TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

At the beginning of May, American Express confirmed that holders of its Platinum Card would be given two new ways to earn monthly statement credits as the card issuer looked for ways to help cardholders get value out a card whose primary benefits all center around travel. For most people, this was very good news. For me, it presented a challenge.

Between May and December 2020, holders of the Platinum Card from American Express will receive a statement credit of up to $20/month for spending on select U.S. streaming services and a statement credit of up to $20/month for spending made directly with U.S. wireless telephone service providers.

On the face of things, there doesn’t appear to be anything particularly challenging about making the most of those new statement credits, but there are a few things that I should point out:

- I’m seeing out the current pandemic outside of the United States (these credits are for US services only)

- I pay for my streaming services annually and I have no need for a new streaming service.

- Because I split my time between the US and the UK, I choose to use a UK wireless provider for my primary phone as it’s a considerably cheaper (and better) option than anything available in the US.

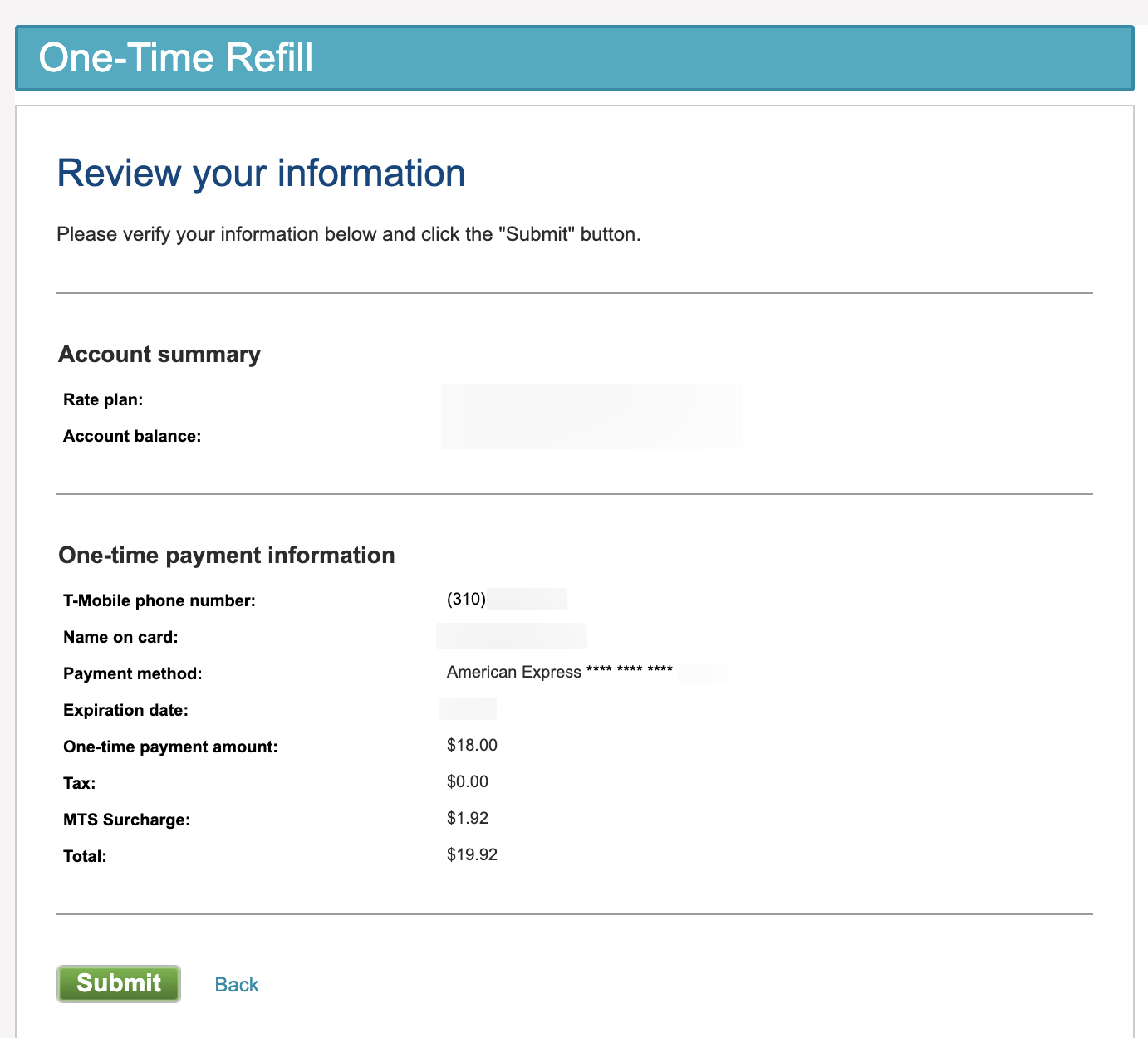

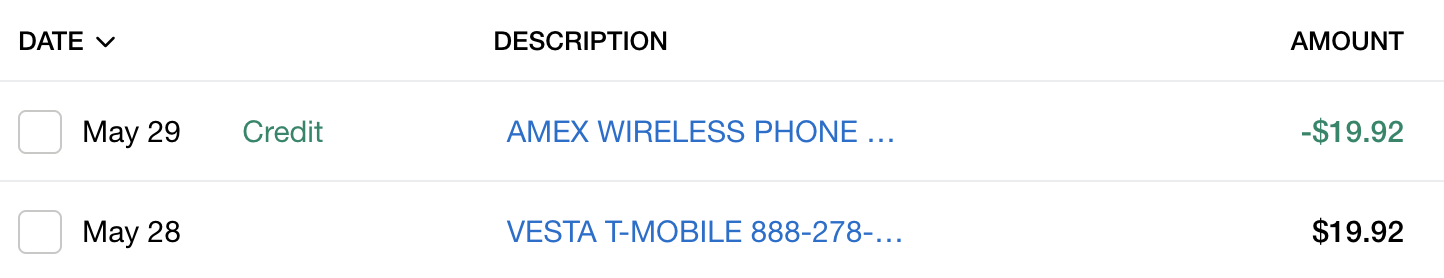

Using up the US wireless statement credit was looking tricky until I remembered that I have a T-Mobile pay-as-you-go phone that I keep for foreign guests visiting me in the US (most people I know don’t have international roaming included in their phone plans). It’s easy to top up a pay-as-you-go phone via the T-Mobile website and, in the state of California, an $18 refill costs a total of $19.92 once tax is added on:

More importantly, a T-Mobile refill triggers the Platinum Card’s wireless statement credit:

This isn’t the most economical use of the statement credit as the phone I keep for guests doesn’t cost very much to run and it’s going to have a very large credit on it come December…but it’s better than letting the statement credit go to waste.

I was very tempted to take out a subscription to the new HBO Max streaming service to use up $14.99 of the $20 monthly streaming credit but two things stopped me. Firstly, I don’t need HBO Max (so the statement credit wouldn’t be a real saving) and secondly, I wanted to find a way to use up the full $20 (I like to get my money’s worth!)

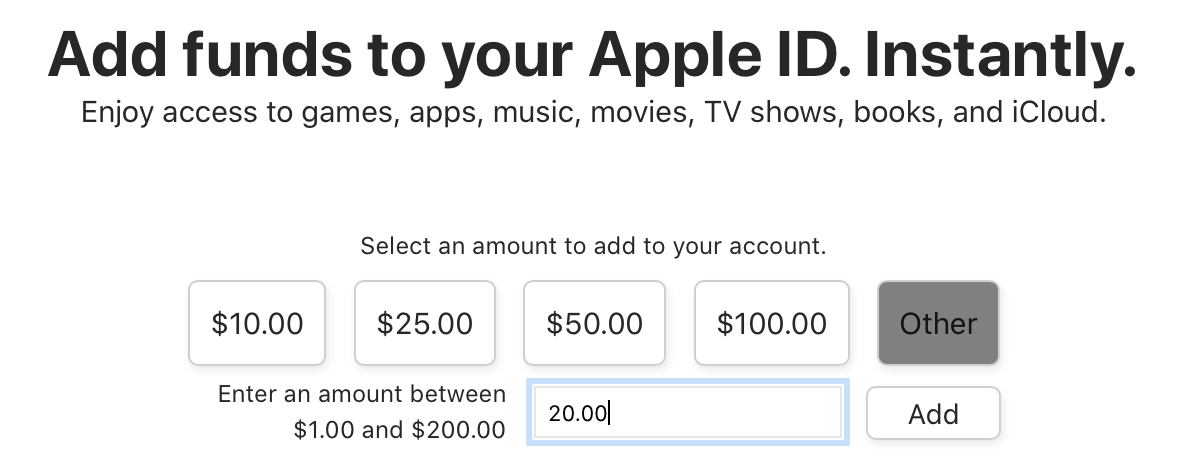

I considered making a few purchases through iTunes to use up the credit until I remembered that iTunes isn’t a streaming service (this fact hasn’t passed Amex by) so I was struggling for a solution until an idea occurred to me – perhaps Amex can’t really tell the difference between some of the different purchases you can make through Apple? Can Amex really differentiate between an outright purchase of Apple TV+/Apple Music and a top-up of an account that could be used to fund those services? I decided to find out.

I logged in to my Apple account and chose to add $20 to an ID that’s associated with the Cloud storage I buy from Apple:

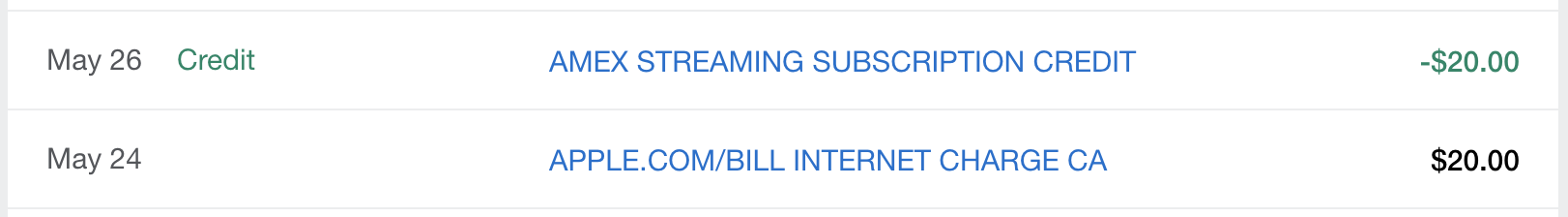

Two days later the transaction cleared my Platinum Card account and two days after that the statement credit triggered:

It would appear that Amex cannot tell the difference between an Apple streaming purchase and a top-up of an Apple account.

This a nice “win” for me as the $20/month rebate that I’ll be receiving each time I top up this Apple ID represents a genuine saving rather than being a rebate for a purchase I made purely to use up the statement credit. All I have to do now is set a note in my calendar to remind me to trigger the credit every month.

Bottom Line

When I first saw what new temporary statement credits the Platinum Card is offering I wondered if I’d be able to get any value out of them while I was away from the US. I had my doubts, but luckily for me things appear to have worked out. These credits should help me recoup ~$320 of the Platinum Card’s $550 annual fee by December, and that’s an outcome I wasn’t expecting a little over a month ago.

How are you using your Platinum Card statement credits?

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

Click on the charge. It will show you details. You can then click on the receipt link, which shows your loaded funds onto an account. Beware the claw back….

$440000

You should consider using a vpn and connect to a US server. Always make sure you are logged into the US before connecting to a US website or application. That is how you can maximize Amazon Prime, Netflix, Hulu, and other restricted sites that say you must be in the US. Prior to leaving the US, also create a Google phone number so people can call you abroad but not pay international fees. Works the other way around too. It is a voip number.