TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

For a limited time, Chase is now offering improved welcome bonuses on all three of the IHG One Rewards credit cards that it issues. One of the new bonuses combines points and free night awards, the second is a standard points bonus while the third, is a two-part bonus with points offered for two spending targeted.

This article will focus solely on the newly improved welcome bonuses, but if you want our thoughts on the IHG co-branded credit cards that chase issues, take a look at our article comparing the three IHG Rewards credit cards.

IHG® One Rewards Premier credit card

The new bonus (which expires on 22 October 2025) is as follows:

Earn 165,000 bonus points after spending $3,000 in the first 3 months following the opening of your credit card account.

Note: This product is not available to either (i) current cardmembers of any personal IHG One Rewards Credit card, or (ii) previous cardmembers of any personal IHG One Rewards Credit Card who received a new cardmember bonus for any personal IHG One Rewards Credit Card within the last 24 months.

At TFM we value IHG One Rewards points at 0.4 cents each and that means that we value the welcome bonus at $660.

That’s equivalent to a return of 22% on the $3,000 of spending required to trigger the bonus (not including any standard points that a cardholder would earn from putting spending on the card), and that’s not bad going.

The going could get even better if you used the points to book some of IHG’s more expensive properties when the cost of an award night isn’t priced too high.

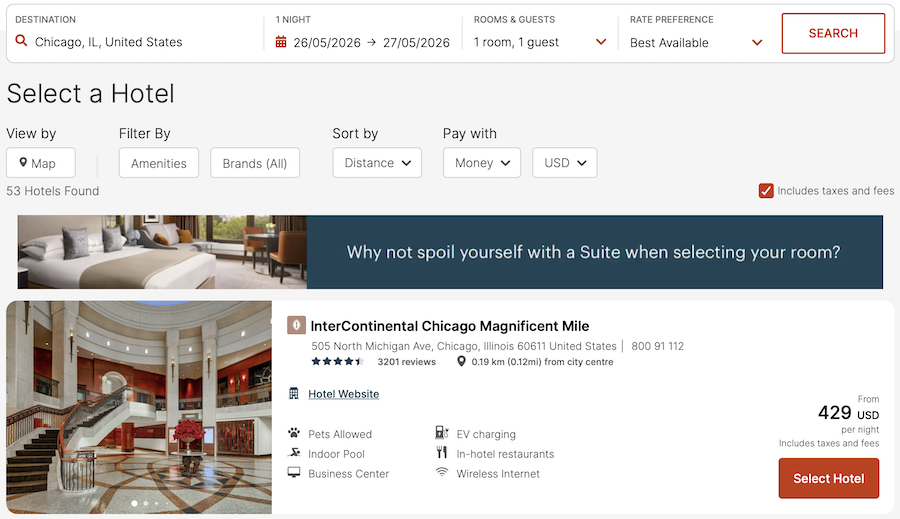

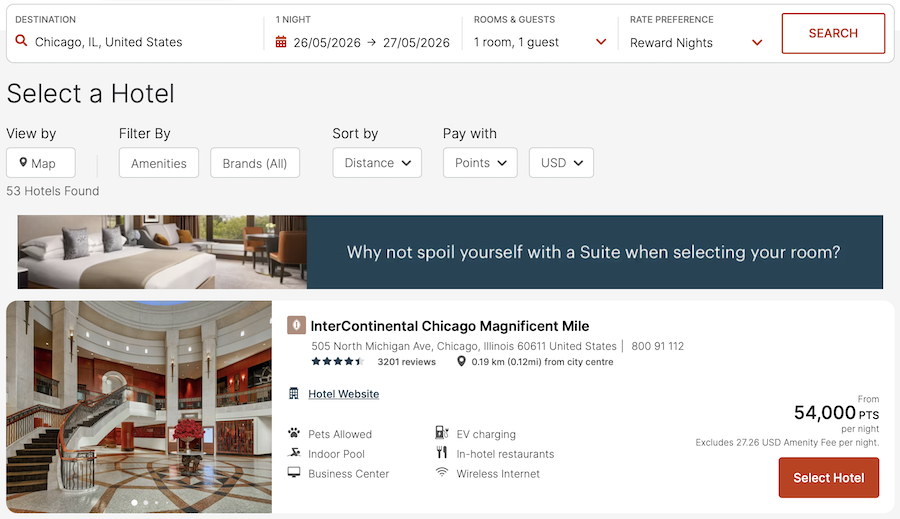

As an example, here’s a night at the InterContinental Chicago Magnificent Mile which can be booked for $429 (including all taxes and fees) or for 54,000 points + a $27.26 rip-off amenity fee.

Using points to make this booking would see a guest getting ~$400 out of just 54,000 points (~0.74 cents/point) and if that return could be repeated, the welcome bonus could be said to be worth at least $1,221.

I’m not going to value it at that because it could take a bit of effort to get that much out of the welcome bonus, but this shows what is possible if you look around.

IHG® One Rewards Traveler credit card

The new bonus (which expires on 22 October 2025) is as follows:

Earn 2 free nights and 40,000 bonus points after spending $2,000 in the first 3 months following the opening of your credit card account.

Note: This product is not available to either (i) current cardmembers of any personal IHG One Rewards Credit card, or (ii) previous cardmembers of any personal IHG One Rewards Credit Card who received a new cardmember bonus for any personal IHG One Rewards Credit Card within the last 24 months.

The two free nights on offer are valid at properties costing up to 50,000 points/night and these come in the form of certificates which cannot be topped up with points from your account and which will expire after a year.

That makes them a lot less useful than they may otherwise have been and it means that they’re not as valuable as 50,000 points in your hand.

In fact, I wouldn’t value them at any more than 40,000 points each.

Based on our valuation of IHG points (0.4 cents each), the 40,000 points on offer here could be said to be worth $160, and the two free night certificates worth a further $320 for a grand total of $480.

That’s equivalent to a return of 24% on the $2,000 of spending required to trigger the bonus (not including any standard points that a cardholder would earn from putting spending on the card) and, once again, that looks very good.

The problem facing the Traveler card’s welcome offer, however, is that if you’re eligible to earn it, you’re also eligible to earn the welcome offer on the Premier card, and even though that requires you to spend $1,000 more and to pay a $99 annual fee (the Traveler card comes with a $0 annual fee), that’s a much better offer to have.

IHG® One Rewards Premier Business credit card

The new bonus (which expires on 22 October 2025) is as follows:

Earn 140,000 bonus points after spending $4,000 in the first 3 months following the opening of your credit card account and earn a further 60,000 bonus points after spending a further $5,000 ($9,000 of spending in total) within 6 months of opening your new account.

Note: This new cardmember bonus offer is not available to either (i) current cardmembers of this business credit card, or (ii) previous cardmembers of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.

For a lot of readers this will be the welcome bonus for which they’re most likely to be eligible as unlike what we’ve seen with the first two offers, the presence of a consumer IHG co-branded credit card in your wallet doesn’t make you ineligible for this welcome offer.

Overall, there are 200,000 bonus points on offer which we value at $800, but I think that it makes most sense to separate out the two components.

140,000 points (worth, to us, $560) in exchange for $4,000 of eligible spending isn’t a bad deal (a 14% rate of return not including the points earned from the cards earning rates).

On the other hand, a further 60,000 bonus points (worth, to us, $240) in exchange for a further $5,000 of spending is a very disappointing 4.8% return.

With that in mind, most people would probably be better off aiming for the 140,000 bonus points and ignoring the second part of the offer.

Of course, if you’re in a position to put a considerable amount of IHG spending on your new card, that changes the dynamic significantly.

$9,000 of spending with IHG would trigger the full 200,000 bonus ($800) and would earn a card holder a further 26 points/dollar (10 for using the credit card, 10 for being an IHG member* and 6 for having IHG Platinum status which this credit card bestows upon cardholders) for an extra 234,000 points.

That would be a haul of 434,000 points which, to us, would be worth $1,736.

Looks good doesn’t it? 🙂

The fact is, however, that very few people will be in a position to do this, so that brings me back to my original suggestion – if you’re going to apply for this card, aim for the 140,000 bonus points and forget that there are more bonus points on offer because they’re probably not worth chasing.

*This assumes that all spending is made at IHG properties at which 10 points/dollar is the standard earning rate.

Bottom line

All three of the IHG One Rewards credit cards which are currently open to new applicants are now offering boosted welcome offers.

My favorite of the offers is the 165,000 bonus points after $3,000 of eligible spending that the Premium consumer card is offering because it’s an offer that’s easy to earn and the points from offer should be easy to use.

My least favorite is the offer on the Traveler card because the free night certificates could be tricky to use economically and because the 40,000 points on offer doesn’t make up for that.

What do you think of these offers? Are you tempted by any of them?