TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

I like PayPal. I make a substantial number of transactions with non-US entities and PayPal often makes my life easier. There is, however, one aspect of PayPal that I avoid at all costs – the currency conversion system – and I strongly advise everyone else to avoid it too.

Note: I realize that a lot of TFM readers are seasoned world travelers and are well aware of the various foreign currency pitfalls that can lie in wait – this post is for the less experienced among us in case anyone is not quite up to speed just yet.

I’m always happy when I find that a foreign retailer or supplier that I’m using offers PayPal as a payment option as I don’t like inputting my credit card details into more websites than I have to, and I’ve lost count of the number of times that standard payment systems have thrown a fit worthy of a Hollywood diva when I’ve tried using US billing address alongside a non-US delivery address. PayPal is a very useful 1-stop option for me.

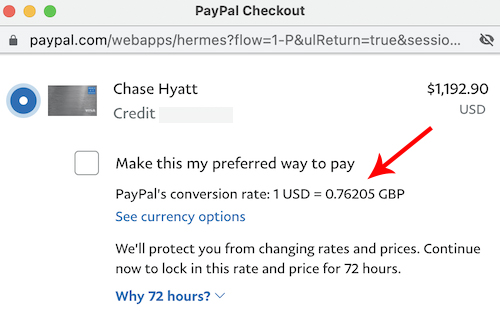

What I don’t like about PayPal, however, is that when I try to make a non-USD payment using one of my US-issued credit cards, it automatically converts the transaction into dollars using its own conversion rate.

I have to remember to click on the “see currency options” link to tell the site that I want to let my credit card issuer process the conversion and that I really, really, don’t want to use PayPal’s conversion rate.

This is why…

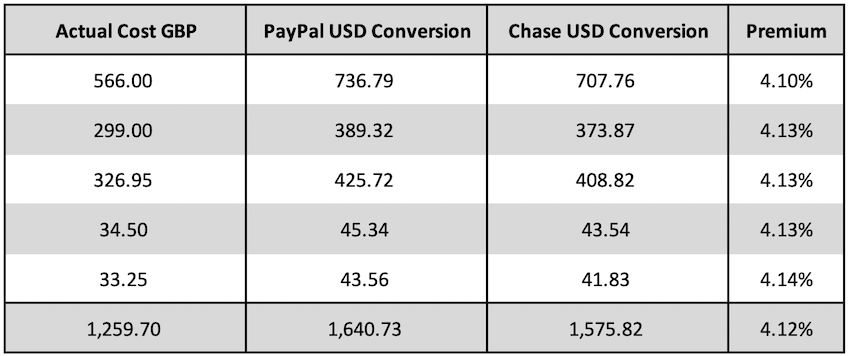

In the past couple of weeks, I’ve had to make a number of purchases in British Pounds and as I’ve wanted to use my card_name to pay, I’ve used PayPal to process the transactions.

Remembering that I’ve wanted to write this article for some time, I took screenshots of the actual cost of my transactions in GBP as well as the USD figure that PayPal was quoting me.I then compared what PayPal wanted to charge me through its currency conversion system to what Chase eventually charged me when it processed my transactions.

These are the results:

Essentially, PayPal would have charged me ~4.1% more than Chase on every transaction, and that’s the cost of using PayPal’s currency conversion instead of allowing the US card issuer to handle it.

Put simply, this is PayPal’s version of what happens when you allow a non-US credit card terminal (at some distant coffee shop, hotel, or bar) to charge you in USD instead of the local currency – you get ripped off.

Bottom line: Always let your US credit card issuer handle foreign currency conversions and ignore PayPal’s offer to convert your transaction for you.

Thanks for writing. I literally did my first one of these on Monday and wish I had this info earlier 😀 Hopefully others read this and dont get into this pitfall

This is called Dynamic Currency Conversation. Stay far away from it. Especially, overseas – always pay in local money. Charles Schwab, Bank of America and several companies actually give you the LIBOR rate (what they pay for the currency).

I’ve always though that the name “dynamic currency conversion” is a big misnomer for this rip-off. When you get right down to it, “dynamic” just means “constantly changing” which is what describes just about all FX rates. In the real world, all the FX rates that our credit card issuers use are “dynamic” so the name “dynamic currency conversion” doesn’t tip-off the end user that they’re about to be overcharged. I’d like to see this renamed to something like “premium rate currency conversion” or, better yet “non-standard currency conversion”.

Xoom for money transfers is a PayPal company and I was astounded at the exchange rate I was given for sending money to Jamaica last week. Because I had a PayPal account the transfer FEE was excellent at $4.99 for the $1000 USD wire but it arrived about $80 less than at the EXCHANGE RATE I’d’ve received at the bank in JA, or on a credit card conversion from my US bank. any idea if there’s any way to control Xoom’s currency conversion rate? Live and learn.