TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Selecting the airline on which to use the airline fee credit is usually one of the first things that a lot of people do when they get their Platinum card in the mail, but what a lot of people often forget is that you can change the airline on which you use this credit once per year.

Specifically, you can change your preferred airline every January, so this is a reminder for holders of Amex Platinum cards that you have just a couple of days left to choose/change your preferred airline for 2025.

What you need to know

The airline fee credit that comes as a benefit of the Platinum Card® from American Express and the Business Platinum Card® from American Express* is worth $200 per calendar year (terms apply), but it comes with a significant number of restrictions.

Only select domestic airlines are eligible for a Platinum Card airline fee credit:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Hawaiian Airlines

- JetBlue Airways

- Southwest Airlines

- Spirit Airlines

- United Airlines

Holders of The Platinum Card® from American Express and The Business Platinum Card® from American Express can only nominate one airline per year as the airline whose fees they’d like to have rebated (up to $200/year).

Once an airline choice has been made, the choice is set for the rest of the year and cannot be changed until January comes around.

The airline fee credit does not cover airfare.

Examples of airline charges that American Express has, historically, told us will trigger the fee credit include:

- Baggage fees.

- Seat selection fees.

- Change fees.

- Pet fees.

- In-flight purchases of drinks, food, and amenities.

- In-flight entertainment fees (excluding wifi if billed by a 3rd party).

- Airline lounge day passes and annual memberships.

For some reason, the terms and conditions of the airline fee credit no longer give examples of what an eligible fee is, so we’re left to assume that the information above remains true.

Officially, the following charges will not be rebated:

- Airline tickets

- Upgrades

- Mileage points purchases

- Mileage points transfer fees

- Gift cards

- Duty free purchases

- Award ticket fees/taxes

I’ve used the word ‘officially’ very deliberately (above) because, as with a lot of things in life, there can be exceptions to the rules.

This is the list of non rebatable items as set out in the terms and conditions but, as an example, some gift card purchases may still trigger the credit, and we know that in the past, some upgrade fees have been known to trigger the credit.

The key here is to not expect any of these charges to trigger the credit and to view it as a nice bonus if they do.

*Other Amex-issued Platinum cards may offer the same benefit.

Selecting an airline

If you are new to the Platinum Card® from American Express or the Business Platinum Card® from American Express and haven’t yet chosen an airline for your airline fee credit, you can make your choice at any time after you receive the card, just keep in mind that the sooner you make your choice, the sooner you can start to claw back some of your card’s annual fee.

If you’re an existing cardholder, you have the whole of January of each year to reconfirm your airline selection or to change your decision from the prior year.

The easiest way to make your airline selection is to head over to this American Express webpage, log in to the American Express account linked to your card, and make your selection on the page that opens up.

If (for some reason) the link provided above won’t resolve, you can access your airline fee credit benefit by following these simple steps:

- Log in to your American Express online account.

- Click on “Rewards & Benefits” from the top menu bar.

- Now click on “Benefits” from the top menu bar.

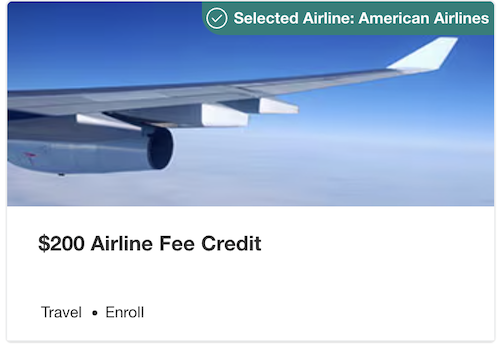

- Scroll down the page until you see the airline fee credit benefit which, at the time of writing, looks like this:

If you have a particular domestic airline with which you fly a lot, then that may be the obvious airline for you to choose (currently, I have American Airlines selected), but don’t forget that if you have elite status with that airline, there’s a good chance that a lot of the ancillary fees that it charges may be complimentary as part of your benefits package.

You may be better off selecting a secondary airline with whom you don’t have elite status and where there’s a greater chance that you’ll be hit with a few unavoidable fees.

Bottom line

January is the one month of the year in which holders of American Express Platinum cards can change the airline that’s associated with their card(s) for the purposes of the airline fee credit.

So, with only a couple of days of January remaining, now would be a good time to review your airline of choice if you hold one of the cards in question.

Have a think about which airlines you’re likely to fly this year, which airline is likely to charge you fees that you cannot avoid, and which airline is likely to give you the most opportunities to earn the full $200 credit that your card offers (terms apply).

Only then make your selection, and make sure you make it before the end of tomorrow (31 January).

Which airline are you choosing to nominate for your Amex airline fee credit and why?

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)