TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission which helps contribute to the running of the site – I’m very grateful to anyone who uses these links but their use is entirely optional. The compensation does not impact how and where products appear on this site and does not impact reviews that are published. For more details please see the advertising disclosure found at the bottom of every page.

UPDATE: American Express has now rebranded the Hilton Honors Ascend credit card as the Hilton Honors Surpass credit card (more info here)

I’m a little bit of an outlier in the miles & points world in that I don’t apply for a lot of credit cards every year. My credit card portfolio is pretty settled and it usually takes a new entry into the market or a significant improvement in an existing card’s offering to pique my interest. But this week something else caught my eye.

I’ve held the entry-level Hilton Honors credit card from American Express for quite a few years and it’s long been a card I’ve liked quite a bit.

Historically I don’t stay at many Hilton properties so the no annual free Amex card which offers 7 Honors points per dollar for spending at Hilton properties has been perfect for me – it costs nothing to keep, it doesn’t charge foreign transaction fees and on the rare occasions I stay with Hilton (like when I stayed at the Conrad Singapore last year) it earns me an acceptable number of points.

But things may be changing.

Back in February I mentioned that I’m considering moving some of my stays over to Hilton as my Marriott Lifetime status isn’t really doing all that much to keep me loyal to Marriott, and those thoughts haven’t gone away.

I have a Hilton stay coming up next week (albeit on points) and I’m tempted to book a couple of Hilton properties for trips I have coming up later in the year so I’ve been reconsidering my need for a more powerful Hilton Honors credit card.

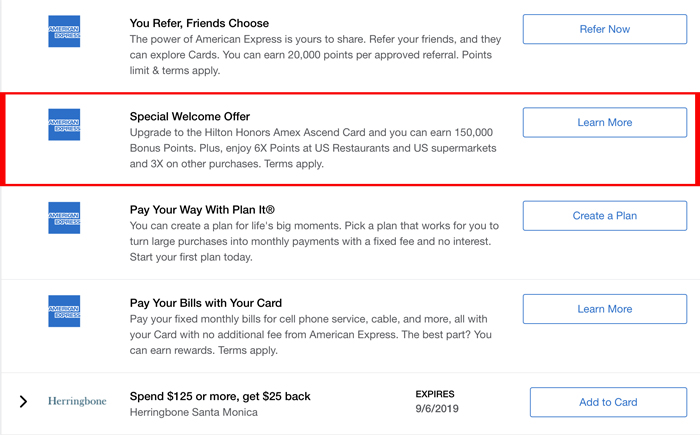

Almost as if American Express read my mind this is what I saw on one of my Amex Offers pages the other day:

This is the same offer as is publicly available for new applications for the Hilton Honors Amex Ascend Card and, interestingly, this upgrade option wasn’t appearing anywhere else on the Amex website – it was just showing under my Amex offers.

American Express had my attention.

Hilton Honors Credit Card vs Hilton Honors Ascend Credit Card

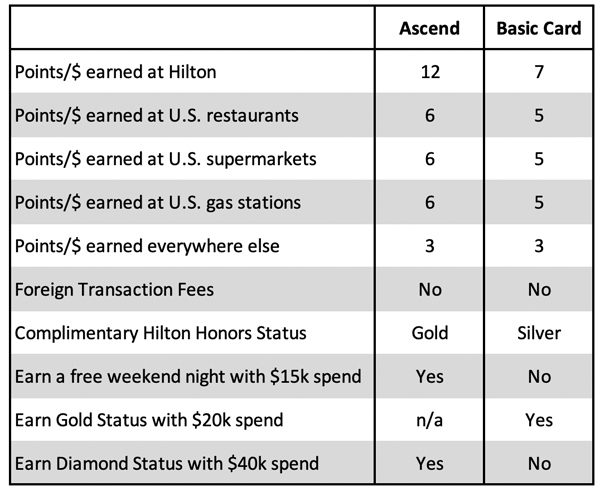

Here’s how the entry-level Hilton Honors credit card and the $95/year Hilton Honors Ascend credit card compare in the more major categories:

Outside of the Hilton earnings there’s not really too much difference between the two cards if you’ve viewing them from my perspective as….

- I wouldn’t use either card at restaurants – I’d use my Citi Prestige card

- I wouldn’t use either card at supermarkets – I’d use my Amex EveryDay card

- I wouldn’t use either card at gas stations – I’d use my Chase Ink Business Plus card

- I don’t need Hilton Silver or Gold status from these cards as I already get Gold status courtesy of my Platinum Card from American Express.

- I’m never going to spend $40,000 on the Ascend Card just to earn Hilton Diamond Status.

But the Hilton earnings are noticeably different.

By my valuation the Ascend card offers a 4.8% effective rebate versus a 2.8% effective rebate offered by the basic card and that makes the Ascend card interesting….and the chance to earn 150,000 Hilton Honors points (which I value at $600) just adds to the interest.

Upgrading To The Hilton Honors Ascend Credit Card

I called up Amex to see if this offer could be transferred over to the Hilton Honors Aspire credit card (Diamond Status would be useful to me over the course of the next few months) but, sadly, the answer was no……but I did manage to confirm the following:

- An upgrade to the Hilton Honors Ascend card would not result in a hard pull on my credit score

- Upgrades are instantaneous

- The $95 annual fee would be prorated across the remainder of my existing credit card year

- My credit card number would not change following the upgrade

With no hit coming to my credit score (no new credit card application will appear on my credit report) and with an upgrade offer as good as any publicly available sign-up bonus, the decision to upgrade was a no-brainer….and the confirmation came through the second I agreed to the terms and conditions of the upgrade.

Even if I eventually decide not to move more of my business over to Hilton I’ll still be getting $600 of Hilton Honors points for $95 (at most) and I can always downgrade back to the no annual fee basic card further down the line. There’s no real downside to me here.

I genuinely don’t know how much use I’ll get out of the Hilton Honors Ascend card over the next year (I’ll be re-evaluating its use to me in 12 months time) but it’s nice to know that my upcoming Hilton stays will see me earn noticeably more points than they would otherwise have done and I’m looking forward to putting the 150,000 bonus points to very good use (once I earn them).

With a bit of luck Amex will target me for a similarly tempting upgrade to the Aspire credit card in the near future so I can earn another large batch of Hilton Honors points without my credit report being touched 🙂

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

I don’t think you’ll regret going to Hilton. I am Diamond in the program.

Last weekend I stayed at 2 different HGI’s. At the 1st hotel I received an upgrade to a junior suite as well as a free drink for my wife and myself at the bar. The 2nd hotel upgraded me to a whirlpool suite and again received a voucher for a free drink for my wife and I at the bar. There is always 2 bottles of water in the fridge and some properties will replenish that supply just for the asking. We opt for the free breakfast which is quite good.

The points are easy to earn, they always run promotions and I have been fortunate to usually receive room upgrades upon arrival to the hotel. Last year I had 31 stays so I achieved Diamond that way, but I also qualified by spending over $40K on the credit card. I have since applied for and received the Aspire Card (150K bonus points for upgrading) and Diamond status the easy way.

I am formally an old program Gold member who used to pay with points to keep my status but also managed to stay 20 to 25 nights a year on my own dime. I don’t blame Marriott for the downgrade as I didn’t have the required stays, but I went from something to nothing when the programs merged.

Amex and Hilton have combined to make a good program even better.

It’s always nice to hear positive stories from people’s experiences (its usually the bad news that we get to hear about most!). I’m very happy to give Hilton a bit more of my Business when the math is in my favor and with that happening more and more it just makes sense to have a better credit card to make the most of the spending I’m putting Hilton’s way.

The thing that I’m most interested to see is what comes of the suite upgrade trial that Hilton has been trialing – if Hilton introduces suite upgrades that can be confirmed at the time of booking (like Hyatt already offers) I suspect that Marriott will haemorrhage top-tier elites.