TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Over here at TFM, we’re not huge fans of airline co-branded credit cards because overall, we find that we can get better value out of quite a few of other cards that we have in our wallets.

As with most things in life however, there are exception to this, and the card discussed in this article falls into our list of exceptions because for United Airlines frequent flyers, it’s a must-have card.

Key facts

Annual fee

- annual_fees

Welcome bonus

bonus_miles_full (more details)

We value United miles at 1.25 cents each based in how we use them and the value we know we can get out of them without much effort, and this means that to us, the welcome bonus is worth an impressive $1,125.

Earning rates

- 4 miles/dollar spent on purchases made directly with United Airlines

- 2 miles/dollar spent on all other travel purchases

- 2 miles/dollar spent on dining (includes delivery services like GrubHub and DoorDash)

- 1 mile/dollar spent in all other categories

Note: This product is available to applicants who do not currently hold any United Club cards and who have not received a new cardmember bonus for any United Club card in the past 24 months.

Key card benefits

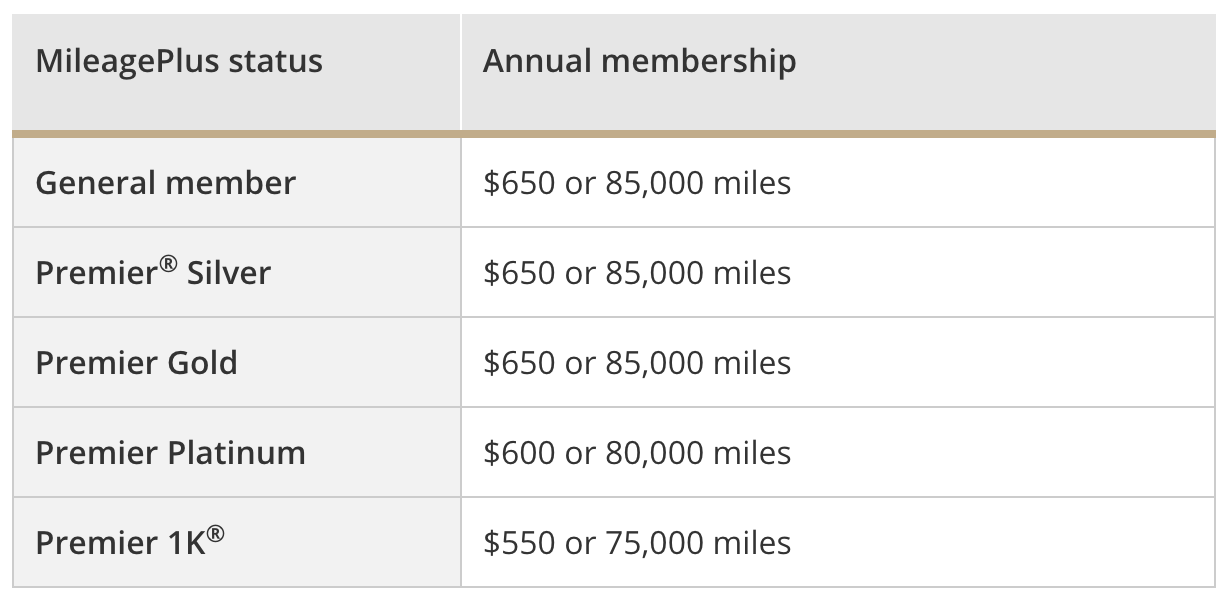

United Club membership

The biggest benefit that the card_name offers is United Club Membership which, depending on your elite status with United, can be worth up to $650 per year.

Two free checked bags on United Airlines

The primary cardholder and one companion traveling on the same booking will each receive their first and second checked bags for free on United-operated flights if the booking is paid for using their card_name.

With the first checked bag costing $35 and the second checked bag costing $45 when you prepay ($40 & $50 if you pay at the airport), this can represent a saving of up to $360 per round trip.

Priority treatment at airports

Holders of this card and their traveling companions receive access to priority check-in, priority security screening (where available), priority boarding, and priority baggage handling.

25% Rebate on United Airlines inflight purchases

When a cardholder uses their card_name to purchase food, drinks, or wi-fi onboard a United Airlines operated flight, they will receive a statement credit equal to 25% of the amount paid.

Earn Premier Qualifying Points (PQP)

Holders of the card_name can earn up to 10,000 PQP per year through spending on their card (25 PQP per $500) and for big spenders, this can be a very nice way to cut down on the number of PQP that they have to earn through flying.

While all United Airlines elite status tiers require MileagePlus members to fly a a minimum of 4 flight segments operated by United or United Express, anyone in a position to max-out this benefit could use their credit card spending to get them a significant way to the elite status of their choosing.

Specifically, through spending on this card alone, a cardholder could earn:

- 200% of the PQP needed for Premier Silver status (with no need for any PQF).

- 100% of the PQP needed for Premier Gold status (with no need for any PQF).

- 66% of the PQP needed for Premier Platinum status (with no need for any PQF).

- 42% of the PQP needed for Premier 1K status (with no need for any PQF).

For flyers happy to earn United Premier status through a mixture of PQP and PQF, spending on this card could earn them:

- 250% of the PQP needed for Premier Silver status (with 12 PQF needed).

- 125% of the PQP needed for Premier Gold status (with 24 PQF needed).

- 83% of the PQP needed for Premier Platinum status (with 36 PQF needed).

- 55% of the PQP needed for Premier 1K status (with 54 PQF needed).

Note: No one here is suggesting that anyone should be going out of their way to put this much spending on their card, but it’s always nice to know the option is there if you’re traveling on the company dime.

Global Entry, NEXUS, or TSA PreCheck credit

A holder of the card_name receives a statement credit of up to $100 every four years to cover the cost of Global Entry, NEXUS, or TSA PreCheck when they use their card to pay for their enrolment into either of those programs.

Where this card shines

This is a card that United Airlines frequent flyers should find pays for itself with quite a bit of ease … and more.

The card_name costs annual_fees per year, while the cheapest United Club annual membership costs $550 (for Premier 1K members) so, straight away, all United Club members would be better off holding the Infinite Card (and enjoying all of its benefits) rather than paying for standalone Club membership.

The 25% back on inflight purchases, the free checked bags, and the Global Entry/TSA PreCheck credit that the card offers all just add to the fact that, in the right hands, it is a card that shouldn’t cost anything extra to hold.

It’s also worth pointing out that there isn’t another available credit card that will earn a cardholder more United Miles for spending with United Airlines than this one. At 4 miles/dollar for all spending with United Airlines, this is the card anyone looking to boost their MileagePlus balance should be using.

Bottom line

The card_name is a great card to hold if you’re a United Airlines frequent flyer because it offers a United Club membership as well as a variety of other benefits for less than the cost of standalone United Club membership. The fact that it also earns cardholders more miles per dollar on direct spending made with United Airlines than any other card on the market is the icing on the cake.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)