TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

American Express has confirmed that it’s piloting a new “experience” for consumers, which will allow select applicants to find out if they’ll be approved for their preferred Amex card without having their credit score affected (i.e. Without a hard pull on their credit file).

How this works

The new experience is currently available for individuals who wish to apply for a U.S. consumer card at AmericanExpress.com/us/credit-cards or by calling American Express.

This option is not available if you apply for a card after you log into an existing online Amex account.

Here is how it works:

- Consumers who are interested in applying for a U.S. Personal American Express Card can visit AmericanExpress.com/us/credit-cards to see card offers.

- Upon applying for a chosen Card, a soft inquiry will be made on an applicant’s credit report and applicants will be told with 100% certainty if they are approved – without any impact to their credit score.

- If the approved applicant then accepts the Card, a hard inquiry will be made on their credit report, which may impact their credit score.

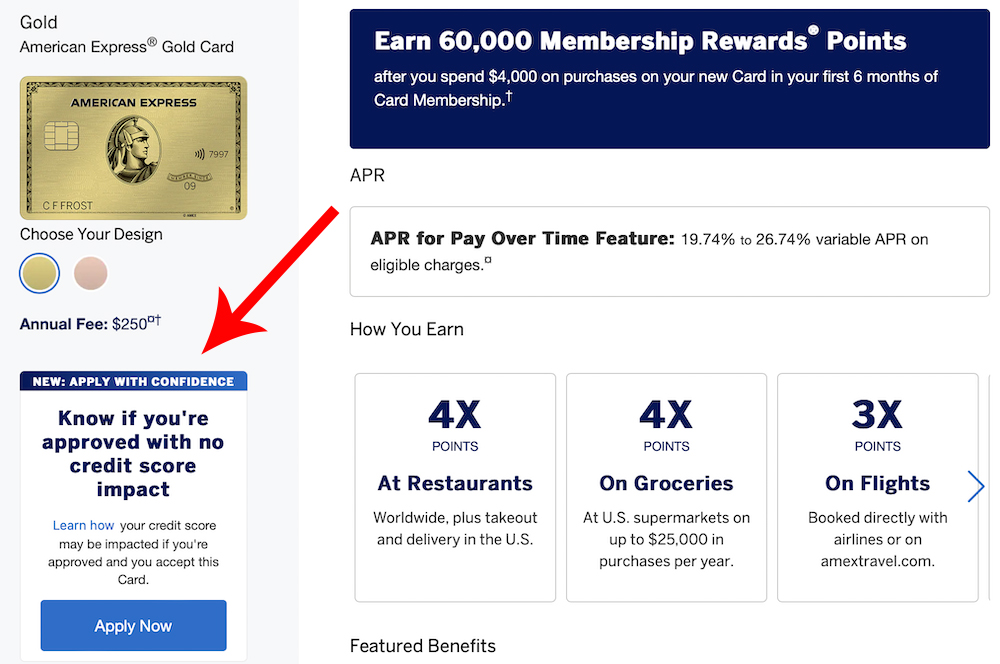

This is what it looks like when I access the application page for the American Express® Gold Card (when not logged in to my Amex account):

ETA: It look like application pages reached through TFM affiliate links also now offer this new experience:

ETA: It look like application pages reached through TFM affiliate links also now offer this new experience:

Amex tells us that in the future, prospective card members will be able to access this new experience through their co-brand partners’ websites (e.g. Hilton. Marriott, Delta, etc…) and that eventually, it will also be made available to current cardholders who are applying for another consumer card.

Quick thoughts

There are two important things to note here:

- This isn’t new. This is something Amex has been piloting for a number of weeks (some of you may have seen evidence of this already) but for reasons best known to Amex, a lot of us who write about credit cards have been prohibited from writing about it. Now that it has been announced via a press release, I’m assuming that it’s safe to mention it!

- Amex may be saying that that this isn’t yet available to existing card holders, but in reality, that shouldn’t matter. Historically, Amex has not requested a hard pull of an existing customer’s credit file if they’re not prepared to approve them for a new card (this applies to most, but not all, cases) so most existing cardholders don’t really need this new “experience”.

Having said that, overall, this is good news for prospective new Amex cardholders. There are few things more annoying (in the credit card world) than having a your credit card score affected by a hard pull for a credit card that you don’t get approved for, so anything that prevents this from happening is a big positive.

Bottom line

American Express is trailing a new option for prospective cardholders which allows them to check to see if they’ll be approved for an Amex consumer card without a hard pull on their credit score. The option appears on a consumer card application page as long as you’re not logged in to an existing American Express account.

Featured image courtesy of American Express

Link (AmericanExpress.com/us/credit-card) in story doesn’t work. Add an “s” to the end and it will. Also – why not just make it a clickable URL?

The link in question (the erroneous one) was copied directly from the Amex press release. Now corrected and made into a clickable link as requested.