TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

Update 11 April 2019: The registration period has been extended to 31 May 2019

What was once called the Starwood Preferred Guest Card from American Express is now called the Marriott Bonvoy Card from American Express and Amex is currently looking to incentivize card holders to use their cards more by offering them the chance to earn up to 100,000 bonus points.

Getting people to use the old SPG Amex wasn’t hard as it essentially earned 3 Marriott points per dollar on all non-bonused spend (one of the better returns available on non-bonused spend) while now, in its new guise, the card earns a third less – just 2 Marriott points per dollar – which is a lot less enticing so it’s possible that Amex is seeing a lot fewer people taking this card out of their wallets.

Earn 100,000 Bonus Points With The Marriott Bonvoy Amex Card

American Express is now attempting to incentivize Marriott Bonvoy Amex Card holders to get back to using the card on a more frequent basis and it’s doing this by offering bonus points for spending large sums of cash on its entry-level Bonvoy card.

Here’s the deal:

- Register for the offer by

7 April 201931 May 2019 - Earn 25,000 bonus Marriott Bonvoy Points for every $25,000 spent up to a maximum of 100,000 bonus points

- Offer runs through 31 December 2019

Registration

Here’s a link to the page I registered on but, if that doesn’t work for you, you should be able to register via your American Express homepage.

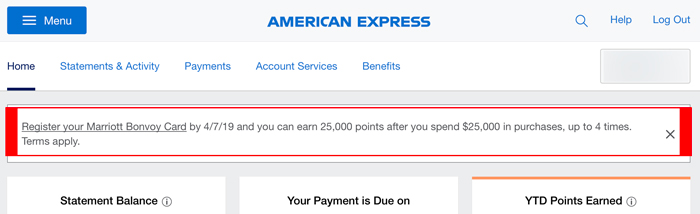

When I logged in to my American Express account this is what I saw at the top of my Marriott Bonvoy Card’s homepage:

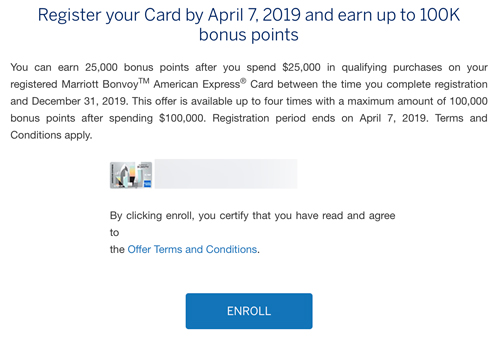

Following the link took me to a page with an option to enroll…

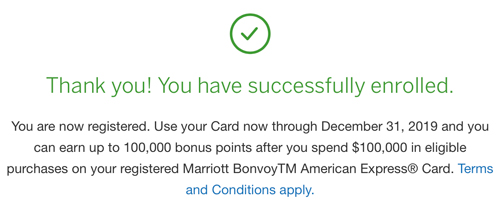

….and, after clicking on the ‘enroll’ button I got the following confirmation:

It’s as simple as that.

Thoughts

If you’re able to spend $25,000/$50,000/$75,000/$100,000 on your Marriott Bonvoy card then you’ll essentially be earning at least 3 Marriott points per dollar on all your spending so the new Bonvoy card will match what the old SPG card offered.

That sounds great and is great for those who can spend that much on this card but I’d like to urge a bit of caution.

You need to be very sure that you’re going to hit whatever 25k milestone you’re going for before you start putting all your spend on the Marriott Bonvoy card because, if you fall short of the target, you’ll essentially just have put a lot of spend on to a card that hasn’t earned you as much as if you’d put that spend on to a more lucrative credit card.

Here’s an example of what I mean.

I value Marriott Bonvoy points at no more than 0.7 cents each while I value Citi/Chase/Amex points all at around 1.5 cents each.

If you were to spend just $21,000 on the Marriott Bonvoy card from American Express you’d miss the target for the bonus so you would only earn 2 Bonvoy Points/dollar for all of that spend – a rebate of 1.4%

If that same spend had been put on a Citi/Chase/Amex card that earned just 1 point/dollar the rebate (at a conservative valuation) would be 1.5%.

That may not seem like a big difference but there are a few things to bear in mind here:

- I’ve use a generous valuation for Bonvoy Points

- I’ve used a conservative valuation for Citi/Chase/Amex Points

- Citi/Chase/Amex points are considerably more versatile than Bonvoy Points

If you’re not sure of hitting the targets set by the promotion it’s really not worth putting such large amounts of spend on to the Bonvoy Card – even a simple cashback card (a lot of which offer ~2% back) would be a better option.

Also, let’s not forget that for this promotion to be any good the spend that’s being put on the Marriott Bonvoy card must be spend that wouldn’t earn a better bonus with any other credit card.

If you hold cards like the Citi Prestige, Citi ThankYou Premier, Chase Sapphire Reserve or Chase Sapphire Preferred they’ll all offer you better rates of return than the Bonvoy Card for spend on non-Marriott travel, gas and dining.

And If you hold either of the Amex EveryDay cards or the Amex Gold card (for example) they’ll will offer you a better rate of return for grocery spend and, in the case of the Gold Card, a better rate of return for dining at US restaurants too.

So each $25,000 that you need to spend on the Marriott Bonvoy card will need to be made in categories other than the ones I’ve mentioned above….and that’s not going to be easy for most.

Bottom Line

If you’re in a position where hitting the required targets in this promotion will be easy (and you’ll be spending in categories where your other credit cards wouldn’t give you a better rate of return) then this is a nice promotion for you.

For everyone else I suggest that this is a bust.

$25,000 is a lot of money to spend and it becomes even harder to hit that limit when you have to exclude traditional big-ticket items like hotel stays and airline fares so I don’t think this is going to be a very useful offer for a large percentage of people reading this blog.

I’ve enrolled for the promotion because you never know what life throws up at you but I have no intention of making any great effort to spend $25,000 on my Marriott Bonvoy Amex (let alone $50k, $75k or $100k) – I’ll earn considerably more by putting my spend on other credit cards that I hold.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

wow! so you only have to spend $100,000.00 to get 100,000 points,what a steal !!!

I did say that I didn’t think this was a very good deal 🙂