TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Hotels.com is a site that I frequently suggest most people should be using a lot more and in combination with Wells Fargo, it has just unveiled its first co-branded credit card – the Hotels.com Rewards Visa Card. With no annual fee, no foreign transaction fees, and a useful first-year benefit this is a card that may have its uses.

Note: At the time of writing TFM doesn’t have any referral links for the Hotels.com Rewards Visa Card so all the credit card links lead directly to the card’s application page.

The Hotels.com Rewards Visa Card

Annual Fee:

- $0 (zero)

Welcome Offer:

- Earn a reward night worth $125 after spending $1,000 in the first 3 months of card membership (excludes taxes and fees).

Earnings:

- Earn a stamp towards a future free hotel night for every $500 spent on the card (10 stamps = a free night) which Hotels.com will value at $110.

Key Benefits:

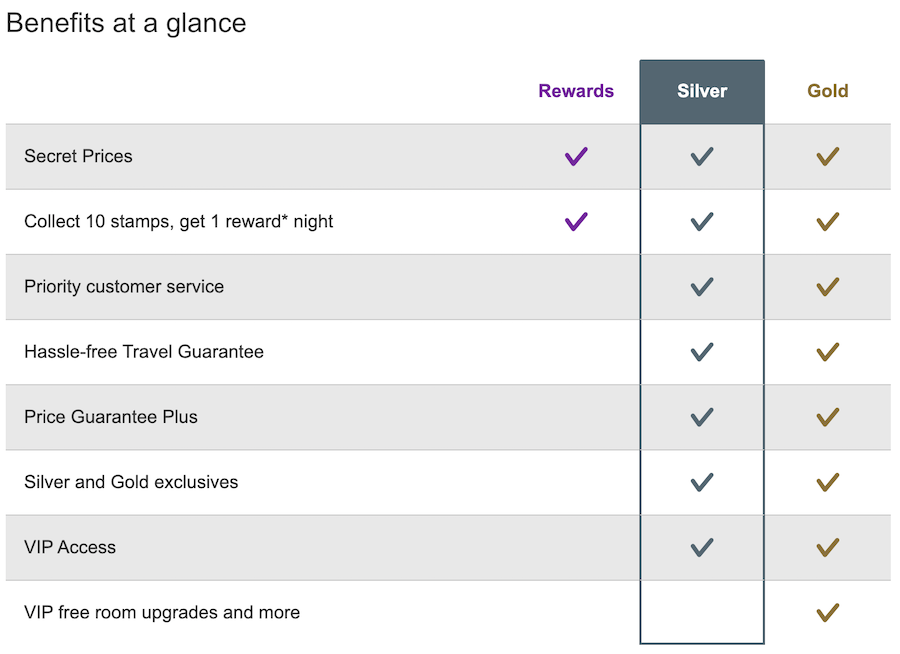

- Receive Hotels.com Silver Membership in the first year of card membership

- Cell phone protection

- No foreign transactions fees

Thoughts

Overall, this is a pretty basic credit card and if you’re a miles and points junkie you’re probably not going to be wowed by it…but that doesn’t mean that the card doesn’t have its merits.

The Return

With Hotels.com valuing the stamps earned by its new credit card at $110 each, cardholders are effectively being offered a room worth $110 (taxes and fees would have to be paid on top) for every $5,000 spent on the card. That’s a return of 2.2%. Hardly spectacular but also not terrible…especially as the card doesn’t charge an annual fee. If you’re a fan of Hotels.com Rewards this could be a good card to use for any spending in categories where most other credit cards don’t offer a bonus (e.g. at big box stores and department stores).

The Cell Phone Cover

The cell phone cover that the Hotels.com Rewards Visa Card offers is pretty impressive considering it’s effectively free (you simply have to charge your phone’s monthly bill to the credit card). The card covers a cardholder for damage or theft of a cell phone with reimbursement limited to the repair or replacement of the original cell phone, less a $25 deductible.

There’s a maximum benefit limit of $600 per claim and $1,200 per 12-month period and it should be noted that the benefit does not cover cell phones that are lost (i.e., disappear without explanation).

Year 1 Value

Having said all of the above, it’s hard to get away from the fact that this is a credit card that is clearly most valuable in year 1 and less so in subsequent years.

In year 1 a cardholder can earn the welcome offer (a night worth $125) and, in earning that offer, the cardholder will also pick up two stamps towards another free night. The cardholder will also have Hotels.com Rewards Silver status (this normally requires a customer to book 10 nights or more during a membership year) which offers, amongst other things, complimentary breakfast, airport transfers, and spa vouchers at select properties.

Not everyone will need spa vouchers or airport transfers, but breakfast is something that most people need on a daily basis and it’s also something that can be incredibly expensive in hotels. Complimentary breakfast (at select properties) is a very valuable benefit to be given by a credit card that doesn’t charge an annual fee.

Bottom Line

Hotels.com has just rolled out the Hotels.com Rewards Visa credit card and in the first year of card membership, it can offer very good value. How much value the card offers in subsequent years will depend on how it’s used and different people will have different outlooks. Some will say that it’s worth keeping for the cell phone cover alone while others will point to the fact that there are other no-annual-fee hotel credit cards that offer better all-around packages and there are cash back cards that offer a better return on everyday spending.

For someone immersed in the Hotels.com rewards program, I can see how this card may be attractive in year 1 but I’m not convinced that it’s a card worth keeping from year 2 onwards.

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-218x150.jpg)

![The ideal 4 card American Express Membership Rewards team [Updated] a glass door with a picture of a man](https://travelingformiles.com/wp-content/uploads/2021/06/Amex-Centurion-Lounge-SFO-featured-741-356x220.jpg)

The VIP bonuses can be something nice (I’ve seen bottles of wine, true resort credit, etc.), but it’s much more often either not known/unstated (stories of people asking at the front desk and they have no idea where and there is no indication on Expedia of what it is) or something basically meaningless like 20% off the ridiculously overpriced spa.

I’ve probably looked at 100+ VIP Access hotels and never saw them advertise a free breakfast as a perk. Any examples?

To clarify the above – I never saw a free breakfast as a VIP perk that a non-VIP booking through Expedia/Hotels.com (same program, same VIP hotels, same perks) wouldn’t receive, as obviously many hotels either offer it to all or through a special breakfast included rate.

I’m with Ben on this one. I’ve (accidentally) been a Hotels.com Gold member for ~2-3 years now, mostly from booking many rooms for youth/school trips. I think the most I’ve ever been offered as an extra for my “gold status” by an hotel was a room temperature bottle of Bud Light and small pack of chips. I don’t think I’ve ever seen breakfast, spa treatments or airport transfers offered as a perk anywhere, at least where it wasn’t also available to every other customer for free.

I’d be happy to learn I’m doing it all wrong, though.