TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

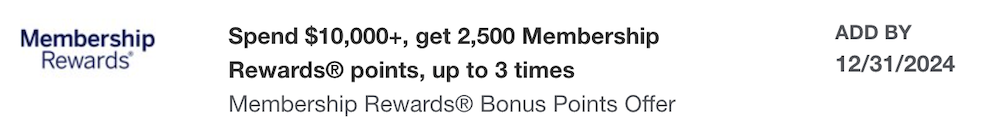

American Express has launched a new targeted spending bonus offer for holders of its business cards and while I can only see one version of this offer in my online account, past experiences tell us that there will almost certainly be other versions of this offer going around.

My targeted offer

Headline details

Get 2,500 additional Membership Rewards® points by using your enrolled eligible Business Card to spend a minimum of $10,000+ in one or more qualifying purchases. Once you add the offer to your eligible card, you will have 90 days to spend $10,000+ or more.

Key terms

- Enrollment limited.

- Must first add offer to Card and then use same Card to redeem.

- Once you save the offer to your eligible Card, you will have 90 days to redeem.

- American Express Corporate Cards, Prepaid card products and Cards issued outside the United States are not eligible.

- Limit 1 enrolled Card per Card Member across all American Express offer channels.

- Your enrollment of an eligible American Express Card for this offer extends only to that Card.

- Your enrollment does not extend to any other Cards that may be linked to the same Membership Rewards program account (such as Additional Cards).

- A “qualifying purchase” means a purchase made with your enrolled Card within 90 days upon saving the offer to your Card in accordance with these terms.

- Each time you make one or more qualifying purchases totaling at least $10,000+, you will receive 2,500 additional Membership Rewards® points, up to 3 times.

- Valid only on purchases made in US dollars.

- Cash advances, other fees and charges such as interest, annual fees and foreign currency conversion fees are not eligible transactions and do not qualify for this offer.

- Additional points will be credited to your Membership Rewards program account within 90 days after the offer end date, provided that American Express receives information from the merchant about your qualifying purchase.

- Limit 1 enrolled Card per American Express Card online account.

Full terms and conditions can be found alongside your targeted offer.

Quick thoughts

The first thing to note is that as we’ve seen in the past, this offer doesn’t have to be added to a targeted card any time soon. The end date for this offer is 31 December 2024, so as a targeted cardholder will only have 90 days from the day they add the offer to their card to earn the bonus points, the best move here is for cardholders to only add the offer to their targeted card once they know they’ll be able to hit the spending target in the following 90 days.

The second thing to note is that it’s not exactly a very generous offer.

I value Membership Rewards Points at 1.5 cents each (based on the value that I know that I can get out of them with relative ease) so effectively, Amex is offering me an added incentive worth just $37.50 to put $10,000 of spending on card_name (up to 3 times).

Considering that this is a card that I use almost exclusively for unbonused spending only, that’s a very high spending target for me to hit and one that I’m unlikely to reach.

I love using card_name for spending in categories where my other cards don’t offer me a bonus because it gives me 2 points/dollar on up to $50,000 of spending per year (1 point/dollar thereafter – terms apply), but the added points this targeted promotion is offering me are not enough to tempt me into using this card any more than I already do.

Variations on this offer are probably available

We have seen Amex publish similar offers to this one in the past, and as the nature of those offers varied significantly, it’s reasonable to assume that the same will be the case this time around.

These are the kinds of offers we’ve seen in prior years:

- Spend $1,500+, get 1,000 Membership Reward points, up to 3 times

- Spend $2,000+, 1,000 Membership Reward points, up to 3 times

- Spend $6,000+, get 3,000 Membership Reward points, up to 3 times

- Spend $8,000+, get 2,000 Membership Reward points, up to 3 times

- Spend $9,500+, get 5,000 Membership Reward points, up to 3 times

Essentially, all of these are offers that should be viewed as nice bonuses if you can hit the target with organic spending (i.e you don’t go out of your way to earn the bonus), and offers that are best ignored if your spending levels on your targeted card would not otherwise be as high as the offer requires – the payoffs are (mostly) not high enough to warrant diverting spending from cards that will earn a better rate of return.

Bottom line

American Express is targeting holders of select business cards for offers that would see them earn bonus points for hitting preset spending targets within 90-days of loading the offer to their targeted card.

Based on the offer that I’ve been targeted for, it’s likely that most of the offers being published will not be lucrative enough to justify putting additional spending on cards that wouldn’t otherwise have seen that spending, but if you’re in the fortunate position of being able to earn the bonus with organic spending alone, the extra points will probably be very welcome.

Have you been targeted for an offer like this? If yes, let us know which of your cards has been targeted and what your offer is in the comments.

Featured image courtesy of American Express

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)

![Save at select Mandarin Oriental properties in the US, Europe, and Asia [Targeted] a pool with palm trees and a city in the background](https://travelingformiles.com/wp-content/uploads/2021/02/mandarin-oriental-miami-741-218x150.jpg)

![Save $200 on spending at select Hilton all-inclusive resorts [Targeted] a resort with a pool and palm trees](https://travelingformiles.com/wp-content/uploads/2024/06/Hilton-La-Romana-all-inclusive-resort-741-218x150.jpg)

![Save $100 at Hyatt Unbound Collection properties around the world [Targeted] a pool in a resort](https://travelingformiles.com/wp-content/uploads/2022/09/hyatt-la-zambra-sapin-741-1-218x150.jpg)

![Save up to 40% on select Marriott stays with this Amex offer [Targeted] a sign on a wall](https://travelingformiles.com/wp-content/uploads/2024/01/marriott-bonvoy-741-1-218x150.jpg)