TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Earlier this week, the government of the United Kingdom announced that its idiotic quarantine regulations would no longer apply to travelers visiting England from 60 nations as of 10 July but, even if you now find yourself allowed to travel to the UK, a recent announcement by the Chancellor of the Exchequer means that you probably shouldn’t be rushing to book your accommodation before 15 July.

As of 15 July, the UK government will be cutting the rate of tax levied on purchases made from various parts of the hospitality sector by 15%. Value Added Tax (VAT) on food, accommodation, movie theatres and select attractions will be reduced to just 5% and will remain at that rate through 12 January 2021.

Logically, you would expect this to mean that hotel rates for stays being made from 15 June would automatically be reduced by up to 15% (there’s no guarantee that hoteliers won’t keep some of the VAT savings for themselves by hiking prices) but, from what I can see right now (across all the major hotel chains), it would appear as if rates are not yet being reduced.

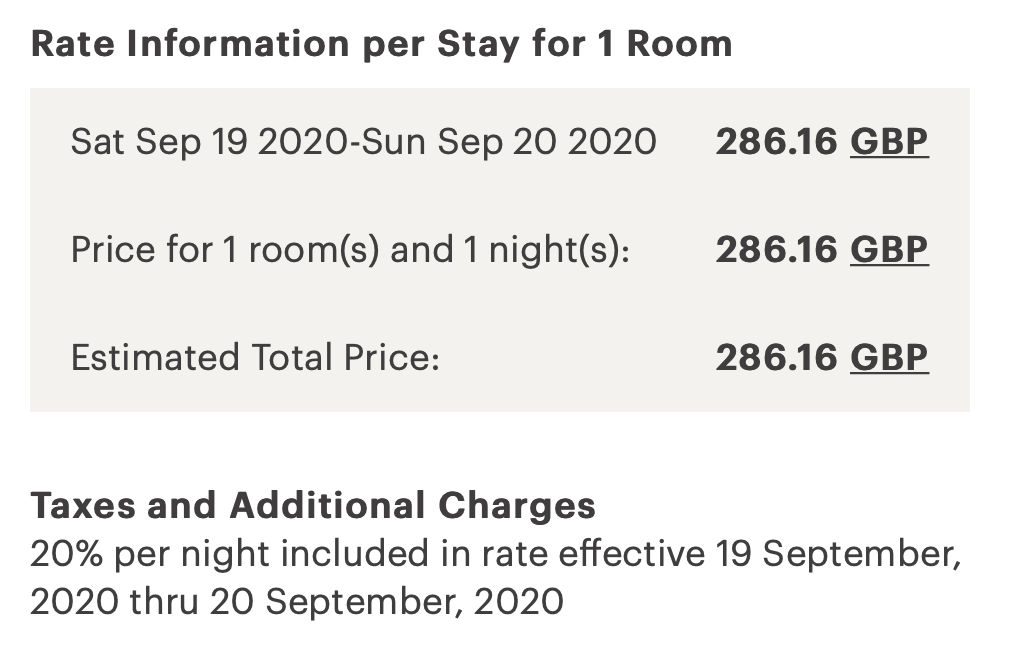

Here’s what IHG is currently charging for a room at the InterContiental Park Lane for a night in September…

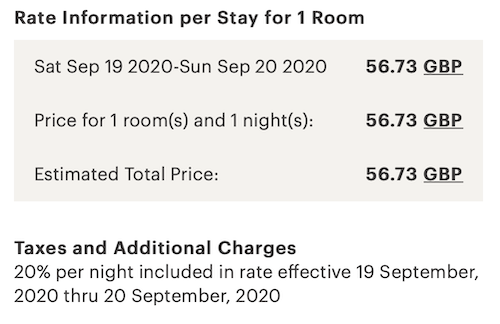

…and here’s the cost of the same night at the Holiday Inn Express in Limehouse (a property at the diametrically opposite end of the market):

Notice that both are still charging VAT at 20% and, if you have the time and inclination to check, you’ll find that the same is happening with all rates (not just prepaid rates).

It may be the case that some properties will drop their flexible rates in the next couple of days as their IT departments catch up with the government’s announcement, but I suspect that prepaid rates may not drop until the rate of VAT drops on 15 July. Right now, with a lot of hotels still offering flexible cancellation policies for all reservations (including prepaid rates)*, it’s often not worth paying extra for a flexible rate so people should be holding out to see what the prepaid rates look like when the VAT element is finally adjusted.

Bottom Line

With the official rate of VAT on large parts of the UK hospitality sector set to drop to just 5% on 15 July 2020, I’d advise travelers looking to visit the UK to avoid booking any hotel rate that doesn’t show VAT as being charged at 5%. Annoyingly, you may well have to wait until 15 July before that’s possible.

*Make sure you read each hotel’s Covid-19 cancellation/refund/rebooking policy carefully as changes to these policies are occurring more frequently right now – don’t assume all hotel policies are as generous now as they were just a few weeks ago.

[…] I wrote about this change to the level of VAT a few days ago, I did so to show readers that the level of VAT being charged at UK properties had not yet dropped […]

It’s now the end of July and IHG still have not reduced there rates in line with VAT counts…. Customer services will not answer why..

I have used IHG. for my business and holidays. Never again wil I use IHG, nor will my staff. They are a big chain just profiteering.

Shame on you IHG….