TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

I’ve had a number of targeted offers set to me by Citi in recent months and the last offer I used (targeted to my now closed Prestige Card) even worked for purchases outside of the US. Now Citi is back with another round of offers which, if you’ve been targeted in the past, you may well recognize.

The offer below is the one I was emailed and which has been targeted to my Citi Premier Card but I have seen similar offers sent to Citi Prestige and Citi ThankYou Preferred cardholders too.

- Use your card to earn 5 ThankYou Points per $1 spent, up to 2,500 points, through 07/31/2020 on eligible purchases like:

- Home Improvement Stores

- Home Furnishing Stores

- Computer & Electronics Stores

- Department Stores

Full terms and conditions have been reproduced at the end of this post

If you hold a Citi ThankYou card and you haven’t seen an email from Citi targeting you for this offer I suggest you sech your email accounts and spam folders for a subject line that starts with your first name and the phrase “Use Your Citi Card to Earn Bonus ThankYou® Points on Eligible Purchases“.

Thoughts

While I’ve had numerous offers targeted to my Citi cards in the past, this is the first one that has offered bonuses for spending on which most other cards don’t offer bonuses at all. That’s a very good thing. What’s less good is the fact that, under current conditions, most people are probably not doing much shopping in at least two of those four categories.

Having said that, this is still a pretty decent offer and there are actually more points available than it may appear at first glance.

If you take a look at the information I’ve posted above (which comes directly from the email I received from Citi) you could be forgiven for believing that the total number of points you can earn in this promotion (including bonus points) is 2,500.

It’s not. It’s 3,125.

The full terms and conditions (reproduced below) actually say the following:

“Bonus points awarded with this offer are subject to a maximum of 2,500 additional points”

- The Citi Premier card only earns 1 point/dollar in the categories eligible for this offer so there are 4 bonus points/dollar on offer in this promotion.

- To earn the maximum 2,500 bonus points I would have to spend $625 across the eligible spending categories.

- $625 of eligible spending will earn 1 base point/dollar = 625 points

- 2,500 bonus points + 625 base points = 3,125 points in total.

That’s not bad at all.

There are two things that make this an offer worth considering:

1. No Need To Give Up A Better Return Elsewhere

I value Citi ThankYou points at 1.5 cents each (based on how easily I can achieve that value when I use my points) so, effectively, this promotion is offering a 7.5% rebate on spending in the targeted categories.

There are no credit cards on the market that offer a better return on spending (in these categories) than what Citi is offering in this promotion so to earn all the points on offer doesn’t require anyone to give up a better return on spending elsewhere.

2. Gift Card Purchases Trigger The Bonus Points

At a time when a lot of people are social distancing and doing their best not to go out more than they have to, it’s good to know that you can bring forward some future spending from the comfort of your own home while still picking up all the bonus points on offer.

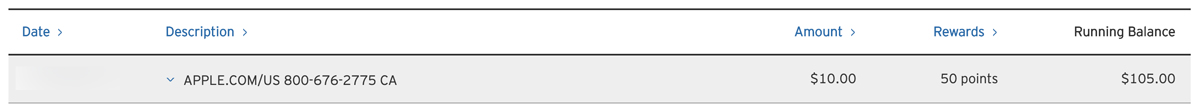

So far I’ve bought e-gift cards from Bloomingdales and Macy’s and both have triggered the bonuses that my Citi Premier Card is currently offering but, a little more surprisingly, I discovered that an iTunes e-gift card purchase made via the Apple Store triggered the 5 points/dollar on offer at “Computer and Electronics” stores.

This should make it incredibly easy for even the most agoraphobic of people to earn all the points that Citi is offering with this targeted offer.

Bottom Line

There are 2,500 very easy bonus points on offer here and I’ll be doing my best to pick up every single one…probably via gift card purchases but I may throw in a couple of home improvement store purchases too.

What offer did Citi target you for?

Terms & Conditions Per Citi:

This offer starts upon enrollment and will end on 07/31/2020. Earnings associated with this program will equal 4 bonus ThankYou® Point(s) per $1 spent on eligible purchases and may overlap with other special offers in which you are currently enrolled. Bonus points awarded with this offer are subject to a maximum of 2,500 additional points.

This offer excludes purchases made at discount stores, supercenters, warehouses, and independent contractors.

Home Improvement Stores are classified as merchants that primarily sell hardware, appliances and/or tools for home repair and remodeling. Home Furnishing Stores are classified as merchants that primarily sell furniture for homes. Computer & Electronics Stores are classified as merchants that sell, repair or lease a wide variety of electronic goods, including computer hardware, software and related equipment. Department Stores are classified as merchants that provide a general line of merchandise from departments that usually have separate checkout counters.

Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. We don’t control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, we’re provided an MCC for that purchase. We group similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category, your purchase will not qualify for additional rewards. Please also note – purchases made through mobile/wireless technology may not earn additional rewards depending on how the technology is set up to process the purchase. We reserve the exclusive right to determine which purchases qualify for additional rewards. All purchases must be made during the promotional period.

Balance transfers, cash advances, checks that access your Card Account, items returned for credit, unauthorized charges, interest and account fees, traveler’s checks, foreign currency purchases, money orders, wire transfers (and similar cash-like transactions), lottery tickets, gaming chips (and similar betting transactions), Citi Flex Loans and the creation of Citi Flex Pays, are not purchases.

ThankYou Points earned will be posted to the primary cardmember’s account in 1-2 billing cycles.

In order to qualify for this offer, the account must be open and current at all times. If your account is closed for any reason, including if you convert to another card product, you may no longer be eligible for this offer.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

No love here. We’ve got 4 citi cards.

It may be worth calling up to see if they’ll add a promotion to one of your cards – nothing to lose.