TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Cash back can be great, but in the miles and points world it’s the versatile transferable currencies that rule and that’s why Rakuten’s partnership with American Express can be a key tool to use in your day-to-day miles and points strategy.

This becomes especially true as we enter the two months of the year which, for a lot of people, are the months in which a lot of shopping and spending is done.

If you haven’t used Rakuten before or if you haven’t set your account up to earn Membership Rewards points, you should probably read on.

What is Rakuten

Rakuten is a shopping portal that’s free to use and which offers members cash back when they use its links to click through to an incredibly wide variety of retailers and service providers.

You’ll find just about every major retailer on Rakuten as well as a few popular travel sites (IHG, Best Western, Expedia, etc…) so the opportunities to get something back from any spending made through the portal are significant.

Earn Membership Rewards points with Rakuten

The default setting on Rakuten is to offer various levels of cash back to members that use the links, but if you’d prefer to earn Membership Rewards points instead of cash back (1% cash back would earn 1 Membership Rewards points), you can set your account up to do just that.

How to elect to earn Membership Rewards points

Rakuten’s default setting is to offer users cash back, so if you want to earn Amex Membership Rewards instead of cash back, you’ll have to go through a few steps and you’ll have to start ant the Rakuten homepage.

If you don’t have a Rakuten account, if you haven’t logged in for a while, if you’re using a computer other than your own, or if you’ve cleared your cookies recently the top of the page may look like this:

If you haven’t used Rakuten before, sign up for an account and then follow the steps below.

If you already have a Rakuten account but aren’t yet earning Membership Rewards points, follow these steps:

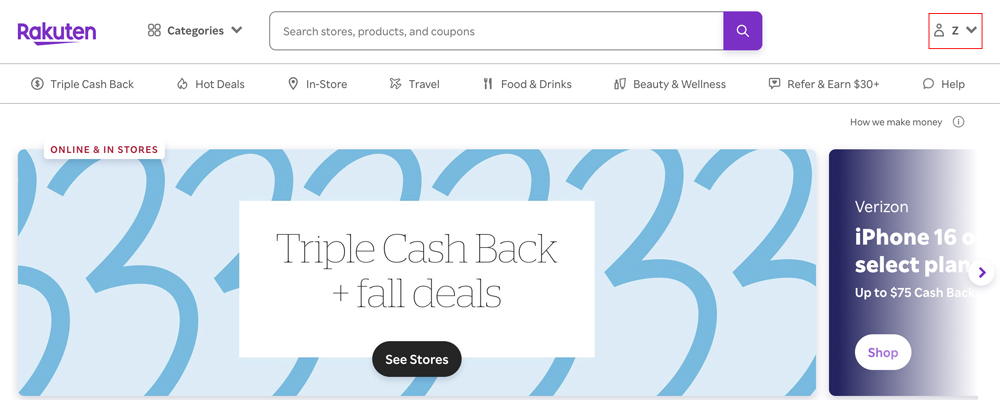

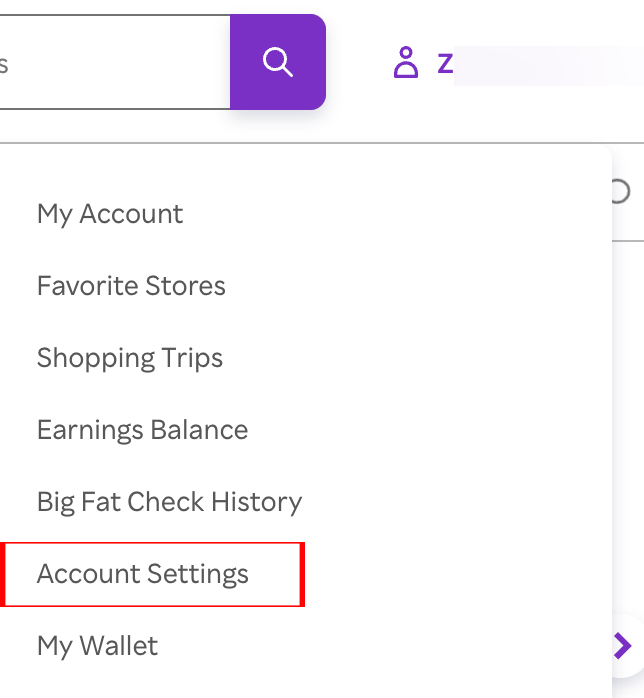

Sign in and hover your mouse cursor over your name/Rakuten account balance in the top right corner of the page to reveal a drop down menu.

In the drop-down menu which should now have appeared, click on “Account Settings”.

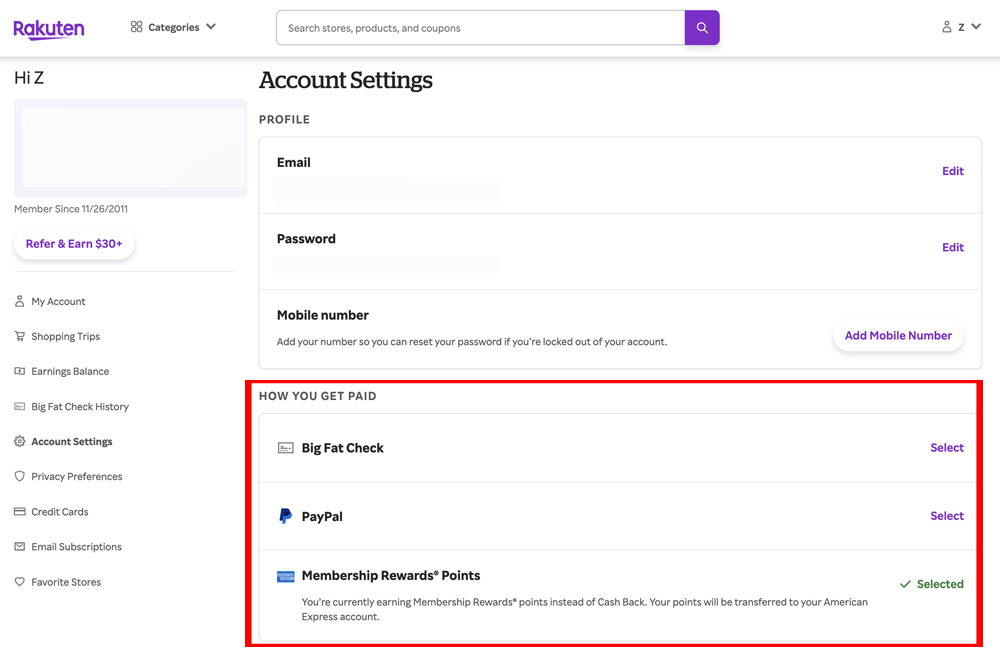

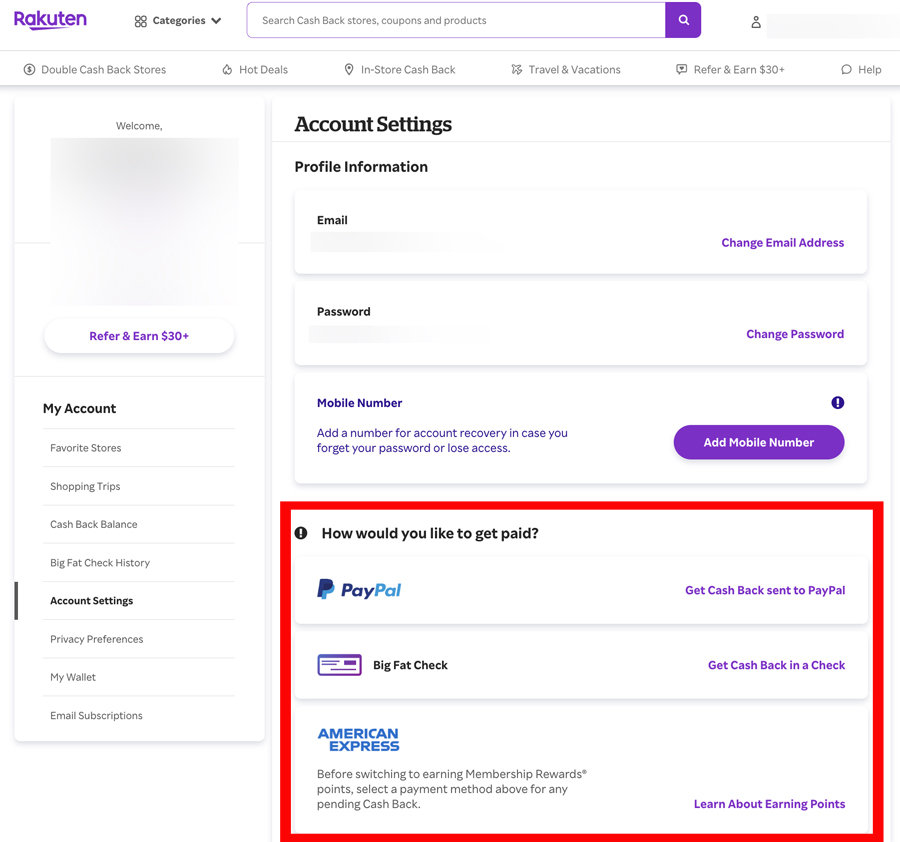

Your account settings page should now be open and on it, you should be able to see your current preferred payout method and all the other payout options available to you.

If you’ve been earning cash back that has been paid into a PayPal account or via a “Big Fat Check” this is where you can choose to change your preference to Membership Rewards Points.

If you’re new to Rakuten and haven’t yet set up a payment option, this is the screen that you’re likely to see:

From here, you’ll have to select to be paid via PayPal or via a Big Fat Check before you can choose to earn Membership Rewards points.

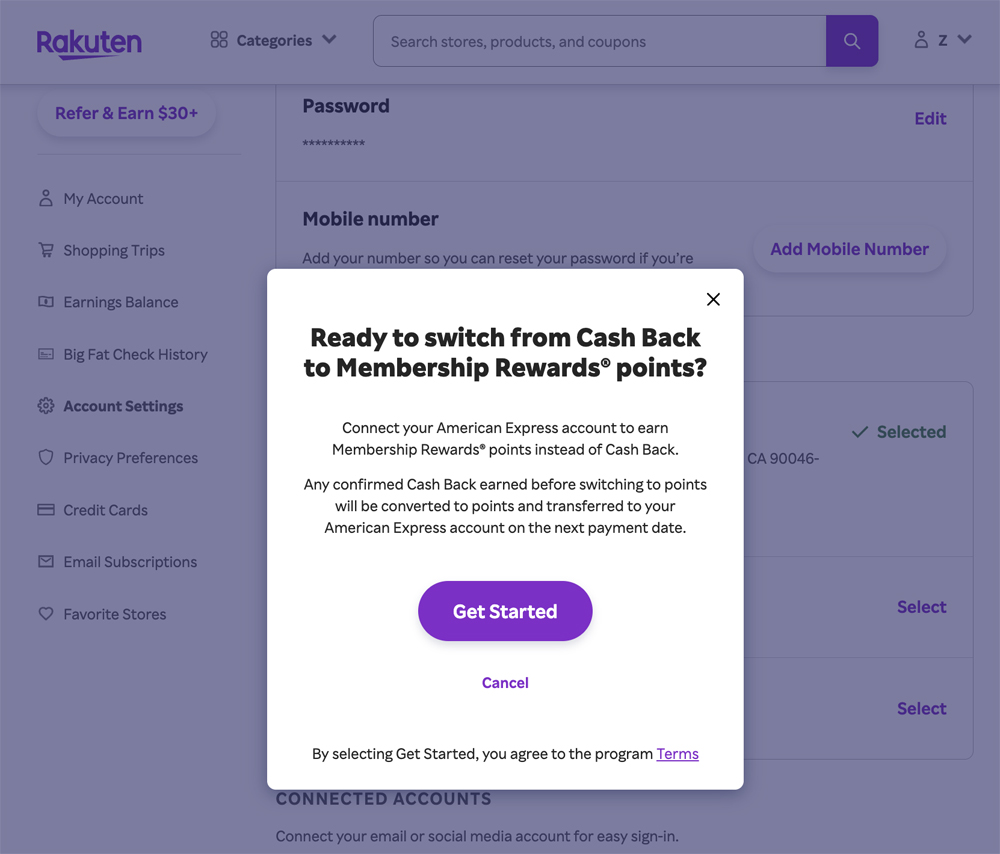

Clicking the “switch to Membership Rewards points” link will open up a pop-up window asking you to confirm that you’d like to earn Membership Rewards points going forward.

Click “Get Started” in this pop-up window.

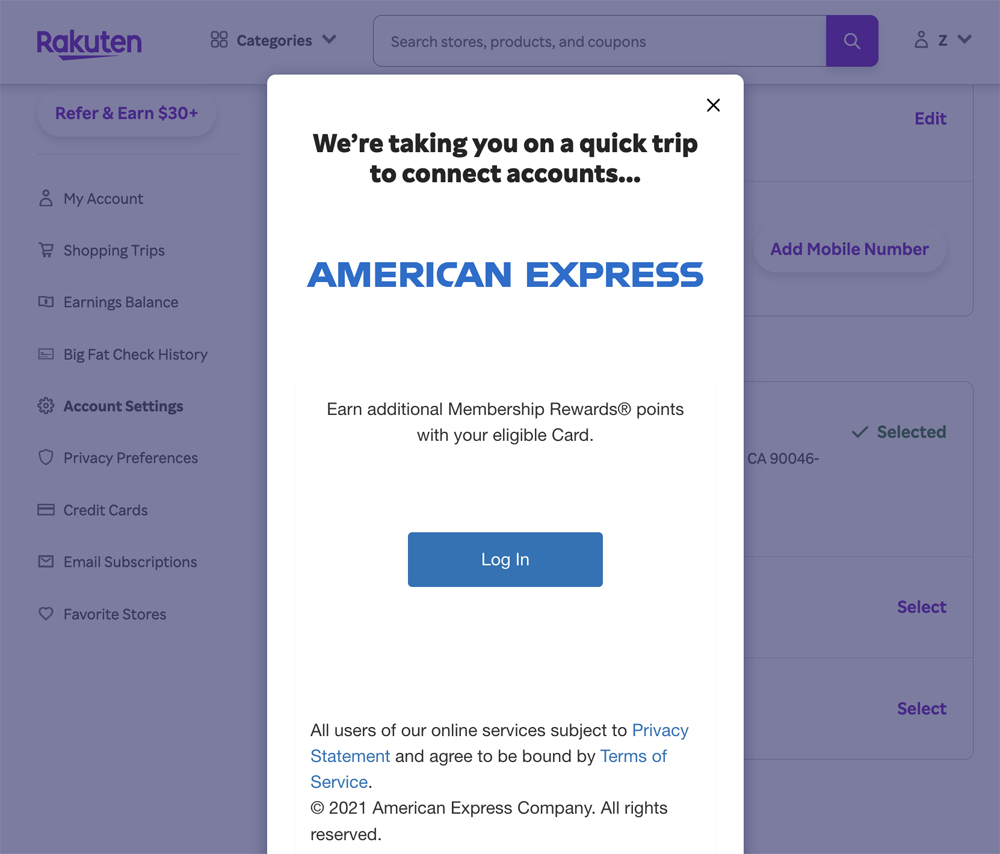

A new pop-up window will now appear asking you to input your American Express Membership Rewards account login details (the login details you use to access your Amex account) so that your Rakuten and Amex accounts can be linked.

Click on “log in”.

You’ll now be redirected to the Amex website where you’re asked to submit your login details to link your Amex and Rakuten accounts.

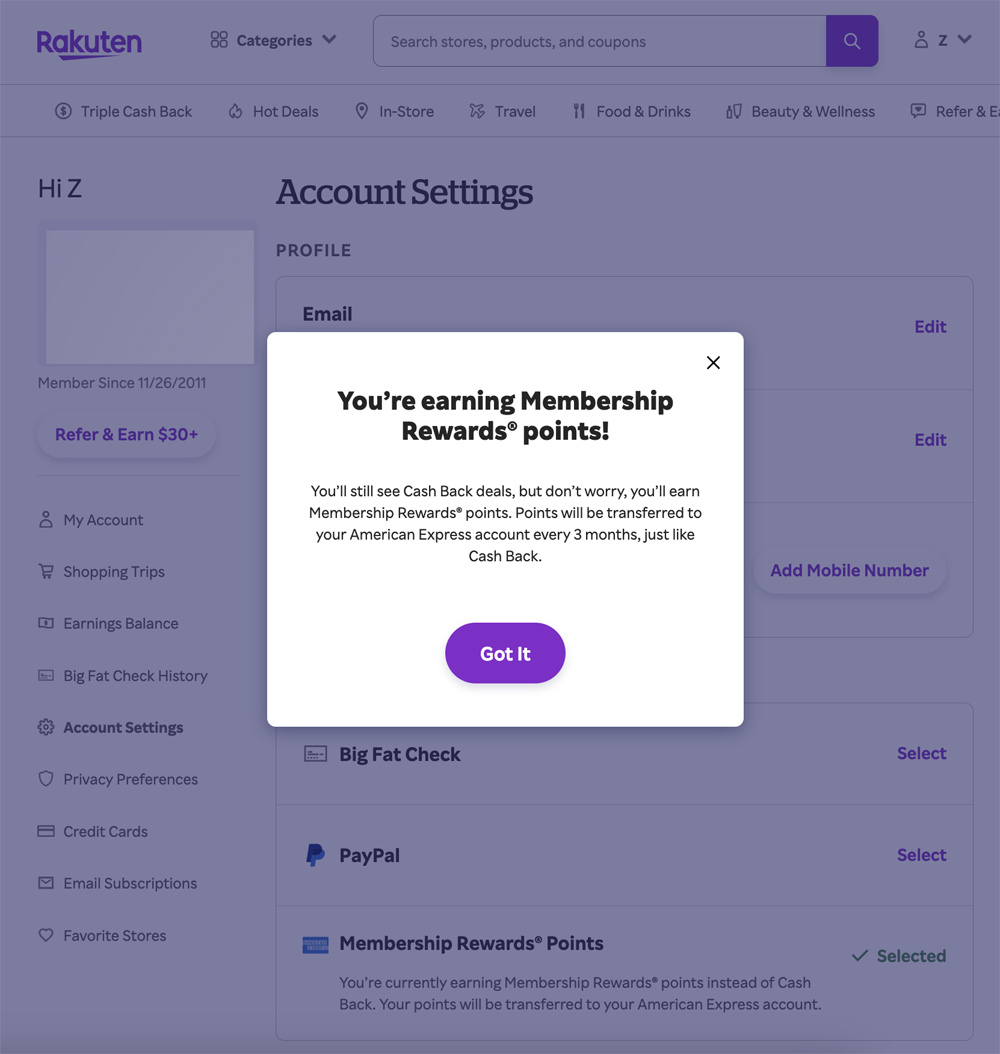

After you submit your Amex login details you’ll see another pop-up box appear confirming that you’re now earning Membership Rewards points.

With your Rakuten and Amex accounts linked and your details confirmed you’ll be taken back to your Rakuten account page where you should see that your preferred payment method has changed to American Express Membership Rewards points.

Any outstanding cashback balance that you had in your account before the change to your payment method will now be converted to points and will be transferred over to your Membership Rewards account when the next payment run is made.

Things to know

You’ll see cashback but you’ll earn points

All the deals you’ll see on Rakuten will show as cashback deals (e.g. earn 5% back at GAP), but you’ll earn Membership Rewards points instead of cash if you’ve followed the steps above.

How cashback translates into points

This couldn’t be simpler – for every 1% (1 cent) of cashback earned you’ll now earn 1 Membership Rewards point.

What this means is that the next time we see another great 10% – 15% cashback deal for bookings made with IHG, for example, (we should be due one of these soon), anyone who has elected to earn Membership Rewards points will earn 10-15 Membership Rewards points per dollar spent on any IHG bookings made through the Rakuten link.

We value Membership Rewards points at a conservative 1.5 cents each, so every 1% of cashback we earn through Rakuten will actually translate to an effective rebate of 1.5%.

What makes this even better

When you click through to one of the hoteliers from the Rakuten website (e.g. IHG, Best Western, etc…), you’ll be making a booking directly with that hotelier, so you’ll be entitled to earn whatever loyalty points that particular hotelier offers as well as being entitled to use whatever status you hold with that hotelier.

By clicking through Rakuten before making a hotel booking you can now earn miles/points in 3 different ways:

- Membership Rewards points from Rakuten

- Hotel loyalty points for booking directly with a hotel/hotel chain

- Miles/points from whatever credit card you choose to use to make your booking

What credit card to use

If you’re making a hotel booking you’ll probably be best served by using one of the many hotel co-branded credit cards like the Marriott, Hyatt, and IHG cards from Chase or the Marriott and Hilton cards from American Express or by using a credit card with strong earnings in the travel category (e.g. the Chase Sapphire Reserve® Card).

If, however, you’re just doing some regular shopping (e.g. through a department store’s website) it’s likely that you’ll be spending in a category for which most credit cards don’t offer a bonus, and that’s when a good cashback card would work well.

The Citi® Double Cash Card will offer a cardholder 2% back, but a better option may be the Blue Cash Everyday® Card from American Express which earns cardholders 3% cash back on up to $6,000 of US online retail purchases (1% thereafter – terms apply).

You could also use a card like the Blue Business® Plus Credit Card from American Express which earns 2 Membership Rewards points per dollar on the first $50,000 in purchases per year (1 point/dollar thereafter – terms apply).

Bottom line

Cash back can be a very useful thing to earn even if you’re a huge miles and points fan, but because Membership Rewards points are so versatile and because Amex is good at publishing bonuses for transfers made to programs run by the like of British Airways, Marriott, Air France/KLM, and more, we choose to take all our Rakuten earnings in the form of points and not cash back.

This tactic won’t suit everyone, but if you’re reading this article, you’re probably interested in collecting as many valuable currencies as you can, and that’s why Rakuten’s partnership with Amex is one that you should explore.

![Save on select IHG stays with this new Amex offer [Targeted] a view of a city from a window](https://travelingformiles.com/wp-content/uploads/2019/07/intercontinental-los-angeles-downtown-1-218x150.jpg)