TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

On the whole, I’m a fan of Chase. I’ve never really had any problems with the bank and I’m a big fan of a number of its travel-related credit cards which I’m very happy to hold. Just recently, however, I’ve had one small but annoying issue with Chase that I thought I’d share.

I’m currently “sheltering in place” in the UK so the majority of the transactions I make using my US-issued credit cards are being processed in British Pounds but, as I spend almost half my time on this side of the pond, this is something I’m more than used to dealing with and, on the whole, it hasn’t ever really caused an issue.

On 30 April I made an online purchase totaling £2,140 and, 1 hour and 19 minutes later, the same vendor issued me with a refund of £214 (this was a 10% discount that was omitted from the original order). Both transactions were made on my Chase Sapphire Reserve Card.

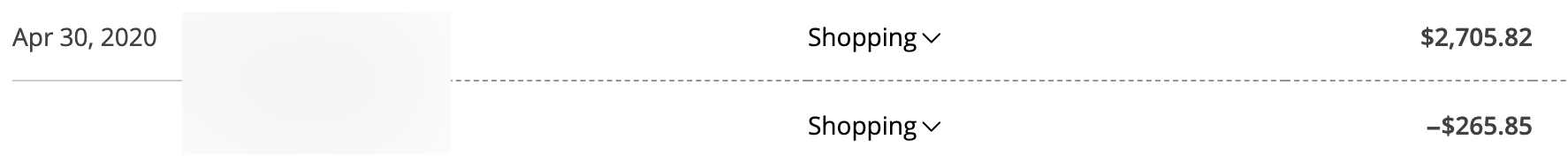

A few days later both transactions appeared in my Chase online account:

As I’m a little OCD when it comes to my credit card spending I keep a spreadsheet of all my transactions which automatically shows me the rates at which all my foreign currency spending is converted…and something stood out.

As I’m a little OCD when it comes to my credit card spending I keep a spreadsheet of all my transactions which automatically shows me the rates at which all my foreign currency spending is converted…and something stood out.

- £2,140 – converted at 1.2644 = $2,705.82

- £214 – converted at 1.2423 = $265.85

Considering these two transactions took place just 79 minutes apart, these conversion rates are surprisingly different. More importantly (to me), neither rate was in my favor – the cost was converted at a higher rate than the refund.

I’m well aware that transactions are not necessarily processed on the day they actually take place and, in this case, even though the transaction appears as a 30 April transaction online (the date I made the purchase and received the refund), further investigation shows that both transactions posted on 1 May.

If both transactions were made on the same day and if both transactions were processed on the same day and if the transactions took place just 79 minutes apart, why is there a difference in exchange rates?

I checked the official Visa Exchange rate calculator to see what rates Visa was using on the days in question and these were the results:

- 30 April – 1.248898751

- 1 May – 1.264398736

This helps…but only a little.

My larger transaction appears to have been converted at the rate on 1 May while my smaller transaction (the refund) appears to have been converted at the rate on 30 April…but how is this possible considering the smaller transaction took place over an hour after the larger one?

There are two ways to look at this:

- Both transactions took place early enough to be processed using the 30 April conversion rate, in which case I’ve been overcharged by $47.30.

- Both transactions took place too late to be processed on the 30 April so the 1 May conversion rate was used. In this case, I’m only out a highly inconsequential $4.74.

Logic would dictate that if the second transaction was made early enough to be converted at the lower rate in place on 30 April (which it was) then the first transaction should be converted at that rate too but, right now, that’s not my main issue with Chase.

My issue with Chase is that it has been entirely unhelpful ever since I asked for an explanation.

The first response I got from the bank only proved that whoever looked at my secure message hadn’t been able to grasp the simple issue at hand – I got a reply telling me that the merchant hadn’t overcharged me. They may as well have told me that the sun sets in the west!

All of Chase’s subsequent responses have essentially said the same thing – “this has nothing to do with us, call Visa and discuss it with them.”

That’s simply not good enough.

As I’ve pointed out to the bank, I don’t have a direct relationship with Visa but I do have a $495/year direct relationship with it courtesy of my Sapphire Reserve Card so, as far as I’m concerned, it’s up to Chase to deal with Visa and to give me an explanation of what’s going on.

Since when are customers expected to deal with middlemen with whom they have no direct connection? Would a retailer expect me to deal with a courier company if something they sent me was damaged in transit? Of course not.

This really, really annoys me.

If Chase had come back to me and said “we’ve looked into it and discussed the matter with Visa and discovered that, due to the difference in the size of the transactions, one took longer to process than the other and so the conversion rates are correct” (or if they came up with some other plausible explanation) I’d probably have accepted it and moved on (even though it still wouldn’t explain why both transactions show as having posted on the same date). But telling me that it’s not their problem and that it’s up to me to figure things out with their processing company is like a red rag to a bull.

All Chase had to do was to appear reasonable and to provide a bit of customer service but, now that that’s clearly not happening, I’m going to keep escalating this until someone takes ownership and gives me a proper answer. It may be a colossal waste of my time but I’m taking a little solace from the fact that I’m wasting Chase’s time too.

Has anyone else had bad or annoying experiences with Chase customer services recently?

Go for it. I have long thought that credit card exchange rate application is a way for banks to skim additional income that no one notices. Granted, mostly in very small amounts, but a million transactions with a .5 cent profit is still a half million dollars.

No, it’s 5000. And .. pounds?

This is something they do, and I’ve file a CFPB complaint in the past and they just refunded the difference as a courtesy, it’s also not a round % off either.. ie 1.2548 if they took 1% rate addon, it’s 1.2423, but add the 1% to 1.2548 it’s not 1.2643. It’s solely a scam on their end to make money.

File a complaint with CFPB

Is it due to the spread between buy and sell rates?

I’ve had, and will continue to have, multiple foreign transactions (from over 50 countries) done using all of my US credit cards (Bank of America, Capital One, Citi Card, Discover, Amex and, yup, Chase) in the past 20+ years. The primary reason that the conversion rate could be different for each transaction done in the same day is that, as far as I understood the international rules, it mostly depends on how and what decimal place the amount is converted from. As a result, one might have more than transaction in a single day and each has a different conversion rate. More often I find it to be an advantage. This past late fall, for example, I had bought opera tickets from The Bolshoi Theatre in Moscow. The average ticket price for my second transaction was less that the first. And the time difference between the two was less than an hour. Yes, it is conceivable that there are times we get overcharged a tiny bit. However, in my case, I have to consider the times when the credit cards have done me a “favor” by giving me a more favorable rate.

I used to work at JP Morgan Chase with their high net worth clients. This is explained by the fact that banks sell foreign currencies for more than what than what they buy them for. This is how banks make their profit. Given that you are purchasing things in Britain, this means Chase is selling you pounds to allow you to buy stuff. The refund, however, requires the bank to buy your pounds to convert them to dollars.

But if it’s Chase buying and selling GBP why is Visa doing the conversion and the transaction?

Could it have anything to do with the time of transaction since US banking laws require the small transactions posted first and larger transactions later? If Visa handles all transactions in bulk, it could be considerably later making the X rates different? (Not a banker nor did I sleep at a Holiday Inn last night). Just a thought.

Chase do high transactions first then small

Check your math… 1 million transactions at .05 equals 50000. Still enough extra income to make me happy

Could it be time zone in America made 79 mins go past midnight to may 1 Calculation?

Unfortunately not – the UK is ahead of the US and the transaction took place on 30 April in the middle of the day (UK time) so, according to US time, it actually took place even earlier on 30 April.

Yes I agree their customer service is robotic! To say the least. Actually a robot probably has better answers. Twice a month a family member deposits the same amount into my chase account. But since the pandemic chase has closed all lobby’s in family members area. They are not chase customers so they have to first purchase a money order then go into bank lobby and deposit into my account. However not only is the lobby closed but there are no tellers at the drive thru. So now what? Make an appointment they said. And upon trying to do so it would be 8 days before the next available appointment.

To make a deposit. They mailed me the money order and 3 days later I had my little $300 donation from my family. I’m 64 disabled and can’t drive. And on social security so to say that I really need that gift from family and could really use it is to say the least. I live alone 2500 miles away from my family. And chase has to have no thought of how badly we need a drive up teller.