TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

One of the big reasons why I think the card_name still has its uses is because, despite the highly annoying news we got last week, the card still offers some of the best consumer travel protections around…as does its sister card the card_name.

While Citi has stripped most of its credit cards of just about all consumer protections and while Amex likes to play little games with its travel protections (one-way bookings don’t appear to be covered by Amex’s recently introduced trip insurances), The card_name and card_name both have very solid offerings… but they recently took one small but important hit.

Both the card_name and card_name offer…

- Trip Cancellation/Interruption Insurance

- Trip Delay Reimbursement

- Baggage Delay Insurance

- Travel Accident Insurance

- Primary Rental Car Cover

…so cardholders using these cards to book their trips get one of the more comprehensive sets of travel protection packages that any of the mainstream credit cards offer, but the trip cancellation/interruption insurance just got a little worse.

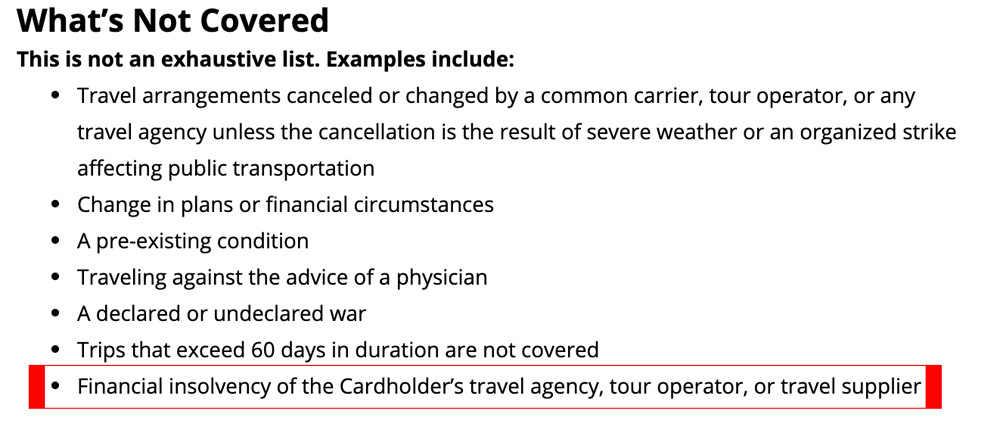

At some point in the past few months (it’s not clear when because Chase decided not to inform anyone!) a new item was added to the list of situations in which a cardholder will not be covered for trip interruption/cancellation.

If a cardholder’s airline, cruise line, travel agency, tour operator, or any other kind of travel supplier goes out of business, the Chase Sapphire trip interruption/cancellation insurance will not cover the cardholder for losses.

If a cardholder’s airline, cruise line, travel agency, tour operator, or any other kind of travel supplier goes out of business, the Chase Sapphire trip interruption/cancellation insurance will not cover the cardholder for losses.

That’s not cool at all.

When you consider the fact that we’ve seen numerous airlines fold in recent years (WOW, Jet Airways, and Thomas Cook are just 3 examples of airlines that ceased operations in 2019) and the fact that we still have quite a few airlines teetering on the brink of financial ruin, it’s not good to hear that two of the major travel credit cards no longer cover cardholders if they’re affected by an insolvency.

It’s even worse when you consider the fact that the card issuer (Chase) hasn’t even bothered to contact cardholders to let them know!

Initially, reports suggested that the card_name which, like the card_name, offers 3 points/dollar on travel spending (albeit only up to a maximum spending limit of $150k) and travel interruption/cancellation protection, wasn’t yet showing this new limitation on coverage but this card eventually took the hit as well.

Bottom line

I’m disappointed with Chase.

I love the customer service I get when I call Chase and I’m a big fan of a lot of the credit cards that Chase issues, but I don’t like the fact that the bank apparently thinks it’s ok to modify benefits without informing cardholders.

I’m still waiting to get an email about the change to my card_name (if I didn’t write about the subject or read websites on the subject I’d be none the wiser), and I think it’s pretty safe to assume that no one is going to get an email about the change, and that’s unacceptable.

Right now, I don’t think this change moves the needle on the value of the Chase Sapphire cards, but all Chase cardholders clearly need to stay on their toes – if the bank can slip in a subtle but important change to a benefit of the Sapphire cards, it’s capable of doing the same on all its other cards too!

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

Definitely a big hit. This is like adding insult to injury combined with the $100 fee increase.

How about some clarification on item #1. If a flight is cancelled and it’s not weather related then there is no coverage?

And how about if I book a trip using my Chase points on United. Is that covered?

Or if I book my travel through the Chase travel portal and pay in points. Is that covered?

Thanks

To get a definitive answer you’ll have to ask Chase (I ‘m neither an insurance expert nor do I know all the intricacies of Chase’s insurance cover) but here are the examples the bank cites of times when you are covered:

– Accidental bodily injury, loss of life, or sickness experienced by the Cardholder, a traveling companion or an immediate family member of the Cardholder or a traveling companion

– Severe weather that prevents the start or continuation a covered trip

– Terrorist action or hijacking

– Jury duty or a court subpoena that cannot be postponed or waived

That would suggest that a flight cancellation that’s not due to weather isn’t covered.

As far as points bookings go they appear to be covered because Chase cites an example (of a covered occasion) in which it mentions “A Cardholder charges a covered trip to their Chase card or pays with rewards earned on a Chase card for a covered trip”

They have been updating the benefits regularly without informing. For example in 2018 they excluded political unrest and didn’t inform. I guess many didn’t notice? If I remember correctly they also started excluding one ways but I am sure when they changed it. If you like chase customer service then try their benefit department. You would change your opinion

I have the Reserve card and had to use the Travel Insurance for a last minute illness in 2018. It took 6 months to get reimbursed for nonrefundable airline tickets, on top of 30+ interactions with the insurance folks. I had no less than 20 attachments covering all sorts of correspondence with the airline. It was insane. So, my experience with Chase Reserve travel insurance is that the insurance coverage is a bait and switch….it was clear that the coverage folks were working hard to discourage payment/compensation.

It was a personal account, but I run my own business and it was only when I threatened to pull my banking relationship at the local branch, that the branch folks advocated on my behalf.

As a result of this experience, the insurance is pretty much worthless to me, and I don’t wish that experience on anyone. If this is how they choose to do business, they should just pull the benefit because it tarnishes the brand.

My grandson works for Allianz who administers the Chase program and he could have been one of the many people who you interacted with. He tells me that is exactly their strategy, do everything they can to delay, lose paperwork, ask for additional documentation until you give up and they don’t have to pay.

Do you mean Chase or Allianz stonewalls?

I have been exceptionally disappointed with them lately as well for another reason. It used to be that you could pretty much book any flight on their travel portal if it was available for the same fare you could get on expedia or the airline website. Now apparently, airlines are only offering select inventory to the chase portal. As one rep said to me – they get flights that the airlines are trying to liquidate. Just this week they were only selling basic economy on United on my EWR – LAS route. You could not purchase regular economy on the website or via phone. Reps said they were not given access to that inventory. That is absolutely ridiculous. And I haven’t seen anything about this publicized anywhere – just one more pullback of benefits with no notice

I also tried to use the trip interruption benefit. Not worth the hassle. They ask for something, you tell them you don’t have it (and is actually irrelevant to the interruption) – the response is they ask again. However, the rental car insurance DOES work, at least for me.

Everything went south since they partnered with Expedia as somebody else mentioned. The availability of flights are poor and their prices are much more than any other website .. I had a terrible experience dealing with rewards supervisor that totally delayed and dismissed my clAim of an error on of their representatives made and they blamed on me as per their one sided investigation that lasted more than two months .. my protest: pull my money from chase branch and cease using my chase cards .. as per CSR card .. +100 on gimmicks .. one more reason to leave town for greener pastures

David’s post is the most troubling. This crap is starting to taste like the timeshare industry. Guess I’m going to use my Chase points and move on to a bank and a card that may offer less but, costs less, does not screw me on availability of seats and pricing, or purposely waste my time while trying to cheat me out of my insurance coverage they claim to offer. Banks disgust me in general, they are the definition of what is wrong with this country. $450/yr was just in the cusp of “too much”, $550/yr for bullshit, bye bye Chase.

[…] was only yesterday that I was giving Chase a well-deserved hard time for altering credit card benefits without any advance w… (cardholders are left to find out by chance or from the various blogs that write about this […]

meep. i guess ill shoot them an email. i dunno what else to do cause im not a freaking blogger