TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

The Ink Business credit cards issued by Chase are among the very best business credit cards on the market and are, as a result, very popular.

Each of the four Chase Ink cards offers cardholders something different and each card has its own strengths, so to make it easy to see exactly how these cards compare, we’ve listed out their earnings rates, their key benefits, and their annual fees across two tables and added in a little commentary as well.

The four Ink Business credit cards

These are the Ink Business credit cards that are currently open to new applicants:

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

- Ink Business Preferred® Credit Card

- Ink Business Premier® Credit Card

Two of these cards charge an annual fee and two don’t, three offer cash back and one offers points, and the cash back from two of the cards can be converted to points under the right conditions, so there should be something for everyone here.

A note before we continue

We have chosen to use tables to show what the four the Ink Business credit cards offer, and because we think the information speaks for itself, we haven’t included a lot of commentary about specific differences between the cards.

This article is intended more as a resource (with a few of our thoughts added in) rather than a blow-by-blow discussion of what we think is good and less good about each of the Ink Business credit cards.

Ok, let’s move on to the comparisons …

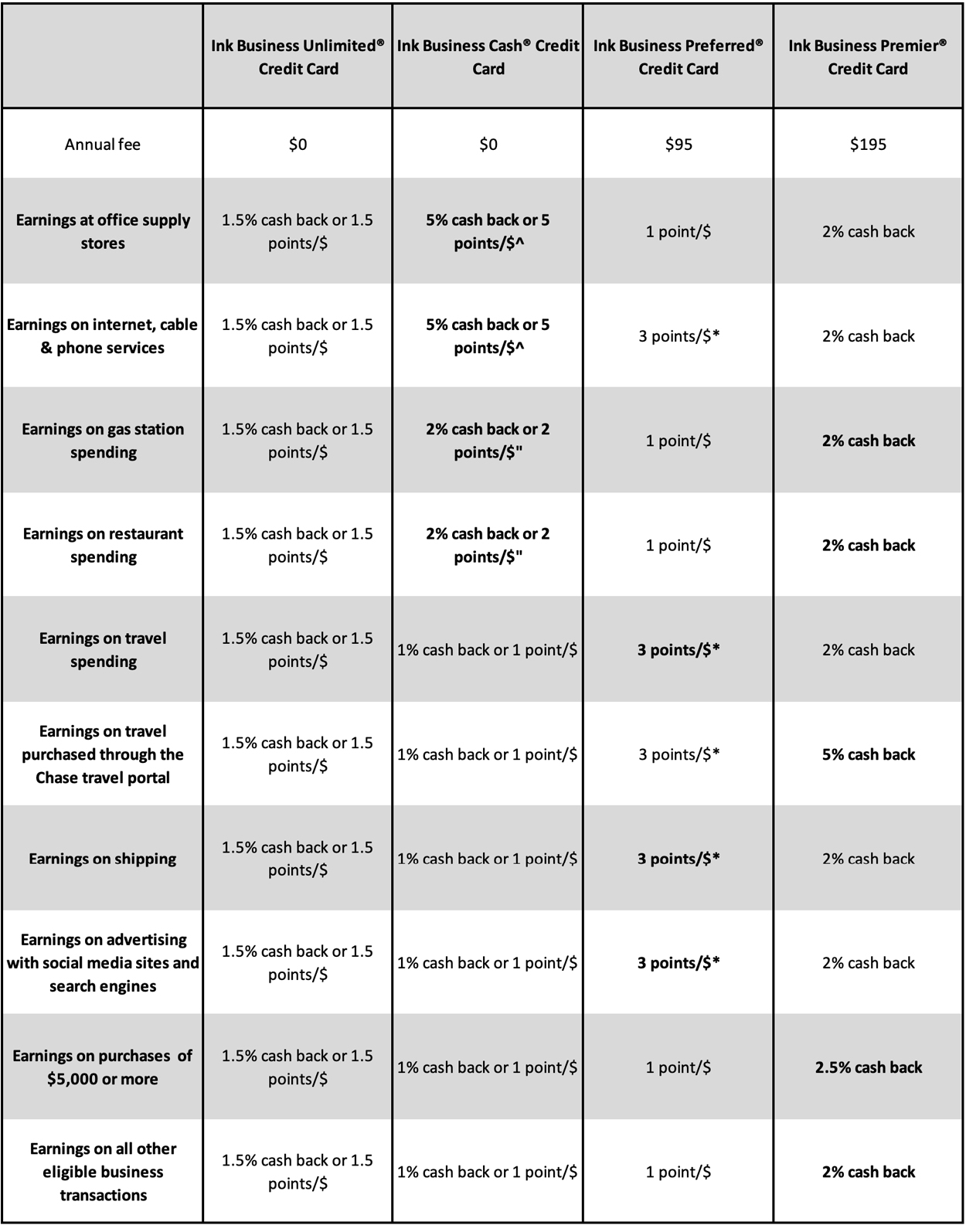

Comparing earning rates (terms apply)

The Ink Business Unlimited® credit card and Ink Business Cash® credit card are both cash back cards, so the points that they earn can only be used to offset spending made on them.

However, if a holder of an Ink Business Unlimited® credit card or Ink Business Cash® credit card also holds one of the Chase Sapphire cards or the Ink Business Preferred® credit card, the points that their $0 annual fee card will earn can be used for more than statement credits.

They can be transferred in a 1:1 ratio to a variety of airline and hotel loyalty programs (more info on that via this link).

The cash back earned by the Ink Business Premier® credit card cannot be converted into transferable points regardless of what other cards a cardholder has in their wallet.

Keep that in mind when looking at the earning rates in the table below.

*The Ink Business Preferred® credit card earns 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping, internet services, cable services, phone services, and advertising purchases made with social media sites and search engines each anniversary year, and then 1 point/dollar thereafter.

^The Ink Business Cash® credit card earns 5% cash back or 5 points/dollar on the first $25,000 spent each account anniversary year on office supply stores and internet, cable, and phone services.

“The Ink Business Cash® credit card earns 2% cash back or 2 points/dollar on the first $25,000 spent each anniversary year on gas stations and restaurants combined.

The key thing to point out here is that there’s a clear winner in most spending categories, so a lot of people hold more than one Ink Business Card to make sure that they can maximise the earnings across multiple categories.

We, for example, hold the Ink Business Preferred® credit card and an older version of the Ink Business Cash® credit card and that allows us to maximise our earnings across at least seven different spending categories.

Don’t look at points/dollar in isolation

When looking at these earnings rates, don’t just look at the points/dollar number in isolation.

To get a true view of how good or bad these earning rates are, you should always work out how much value the earning rates are offering you and go from there.

Here’s what we mean by that:

We value Chase Ultimate Rewards points at 1.5 cents each (based on the value that we know that we can get out of them with ease) and that means that where one of these Ink cards offers us 3 points/dollar for spending in a given category, we know that for us, that’s an effective return of 4.5% on our spending.

This helps put things in context as, in isolation, an earning rate of x points/dollar doesn’t mean very much.

Other cards may also the same number of points per dollar in the same categories, but if those points are not Chase Ultimate Rewards points, they may hold a different value to you and therefore offer a different effective rebate.

Also, by applying a value to the points that the Ink Business Preferred® credit card earns, you can get a better sense of how that card compares to the earning rates offered by the Ink cash back cards.

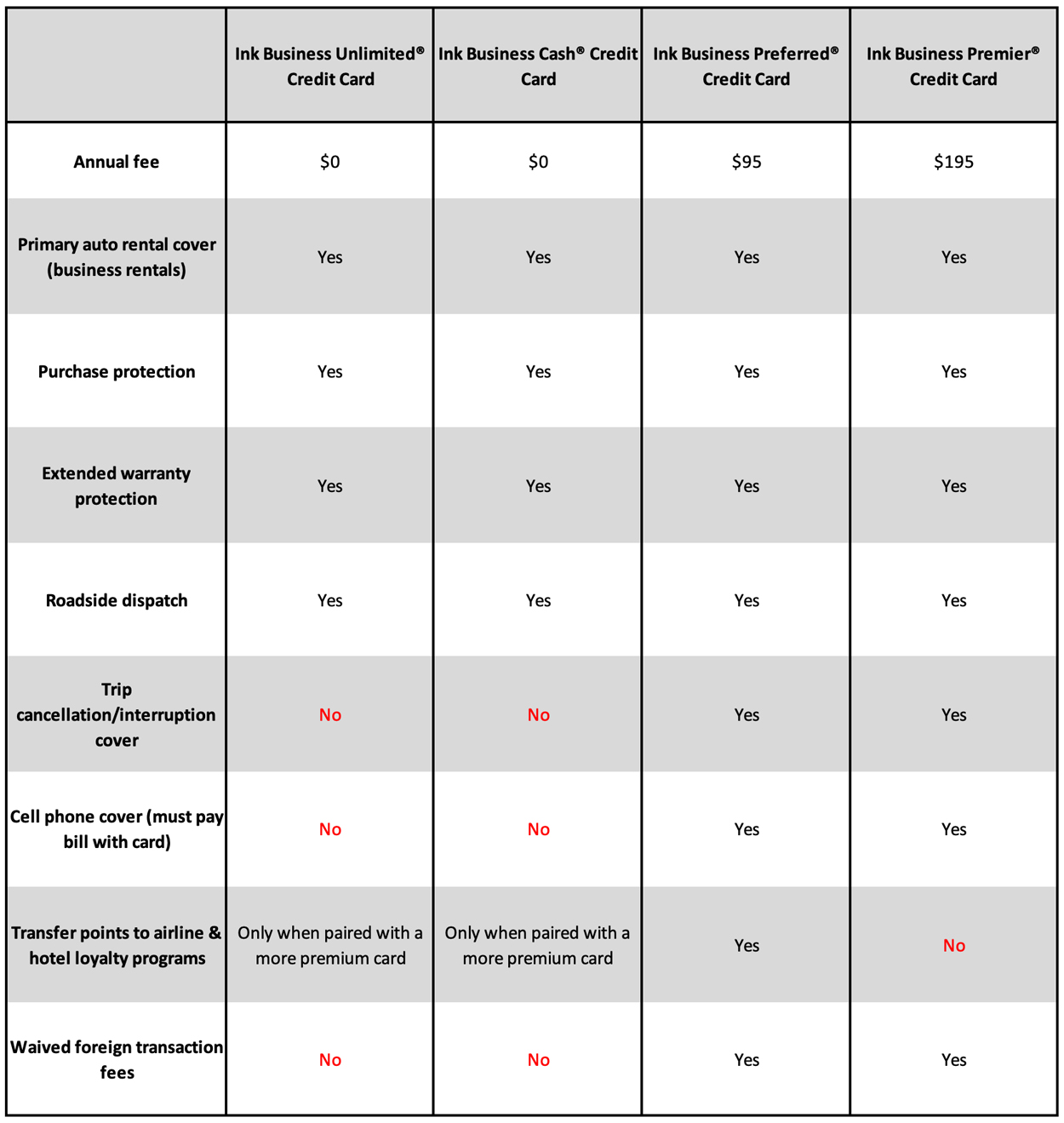

Comparing key benefits (terms apply & enrollment may be required)

Deciding what is and what isn’t a key benefit is, by definition, a subjective thing, so not all benefits may have been listed below.

Having said that, the benefits that have been included below should be more than enough to help you see just what a cardholder is being offered in return for the annual fee that each card charges.

As you should be able to see, there’s quite a lot of uniformity to the key benefits that these cards offer and there are only four key benefits not offered by all four cards.

When looking at the key benefits alone, the standout card is the Ink Business Preferred® Credit Card which despite costing considerably less than the Ink Business Premier® Credit Card, is the only one of the Ink cards to offer all the key benefits.

Also, it’s worth noting that a great aspect of these Ink cards is that even both of the $0 annual fee cards offer primary auto rental cover when a cardholder uses their card to rent for business purposes.

There are ultra-premium cards out there (cards costing $450 and more) that consider this to be one of the key benefits that they offer and yet here we have the Ink Business Unlimited® Credit Card and the Ink Business Cash® Credit Card charging $0 annual fees and offering the very same benefit.

The last point we’ll make in this section is to remind you that when the Ink Business Unlimited® credit card or Ink Business Cash® credit card are held alongside one of the Chase Sapphire cards or the Ink Business Preferred® credit card, the points that they earn can be transferred in a 1:1 ratio to a variety of airline and hotel loyalty programs (more info).

Our (very brief) thoughts on the cards

As a standalone card, our favorite Ink card is the Ink Business Preferred® credit card because we love the combination of a low annual fee + solid earning rates in key spending categories (e.g. travel) + the good benefits that the card offers.

The Ink card that we are least enamoured with is the Ink Business Premier® credit card because we don’t consider it to be flexible enough (its earnings can’t be transferred to other loyalty programs) or rewarding enough for a card that charges an annual fee of $195.

Overall, however, we think that a two Ink card combination will be the best option for most small businesses with the Ink Business Preferred® credit card/Ink Business Cash® credit card pairing just edging out the Ink Business Preferred®/Ink Business Unlimited® pairing.

Bottom line

Hopefully, the two tables above will provide a useful resource for readers when it comes to deciding which Ink Business credit card (or combination of cards) is best for them or if they should bother having an Ink Business credit card at all.

If there’s anything that you think we’ve missed or something that you’d like us to add in or discuss, let us know in the comments section below and we’ll see what we can do.