TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

One of the major selling points of the World of Hyatt credit card is that cardholders can earn 2 elite night credits for every $5,000 of spending charged to their card. For big spenders, this can offer an easy pathway to World of Hyatt elite status without the need for many Hyatt stays while for the rest of us, these nights can make earning or retaining status slightly easier.

This is a benefit that I value quite highly but it’s also a benefit whose execution has recently really annoyed me.

The issue – how to track spending?

Nowhere, in a Chase online account, is there a counter showing a World of Hyatt cardholder their progress towards the next $5,000 marker which will earn them 2 elite night credits. This means that cardholders have to keep their own record of their spending if they want to keep track.

This, however, is easier said than done because …

(a) Spending towards a World of Hyatt credit card $5,000 marker can cross a calendar year (the counter doesn’t reset at the end of any set period) so cardholders have to attempt to accurately track their credit card usage from the very first transaction they make on their card. For a lot of people that means tracking years’ worth of transactions.

And …

Nowhere in the terms and conditions of the World of Hyatt credit card does it explicitly state what will and will not count towards each $5,000 marker, and nowhere is any guidance given to help cardholders understand which transactions to include and which to exclude when attempting to track their progress to the next $5,000 marker.

Common sense (and Chase customer services) tells us that all regular spending will move the $5,000 marker counter forward, that refunds/returns will set the counter back, that any cash withdrawals or balance transfers will have no effect on the counter whatsoever, and that the card’s annual fee won’t affect the counter either.

All of that should, in theory, allow cardholders who keep spreadsheets of all their transactions to track their progress to their next 2 elite night credits.

Unfortunately, what may be true in theory isn’t always true in practice.

Why tracking progress to the next $5,000 milestone can be important

In the middle of the year, it may not seem like it matters how far along you are to the next $5,000 target, but that can all change when you get to whatever World of Hyatt elite status level you’re aiming for.

Putting spend on the World of Hyatt credit card is beneficial if …

- You need World of Hyatt points (although I could argue that a number of other Chase cards would serve you better if your spending wasn’t being made directly with Hyatt).

- You’re aiming to earn a Category 1-4 Free Night certificate (awarded after $15,000 of eligible spending).

- You need elite night credits.

What this means is that after you’ve earned the Free Night Certificate and reached the highest elite night status you expect to reach, there isn’t much reason to put more spending on the World of Hyatt credit card unless you’re actively trying to earn more benefits through Hyatt’s Milestone Rewards program.

In fact, once you’ve earned the Free Night Certificate and all the elite night credits you need, it can be a very good idea to make sure that you don’t continue to spend on your World of Hyatt credit card to the point where you trigger another two elite night credits.

Those elite nights are of no real use to you and by earning them you will have just put yourself another $5,000 away from the next 2 elite night credits.

Because the (invisible) counter that calculates how far you are away from the next 2 elite night credits doesn’t reset at the end of a calendar year, the ideal play here is to stop your spending just short of the next $5,000 marker and to only restart spending on your World of Hyatt credit card in a new calendar year (elite year) when any elite night credits earned will, once again, get you a little closer to earning/retaining elite status.

This is why it’s important for a holder of the World of Hyatt credit card be able to accurately track how close (or not) they are to triggering their next 2 elite night credits.

My experience (you can probably see where this is going!)

I had credited 60 elite nights to my World of Hyatt account by the end of August and I had triggered the Category 1-4 Free Night Certificate long before that, so as I wasn’t chasing any Milestone Rewards, I had no need to put any more serious spending on my World of Hyatt from September onwards.

I keep detailed spreadsheets showing every single transaction made on each of my credit cards and I keep a separate spreadsheet which charts my progress towards each $5,000 marker on my World of Hyatt credit card.

Up until this year, this has worked well, with elite nights only appearing in my World of Hyatt account when I expected them to appear. On the face of things, my spreadsheet system was working just fine.

As I didn’t need any more elite night credits to hit my account in 2023, most of my non-bonused spending (spending that wouldn’t earn me a category bonus with any other credit card) from September onwards was going on my favorite no annual fee card (the Blue Business® Plus Credit Card from American Express), but because I was keen to get reasonably close to the next $5,000 marker while I was spending in categories that weren’t particularly lucrative, I continued to put a little bit of spending on my World of Hyatt card.

I stopped spending on the World of Hyatt card when my spreadsheet told me I was ~$130 short of the next $5,000 marker and I put my card away in my bedside drawer ready to be brought back into action in 2024.

Then, in late November, shortly after my World of Hyatt statement closed, I saw something entirely unwelcome in my World of Hyatt account.

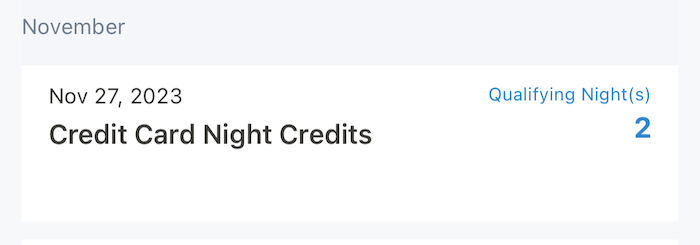

And when I checked my elite night counter, this is what I saw:

Somehow I had earned two elite night credits that I was not expecting. I was not impressed! 🙂

Chase and Hyatt need to deal with this

Since my unexpected 2 elite night credits appeared, I have checked through my Hyatt spending spreadsheet (which goes back to 2020) and I haven’t been able find anything that may be out of place or that could have led to me underestimate how close I was to triggering the next 2 elite night credits.

What’s more annoying, however, is that when I called up Chase customer services to get some clarity, not only could they not tell me what spending had led me to cross the $5,000 marker, but they also couldn’t tell me what my current status was.

Assuming I wasn’t given the wrong information (this was information provided by two separate agents), it would appear that Chase has no way of allowing cardholders to find out what their elite night credit spending looks like, and that strikes me as being more than a little ridiculous.

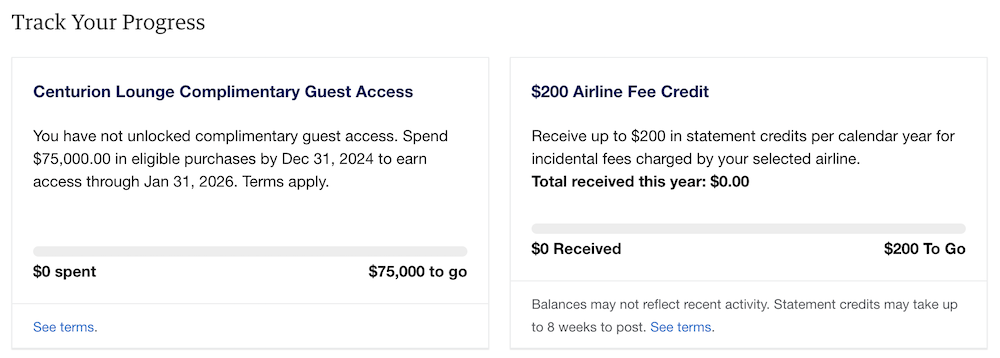

Amex manages to provide cardholders with trackers showing the spending they have made relating to various benefits that their cards offer, so I don’t understand why Chase cannot do the same.

Perhaps it’s just me (please tell me if it is), but if I was designing a product that required people to hit certain targets in order to earn specific benefits, one of the very first things that I would expect to have to provide users of that product would be a way for them to track their progress towards those targets. That just seems obvious … but apparently not to Chase.

A final note

Yes, I get it. In the grand scheme of things this is hardly a major issue. It’s actually a miniscule and highly unimportant issue when compared to what’s going on in the world around us, so I can already hear the clicking of keyboard warrior keyboards as they get ready to spew out bile over an article they’ll claim is a complaint over nothing.

In the grand scheme of things, however, no issue relating to the miles and points world is a major one or even an important one so can we move on from that please? If not, we may as well all stop discussing credit cards, miles, and points right now and focus on something else.

Bottom line (a note to Chase/Hyatt)

Dear Chase/Hyatt, please can you give holders of the World of Hyatt credit card a way of tracking their progress towards the benefits their credit cards offer because the inability to track that progress can be very, very frustrating.

Amex already does this and as you both make incredible amounts of money out of us, this doesn’t seem like too much to ask.

Thanks!

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)

Theres a spending tracker on the Chase website that can be accessed for YTD spend. Are you not able to find it?

I can see YTD spend but because the elite night spending counter doesn’t reset at the start of the year, YTD number doesn’t really help.

1- there is carry-over from year to year eg you spent 14,900 the 1st year you had the CC by 12/31, then when you spend another 100 the next year you get 2 night credits, Ive found it hard to nail down the exact amount that is carried over

2- when you log onto your Chase acct theres a button ‘More” click that then ‘Spending Report’ and it shows the total you have spent that year, But if you dont know the amount that fell below the 5,000 mark the previous year and isnt apart of that # So eg Jan 24 I spend 14,900 and may or may not get 6 nights depending if I had at least 100 carry-over from my ’23 spending

personally Ive yet not to end a year in a round # 60-70-80 etc by doing the above, and dont see Chase doing anything to help us out

Same … I had 62 nights at the end of December (it was 60 at the end of November). Wish there was a way to avoid that, so frustrating

I’m reading Isaac’s comment, and I think the spreadsheet is overkill, given the Spending Report function. I opened my card last year and had X spending. So $15,000 – X = Y, where Y is the spend I need to hit my next set of two nights (and finish the 60K bonus earning).

Should be easy to keep track of it at all times through the spending reports and a little extra simple math.

That said, it is completely true that Chase could throw up a simple progress tracker, just the way Hyatt has a nights tracker. What’s so hard about that?

No argument with anything in the article, but IMHO you simply cut it too close at the end of the year for your next $5000. I had one of those frustrating 62 night years long ago. After that I kept closer records and changed my statement ending date closer to the end of the month so I ‘d have less chance of going over, but enough time for a mattress run if short. I was also lucky enough one month early in the year to be only a few dollars short of $5000 and I got no nights, so it was obvious I had close to zero carry over that month. Now I aim for about 57 or 58 nights before my mid December statement and if short we head off to a nearby Hyatt.