TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Generally speaking, I’m not a big fan of airline co-branded credit cards because I find them to be remarkably unrewarding when it comes to the spending I’m encouraged to put on them, and I can almost always do better elsewhere.

Currently, the best cards to use if you have lost your mind and have decided to rack up a big balance of Delta SkyMiles are the American Express Membership Rewards cards and not any of the Delta co-branded credit cards (which, ironically, are all issued by Amex).

This is because Membership Rewards points convert to SkyMiles in a 1:1 ratio and because if you hold the right combination of Membership Rewards cards you’ll earn a lot more points from your spending than you would if you used your Delta co-branded cards for the same spending (this even applies to spending made with Delta itself).

It’s a similar situation when it comes to United Airlines miles.

If MileagePlus miles are what your heart desires, putting your spending on a variety of Chase Ultimate Rewards cards is the way forward and you should (mostly) keep away from the United Airlines co-branded cards.

This is because Ultimate Rewards points convert to MileagePlus miles in a ratio of 1:1 and because if you hold the right combination of Ultimate Rewards cards you’ll earn a lot more points from your spending than you would if you used your United Airlines co-branded cards for the same spending (this won’t always be the case when you’re spending directly with United Airlines, but it will apply for most other spending categories).

With American Airlines, however, things have been different.

Historically, if you wanted to earn American Airlines AAdvantage miles you’ve only had a limited number of pathways through which you could achieve that aim.

You could fly with American Airlines and credit your flights to the AAdvantage program, you could use the AAdvantage shopping portals, or you could put your spending on an American Airlines co-branded credit card. That was pretty much it.

Because, historically, the American Airlines AAdvantage program has not been a transfer partner for any of the transferable currencies that the big banks issue, there wasn’t an option to earn AAdvantage miles through any credit cards other than the co-branded cards issued by Citi and Barclays.

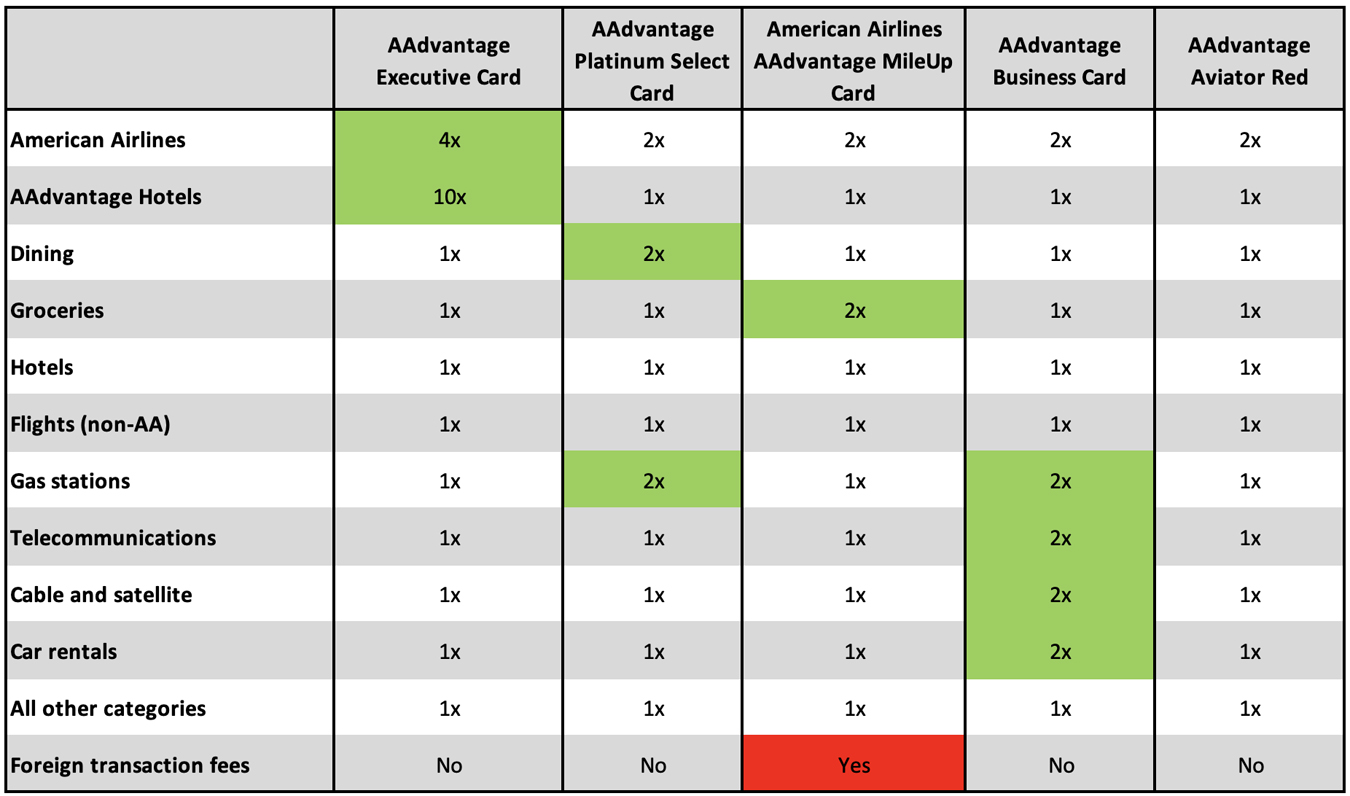

While this remained the case, these were the options open to you if you wanted to earn AAdvantage miles from your everyday spending (a number in green shows where the best earning rate is to be found for that spending category):

Note: I have only included cards that you can currently apply for.

As you can see from the table above, the earning rates are far from impressive and no single card will serve you particularly well.

Now, however, things have changed. And suddenly.

Over the past weekend and with very little warning, the American Airlines AAdvantage program became a Citi ThankYou Rewards transfer partner.

This means that now, anyone who holds at least one of the three more premium Citi ThankYou Rewards cards – the Citi Strata Elite card, the Citi Strata Premier card, and the Citi Prestige card (no longer open to new applicants) – can convert the points that their card earns into AAdvantage miles in a 1:1 ratio.

That’s a game changer.

The Citi Strata Elite card has only very recently been released and, frankly, it looks like a colossal disappointment, and the Citi Prestige card is no longer accepting applications, so I’m not going to waste your time discussing how either of those cards could fit into a sensible AAdvantage miles accumulation strategy.

The card I think anyone wanting to boost their AAdvantage miles balance should be focusing on is the Citi Strata Premier card which comes with a very reasonable $95 annual fee.

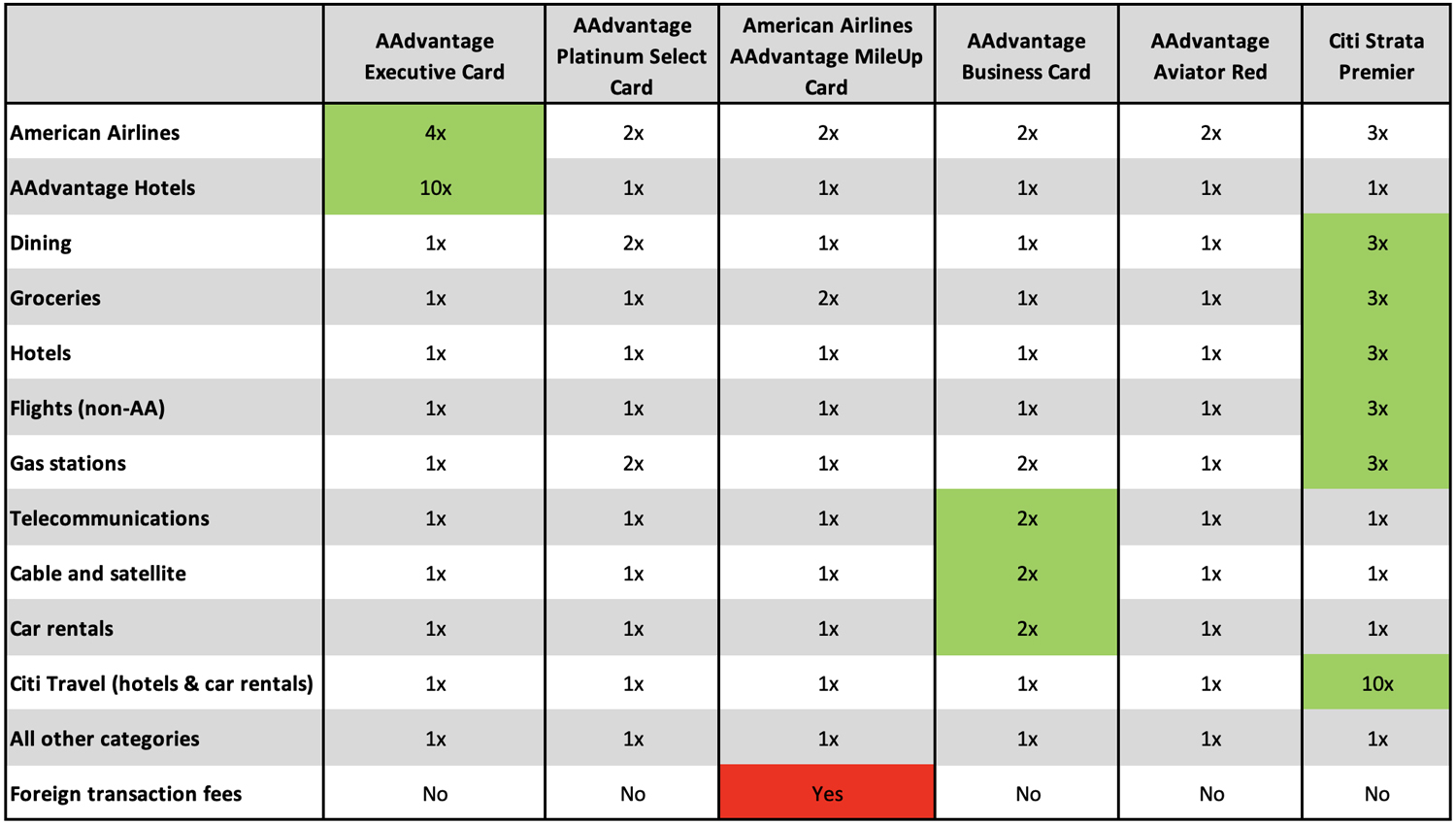

The easiest way to show you how this card can change the AAdvantage miles game for you is by slotting it into the table I published earlier. This is what that looks like:

If the numbers are a little too small for you to read, here are the headlines:

- The Citi Strata Premier card will, effectively, earn you more AAdvantage miles per dollar spent than any of the AAdvantage co-branded credit cards in the following spending categories:

- Dining

- Groceries

- Hotels

- Airfare (excluding American Airlines bookings)

- Gas stations/EV charging

- The AAdvantage Executive card earns 10x on bookings made through the AAdvantage Hotels portal, but the Strata Premier Card earns 10x on hotel bookings and car rental bookings made through the Citi Travel portal (which you could argue is a little better).

- Only the Citi AAdvantage Executive card earns more miles per dollar spent with American Airlines than the Strata Premier card (4x vs 3x).

- The only other spending categories in which an AAdvantage co-branded card will beat the earnings from the Citi Strata Premier card are telecommunications, cable & satellite, and car rentals (2x vs 1x in all those categories.

That, however, is not where things end.

If a holder of the Citi Strata Premier card also holds the Citi Double Cash card (which comes with a $0 annual fee) they can do even better.

The Citi Double Cash card earns card holders 2% cash back on all eligible spending (1% when they make a purchase and 1% when they pay off their card), but that cash back can be taken in the form of transferable ThankYou points if you also hold the Premier card (or the Strata Elite or the Prestige card).

Effectively, this means that when it’s combined with the Strata Premier card, the Citi Double Cash card can earn 2 AAdvantage miles/dollar on all eligible spending across all spending categories.

The Double Cash + Strata Premier combination will earn card holders at least 2x/dollar in every spending category, and that nullifies the AAdvantage Business card’s supremacy in the telecommunications, cable & satellite, and car rentals categories (not that I would advise anyone to use the Double Cash to book a rental car – you should always use a card which gives you primary rental cover when you rent).

So, where does that leave us?

Well, we now have a situation where the only meaningful spending category in which any of the AAdvantage co-branded credit cards can beat the earnings rates offered by the Citi Double Cash and Citi Strata Premier team is the American Airlines spending category, and even then the AAdvantage Executive card only wins by 1 mile/dollar.

On its own, the Citi Strata Premier card is a fantastic card to hold if you need to boost an AAdvantage miles balance, and when you add the Citi Double Cash card into the mix, you have what is probably the most economical credit card combination available to people wishing to accumulate AAdvantage miles.

AAdvantage cards still have their uses

It’s important to recognise that all that I’m discussing here are earning rates. I’m not discussing any of the benefits that come with the cards, and that’s something you need to keep in mind when considering this information.

Purely from an earning AAdvantage miles standpoint, I think that most effective single card to hold is the Citi Strata Premier card, and the most effective card pairing is the Citi Double Cash card + the Citi Strata Premier card.

From a more holistic point of view, however, that’s probably not going to be enough for American Airlines frequent flyers.

What the AAdvantage cards offer that none of the Citi cards offers are benefits specific to American Airlines.

All the AAdvantage co-branded cards earn card holders Loyalty Points (elite qualifying points) and to a greater or lesser degree, all of the AAdvantage cards offer some sort of in-airport or in-flight benefit(s) which can make life cheaper and/or easier if you’re often flying with American Airlines.

You don’t get any of that with the Citi cards.

What this means is that while the Citi ThankYou cards have now (mostly) surpassed the AAdvantage co-branded credit cards when it comes to earning AAdvantage miles, the AAdvantage cards still have their uses, and if you’re an American Airlines frequent flyer, you’ll still probably need to hold one of these cards in your portfolio.

Bottom line

Now that the AAdvantage program is a transfer partner for Citi ThankYou Rewards, the most useful cards for earning AAdvantage miles are not the AAdvantage co-branded cards but the Citi Strata Premier card and the Citi Double Cash Card.

That isn’t to say that the AAdvantage cards are now obsolete (they’re not), but it does mean that if you’re serious about building up a American Airlines miles balance as you go about your everyday spending, you should at least have the Citi Strata Premier card in your wallet and, preferably, the Citi Double Cash card as well.

Will you be changing your credit card strategy/portfolio now that AAdvantage is a Citi ThankYou Rewards transfer partner?

![[Targeted] Fast track to American Airlines status for World of Hyatt elites a plane parked at an airport](https://travelingformiles.com/wp-content/uploads/2019/05/american-airlines-741-tails-2-218x150.jpg)

I’ve been concentrating so hard on the doubtless impending devaluation that will soon follow the transferability to American that I hadn’t really considered the earnings side.

I hold Executive Platinum status with AA, mostly through business spending. Now I’ll need to reevaluate whether the benefits are outweighed by earning double the miles. Another consideration is insurance coverage. My executive card not only gives me lounge access and solid earnings on American flights but has surprisingly good travel insurance coverage. The regular cards are pretty bad about that.

You’ve certainly provided some food for thought. Thanks.