TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Last week, Citi revealed that it will be overhauling the card_name and making significant changes to the card’s bonus categories and to the bonus points on offer. One key piece of news was that, from later this year, the Citi Premier Card will no longer earn bonus points across all travel categories…but a lot of us missed one key element to that part of the announcement.

The kudos for spotting what I’m about to discuss has to go to Greg from Frequent Miler and I have to admit that I have no idea how he noticed what he did because it’s far from obvious.

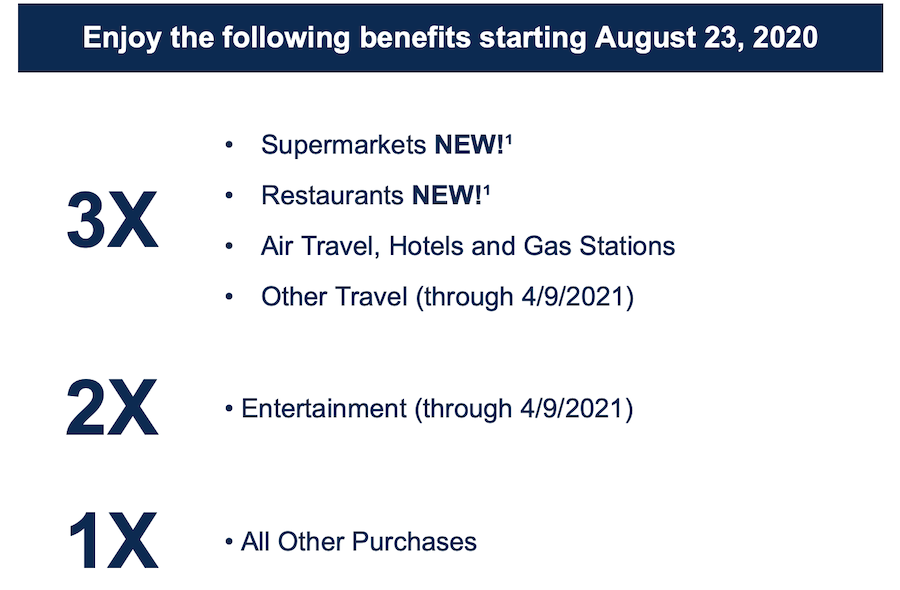

If you’re a Citi Premier cardholder (as I am) you will have received an email from Citi outlining the changes coming to the card from August 2020 and the promotional material in the email appears to be very clear:

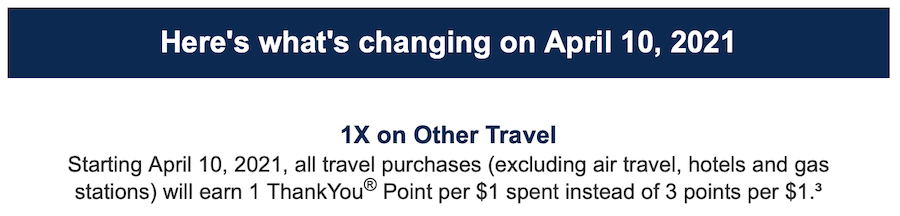

The card_name will offer 3 points/dollar on all travel through 9 April 2021 and, after that, all travel purchases (excluding air travel, hotels, and gas stations) will earn just 1 point/dollar. There’s no footnote to contradict any of that.

Even if you go to the dedicated page for the Citi Premier® Credit Card you won’t find anything to disagree with the idea that only airfare, hotels, and gas stations will earn 3 points per dollar, so most of us have been working under the assumption that only bookings made directly with airlines and directly with hotels/hotel chains will earn bonus ThankYou points…but that’s not the case.

If you delve into the full terms and conditions of the card_name (on this page) and scroll down to where the new earning rates from 10 April 2021 are explained, you’ll find this mini-paragraph:

Air Travel and Hotels: Additional ThankYou Points for each $1 spent on purchases at airlines, hotels, and travel agencies.

Note the last two words: Spending made through travel agencies will also earn 3 points/dollar.

What isn’t clear here is if Citi has any way of knowing whether a purchase made through a travel agency is for air travel/hotels or if it’s for anything else.

At the very least this news means that the card_name will continue to earn 3 points per dollar for airfares and hotels booked through online travel agencies (useful if you’re a Hotels.com fan) and, if it turns out that Citi cannot split airfare and hotel spending made with travel agencies from all other travel agency spending, this may mean that the card_name will continue to earn 3 points/dollar for all other travel agency bookings too (e.g. cruises, tours, rental cars, etc…).

I don’t think we’re going to know for sure what type of travel agency spending will and will not earn 3 points/dollar until new cardholders start using their cards this coming August, but we can be sure that you won’t have to book travel directly with airlines or hotels to earn 3 points/dollar with the card_name.

Bottom line

A lot of people (like me) will continue to use card_name for most airfare bookings and the card_name for all other travel spending because those cards offer a lot more traveler protections than the card_name, because they offer earning rates that are as good or better than the Premier Card’s, and because we prefer to earn Membership Rewards Points and Chase Ultimate Rewards Points over Citi’s ThankYou points.

But this will be good news for those who are heavily immersed in Citi’s ThankYou program and for whom ThankYou points are the preferred currency to earn.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

Does AirBnB count as hotels with the new categories?

I’m not 100% sure that it doesn’t but as Airbnb doesn’t code as travel with any other major credit card I doubt it will do so with this one.

So for me, the card is improved for the next year and then worthless. OK, I’ll keep it until next April.

When I booked with AirBnb with my Prestige it coded as a hotel purchase and I received 3x. I don’t know why the Premier would be different. It all depends on how the purchase is coded.

That’s very interesting because my Airbnb booking (back when I had the Prestige Card) only earned 1 point/dollar.

In my experience OTAs do not distinguish the underlying purchases. It just codes as a travel agency purchase. I received 5x on my Prestige purchasing museum tickets on Expedia.

That’s what I would have expected but I was suspicious when Citi didn’t remove OTAs from the Travel category.

i have the premier card, and airbnb gets me 3 pts.