TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

With Southwest currently running a promotion in which holders of its co-branded credit cards can earn bonus tier qualifying points through credit card spending, now would seem to be a good time to take another look at what each of the three Southwest consumer cards offer.

This article compares the annual fees, the earning rates, and the key benefits that the Southwest consumer cards offer in what is (hopefully) an easily digestible format to make it easier to see which card (if any) will work best for you.

The three Southwest Rapid Rewards consumer credit cards

Southwest offers three consumer credit cards through its partnership with Chase and deciding which Southwest Card is best for you will depend on your travel patterns and what you aim to achieve by applying for the credit card.

A card that’s great in the short term may not be the best card for your long term goals.

These are the three consumer cards that Chase issues:

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Priority Credit Card

Eligibility

These cards are not available to current holders of any Southwest Rapid Rewards consumer credit card, or former holders of any Southwest Rapid Rewards credit card who received a new Cardmember bonus within the last 24 months.

This does not apply to holders of the Southwest® Rapid Rewards® Performance Business Credit Card, holders of the Southwest® Rapid Rewards® Premier Business Credit Card, or holders of any Employee Credit Card products.

Comparing the Southwest consumer credit cards

A couple of notes before I get to the comparisons:

I’ve chosen to use tables to show what the three Southwest Rapid Rewards consumer credit cards offer, and because I think the information in the table speaks for itself, I don’t intend to add a lot of commentary about specific differences between cards.

This article is intended more as a resource (with a few of my thoughts added in) rather than a blow-by-blow discussion of what I think is good and bad about each of the Southwest consumer cards.

Ok, let’s move on to the comparisons…

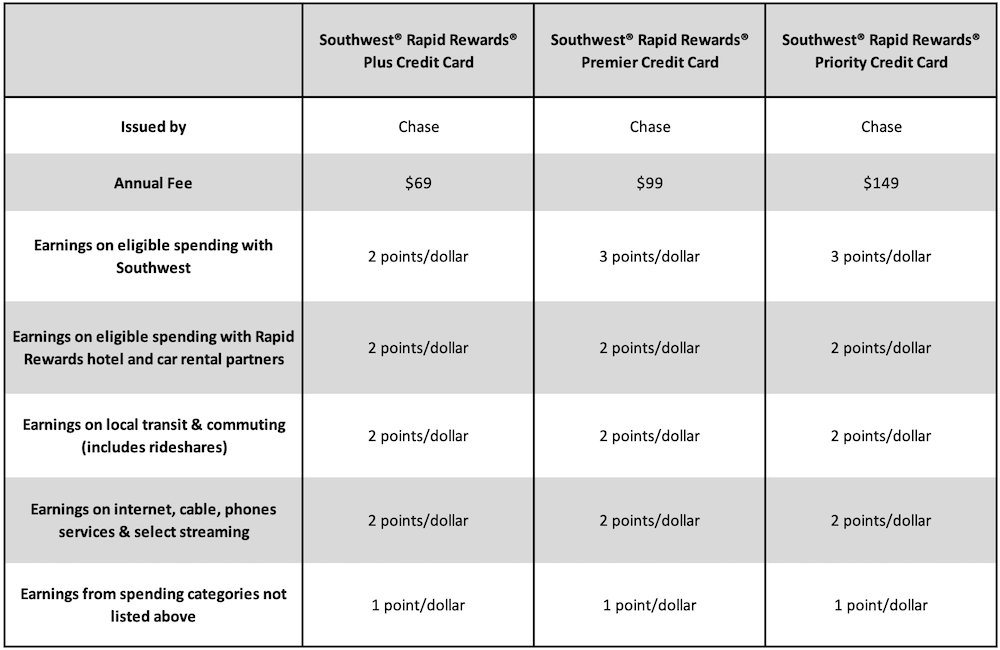

Comparing earning rates (terms apply)

There are three important points that I’d like to highlight here:

- You don’t have to pay for the Southwest Rapid Rewards® Priority Credit Card to earn the maximum number of points/dollar available for spending made with Southwest.

- The points earned by spending on all three Southwest consumer credit cards count towards the Companion Pass annual points target.

- To get a true view of how good or bad the earning rates that these cards offer are, don’t just look at the earning rate in isolation. Work out how much value the earning rates are offering you and go from there.

To expand on that final point…

I value Rapid Rewards points at 1.3 cents each (based on the value that I know that I can get out of them with relative ease) and that means that where one of these cards offers me 2 points/dollar for spending in a given category, for example, I know that for me, that’s an effective return of 2.6% on my spending.

This helps put things in context as while a headline earning rate of 2 points/dollar may look reasonable (to some), the fact that it only equates to a 2.6% return shows that it’s not really a good rate at all and that I would do better by using one of my other credit cards when spending in that category (if you have a different valuation to mine, you should adjust the numbers accordingly).

It’s worth noting, however, that if you’re using credit card spending to help you to earn a Companion Pass, the effective return that these cards offer on spending becomes a little less important.

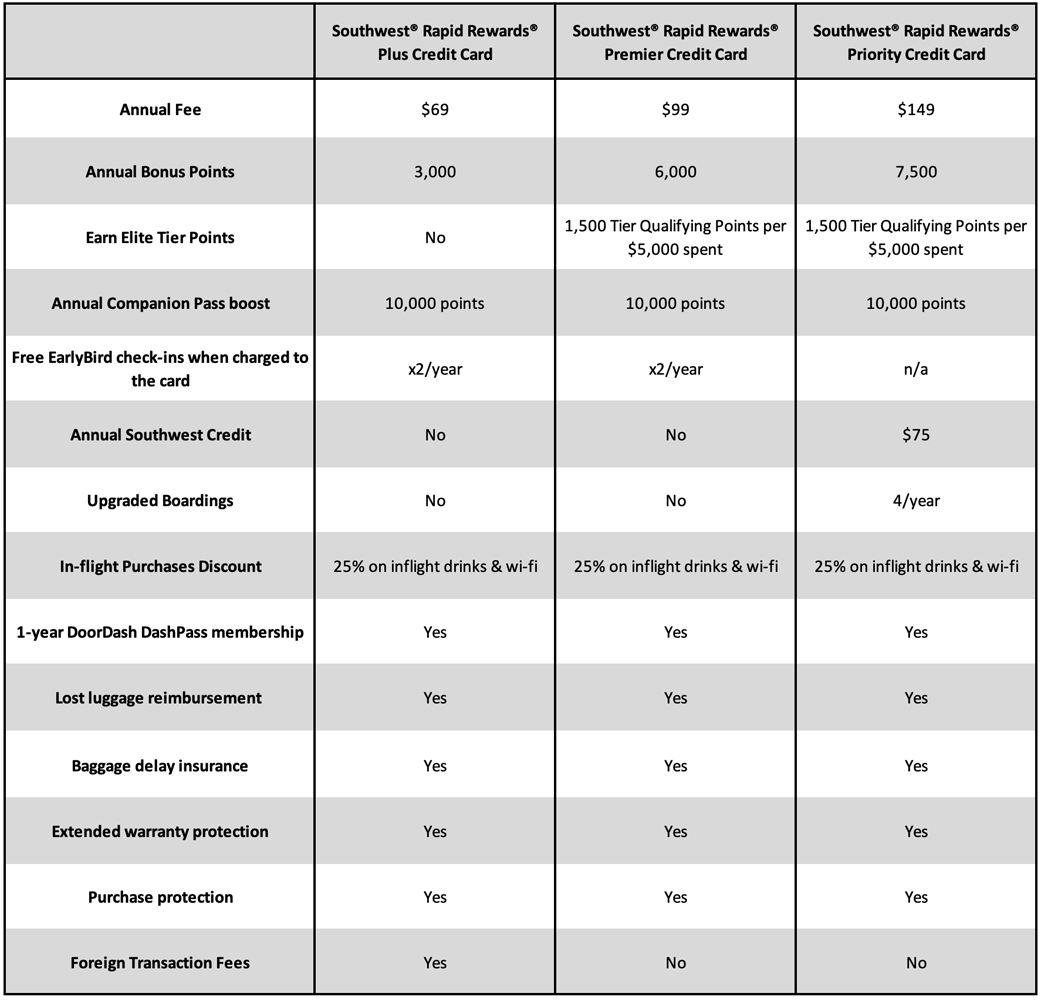

Comparing key benefits

Deciding what is and what isn’t a key benefit is, by definition, a subjective thing so not all benefits may have been listed here.

Having said that, the benefits that have been included here should be more than enough to help you see just what a cardholder is being offered in return for the annual fee.

There are a few important points that I’d like to highlight here:

- The key differences between these cards are to be found in the benefits they offer for travel with Southwest. Most of the other benefits that these cards offer are identical regardless of which card you choose.

- Of the three cards the Southwest Rapid Rewards® Plus Credit Card is the only one that doesn’t offer cardholders the option to earn Tier Qualifying Points though spending.

- Of the three cards the Southwest Rapid Rewards® Plus Credit Card is the only one that charges foreign transaction fees.

- The DoorDash, lost luggage, baggage delay, extended warranty, and purchase protection benefits are the same for all three cards.

- Make sure you consider how often you will be making the most of each of the benefits on offer and how much value each will genuinely give you before you choose a card. Some benefits can look very tempting but they’re only worth something if you’re actually going to get to use them.

While there aren’t too many significant differences between the earning rates that the Southwest consumer cards offer, the differences between the benefits they offer when flying with Southwest are more noticeable.

That makes it all the more important to make sure that you consider exactly what each card is offering in return for its annual fee.

Which is best?

This isn’t a question that anyone other than the person wanting to apply for one of these cards can answer as one person’s needs and aims will be different to the next persons. The best thing that I can do here is to sum up which groups of people I think would benefit most from earn card:

The Southwest Rapid Rewards® Plus Credit Card

This card is best for travelers focused primarily on earning bonus points towards a Companion Pass with the lowest cash outlay.

The Southwest Rapid Rewards® Premier Credit Card

This card is best for flyers who want to earn Southwest points domestically and abroad (while paying the lowest annual fee they can) as well as those focused on earning bonus points towards a Companion Pass

The Southwest Rapid Rewards® Priority Credit Card

This card is best for someone who flies frequently with Southwest as the best benefits that it offers (the benefits that help offset part of the annual fee) are heavily focused on travel with Southwest.

Bottom line

There’s a personal Southwest credit card for everyone in this range and with a solid welcome bonus on each card, with all cards offering good earning rates in important spending categories and with two of these cards also offering 3 points per dollar for Southwest spending, there’s a lot to like about the consumer Southwest Rapid Rewards Cards.

For frequent flyers, the Southwest Rapid Rewards® Priority Credit Card will almost certainly be the best option. Novices and travelers primarily focused on earning points towards a Companion Pass may prefer the low annual fee of the Southwest Rapid Rewards® Plus Credit Card, and more seasoned travelers who don’t use Southwest particularly often may prefer the middle-of-the-road earnings and benefits of the Southwest Rapid Rewards® Premier Credit Card.

Featured image courtesy of Southwest

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-80x60.jpg)