TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

The card_name is one of the cards that gets a lot of people started in the miles and points world, and when you consider the card’s relatively low annual fee together with the benefits that it offers and the power that the card has to make other cards even better, that isn’t particularly surprising. In fact, I think so highly of this card that it now has a permanent place in my wallet.

The card_name

In brief

The card_name is a mid-tier card that offers access to Chase’s highly regarded Ultimate Rewards program from where cardholders can transfer their hard-earned points to a variety of airline and hotel loyalty programs in a 1:1 ratio.

With bonus points offered for spending on travel and on dining and with benefits that include excellent rental car protection, no foreign transaction fees, and good trip insurances, this is a card that works very well in the wallets of those who love to travel.

In detail

Here’s what you need to know about the card_name:

Annual fee:

- annual_fees

Cost of authorized user cards:

- $0

Current welcome bonus:

- bonus_miles_full

Note: You can only apply for a card_name if you don’t already hold one of the Sapphire Cards and you’ll only be eligible for the welcome bonus if you haven’t received a welcome bonus on a Sapphire Card in the past 48 months.

Earnings:

- 5 points/dollar on travel purchased through Chase Travel℠*

- 5 points/dollar on Lyft rides (through March 2025) – link

- 3 points/dollar on dining worldwide

- 3 points/dollar on online grocery spending#

- 3 points/dollar on select streaming services

- 2 points/dollar on all travel that isn’t booked through Chase Travel℠^

- 1 point/dollar for spending in all other categories

*Hotel purchases that qualify for the $50 Anniversary Hotel Credit will not earn 5 points/dollar

^Chase’s “travel” category is very broad so you’ll earn 2 points per dollar on everything from airfare, rental cars, and hotel bookings through to car parking, tolls, and ride-sharing services.

#Excludes Target, Walmart, and wholesale clubs

Other key benefits:

- Redeem points at 1.25 cents each when booking travel through Chase Travel℠.

- Earn up to $50 in statement credits each card anniversary year for hotel stays purchased through Chase Travel℠.

- 10% anniversary points bonus.

- Primary auto rental cover.

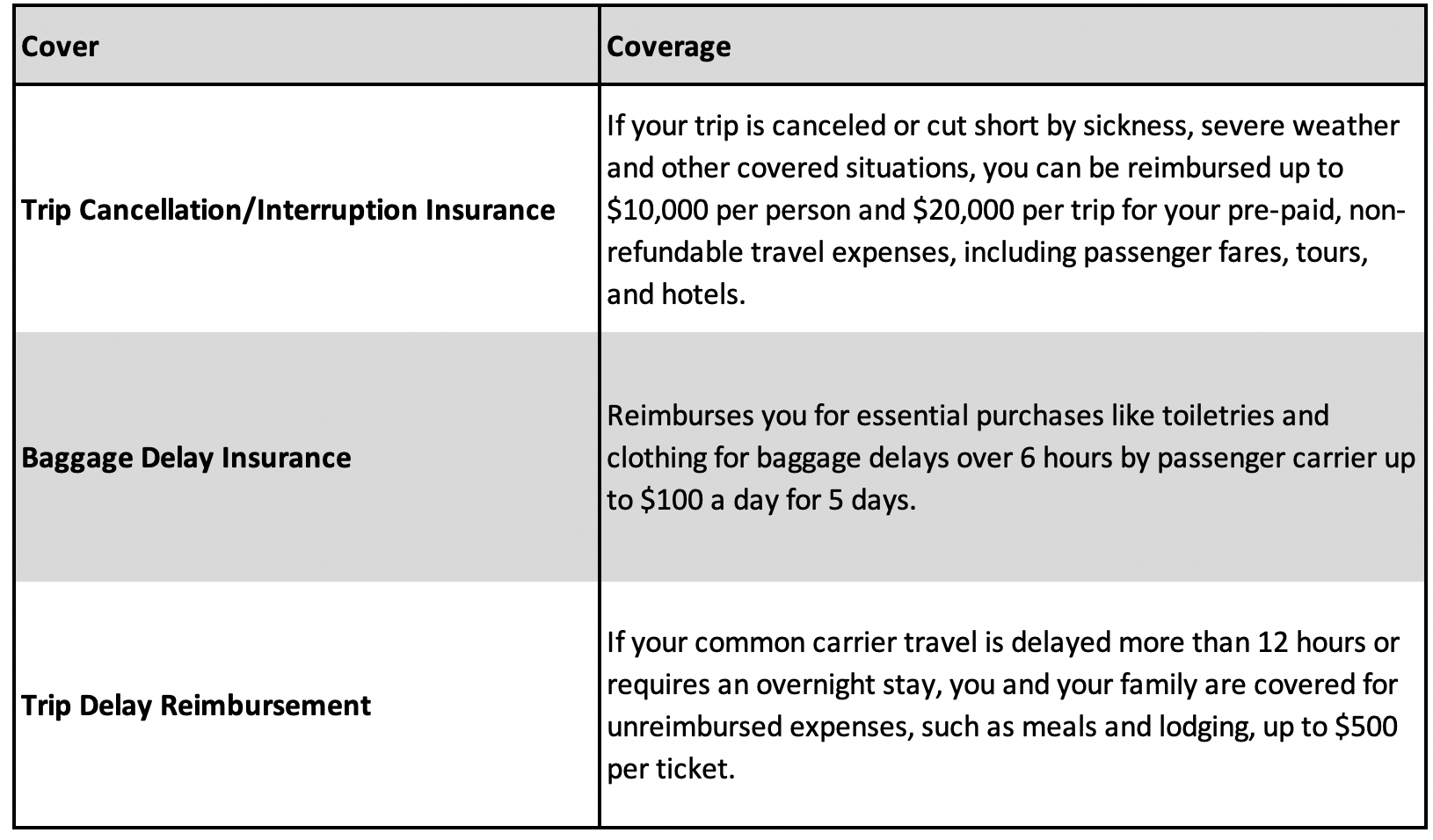

- Trip cancellation/interruption insurance.

- Baggage delay insurance.

- Trip delay reimbursement.

- Purchase protection.

- Extended warranty protection.

- No foreign transaction fees.

Why this is a great card

The cost

The card_name costs annual_fees/year but any cardholder that makes the most of the $50 credit that can be earned when booking hotels through Chase Travel℠ will effectively be lowering that cost to just $45. That’s an incredibly low price to pay for a card that comes with all the benefits that the Sapphire Preferred Card offers.

3 points/dollar on worldwide dining

One of the more recent improvements made to the card_name is that it now earns 3 points/dollar on dining worldwide and that’s a rate that no other Chase-issued credit card can beat (not even the considerably more expensive card_name).

More importantly, as the card_name doesn’t charge foreign transaction fees, it is one of the most economical cards to use when dining at home or overseas.

10% anniversary points bonus

On every card anniversary, holders of the card_name earn bonus points equal to 10% of the total base points earned from purchases made with their credit card during the previous account anniversary year.

E.g. A cardholder who spends $20,000 on their card in their cardholder year will earn 2,000 bonus points regardless of how many points that $20,000 of spending originally earned.

As points have value, this is effectively a (small) rebate on annual spending.

Ultimate rewards partners

The card_name earns 2 Ultimate Rewards points/dollar on all travel and 3 Ultimate Rewards points/dollar on dining worldwide (which can include everything from Michelin-starred restaurants to a coffee booth on a station platform) and these points convert over to loyalty programs like United’s MileagePlus, Singapore Airlines KrisFlyer and the World of Hyatt in a 1:1 ratio (more details here).

There is no cost to transfer points so when you’re spending on travel or dining with the card_name, you are essentially earning 2 to 3 points/dollar in any of the loyalty programs that Chase partners with. That’s an incredible amount of flexibility for a credit card to offer.

There’s no deadline by which you have to transfer over your points, so you can hold all the points you earn as an Ultimate Rewards balance until you know what program you’d like to use them in and then, when the timing is right for you, you simply transfer them across.

When you earn points in a single loyalty program (e.g. United MileagePlus) you’re limited to using those points through that one program only and to make things worse, you’re also at the mercy of that one program (when it devalues your balance devalues too).

By holding your points as a transferable currency like Ultimate Rewards, you limit your exposure to single program devaluations and give yourself considerably more flexibility when it comes to how those points can be used.

Chase Travel℠ bookings

Holders of the card_name can use their points to book travel through the Chase Travel℠ portal with each point worth 1.25 cents towards whatever travel is booked.

The beauty of booking travel in this way is that a cardholder hands over points in exchange for a travel booking that Chase then books with cash, so there’s no need to search for award availability – all the airfares and hotels that are booked through the Chase Travel℠ portal are seen by the airline or hotel as cash bookings.

Flights booked through the Chase Travel℠ portal will earn frequent flyer miles/points and credits towards elite status but because hotels view portal bookings as 3rd party bookings, hotel reservations made using Ultimate Rewards points will not qualify guests for loyalty program points/credits and elite status benefits are unlikely to be honored.

Primary rental car cover

The card_name gives cardholders primary rental car cover when they decline the rental company’s collision insurance and pay for the whole of their rental using their card.

As coverage is primary, there’s no need for a cardholder to get their own car insurance company involved in the case of an incident and they can feel safe in the knowledge that the card’s coverage provides reimbursement up to the actual cash value of the vehicle for theft and collision.

Importantly, this protection covers most rental cars in the U.S. and abroad.

Trip protections & insurances

For a card that comes with an annual fee of just $95, the travel protections that the card_name offers are pretty good…

…especially when you consider the fact that you can pay a lot more for a credit card and not receive any of those protections at all.

…especially when you consider the fact that you can pay a lot more for a credit card and not receive any of those protections at all.

Pairing the card_name with other cards

The card_name can be viewed as a “king-maker” card because it turns a number of other good credit cards into truly fantastic, must-have cards.

- The excellent Chase Freedom Flex℠ Credit Card comes with no annual fee and, on its own, will earn a cardholder 5% cash back in rotating quarterly categories (on up to $1,500 in spending) and on travel purchased through Chase. It will also earn a cardholder 3% cash back on dining and on drugstore spending. If a Freedom Flex cardholder also holds the card_name, all of that cash back can be converted to valuable Ultimate Rewards Points at a rate of 1% to 1 point.

- Like the Flex Card, the card_name also doesn’t charge an annual fee and, on its own, earns 5% cash back on travel purchased through Chase, 3% cash back on dining and on drugstore spending, and an impressive 1.5% cashback on spending in all other categories. If a Freedom Unlimited cardholder also holds the card_name, that cash back can be converted to valuable Ultimate Rewards Points at a rate of 1% to 1 point.

- The card_name comes with no annual fee and, on its own, earns a hugely impressive 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet/cable/phone services. It also earns 2% cash back on the first $25,000 spent in combined purchases at gas stations and at restaurants. When paired with a card_name all that cashback can be converted to Ultimate Rewards Points (1% = 1 Point) making this one of the most valuable cards on the market.

In summary, the card_name can be paired with a number of no-annual-fee credit cards to offer great all-around earnings for the cardholder (read this review of the card_name to see how combined with a Sapphire Card, it can earn 5 points/dollar on spending at more places than you may realize.)

Other reasons to love the card_name

- Anecdotally, it’s an easier card to get approved for than the more expensive card_name.

- The fact that the card doesn’t charge foreign transaction fees means that it can be used globally without costing the cardholder anything extra.

- The DoorDash Dash Pass membership (1 year) that comes with the card_name means that the delivery service will not charge cardholders a delivery fee and will reduce the service as long as the order being placed is for $12 or more.

- The card_name now comes as a contactless card so, if you prefer not to use a mobile wallet, you can still use the card to pay without swiping and signing. This becomes particulary useful in areas of the world where cards are expected to have a pin when not paying via contactless technology (most US-issued cards still do not have chip and pin technology).

Bottom line

The card_name offers great earnings on travel booked through Chase and at restaurants worldwide, it comes with a low annual fee, it doesn’t charge foreign transaction fees, it offers cardholders valuable benefits, it grants access to the wonderful world of Ultimate Rewards, it comes with a great welcome offer, and it has the power to make other credit cards truly amazing. At just annual_fees/year, this is undoubtedly one of the best value cards around.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)