TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

It was a nice surprise when back in July, Citi suddenly announced that its ThankYou Points would be transferable to the American Airlines AAdvantage program for a limited time and as no other bank’s transferable currency has a partnership with AAdvantage, this has been a very useful transfer option to have for the past few months. Sadly, with no signs that Citi will extend this offer, ThankYou cardholders have just three days left to make the most of this opportunity.

The transfer options

Through 13 November 2021 (this Saturday), Citi ThankYou Points earned by the Citi Prestige Card and the Citi Premier Card are transferable over to AAdvantage in a 1:1 ratio. The points earned by all other Citi ThankYou cards can be transferred over to AAdvantage in a 2:1 ratio.

This last fact is a nice little bonus as points earned by other Citi ThankYou cards can’t usually be transferred to any of the ThankYou program’s travel transfer partners unless they’re pooled with points earned by one of the two fee-bearing ThankYou cards.

How to transfer points to AAdvantage

When you head over to the ThankYou Program from your Citi online account it may not be immediately obvious where the option to transfer points is to be found. The key is to click on the “see all ways to redeem” link that you should find a little below the sentence that shows your points balance on the ThankYou program’s homepage…

…and then you’ll need to click the link for “transfer and share” that should appear on the page.

From there, simply follow the instructions that appear on the screen and you should find that the AAdvantage program is the first transfer option that you’re presented with.

How long do transfers take?

For the purposes of this post, I transferred 1,000 points across to the AAdvantage program a couple of days ago just to see what the current transfer time was like and the points appeared in my account somewhere between 18 and 24 hours after I initiated the transfer.

Should you transfer points?

There are a few ways to approach this question.

Ordinarily, no one should ever be transferring a flexible currency like ThankYou points to an inflexible currency like AAdvantage Miles unless they have an immediate use for them because doing so opens you up to the risk of a devaluation.

In this case, however, that rule doesn’t necessarily apply as (a) we may not be given another opportunity to transfer ThankYou points to American Airlines (so this isn’t a regular transfer opportunity) and (b) it looks like AAdvantage probably won’t be devaluing its currency for at least a few more months so the risk of walking into a devaluation is lower than normal (if AAdvantage was going to devalue its award charts in the short term it would have done so when it reinvented how elite status is earned a few weeks ago).

I think the best advice that I can give is this:

If you think that you will be able to use any AAdvantage Miles that you generate in the next few months and you genuinely don’t have any other plans for whatever ThankYou points you convert, a transfer is probably ok.

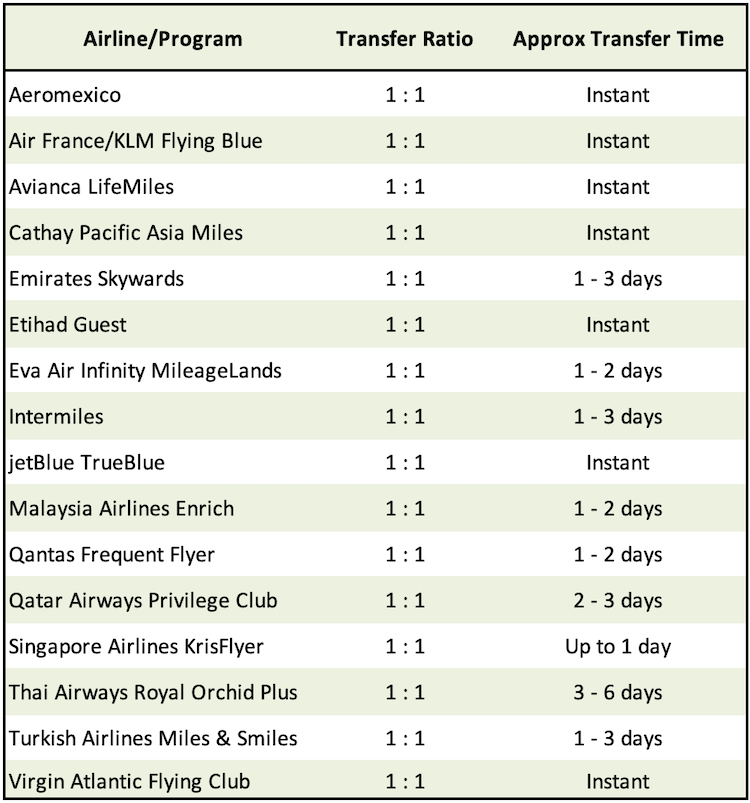

Having said that, no one should be initiating any transfers without thinking things through or without taking a good look at the other airline transfer partners that Citi’s ThankYou program offers.

There are some very useful transfer partners in this list and they shouldn’t be ignored just because the opportunity to transfer to AAdvantage is going away.

Also, if your plans for any AAdvantage Miles that you generate are limited to American Airlines flight bookings, then a transfer to AAdvantage probably isn’t necessary. Citi ThankYou points can be transferred to Etihad Guest and then used to book the same American Airlines awards that you can book with AAdvantage miles on AA.com. Better yet, the awards booked through Etihad will be cheaper.

Personally, I’m not transferring any ThankYou points across to AAdvantage because I’m not sure what I would use them for and I don’t want to leave myself with another scramble to use my miles if a devaluation is rumored in a few months’ time. Also, with Qatar Airways awards now considerably more economical than before and with my Virgin Flying Club account looking like it will need a top-up pretty soon (I have my eyes on an ANA Business Class award), I prefer to keep my options open rather than committing to the AAdvantage program at this time.

Bottom Line

We’ve been able to transfer Citi ThankYou points to the American Airlines AAdvantage program since the middle of July but the doors will be closing on that opportunity in just 3 days’ time. Nobody should be making any transfers to the AAdvantage program without thinking things through and considering how else they may be able to use their ThankYou points to good effect, but if you’ve found a great oneworld award that you’d like to book and your AAdvantage account is low, now is probably the time to generate the miles that you need.

![Deal: Save up to 20% on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-5-741-80x60.jpg)