TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

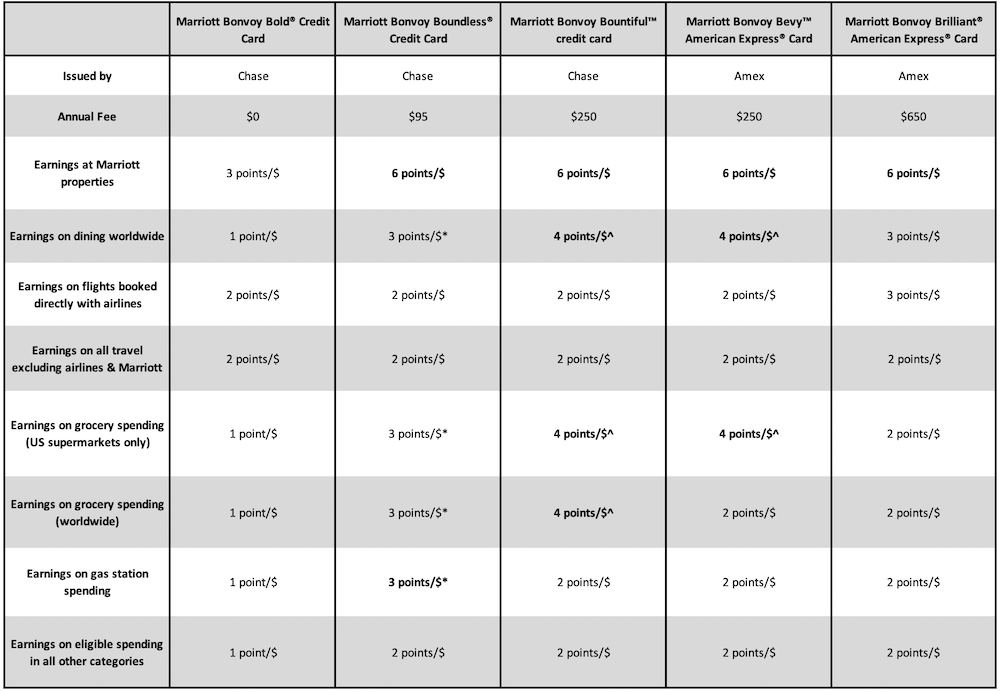

Since Amex and Chase both launched new mid-tier Marriott Bonvoy credit cards back in 2022, the number of Bonvoy consumer cards open to new applicants has stood at five. This article compares the annual fees, the earning rates, and the key benefits that these five cards offer in what is an easily digestible format to make it easier to see which Bonvoy card will work best for you.

The five Marriott Bonvoy consumer credit cards

There are now 5 Marriott Bonvoy consumer credit cards that are open to new applicants with Chase issuing three and American Express issuing two:

- Marriott Bonvoy Bold® credit card

- Marriott Bonvoy Boundless® credit card

- Marriott Bonvoy Bountiful™ credit card

- Marriott Bonvoy Bevy™ American Express® Card

- Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card was refreshed on the same day that the Bountiful and Bevy cards were released and all the details you’ll find below take this into account.

A note before we continue

We’ve chosen to use tables to show what the various Marriott Bonvoy consumer credit cards offer and because we think the information speaks for itself, we don’t intend to add a lot of commentary about specific differences between cards.

This article is intended more as a resource (with a few of my thoughts added in) rather than a blow-by-blow discussion of what we think is good and bad about each of the Bonvoy consumer cards.

We’ve made no secret of the fact that we don’t like the two most recently issued Bonvoy cards (see here and here) and while that’s almost certainly going to come up again, we don’t intend to go over old ground.

Ok, let’s move on to the comparisons …

Comparing earning rates (terms apply)

*The Marriott Bonvoy Boundless® Credit Card earns 3 points/$ on up to $6,000 of combined spending per year in these categories (1 point/$ thereafter).

^Marriott Bonvoy Boundless® Credit Card & the Marriott Bonvoy Bevy™ American Express® Card earn 4 points/$ on up to $15,000 of combined spending per year in these categories (1 point/$ thereafter).

There are four key things that we’d like to highlight here:

- You should be able to see that you don’t have to pay more than $95/year to earn the maximum number of Bonvoy points/dollar that any consumer card offers for spending made with Marriott.

- Make sure you take notice of the fact that the Boundless, Bevy, and Bountiful cards all put caps on the spending that will earn bonus points in select categories. Also, keep in mind that these caps refer to combined spending across the relevant spending categories.

- Take note of the fact that although the Amex-issued Bonvoy Bevy card offers bonus points for spending on supermarket spending, those bonus points will only be paid out on spending made in US supermarkets. Spending in supermarkets outside the US and grocery spending made at smaller establishments in the US will only earn 2 points/dollar.

- To get a true view of how good or bad these earning rates are, don’t just look at the number in isolation. Work out how much value the earning rates are offering you and go from there.

To expand on that final point…

We value Bonvoy points at 0.6 cents each (based on the value that we know we can get out of them with ease) and that means that where one of these Bonvoy cards offers us 4 points/dollar for spending in a given category, we know that for us, that’s an effective return of 2.4% on our spending.

This helps put things in context as while a headline earning rate of 4 points/dollar can look impressive, the fact that it only equates to a 2.4% return shows that it’s actually not very good at all and that we would probably do better by using one of our other credit cards when spending in that category.

Comparing key benefits (terms apply & enrollment may be required)

Deciding what is and what isn’t a key benefit is, by definition, a subjective thing, so not all benefits have been listed here.

Having said that, the benefits that have been included should be more than enough to help you see just what a cardholder is being offered in return for the annual fee.

~Valid only on select rates and a minimum 2-night stay is required.

*Limitations apply per Marriott Bonvoy member account.

The benefits (or lack thereof) mostly speak for themselves so we’ll keep our comments in this section brief.

- Make sure you check what each of the Marriott elite status tiers offers in terms of benefits before allowing yourself to be swayed towards one card or another by the elite statuses on offer.

- Make sure you consider the real value (to you) of any bonus points on offer before deciding which of the cards (if any) is for you. E.g. Because we value Bonvoy points at 0.6 cents each, the bonus points that the Bevy and Bountiful cards offer on each stay are worth just $6 to us – that’s hardly a game changer!

- Make sure you consider how often you will be making the most of each of the benefits on offer and how much value each will genuinely give you before you choose a card. Some benefits can look very tempting but they’re only worth something if you’re actually going to use them.

While there aren’t many significant differences between the earning rates that the Bonvoy consumer cards offer, the differences between the benefits they offer are considerably more noticeable (unless you’re comparing the two $250/year cards).

That makes it all the more important to make sure that you consider exactly what each card is offering in return for its annual fee.

Our (very brief) thoughts on the cards

We’re on the record as saying that we don’t like the two newer mid-tier cards as we can’t see where the value is, and we genuinely have no idea what Marriott was thinking when it came up with these cards.

We’ve always thought that the best way to choose a Bonvoy card is to ignore any of the earning rates that don’t apply to Marriott spending (because a variety of other cards that you probably already hold will offer better value) and to focus on the annual fee and the benefits on offer.

When we do that, the two newer cards don’t make any sense to us.

We can see how the Bold, Boundless, and Brilliant cards may fit into different people’s wallets, but with the exception of someone who has no interest in anything other than earning Bonvoy points on all their spending, we cannot see how the Bevy and Bountiful cards would be a good addition to someone’s wallet.

Bottom line

Hopefully, the tables above will provide you with a useful resource when it comes to deciding which Bonvoy card is best for you or if you should bother having a Bonvoy card at all.

If there’s anything that you think we’ve missed or something that you’d like us to add in or discuss, let us know in the comments section below and we’ll see what I can do.

Great comparison! Thanks for your hard work on this!

You’re welcome – I hope it helps!

Very nice – I appreciate you putting this together. In my case I have the Bonvoy Brilliant card and also the Amex Brilliant one. Previously I could justify $450 for the Brilliant with the Marriott credit and free night. I still can value the credit for dining at $300 but have a hard time justifying an additional $350 for an 85,000 night certificate. Even though I know I could stay at a property with a cost of over $350 (a) it is one night and I would have to pay or cash a lot of points for additional nights and (b) I frankly would more likely just stay at a lower tier property so this isn’t something I am really losing out on. Also, lifetime Titanium so the Platinum status that comes with this is of no value to me and I get the other benefits (Priority Pass, Precheck, etc) with other cards (have Amex Platinum and CSR). I likely will downgrade or cancel this card before my next annual fee and just use the Bonvoy Boundless card from Chase for Marriott stays.

Marriott (and Amex) priced me (and I’m sure many in the same situation as me) out of this card. They would have gotten my $450 annual fee since that I could justify with no problem (50K night for $150 works well) but now they get no AF or usage from me – nice move guys!

It sounds like you in a similar position to the one I found myself in (although I downgraded to the no-fee Amex card before the refresh). The move away from the annual hotel credit to a monthly dining credit was the trigger for me and I have no regrets (even after the refresh).

You mention that you have the CSR in your wallet so keep in mind that unless you’re actively looking to earn Bonvoy points, this is a card that could earn you a better effective rebate at Marriott properties than any of the Bonvoy cards. Naturally, this will depend on the values you ascribe to Bonvoy points and UR points but by my valuations, 3 UR points = 4.5% and 6 MB points = 3.6%.