TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Over the past couple of weeks, we have gone over some of the changes that have been brought in (or announced) for 2024 by Alaska Airlines, Southwest, and American Airlines, so it’s only fair that we also look at the one key change that United’s MileagePlus program has introduced for the 2024 elite year.

United MileagePlus in 2024

In summary

Put simply, there are no key changes to elite benefits for 2024 but one of the ways that elite qualifying credits can be earned has changed. Unsurprisingly, United has decided to start down the path that several other airlines have already gone down and make credit card spending more of a key element to the way MileagePlus members earn elite status.

Elite status earning – What hasn’t changed

I’ll start off with a couple of things that haven’t changed – the targets that flyers need to hit in order to earn/retain elite status in 2024 (for 2025) and the head start bonuses.

United has chosen not to ‘do a Delta‘ and so the targets for the 2024 elite qualification year are exactly the same as they were in 2023.

Note: As well as the Premier qualifying flights (PQF) and Premier qualifying points (PQP) requirements set out above, MileagePlus members must fly a minimum of 4 flight segments operated by United or United Express.

Another thing that hasn’t changed is the fact that United will, at some point this month, give its elite members a head start on the race for status by depositing bonus Premier Qualifying Points (PQP) into their accounts.

This is what those deposits will look like:

- Premier Silver – 250 PQPs

- Premier Gold – 500 PQPs

- Premier Platinum – 750 PQPs

- Premier 1K – 1,250 PQPs

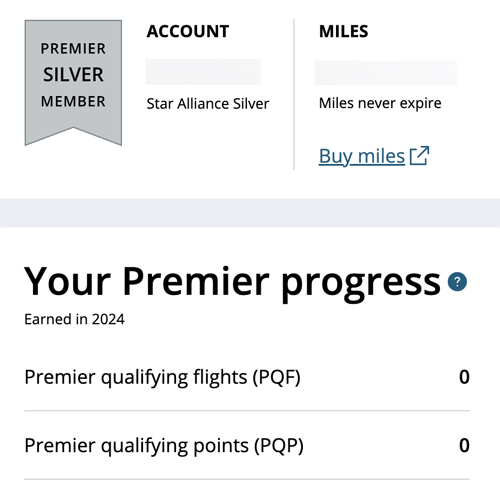

My account doesn’t yet show any bonus PQPs (I have Silver status with United courtesy of my Marriott Bonvoy elite status) …

… but I believe that some members have started to see the PQP appearing in their accounts over the past few days.

Elite status earning – What has changed

The one key change to how MileagePlus elite status can be earned is that United’s co-branded credit cards can now play a more significant role in how flyers earn elite status.

In 2023, holders of most United co-branded credit cards* could earn 500 PQP for every $12,000 of eligible spending they put on their cards.

In 2024, most co-branded cardholders* will earn 25 PQP for every $500 of eligible spending they put on their cards (for comparison, that’s 500 PQP per $10,000 of eligible spending).

In 2023, the PQPs earned through credit card spending* could only be counted towards the targets for the first three levels of MileagePlus elite status (Silver, Gold, & Platinum).

In 2024, the PQPs earned from co-branded credit card spending* will count towards the targets for all levels of MileagePlus elite status.

In 2023, the most premium of United Airlines co-branded cards (the United Club℠ Infinite Card) allowed cardholders to earn up to 8,000 PQP per year.

In 2024, the United Club℠ Infinite Card now allows holders to earn up to 10,000 PQP per year.

In 2023, there was a 15,000 cap on the number of PQP that could be earned through spending across all United co-branded credit cards.

In 2024, there is no cap on the number of PQP that can be earned from co-branded credit card spending.

Note: It’s not only United cards issued by Chase that are seeing changes. Holders of co-branded cards issued by First Hawaiian Bank also now earn 25 PQP for every $500 of eligible spending (although this is capped at 1,000 PQP/year) and all PQP earned now count towards the targets for all MileagePlus elite status levels.

*Not all United co-branded cards offer cardholders the option to earn PQP.

Key United Airlines co-branded cards

Each link will take you to a page with more information and with details on how to apply:

- United Club℠ Infinite Card (can be used to earn up to 10,000 PQP in a calendar year)

- United Quest℠ Card (can be used to earn up to 6,000 PQP in a calendar year)

- United℠ Explorer Card (can be used to earn up to 1,000 PQP in a calendar year)

- United℠ Business Card (can be used to earn up to 1,000 PQP in a calendar year)

Note: The United Gateway℠ Card does not give cardholders the option of earning PQP through spending.

Several other co-branded cards also offer cardholders the option of earning PQP through spending, but these cards are no longer open to new applicants.

Quick thoughts

There’s nothing complicated about these changes and, fortunately, nothing negative either.

United clearly wants to encourage more spending on its co-branded cards and the logical way to do so (given that the value of its miles keeps going down) is to allow cardholders to earn more elite qualifying credits through spending.

Technically, it’s now possible to earn some kind of United elite status almost entirely through credit card spending – you still have to fly a minimum of 4 segments with United to be eligible to earn elite status so you can’t qualify through credit card spending alone – but given the amount of spending needed to do so and given nature of the earning rates on United’s co-branded credit cards, this probably isn’t particularly economical.

Sure, if you have the United Club℠ Infinite Card and have the capacity to spend an incredible amount money on United flights, that may be an acceptable way to get to Gold status, but otherwise, other credit cards will almost certainly offer a better return so you should view any PQP that you can earn from United’s cards as a boost rather than as a primary path to MileagePlus elite status.

Bottom line

United has make one key change to how elite status is earned in 2024 and that change sees its co-branded cards can now play a slightly more central role in how elite status can be earned.

All of United’s co-branded cards that earn Premier Qualifying Points now do so at an enhanced rate, the cap on the number of PQP that can be earned from across the co-branded card portfolio has been lifted, the United Club℠ Infinite Card can now earn a cardholder up to 10,000 PQP per year, and any PQPs earned from credit card spending now count towards all elite status targets.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)