TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

I have a love-hate relationship with Apple as although I still operate an almost entirely Apple environment which I enjoy (phone, laptop, tablet, router, etc…), I have been growing increasingly more frustrated with the lower build quality and increasing prices that the tech giant has been foisting upon customers…but that wasn’t enough to tempt me into bashing the new Apple credit card when it was announced in March this year.

When the first details of the new Apple Card were announced there were a lot of people who jumped at the chance to ridicule the offering and to call it pointless…and that was a little harsh.

The card wasn’t pointless and it wasn’t bad, it just wasn’t aimed at the people criticizing it.

At the time the first details of Apple Card were released I said that “this isn’t a credit card that’s going to wow the miles and points community, but that doesn’t make it a bad credit card and it doesn’t mean we should ignore it either” and I went on to conclude that “overall this is an unspectacular but solid entry into the credit card market by Apple“.

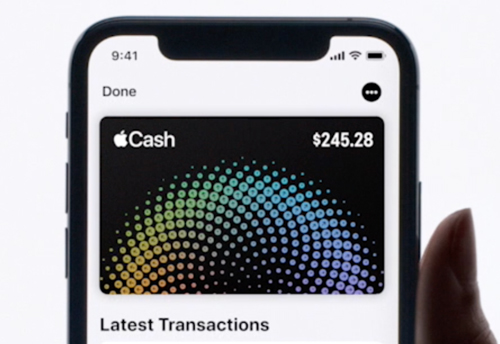

That “solid entry” into the credit card market has now become decidedly more interesting as Apple makes small but important improvements to what its Apple Card offers.

I’m not going to delve back into the full details of what the card offers (you can read about most of those here) but here’s how Apple has improved the card offering over the past few weeks and months.

The Apple Card still offers…

- No annual fee

- No late fees

- No over-the-limit fees

- No cash-advance fees

- No foreign transaction fees

…but while the card initially only offered 3% cashback on transactions made directly with Apple (and 2% cashback on all other transactions made via Apple Pay), Apple has now added the following merchants to the 3% cash back category (more merchants are set to be added too):

- Duane Reade

- T-Mobile*

- Uber

- UberEATS

- Walgreens

*DoctorOfCredit wisely points out that you’ll have to pay your bill in store if you’re to get 3% cashback on your monthly T-Mobile bill.

For someone looking for a pure cashback card, the default suggestion is usually the Citi Double Cash Card which offers 2% back on all transactions (1% at the time of the transaction and 1% when you pay your bill) but now the Apple Card has to be taken a lot more seriously as an alternative.

While cardholders still have to rely on Apple Pay acceptance to make the most of this product, Apple Card’s offering is looking a lot more tempting as the number of merchants at which 3% cashback can be earned grows.

3% back with Uber is a pretty nice deal (the Uber Visa Card offers just 2% back on Uber transactions) and I’m pretty sure that there isn’t another major credit card out there which is both free and which offers 3% cash back at a major drugstore chain.

Also, let’s not forget that Apple Card doesn’t charge foreign transaction fees and, unlike the United States, a lot of countries around the world have fully embraced contactless payments so it’s not hard to find merchants abroad where Apple Pay is accepted – what other mainstream credit card charges no annual fee and allows you to earn 2% cashback across a broad spectrum of merchants while abroad without incurring transaction fees?

Bottom Line

If you’re strictly a miles and points collector and don’t care about cashback then clearly Apple Card is still not a winning proposition for you…but it’s definitely also not a card that everyone else should be ignoring.

The Citi Double Cash card is still the better all-around cashback card for most people because there’s no reliance on Apple Pay to get the 2% rebate that it offers but, with contactless payment acceptance increasing in the US and the fact that Apple Pay now works in 56 countries worldwide (not including the US), Apple Card is growing into a better and better option for spending in non-bonused categories both at home and abroad.

I get 5% back on my AT&T wireless and Uverse bills with the U.S. Bank Cash+ card. I got the Apple card anticipating they would add more 3% merchants, which they’ve done. I anticipate more.

I get 2% back on everything I buy regardless of how I pay for it.