TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Just a few years ago, the card_name was just another co-branded business credit card that offered a good earning rate at Marriott properties and a few good benefits too. Then, in late March 2020, came a small but key policy change that made the card_name an invaluable tool for anyone seeking easy Marriott Bonvoy status.

card_name

In brief

The card_name is the only Marriott co-branded business card open to new applicants and as its name tells you, it’s issued by American Express.

The card’s key selling points are that it offers the most Bonvoy points per dollar at Marriott properties worldwide, at at U.S. restaurants and at U.S. gas stations, that it offers cardholders a free night at select Marriott properties every year, and that it’s the only card that can be paired with one of a number of other Bonvoy cards to give cardholders 30-40 elite night credits towards Marriott Bonvoy status every year.

In detail

Here’s what you need to know about the card_name:

Annual fee

- annual_fees (rates & fees)

Cost of authorized user cards

- $0 for up to five additional cards (rates & fees)

Current welcome bonus

- bonus_miles_full

Note: As is usual with Marriott Bonvoy co-branded cards, there are a number of key rules defining who is eligible for the welcome offer so please make sure that you read these rules carefully before submitting an application (the rules have been reproduced at the end of this article).

Earnings (terms apply)

- 6 points/dollar at Marriott Bonvoy properties worldwide

- 4 points/dollar on spending at restaurants worldwide

- 4 points/dollar on spending at U.S. gas stations

- 4 points/dollar on spending on wireless telephone services purchased directly from U.S. service providers

- 4 points/dollar on spending on U.S. purchases for shipping

- 2 points/dollar on eligible spending in all other categories

Key benefits (terms apply and enrollment may be required)

- An annual free night certificate valid at properties costing up to 35,000 points/night

- 15 elite night credits towards elite status every year

- Get a 7% discount off standard rates for standard room reservations at all Marriott Bonvoy properties

- Marriott Bonvoy Gold Elite status

- No foreign transaction fees

- Access to Amex Offers

Why this is a good card

The welcome offer (terms apply)

The card_name is currently offering successful new applicants three free night certificates (worth up to 50,000 points each) after they spend $6,000 on eligible purchases in the first 6 months of card membership, and even though Marriott Bonvoy now uses dynamic award pricing (and not award charts), these free night certificates can still be put to good use.

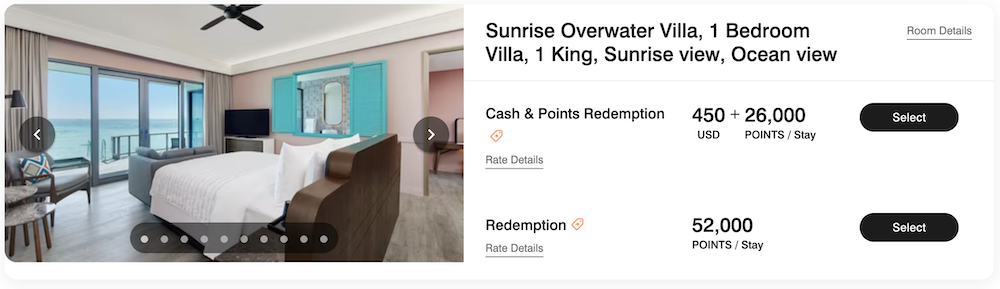

Also, Bonvoy now allows certificate holders to top up the value of their certificate with up to 15,000 further points. That means that when a fantastic property becomes available at a great rate but at a rate that is still a little over the 50,000 point certificate limit …

… certificates can still be used to significantly reduce the cost of booking that great deal.

Obviously (hopefully this goes without saying), the example I’ve shown above is just that – an example – so because a lot of Marriott properties cost a lot more than 50,000 or 65,000 points per night, no one should be thinking that the free night certificates from this welcome bonus offer a sure-fire way of snapping up a great deal. They don’t. But they have their moments.

The earning rates (terms apply)

Quite simply, no Marriott Bonvoy card (not even the high-end card_name) earns more points per dollar at Marriott properties worldwide, and no Bonvoy card can match the Business Card’s earning rates at restaurants and US gas stations which are key spending categories for a lot of people.

If you’re looking to add to your Marriott Bonvoy points balance, the earning rates that the card_name are among the best rates that you’ll find.

If, however, if you’re looking to maximize your effective return, other cards may be preferable.

Based on the value I place on Bonvoy Points, the card_name offers an effective rebate of between 1.2% and 3.6% (depending on the spending category), and you’ll do better than that with a variety of other credit cards that are readily available.

Elite night credits (terms apply)

The card_name offers cardholders 15 elite night credits every year (terms apply) but it’s also a card that can help Bonvoy members do even better.

Back in March 2020, Marriott resurrected an old policy of awarding elite night credits for a personal co-branded credit card as well as elite night credits for a business co-branded credit card, but as American Express is the only US card issuer that currently has the right to offer new Marriott Bonvoy Business cards, anyone who doesn’t hold a legacy Bonvoy business card and who wishes to make the most of this policy update has to hold the card_name.

There is no other option.

Someone pairing the card_name with another card that offers 15 elite night credits (e.g. the card_name), will collect 30 elite night credits which is enough for Bonvoy Gold Elite status.

However, as the Business card already grants cardholders Gold Elite status, this isn’t really a big deal.

A slightly bigger deal is the fact that 30 elite night credits will get a Bonvoy member to within 20 credits of valuable Platinum Elite status and benefits like complimentary breakfasts, nightly upgrade awards, and 50% bonus points on all stays.

Better yet, someone pairing the card_name with the card_name will enjoy Platinum elite status courtesy of the Brilliant card, and thanks to the Brilliant card’s 25 elite night credits, will be just 10 elite night credits away from earning 5 nightly upgrade awards.

Annual free night certificate (terms apply)

On every anniversary, holders of the card_name receive a free night certificate which can be used at properties costing up to 35,000 points/night (terms apply) and this certificate can be topped up by using up to a further 15,000 points from a cardholder’s Bonvoy account.

Even if you disregard the good welcome offer and the strong earnings rates at Marriott properties that this card offers, the free night certificate alone should be enough to cover the card’s annual fee year after year.

7% discount (terms apply)

Amex refreshed the card_name in July 2022 and it was at that point that this card started to offer a 7% discount on the standard rate for standard room bookings.

It’s important to note that the standard rate offered by a property may not be the cheapest rate that’s available – early booking rates and special rates like the AAA rate may be cheaper – but as standard rate bookings are usually flexible and some of the cheaper rates are often not, this discount may work for travelers who like to keep an element of flexibility to their plans.

The key thing to keep in mind is that cardholders should always explore all the available rates that a property offers and not assume that the rate discounted by 7% is the one to go for.

Bottom line

The card_name is an excellent card for anyone who’s looking to earn the maximum number of Bonvoy points on their spending and an easy 15 elite night credits without splashing out on a high-price credit card.

It’s also the only card that can help a Bonvoy member earn up to 40 elite night credits every year without setting foot in a Marriott property.

Currently, the free night certificates from the welcome offer are enough to allow new cardholders to book a three night stay at a variety of Marriott properties, while the yearly free night certificate should easily help cover the annual fee every year.

Click here to find out how to apply.

For rates and fees of the card_name Card, please visit this page.

Offer terms per American Express:

Welcome offer not available to applicants who have or have had this product or the Starwood Preferred Guest® Business Credit Card from American Express. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Welcome offer not available to applicants who (i) have or have had the Marriott Bonvoy® Premier Plus Business Credit Card from Chase, the Marriott Rewards® Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business® Credit Card from Chase, or the Marriott Rewards® Business Credit Card from Chase in the last 30 days, (ii) have acquired the Marriott Bonvoy Bountiful™ Credit Card from Chase, the Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, in the last 90 days, or (iii) received a new Card Member bonus offer in the last 24 months on the Marriott Bonvoy Bountiful™ Credit Card from Chase, Marriott Bonvoy Boundless® Credit Card from Chase, or the Marriott Bonvoy Bold® Credit Card from Chase.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)