1 point = 1 cent.

- The terms and conditions of the Prime Visa do not limit the bonus rebates earned at gas stations, restaurants and drugstores to US establishments, so the card works well at home or abroad.

In summary:

The Prime Visa is clearly a niche play in an article about getting the best returns on your grocery spending, but it’s important to be aware of just how much of your grocery shopping can actually be done through Amazon.com – it’s a lot!

If you already have a Prime membership this card is essentially free to hold, so the 5% back that it offers on Amazon.com spending and at Whole Foods and Amazon Fresh is a genuinely good deal (not even the best mainstream cash back cards can match this level of rebate at Amazon.com).

When you add in the fact that the card also comes with a gift card, access to discounts exclusive to Prime cardholders, and good purchase protections it becomes a card that most people who shop frequently through Amazon should probably have.

The Amex limitation

Before you decide which card you should be using when grocery shopping (or which card to apply for), it’s important to keep in mind a limitation that the American Express cards have that is not shared by the cards issued by Chase or Citi – American Express cards only offer bonuses for spending at U.S. supermarkets.

There are two key takeaways from that statement:

- American Express has been very careful to state that bonus points are earned for spending made at stores that it categorizes as “supermarkets”. This can mean that some smaller local establishments will not be recognized as a supermarket and spending at such establishments will not earn bonus points or cash back (whichever your card earns).

- If you find yourself shopping outside of the United States, an Amex card will not earn you a bonus for supermarket spending. This point is may be less important to you than the first, but it’s one that’s worth keeping in mind if you travel abroad with any great frequency.

For most people, this doesn’t diminish the value of the American Express cards at all, but it’s something to keep in mind when deciding which card is best for you.

Bottom line

All of the cards discussed above can be great cards to hold in your wallet if you’re trying to maximize your returns when shopping for groceries.

I have chosen not to suggest which card I consider to be the best as each has its own merits, and a card that’s best for one person may not be best for the circumstances of someone else – that’s part of the fun of the miles and points world.

Still, with no annual fee cards mixed in with cards that charge an annual fee and with cash back cards mixed in with points earning cards, there should be a credit card in here for everyone.

What card do you use when you’re paying for your groceries?

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

One card that should be added to this list is Citi Custom Cash. The limitation is that we could spend up to 500 dollars every billing cycle, assuming that the top spend category is groceries. I switch to AMEX Gold or Citi Premier once I maximize the 500 dollars limit.

Lastly, for groceries outside USA, Citi Premier is a must card to have.

I use my AA MilesUP by CitiAdvantage. No annual fee; two miles per dollar at groceries.

Interested to know why you prefer to earn 2 AA miles in place of 3% cash back from the Amex Blue Cash. No judgement here at all, just interested.

The Verizon Visa earns 4% at grocery stores with no annual fee and no limit on spend.

How is that 4% paid out?