TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

It was just last week that United Airlines revealed that it was receiving a $5 billion bailout from the US government with around $3.5 billion of that bailout coming as a government grant which will never have to be repaid. Apparently that wasn’t enough as the airline has now announced that it’s now raising over a billion dollars in cash from a public offering of common stock.

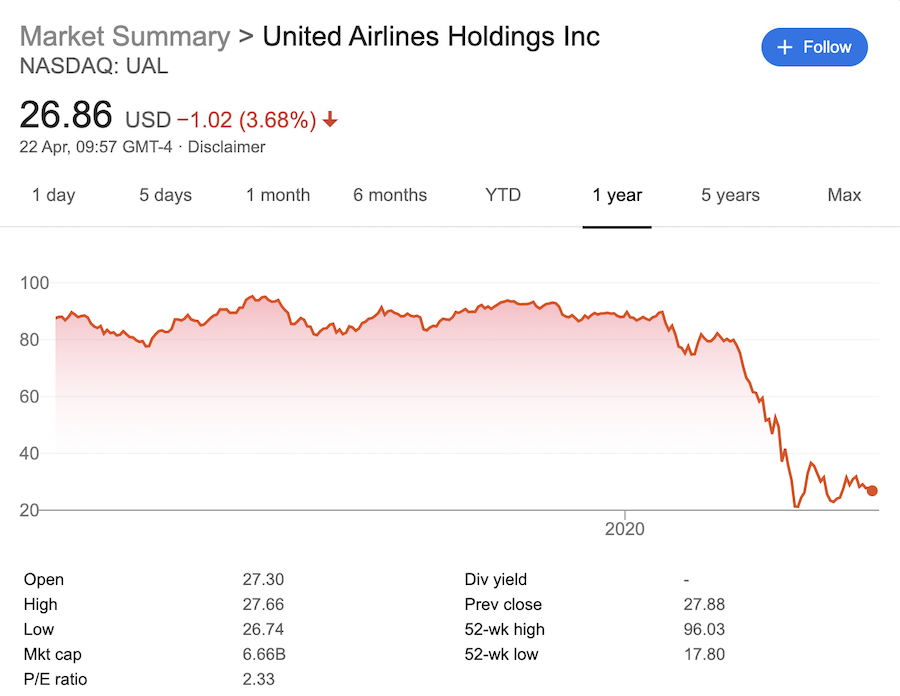

Morgan Stanley and Barclays are underwriting an issue of 39,250,000 shares of United Airlines common stock, at a public offering price of $26.50 per share. At the time of writing, shares in United Airlines were trading at just under $27, down over a dollar from last night’s closing price.

As well as the shares being issued in the public offering, the two underwriters of this sale have a 30-day option to buy up to 3,925,000 additional shares so, once this is all over, the total number of new shares issued could total 43,175,000.

At 26.50 a share that comes to a total cost of $1,144,137,500.

Not all of that money will filter down to United’s bank accounts as there will be various fees to pay, but the airline will still add over a billion dollars of liquidity to its coffers which the airline says will be used “for general corporate purposes”.

There are a few interesting points about this deal:

Firstly, at $26.50 per share, this offer prices United’s stock at around 30% of what it was worth at the start of the year (~$87.90) and at a 27.6% discount to what the stock was trading at a little under a month ago – that should give you a very good idea of just how badly this crisis is hitting the airline industry.

Secondly, United has spent the better part of the last five years buying back its shares as a way of keeping investors happy (at a cost of around $9.8 billion) so this latest share issue is, in effect, a partial reversal of that policy. More importantly, with United Airlines stock not having fallen below $41.00 in the 5 years preceding this crisis and with the stock price having sat between $60 and $97 since late 2016, this is a wonderful example of how not to play the stock market – United has been buying high and is now selling low (and yet the geniuses at corporate still take home millions).

Lastly, I’ll be interested to see how this affects the deal that the airline has done with the US federal government.

As part of the overly generous bailout deal that United was given, the US government is being issued with warrants for 4.6 million shares of United Airlines common stock at a “strike price” of $31.50 per share. Not only is that a price point that’s ~19% higher than the price at which United is issuing shares today, but today’s share issue also means that, should the warrants be exercised, the government will own a lower percentage of the airline than it may have expected to own when the bailout deal was reached.

I wonder if the government was kept informed of United’s plans to issue new stock when the bailout plan was being agreed?

Bottom Line

Between the bailout from the US government and this newly announced stock issue, United Airlines will soon have over $6 billion more sitting in its bank accounts than it did a couple of weeks ago – it will be interesting to see how that money is deployed and how long it will last.

Buy now…..just in time for bankruptcy!

[…] I wrote about United Airlines heading to the stock market to raise up to $1.1 billion to add to the $5 billion the US government just handed the airline, and now it’s […]

[…] Virgin Atlantic money, the airline’s stock isn’t publicly traded so it can’t follow United’s lead and issue more shares to the market to raise the much-needed funds (even if it could, I suspect the […]

[…] the end of last month, United Airlines announced that it was planning to raise $1.1 billion from a public stock offering to go alongside the $5.0 billion the airline has received from the US government and now the […]

[…] April, United Airlines successfully raised over $1bn in a stock floatation but when it attempted to raise a further $2.25bn through a private bond placement just a few weeks […]