TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

There are currently three credit cards linked to the IHG One Rewards program and in this article you’ll find a comparison of the annual fees, the earning rates, and the key benefits that these cards offer in what is (hopefully) an easily digestible format to make it easier to see which card would work best for you.

The three IHG Rewards credit cards

There are 3 IHG Rewards credit cards that are currently open to new applicants (we’re not including the IHG Rewards Select credit card here as it’s no longer available). Two are consumer cards and one is a business card.

- IHG One Rewards Traveler Credit Card

- IHG One Rewards Premier Credit Card

- IHG One Rewards Premier Business Credit Card

Two of these cards charge an annual fee while one does not and as you’ll see below, all three cards have their own key selling points.

A note before we continue

We have chosen to use tables to show what the three IHG Rewards credit cards offer and because we think the information speaks for itself, we don’t intend to add a lot of commentary about specific differences between the cards.

This article is intended more as a resource (with a few of our thoughts added in) rather than a blow-by-blow discussion of what we think is good and less good about each of the IHG cards.

Ok, let’s move on to the comparisons…

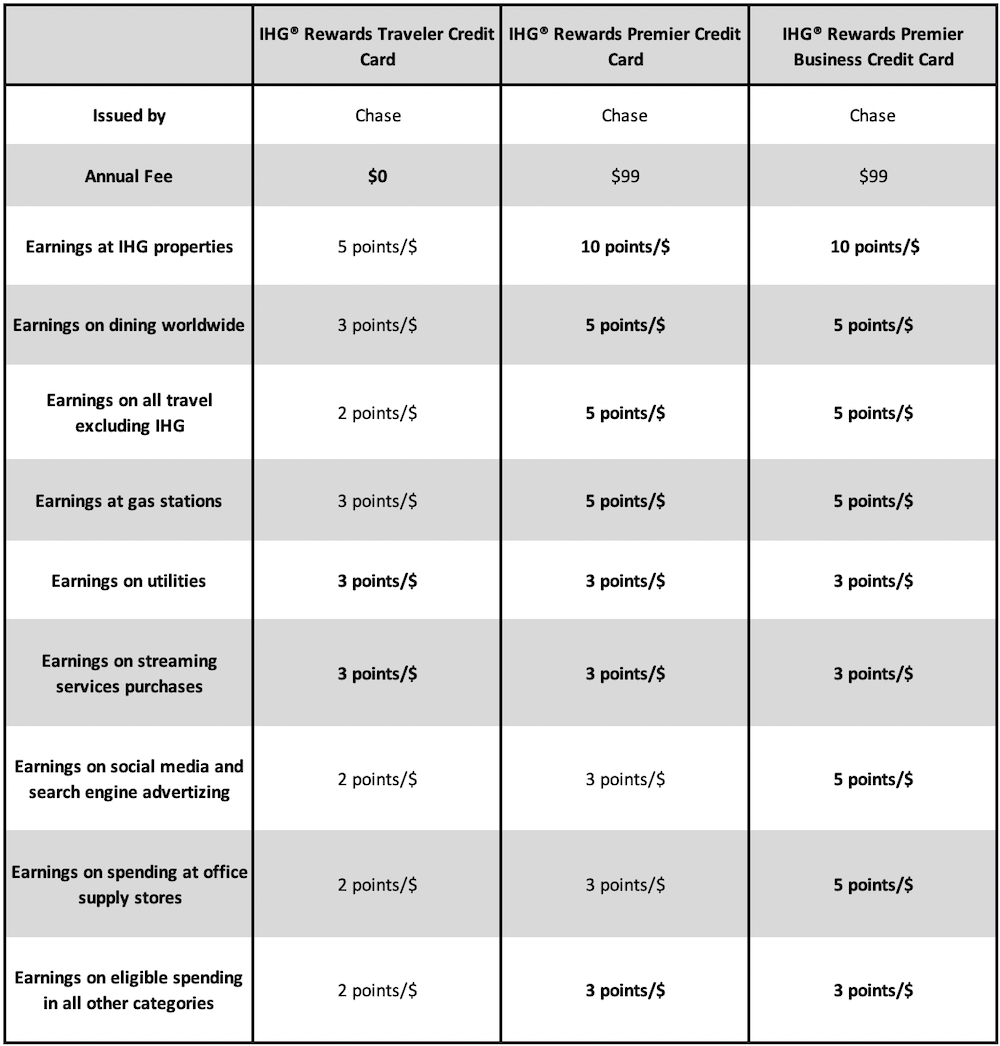

Comparing earning rates (terms apply)

~ Cardholders will earn up to 17 points/dollar on spending at most IHG properties because they will also earn 10 extra points/dollar for being an IHG One Rewards member and 2 extra points/dollar for holding Silver Elite status (a benefit of the Traveler card)

^ Cardholders will earn up to 26 points/dollar on spending at most IHG properties because they will also earn 10 extra points/dollar for being an IHG One Rewards member and 6 extra points/dollar for holding Platinum Elite status (a benefit that comes with these cards)

The key thing to point out here is the similarity between the earning rates offered by the IHG One Rewards Premier Credit Card and the IHG One Rewards Premier Business Credit Card, and it’s interesting to note that the business card is never once beaten by the earning rates offered by either of the consumer cards – that’s not something that we see very often.

Also, while the IHG One Rewards Traveler Credit Card clearly offers the weakest overall earnings, that’s something that needs to be viewed in context – this is a card that doesn’t charge an annual fee while both of its competitors do.

Don’t look at points/dollar in isolation

When looking at these earnings rates, don’t just look at the points/dollar number in isolation.

To get a true view of how good or bad these earning rates are, you should always work out how much value the earning rates are offering you and go from there.

Here’s what we mean by that:

We value IHG One Rewards Points at 0.4 cents each (based on the value that we know that we can get out of them with ease) and that means that where one of these IHG cards offers us 5 points/dollar for spending in a given category, we know that for us, that’s an effective return of 2.0% on our spending.

This helps put things in context as while a headline earning rate of 5 points/dollar can look impressive, the fact that it only equates to a 2.0% return shows that it’s actually not that good at all and that we would probably do better by using another credit card when spending in that particular category.

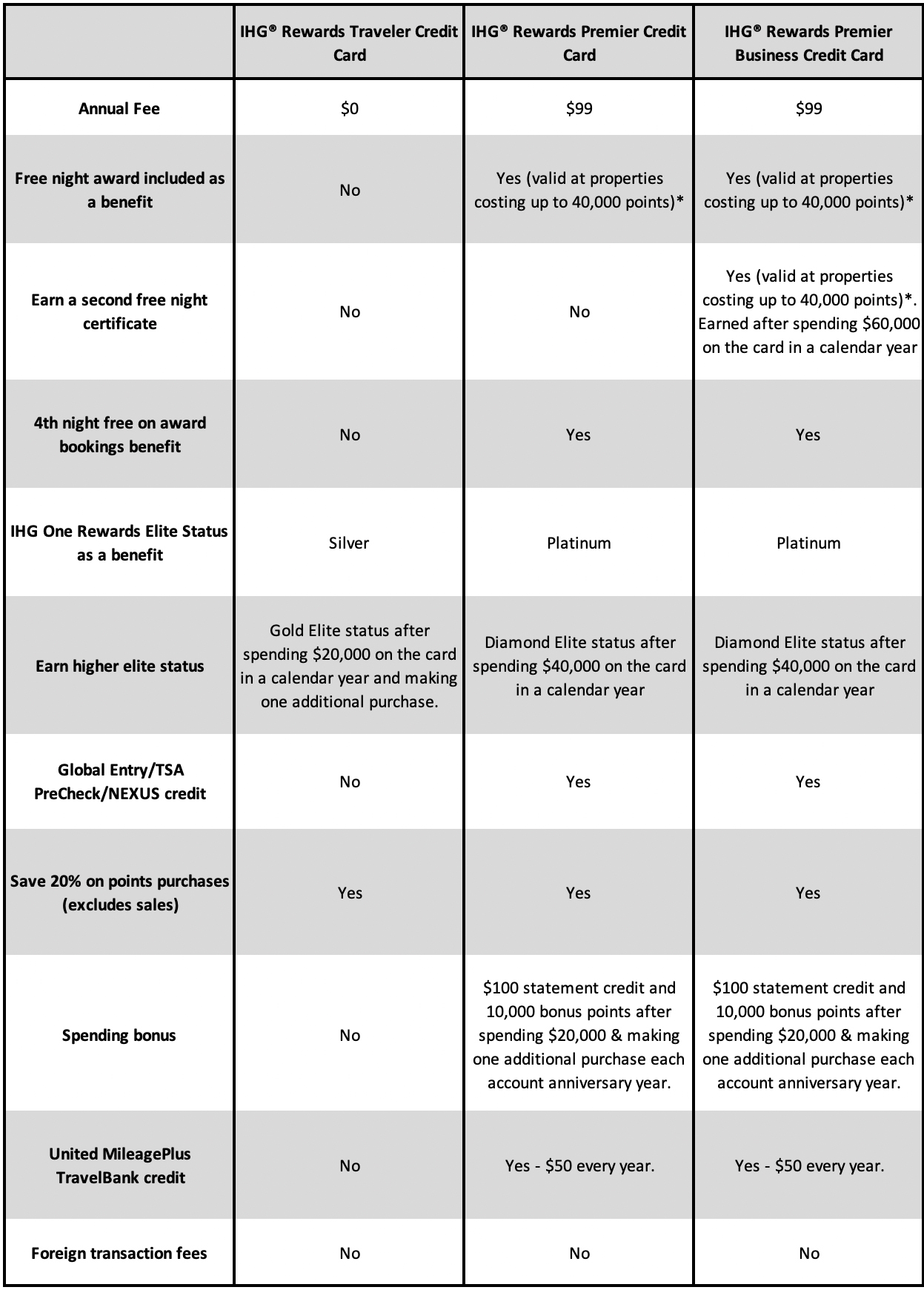

Comparing key benefits (terms apply & enrollment may be required)

Deciding what is and what isn’t a key benefit is, by definition, a subjective thing so not all benefits may have been listed below.

Having said that, the benefits that have been included below should be more than enough to help you see just what a cardholder is being offered in return for the annual fee that each card charges.

*These free night certificates can be topped up using IHG One Rewards Points and so can be used to part-pay for more expensive properties.

As usual, it’s important to keep some of these benefits in context when evaluating the cards as some are not as valuable as they may appear.

Take, for example, the $100 statement credit + 10,000 bonus points that can be earned by holders of the IHG One Rewards Premier Business Credit Card and holders of the IHG One Rewards Premier Credit Card.

$100 + 10,000 points probably sounds quite nice, but because you have to put $20,000 of spending on to these cards to earn this, this isn’t a benefit that most cardholders should be trying to trigger.

Yes, if you’re a cardholder who can spend the $20,000 at IHG properties, then by all means go ahead and do just that, but because in all other categories these cards offer noticeably worse returns than a lot of other credit cards on the market, putting so much non-IHG spending on one of these cards is a sub-optimal idea.

Likewise, the fact that the IHG One Rewards Premier Business Credit Card offers cardholders the chance to earn a second free night certificate may look like it gives the card an edge over its siblings, but because a cardholder would have to put $60,000 of spending on to their card to trigger this benefit, it’s not much of an edge at all.

A 40,000-point free night certificate isn’t worth more than $200, and by putting $60,000 of non-IHG spending on the IHG One Rewards Premier Business Credit Card just to earn that benefit, a cardholder would almost certainly be leaving behind significantly more than that in earnings that they would have enjoyed had they used a more appropriate card for that spending.

Our (very brief) thoughts on the cards

There really isn’t much to split the IHG One Rewards Premier Business Credit Card and the IHG One Rewards Premier Credit Card but because the business card offers more opportunities to earn bonus points, we would have to give that card the edge.

The IHG One Rewards Traveler Credit Card may look like an ugly duckling when compared to its more premium siblings, but the truth is that this is actually a great card to hold. It doesn’t charge an annual fee and it offers one of the best benefits that these cards offer – the 4th-night free benefit on award bookings.

The fact is that unless you’re likely to stay at IHG properties more than once or twice a year, you probably don’t need most of the benefits that the other two cards offer, so why pay for them?

If, however, you happen to be someone who loves IHG One Rewards and stays at IHG properties reasonably frequently, then the extra benefits offered by the two more premium cards will probably be more useful and so paying an annual fee will make sense.

Bottom line

Hopefully, the tables above will provide readers with a useful resource when it comes to deciding which IHG Rewards card is best for them or if they should bother having an IHG Rewards card at all. If there’s anything that you think we’ve missed or something that you’d like us to add in or discuss, let us know in the comments section below and we’ll see what we can do.

Related reading: Comparing the Marriott Bonvoy consumer credit cards

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

Just this week, IHG was sending out links to apply for the IHG premier card and get boosted back up to Diamond on approval. 140k points for $3000 spend in 3 months with that.

Email titled: “Exclusive offer: Get your Diamond Elite status back”

Diamond status just for getting the card?! Wow.

Yes, but these are for US accounts that were Diamond Ambassador last year and recently got downgraded to Platinum Ambassador.

IHG emails today:

“Your Diamond benefits miss you, ____

As a loyal member of IHG One Rewards, you mean the world to us. That’s why we’re offering you an exclusive opportunity to get back to Diamond Elite status.

For a limited time, apply for the IHG One Rewards Premier Credit Card and get automatic Diamond Elite status through December 31, 2024 once approved.*

Plus, you’ll enjoy all of the perks of the Premier Card and earn 140,000 bonus points after spending $3,000 in the first 3 months from account opening.* That’s up to 4 nights at most of our hotels and resorts!

Apply by 02/07/2024”

As of now, those approved accounts from today haven’t updated from Platinum to Diamond, but the offer emails and the targeted link site make it clear that it should be Diamond status. Those same accounts got IHG Ambassador renewal offer emails today too.

Nice if you can get it! 🙂

Do you get the annual fee pro-rated (partial refund) if you downgrade from Premier to Traveler mid-year? I’m hearing conflicting DPs