TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

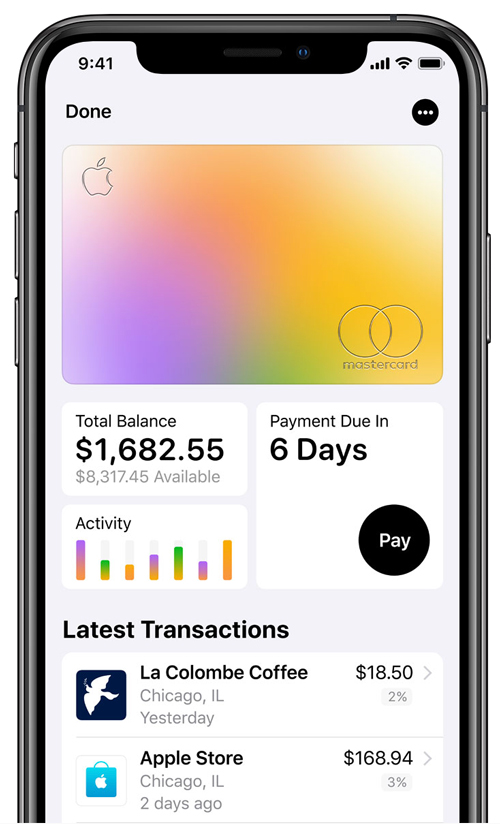

Apple held a one of its much heralded events in Cupertino yesterday in which it announced a number of new ventures for the corporation. Amongst the announcements came the news that Apple was launching its own credit card – Apple Card.

The New Apple Credit Card

The new Apple card is essentially a cash back card with good marketing….but it does have some interesting aspects to it which shouldn’t be glossed over.

Here are the Apple Card’s highlights:

- No annual fee

- No late fees

- No over-the-limit fees

- No cash-advance fees

- No foreign transaction fees

- Earn 3% cash back on all transactions made directly with Apple

- Earn 2% cash back on all other transactions

- No limit to the cash back that can be earned

As well as all this, Apple says its new credit card will offer “interest rates that are among the lowest in the industry” (we’ll have to see what these look like when the card is launched in the summer).

To make the Apple Card work as intended, users will have two new cards in their Apple Wallets. Firstly there will be the actual Apple Card which will be used just like any other credit card you have in Apple Wallet….

….and there there will be the “Apple Cash Card” which is where users will find all the cash back they earn:

Cash back in earned almost instantly (Apple calls it ‘Daily Cash’) so there’s no waiting to the end of a billing cycle (or longer) to get the cash back from your daily transactions.

The cash back can be spent from the Apple Cash card on anything a user chooses to spend it on (in the same way as a user would use a regular credit card) or it can be applied as a statement credit or it can be sent to another individual via iMessage.

For vendors who don’t yet accept Apple Pay Apple Card will also come in physical metallic form (which Apple says will be metallic).

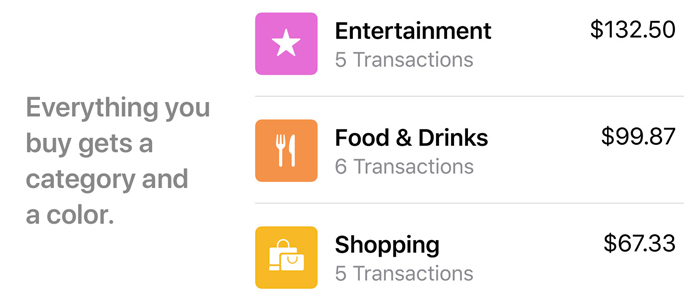

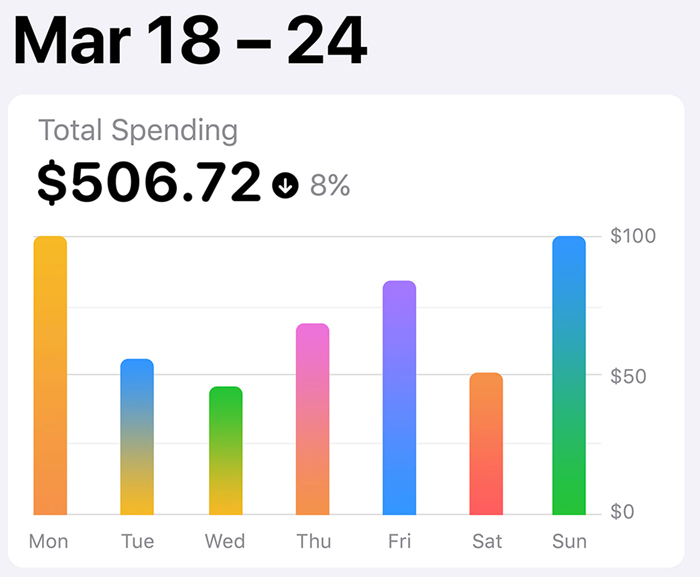

A user’s Apple Card spending is color coded in Apple Wallet and different categories of spend are represented by different colors:

These colors then appear in customisable bar graphs allowing users to see when and where they’re spending on Apple Card.

To avoid confusion surrounding any given transaction Apple has said that users will always be able to recognise a purchase they’ve made thanks to two Apple Card features:

- Apple Card will always ‘translate’ a merchant’s code into an understandable transaction so there shouldn’t be any instances of a statement showing a vendor you don’t recognise (this is usually an issue with online purchases although I’ve seen it happen quite a few times with foreign transactions too).

- A simple tap on a transaction will open up Apple Maps and show the user exactly where the transaction took place.

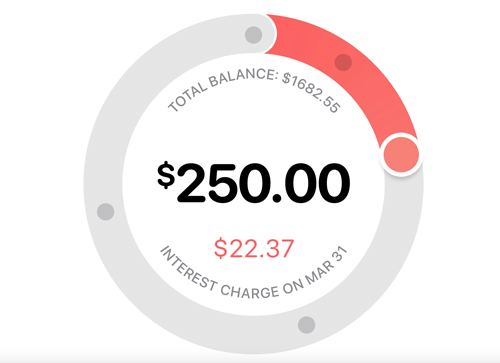

When it comes to how much interest a user is likely to pay Apple Card will attempt to be as transparent as possible.

Within Apple Wallet Apple Card users will be able to see the balance they owe and how much interest they’ll have to pay depending on how much of their outstanding balance they choose to pay off. Note: If you’re a consumer who usually carries a balance on his/her credit card you should be looking to hold a credit card that offers you the lowest rate of interest….and that’s usually not a rewards card/cash back card.

Note: If you’re a consumer who usually carries a balance on his/her credit card you should be looking to hold a credit card that offers you the lowest rate of interest….and that’s usually not a rewards card/cash back card.

The cash back a card offers will not cover the interest you’ll have to pay if you carry a balance.

Underneath the hood the Apple card is issued by Goldman Sachs and works on the Mastercard network so, combined with the fact that Apple Card will not charge foreign transaction fees, this card will be useable worldwide.

Thoughts

It would be very easy to be cynical about Apple Card and label it as another gimmick from a corporation whose product quality has been on the wane for a while (my MacBook Pro isn’t making me happy right now)….but I actually like this card.

I don’t think it will be hugely useful to those of us immersed in the Miles & Point world but I like a number of features that Apple Card introduces.

I like the ease with which you can see where a transaction took place, I like the color coding and I think that the way data is presented will make this a good card for someone just getting to grips with keeping their finances in order – there’s no real excuse for letting your spending get out of hand.

The promised low interest rates (we’ll have to wait to see just how low they are) are a nice touch but unless they’re at least as low as the lowest available rates elsewhere no one should be holding this card with a view to keeping a balance on it.

I’m sure a lot of people will point out that there are any number of other good cash back cards on the market that also offer 2% cash back on all transactions….but I can’t think of any that also come with no annual fee and no foreign transaction fees.

The Capital One SavorOne Cash Rewards Credit Card comes close as it doesn’t charge an annual fee or foreign transaction fees….but its good rates of cash back are limited to specific categories (3% on dining and entertainment and 2% at grocery stores).

Bottom Line

Clearly this isn’t a credit card that’s going to wow the miles and points community, but that doesn’t make it a bad credit card and it doesn’t mean we should ignore it either.

At home the 2% cash back that the Apple Card offers on all purchases is easy to match with cards like Citi’s Double Cash card and, arguably, the Chase Freedom Unlimited card, but Apple Card appears to be a winner for unbonused foreign spend.

I don’t see myself rushing out to apply for this card the moment it hits the market (although I’m sure a lot of Apple fans will do just that) but I will consider it if I think a 2% cash back card will be useful when I’m traveling abroad.

Overall this is an unspectacular but solid entry into the credit card market by Apple.

What do you think?

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)