TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Both the Platinum Card from American Express and the American Express Gold Card offer cardholders Uber/Uber Eats credits that can be used within the United States and up until now, these credits have been easy to use and haven’t required much thought. From November, that’s no longer going to be the case.

The situation now

Since Amex first introduced Uber credits to the Platinum consumer card and the consumer Gold card, the only thing that a cardholder had to do was to make sure that they had an Uber account and that the Amex card that offers them the Uber credit is added to their Uber wallet.

Historically, there has been no need for a cardholder to use their Amex card to pay for any Uber rides or Uber Eats orders just to be able to use their credit, and that has freed up cardholders to use other, possibly more rewarding, cards to pay for any part of their ride or food order that wasn’t covered by the credit.

For people with cards like the Chase Sapphire Reserve Card, this was good news as they have been able to enjoy their Amex credit while earning 3 points/dollar on any spending over and above what the credit paid off, and they haven’t had to think about what card they were using when paying for trips and takeout orders – the Amex credit kicked in automatically and the Reserve card paid for everything else.

Going forward, that’s not going to be the case.

What’s changing

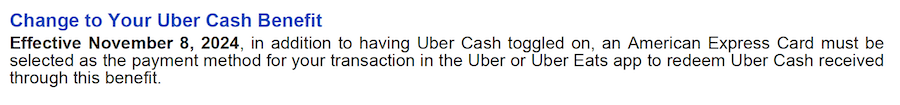

As of 8 November 2024, Amex is changing how things work so from that date a cardholder will not only have to have their Platinum Card of Gold card within their Uber wallet, but they’ll also have to have an American Express card set as the payment method if they want to use their Amex credit.

News to this effect is appearing on statements generated this month:

Taken at face value (i.e. unless there something else going on that hasn’t yet been made clear), this isn’t the end of the world, and this can’t really be called a devaluation … but it’s going to be a little irritating for some of us.

The Amex wording doesn’t say that you have to have the card that earns the statement credits set as the payment method, but some kind of Amex card will have to be in place.

What this means is that those of us who like to maximize our earnings will no longer be able to have just one card set to pay whatever we order through the Uber app.

We’ll have to have an Amex card set as the primary payment method when we want to use the Amex credit, and we’ll then need to remember to switch the payment method to a more rewarding card when the credit is used up and we still have a few weeks to go before the next credit hits our accounts.

To be fair, some people may already have to do this (e.g. people who want to earn 4 Amex points/dollar from their Gold Card when using Uber Eats and who want to earn 3 Ultimate Rewards Points/dollar from their Sapphire Reserve Card when they book an Uber Ride), but for those of us who have been happy just using one card to pay for all the spending we make through the Uber app, a little more thought will be required going forward.

Final thoughts

To be honest, I’m a little more annoyed about this change than I probably should be, and that’s down to the fact that this feels like yet another hoop that Amex is making me jump through to make the most of the benefits that my Amex cards give me.

It has been annoying enough watching Amex slowly altering the benefits offered by the Platinum Card, the Gold Card, the Marriott Bonvoy Brilliant Card and the Hilton Honors Aspire Card in such a way so as to make them a little harder to earn/use and to encourage more breakage, and now with this latest change added in to the mix (which is clearly designed to encourage more breakage), I’m starting to wonder if Amex will ever let up.

Overall and putting my own irritation to one side, if there’s nothing more to this change than Amex requiring us to use an American Express card when we want to use the Uber credits our cards give us, this news isn’t too bad.

If there’s another shoe to drop, however (i.e. if the Uber benefit is going to change in other ways that we don’t yet know about), there could be more to this story, so we’ll have to wait and see what happens when 8 November rolls around.

What do you think of this change? Does it annoy you or could you not care less?

So Amex wants to make sure since they are giving you a credit that you use their card to pay. Big deal. I hate the scam artists, max spend crooks and others that live to wring every possible point out of the system. I get plenty of points and largely go with a card that provides the best benefit but I see nothing wrong with Amex wanting their card to be used to get their credit.

BTW I only have my Amex Platinum and Gold cards tied to my Uber account w the Gold card primary so I’m good. Also anything that annoys bloggers and other scam artists is a good thing!

It doesn’t sound like you know what a ‘scam artist’ or a ‘crook’ actually is.

I look back with joy on the day I canceled my AMEX Platinum earlier this year after being a cardholder for more than a decade. Good riddance.