TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

I tend not to apply for a lot of credit cards every year so without the regular influx of points from juicy welcome offers, I’m always looking for other ways to boost my various account balances.

Chase and Citi don’t really make things very easy, but American Express has come to my aid on quite a few occasions by offering me a bonus to upgrade one of my cards.

A few years ago I earned 150,000 Hilton Honors points for upgrading my entry-level Hilton Honors American Express Card to the mid-tier Hilton Honors American Express Surpass® Card and just last year, Amex offered me 40,000 Membership Rewards points to upgrade my Amex EveryDay® Card to the Amex EveryDay® Preferred Card with just $2,000 of spending.

Given that the Amex EveryDay® Preferred Card charges an annual fee of just $95, I jumped at the chance to earn the 40k bonus, and once I had held the card for a year and had confirmed that I didn’t really need it, I downgraded back to the Amex EveryDay® Card to avoid having to pay a second year’s annual fee.

That downgrade took place at the end of May, and I was under the impression that following a product change (downgrade or upgrade), there is a period of time (at least a year) in which card issuers will not consider allowing you to product change again.

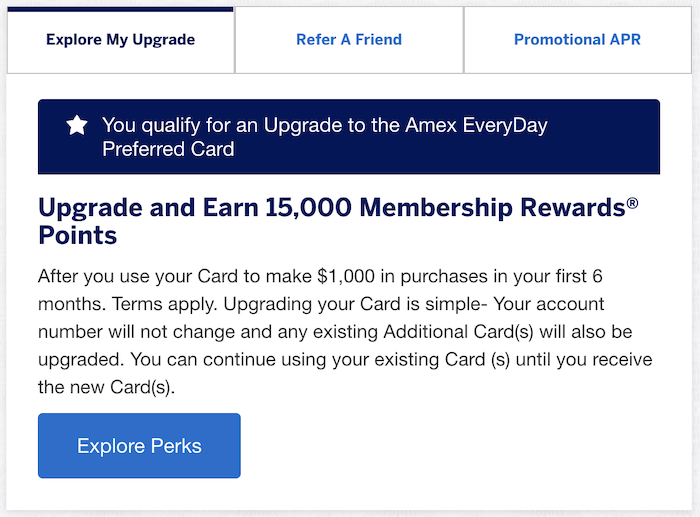

Well, apparently, I was wrong about that because for the past few weeks, this is what I’ve been seeing each time that I log into my Membership Rewards account:

Yes, that’s not the most exciting of offers and it’s not as good as the upgrade offer I got last year, but considering I didn’t think I would be eligible for an upgrade for at least another 7 months, 15,000 bonus points looks tempting.

The numbers

The Amex EveryDay® Preferred Card earns 3 points per dollar on up to $6,000 of U.S. supermarket spending per year (1 point/dollar thereafter), 2 points/dollar on spending at U.S. gas stations, and 1 point per dollar on all other eligible purchases as well as offering a 50% points bonus in each billing period that a cardholder uses their card 30 times or more (terms apply).

For an annual fee of $95 (rates & fees), that’s not bad if you happen to be a fan of Membership Rewards points, need a good card for U.S. supermarket spending, and don’t generally spend more than $6,000/year at U.S. supermarkets.

I, however, have no real need for the Amex EveryDay® Preferred Card (it makes my list of best cards to use for supermarket spending but I’m happy using my Citi Premier® Card when I go out to buy the groceries), so if I’m going to go for this upgrade, I have to make sure that the number stack up.

Essentially, I don’t see this upgrade offer as an opportunity to get a credit card that I expect to be using a lot. Instead, I see this offer as an opportunity to, effectively, buy 15,000 Membership Rewards Points for the cost of the Amex EveryDay® Preferred Card’s annual fee – $95.

If I decide to take up this offer and upgrade to the Amex EveryDay® Preferred Card, I’ll probably do what I did last time – keep the new card for a year and then downgrade it back to the card that I hold now – unless I discover that I suddenly have a good use for it… which is unlikely.

15,000 points at a cost of $95 would see me “buying” Membership Rewards Points at just 0.63 cents each and as I value Membership Rewards Points at 1.5 cents each (based on the value that I know I can get out of them with relative ease), I see this as a pretty solid deal.

If I apply for this upgrade, I should be able to hit the $1,000 spending target with U.S. supermarket spending alone so as long as I also use the card at least 30 times in each billing period that I’m earning points, I should find myself earning a total of at least 19,500 Membership Rewards Points with this offer.

As I value Membership Rewards points at 1.5 cents each, that comes to a total return of $292.50.

That could be viewed as a ~29% rebate on the spending needed to trigger the bonus points and that looks pretty good.

Better yet, as I value Amex Membership Rewards Points and Citi ThankYou Points equally, by transferring my U.S. supermarket spending to the Amex EveryDay® Preferred Card from my Citi Premier® Card, I won’t be giving up any earnings elsewhere – I’ll just be substituting one currency that I value at 1.5 cents each for another.

Bottom line

To my surprise, American Express is again targeting me for an upgrade offer on my Amex EveryDay® Credit Card but this time the upgrade is only worth 15,000 points. With the spending target for the bonus points set at just $1,000 and with 6 months to hit that target, I’m tempted take Amex up on the offer of an upgrade for a second year running.

What I’m more interested in, however, is finding out if anyone else thought that there was a cooling off period after a credit card product change that precluded you from product changing for a second time? I did, but apparently, I was wrong.