TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

A little over a week ago the UK Government announced that it was dropping the level of tax charged on the sale of items and services by the hospitality industry as it looks to try to help those sectors recover from months under lockdown. Of specific interest to readers of this blog was the news that VAT charged on hotel accommodation would be dropping, and that lead to the hope that UK hotel prices would fall when the tax cut came into effect. That hope may not have been entirely justified.

As of today, 15 July 2020, the level of VAT being charged on UK hotel accommodation is 5% (down from 20%) and as VAT is a tax on the consumer and not the hotelier (VAT is a sales tax so the hotelier is only acting as a government tax collector), it would be reasonable to expect the cost of a hotel night to drop in proportion to the drop in VAT…but this isn’t necessarily the case.

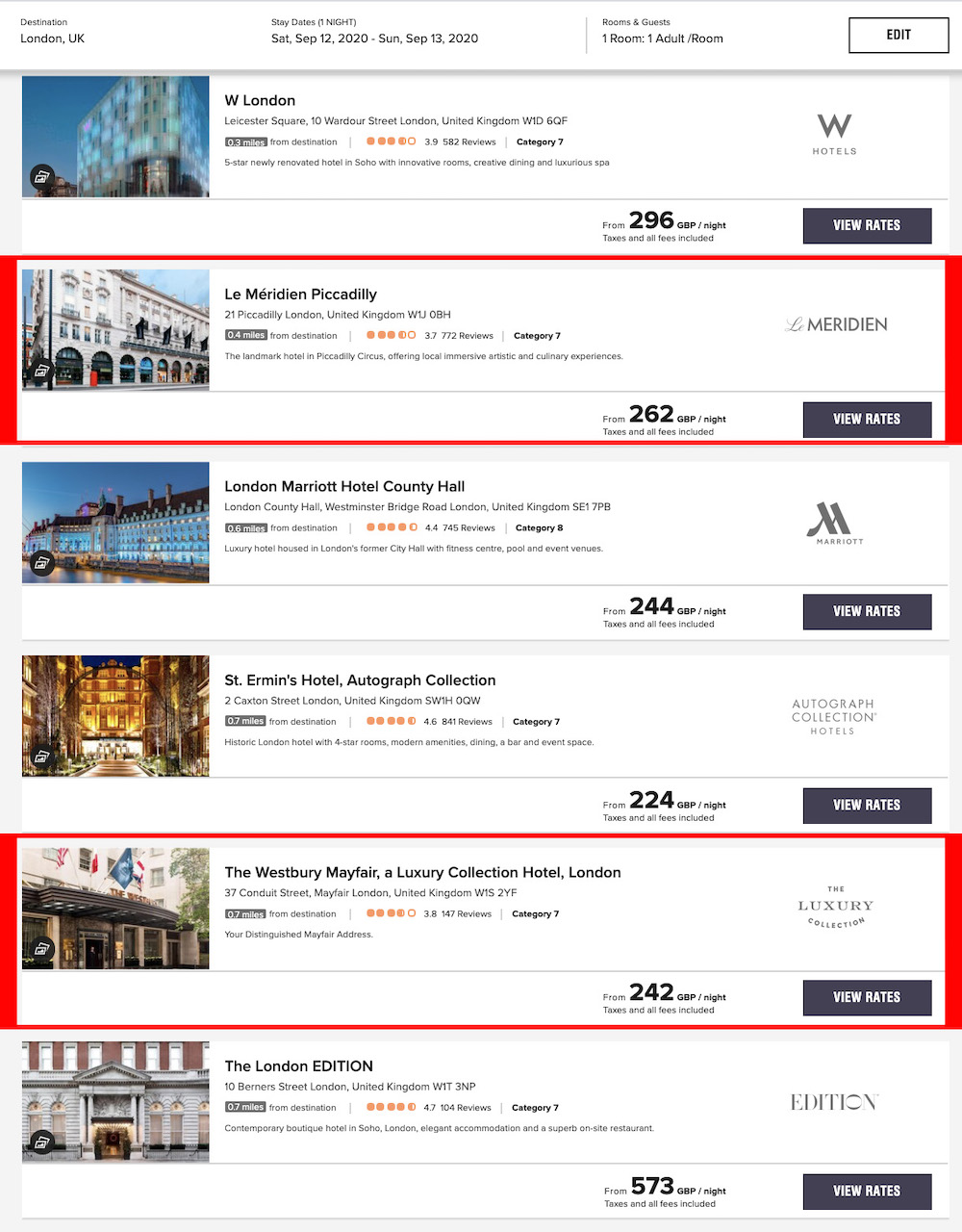

Here’s the cost of a September hotel night at a number of London Marriott properties as of 8 July 2020 (before the tax cut came into effect)…

…and here’s the cost of the same night at the same properties as of today (with the tax cut in place):

Unfortunately, Marriott (like most hotel chains) doesn’t show the split between room rate and tax for its UK reservations so it’s hard to say for sure what’s influencing any price differences being shown above so, as I’m feeling charitable, let’s assume that drop in nightly rate seen at 4 of the 6 properties above is, at least in part, due to the decrease in the level of VAT. But what about the other two properties?

The cost of a night at the Le Meridien Piccadilly and the Westbury Mayfair is the same today (when VAT is being charged at 5%) as it was a week ago (when VAT was being charged at 20%). This could be a coincidence and these properties may have increased the cost of a night due to increased demand or we could be seeing signs that some hoteliers are increasing their nightly rate to take advantage of the tax cut (the consumer doesn’t see an increase in price but the hotel takes home more). I suspect it’s the latter but Marriott.com’s limitations won’t allow me to prove it…so let’s move on.

To get a far more precise insight into what some hotels are doing with their prices we need to turn to IHG who, very kindly, show the level of VAT its hotels charge on all UK bookings.

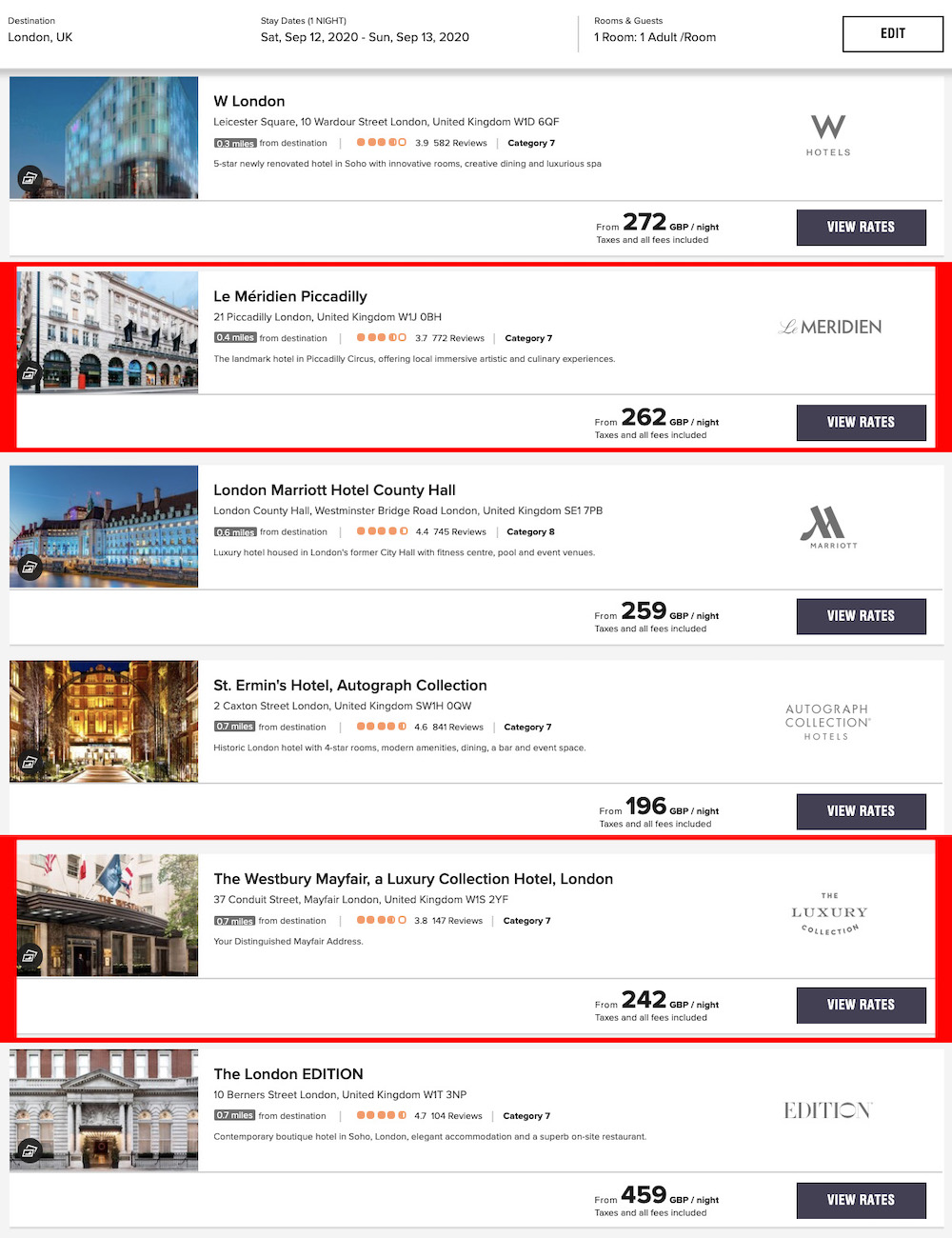

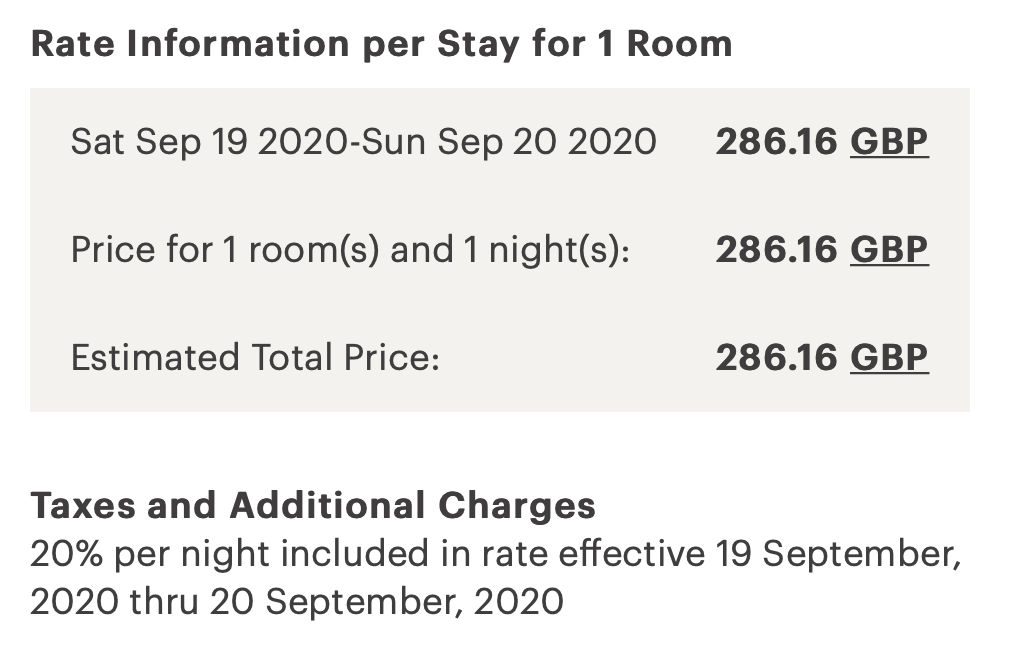

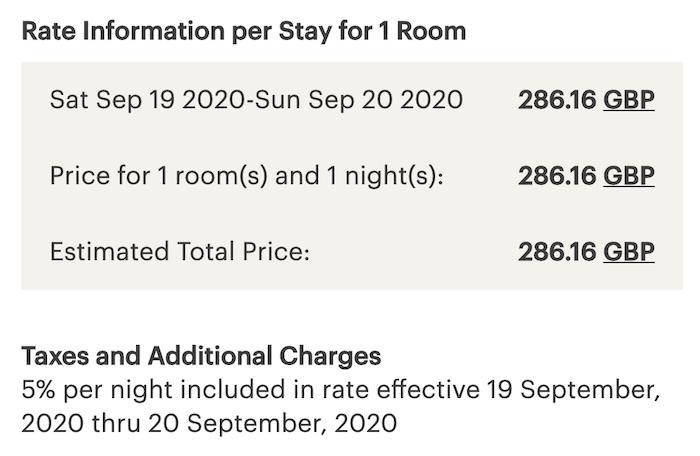

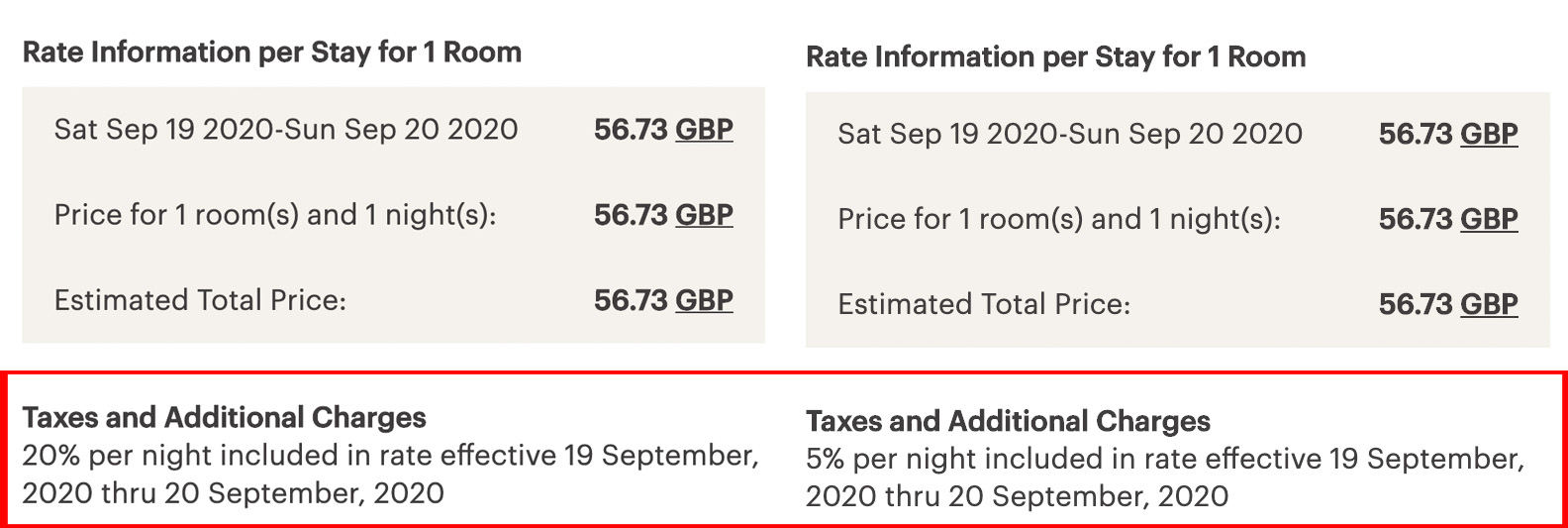

When I wrote about this change to the level of VAT a few days ago, I did so to show readers that the level of VAT being charged at UK properties had not yet dropped and I advised people to hold off making any reservations until the new 5% rate was in effect. To illustrate my point I showed this screenshot of the rate at the InterContinental Park Lane for the night of 19 September 2020:

Here’s what the InterContinental Park Lane is charging right now:

Can you spot the difference? 🙂

In the case of the Marriott properties discussed earlier, there was a degree of doubt surrounding how the properties were handling the decrease in the rate of VAT…but there’s no doubt here. The InterContinental Park Lane has dropped the level of VAT it’s charging (in line with the Government’s edict) but the overall cost to the consumer hasn’t changed – the hotel is keeping 100% of the tax break for itself.

The InterContinental Park Lane isn’t alone in this behavior and it’s not just IHG’s InterContinental properties who are keeping the tax breaks for themselves. Here’s what the Holiday Inn Express Limehouse has done with its room rate for 19 September 2020…

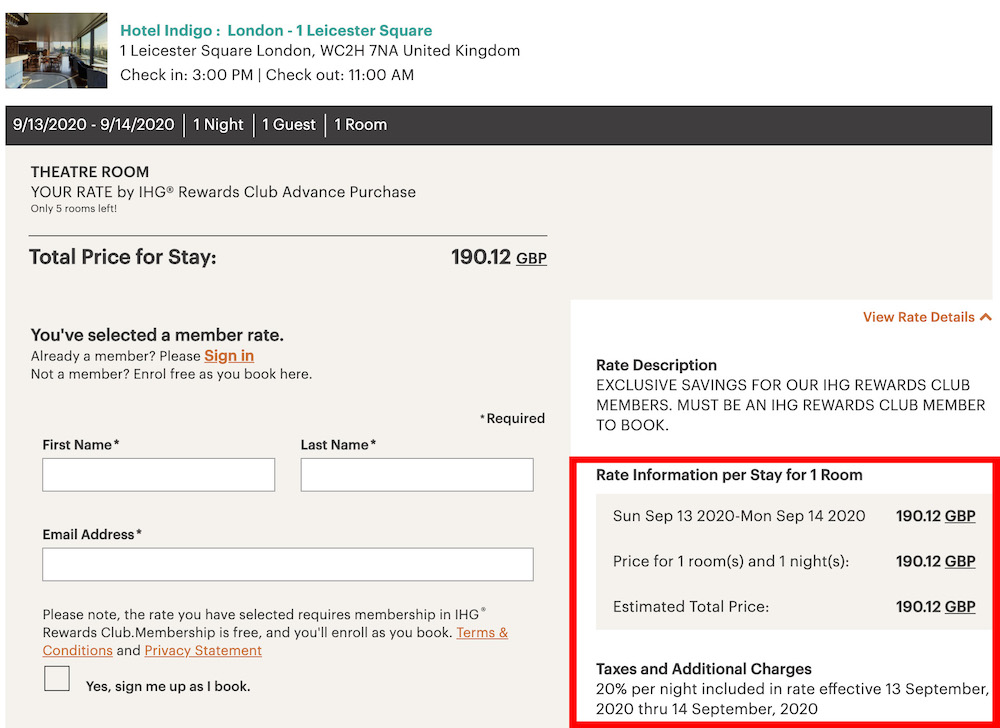

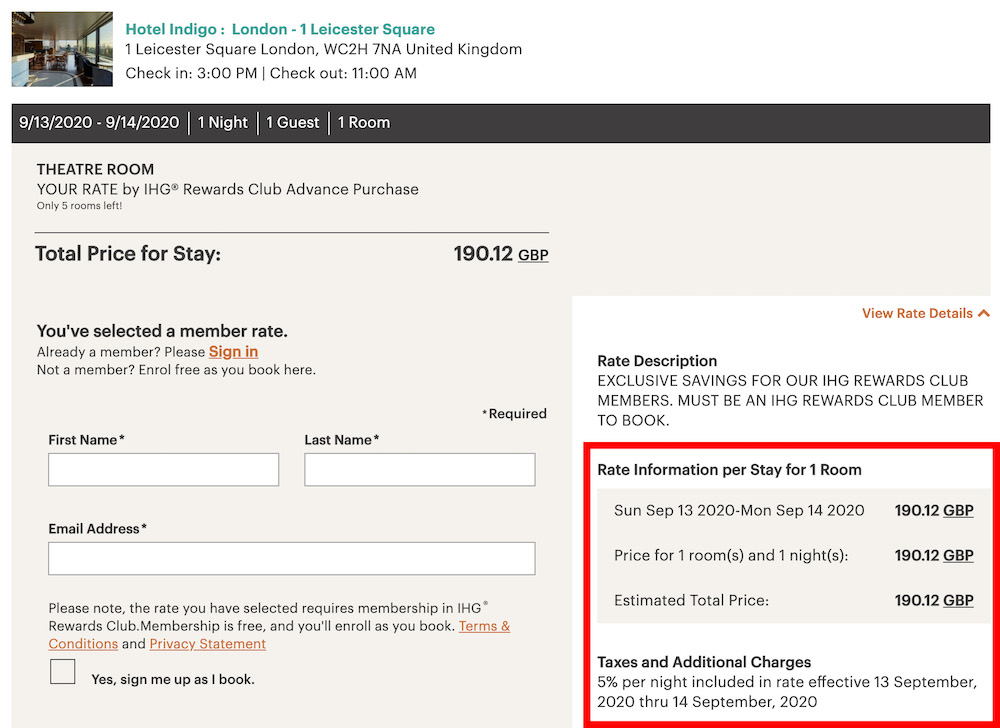

…and here’s the Hotel Indigo London Leicester Square playing the same game:

To be very clear, there’s nothing illegal in what these hotels are doing as the UK Government hasn’t said that the tax cut has to be passed on to consumers (even though it’s a consumer tax that has been cut). These hotels are well within their legal rights to do exactly what they have done. Ethically, however, they’re on pretty shaky ground.

Bottom Line

If you were hoping that your favorite London (or UK) property was going to become 15% cheaper from today you may be in for a disappointment. While there are very clearly a lot of hotels at which prices have fallen in the past few days, there are also a significant number of properties that are choosing not to pass on the UK Government’s tax break to consumers and who are keeping the extra funds for themselves. This isn’t an entirely surprising development, but it is more than a little disappointing.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-356x220.jpg)

Yeah, I have observed the same thing. Shortly before the tax reduction was announced, I made two reservations on Hilton.com. They are both for Hilton hotels in London during August.

Up to this point, the rate of neither booking has budged.

I’ve also monitored rates for a Hyatt property for the same dates (considering switching over from Hilton). No change in rates there, either.

Why should a hotel, or any other business, pass along tax breaks like this to customers unless they are legally required to do so? They are in business and have suffered greatly recently so if they are able to sell rooms at the listed price (regardless of what taxes are charged) they should! That is what capitalism is all about – if you don’t like it stay somewhere else.

Man the petty whining and entitlement on these travel blogs lately is disgusting.

The point of the government’s VAT reduction was to induce consumers to spend, to induce people to get back to “normality” and to bring money flowing back in to the hospitality industry. Someone who wasn’t prepared to pay £X last week isn’t going to be prepared to pay £X this week so the properties that are not passing on the savings aren’t helping the government in its mission what so ever.