TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Firstly, I'm not accustomed to seeing adverts for the World of Hyatt credit card as I'm about to pay for a stay and secondly, this wasn't the standard welcome offer for the card.

I saw the World of Hyatt credit card being promoted on the payment page of a Hyatt booking that I was making recently and this caught my attention for a couple of reasons.

Firstly, I’m not accustomed to seeing adverts for the World of Hyatt credit card appear as I’m about to pay for a stay and secondly, this wasn’t the standard welcome offer for the card.

The World of Hyatt credit card (very briefly)

- The card comes with an annual fee of $95

- The card’s earning rates look like this:

- 4 points/dollar at Hyatt properties worldwide

- 2 points/dollar at restaurants worldwide

- 2 points/dollar on airfare booked directly with airlines

- 2 points/dollar on local transit and commuting spending

- 2 points/dollar at fitness clubs and gyms

- 1 point/dollar on all other eligible spending

- The card’s key benefits are as follows:

- Card holders are given World of Hyatt Discoverist status just for holding the card.

- Each card anniversary, card holders are given a Free Night Certificate valid at properties in Categories 1 through 4.

- Card holders get 5 elite night credits credited to their account at the start of every calendar year.

- Card holders can earn 2 elite night credits for every $5,000 of eligible spending that they put on their card.

- Card holders can earn a second free night certificate (valid at properties in Categories 1 through 4) when they put $15,000 of spending on their card in a calendar year.

Note: Terms apply to all earning rates and benefits.

The welcome offer

At the time of writing, the welcome offer that you’ll see for the World of Hyatt credit card if you visit the Chase website is this:

“Earn up to 60,000 Bonus Points – 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening and up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Points, on up to $15,000 spent.”

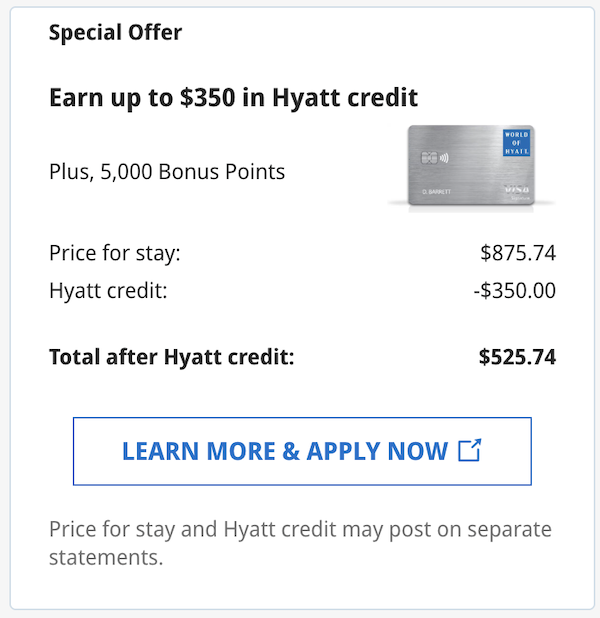

The welcome offer I saw, however, was this one:

Receive up to $350 in statement credits for purchases at Hyatt charged to your card within the first 12 months from account opening.

Plus, earn 5,000 Bonus Points after you spend $1,500 on purchases in the first 3 months from account opening.

Link to this offer (not an affiliate link)

Running the numbers

At TFM, we value World of Hyatt points at 1.4 cents each (based on the value we know we can get out of them without too much trouble) and based on this, someone in a position to max out the standard welcome offer (the one currently viewable on the Chase website) would earn points worth $840.

Meanwhile, someone making the most of the alternate welcome offer (the one which appeared as I was about to pay for my stay) would get a $350 rebate on a Hyatt stay and points worth $70 for a total return of $420.

This means that at first glance, the standard welcome offer looks like the obvious one to go for, but don’t be too hasty.

To max out the standard offer, someone would need to put $18,000 of spending on to their newly acquired World of Hyatt credit card and for most of us, that’s a lot of money.

Moreover, there’s a very good chance that to meet that high spending requirement most people would have to shift some spending across for other cards which probably would have yielded a better return than the World of Hyatt card.

That’s a cost that shouldn’t be ignored.

If I was advising someone considering the World of Hyatt credit card, I would suggest that they view the standard welcome offer in two parts.

The first part is where you get to lock in 30,000 points in exchange for $3,000 of spending and the second part is where you can earn up to 30,000 more bonus points in exchange for $15,000 of spending.

Based on the TFM valuation of Hyatt points, each part of the standard welcome offer is worth $420 and that just happens to be the value that you can get out of the alternate welcome offer.

If you’re a big spender and can easily put $18,000 on the World of Hyatt credit card then the standard welcome offer is clearly the best deal for you, but there’s an argument that says that for some people, ignoring the second part of the standard welcome offer is the way to go because that $15,000 of spending would be better spent on a more rewarding card.

If that’s the situation you find yourself in, the alternate welcome offer may be the better option for you.

Let’s not forget that with the first part of the standard offer you’ll be earning 30,000 points for which you’ll have to find a good use before you can extract some value. With the alternate offer, you get $350 of value just from spending that much with Hyatt – there’s no need to play around with points and award availability.

Sure, if you use 30,000 points carefully, you can get a lot more out them than the value I’m assigning to them, but for some people, a straightforward $350 discount on a Hyatt stay + 5,000 points will be more useful than a 30,000 point credit to their account.

Bottom line

For big Hyatt fans, the widely publicised welcome offer for the World of Hyatt credit card is the best offer currently out there (sadly, it’s not a particularly strong offer), but for some people, there’s a much less well known alternate welcome offer (which is hard to find) which may make more sense, and it’s worth keeping it this offer in mind if the World of Hyatt credit card is on your “applications to submit” list.

Interesting find! I agree that the placement is odd, and I admit that the cash-back offer is a great value prop for a mere $1500 spend, if your plan is to use this as a card of tertiary importance. Those 5K points could score you a free night worth upwards of $200-$225 at an overpriced Category 1 Hyatt.

However, for Hyatt loyalists, I think the original offer is the hands-down winner. First, we need to revisit your key spend assumption: specifically, one needs to spend only $15,000 — not $18,000 — to earn the full 60K bonus points through the original offer. That’s because the card holder “double dips” on the first $3,000 of spend, earning BOTH the 30,000 bonus points AND the first 6,000 of the second 30,000 bonus points. (The offer language does state this, though it’s not easy to parse.)

If you are (or intend to become) a Globalist, then here’s what you get via the original offer for spending that $15.000: 6 qualifying nights (2 per $5,000 spend), 12,000 base points (1x per $1 spend), 1 category 1-4 certificate (1x per $15,000 spend), AND some quantity of bonus and Hyatt points (theoretically, 0 [if none of that $12,000 earned a bonus point] through 126,000 [if all $12,000 were spent on Hyatt stays by a Globalist: 6.5 base points per $1 for the stay plus 3 bonus points per $1 for using the card].

The best-case haul would be HUGE, but let’s estimate it more realistically, some might say conservatively. Let’s assume that of the $12,000, the Globalist card holder spends $3,000 on 20 Hyatt nights (28,500 bonus points), $3,000 on the 2x bonus categories (3,000 bonus points), and $6,000 on no-bonus categories.

The resulting haul:

73,500 Hyatt points (12K base, 31.5K bonus through spend, 30K through the bonus offer)

1 category 1-4 certificate

26 elite qualifying nights (20 through stays, 6 through the $15K spend)

Let’s assign a dollar value to the haul:

Hyatt points (73,500 x 1.4/cpm): $1,029

Cat 1-4 cert: $200-$300

Six FEWER nights (6 x 150 = $900 + 20% tax) needed to reach Globalist: $1,080

TOTAL HAUL: $2,309 to $2,409

I think it would be extremely challenging for anyone to find a card that yields a return this sizeable, especially a card with a sub-$100 annual fee.

Therefore, I declare the original offer the clear winner over the cash-back offer, and also the clear winner for Hyatt elite status-chasers who can put $15,000 on a credit card in six months.

Correction: I overstated the upper bound of bonus points. It is 114,000 (12,000 x 9.5), not 126,000. I regret the error.

Correction: The cash value of the additional spend to reach the original offer is enhanced by the POSITIVE opportunity cost of staying home six more nights during the year. It’s incalculable really, when you factor in not spending on hotel/transportation/food, plus the PRICELESS gift of time. I regret the error.