TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Yesterday was a big day for announcements in the world of Marriott Bonvoy co-branded credit cards with news that the card_name has been refreshed and the news that two new mid-tier cards have been launched. There was, however, one other piece of Bonvoy credit card news that didn’t get any fanfare at all and for some, it was the best news of the day.

How the Ritz-Carlton™ credit card just improved

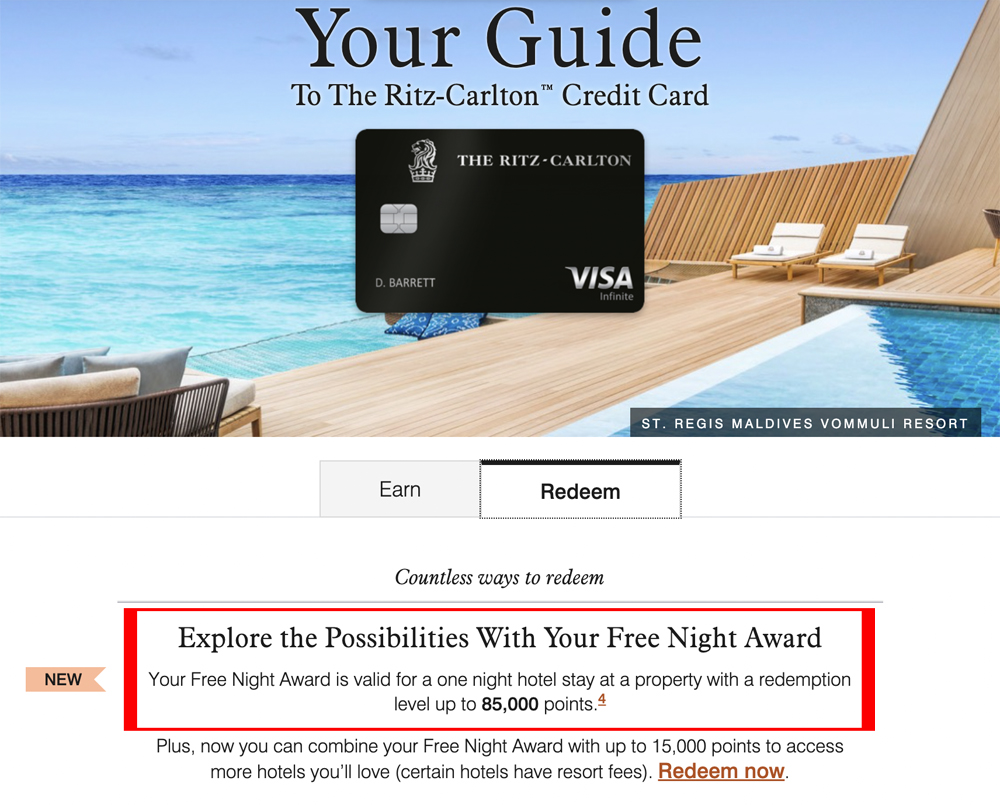

Yesterday, we found out that as part of its refresh, the annual free night certificate issued by the card_name is now valid at properties costing up to 85,000 points/night and this, along with Bonvoy Platinum Elite status and more elite night credits, was one of the key giveaways in exchange for a significant increase in the card’s annual fee to annual_fees (rates & fees).

Historically and as part of its overall benefits package, the Ritz-Carlton™ credit card has offered cardholders the same 50,000 points/night free night certificate that the Bonvoy Brilliant card used to offer, but in a slightly surprising turn of events, the Ritz-Carlton card’s information page has been changed to show that its annual free night certificate is also now valid at properties costing up to 85,000 points/night.

More importantly, this has been done without any corresponding increase in the annual fee.

That’s fantastic news and it makes me love my Ritz-Carlton card even more.

I was already finding it pretty easy to justify the card’s annual fee thanks to the fact that I always manage to max out the $300 airline fee credit, so the fact that the card now gives me a free night at a whole range of high-end properties that were previously out of reach (of the old certificate), just makes it all the better.

Note: Don’t forget that Marriott now allows Bonvoy members to top up any free night certificates that they may have with up to 15,000 points from their accounts.

[HT: Miles to Memories]

Key things to know about the Ritz-Carlton™ credit card

Amazingly, for a card that now gets so little publicity, the Ritz-Carlton™ credit card is actually a very, very good credit card and it’s one of the cards that Chase or Marriott would have to ruin before I’d be prepared to give it up.

It comes with a hefty $450 annual fee, but in return for that annual fee you get some very nice benefits:

- A Priority Pass Select membership that doesn’t cap how many guests a cardholder can bring into a lounge (as far as I know this is the only credit card around for which this is true).

- An annual $300 travel credit which can be used to offset qualifying airline purchases on any airline (this is a considerably more flexible travel credit than the similar credit offered by the card_name – I’ve used it to claw back onboard food & drink spending, award fees, lounge fees and a lot more).

- A credit to cover the cost of Global Entry membership

- An annual free night certificate valid at Marriott properties costing up to 85,000 points/night.

- 15 elite night credits/year

- Marriott Bonvoy Gold Elite status

- Primary rental car cover*

- Excellent trip cancellation/trip interruption insurance*

- Excellent trip delay reimbursement*

- Emergency evacuation and transportation

- No foreign transaction fees

Very importantly, there is no fee to add authorized users to the Ritz-Carlton™ credit card and while authorized users don’t get most of the benefits that the primary cardholder gets, they *do* get a Priority Pass Select membership that’s every bit as good as the one given to the primary cardholder.

I should also mention that the card comes with a number of other benefits as well (e.g upgrade certificates for select stays at Ritz-Carlton properties) but as these are either not really “key” or are hard to use economically, I’m not going to discuss those here (you can read about them on this webpage).

*These insurances match the insurances offered by the card_name which costs significantly more than the Ritz-Carlton™ credit card.

How to get the Ritz-Carlton™ credit card

Chase’s Ritz-Carlton™ credit card was closed to new applicants some years ago (that’s probably why we don’t hear much about it) but thanks to the quirky way that the credit card world sometimes works, this is a card that you can still add to your portfolio if you know how.

While you won’t find the Ritz-Carlton™ credit card listed alongside all the other cards that Chase issues, what some people don’t realize is that anyone with a Chase Marriott Bonvoy credit card can request a product change to the Ritz-Carlton card. This includes holders of other Marriott co-branded cards that are no longer issued to new applicants as well as holders of the Marriott Bonvoy Boundless® credit card and the Marriott Bonvoy Bold® credit card.

If you’ve had your Bonvoy card for less than a year you may have to wait until your credit card anniversary before you can request a product change (I think this rule may vary by state), but I speak from experience when I say that upgrading to the Ritz-Carlton™ credit card is a very easy thing to do.

Bottom line

Alongside all the other Marriott Bonvoy credit card news that was published yesterday was a very nice bit of news that wasn’t mentioned by either Chase or Marriott – without any increase in the card’s annual fee, the free night certificate issued by the Ritz-Carlton credit card is now valid at properties costing up to 85,000 points per night.

For rates and fees of the card_name, please visit rates & fees

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-356x220.jpg)

I think the other side of this benefit jump from 50k to 85k means expect BIG increases in points required for free nights next year.

Oh I was expecting that already 🙂

I got my 50k cert issued right before this announcement ♂️

Ouch. Never mind, you have a better cert on the way next year and you’re not paying any more for it 🙂

I’m trying to decide between the Amex Platinum and Ritz Carlton when paying for flights. Ritz has seemingly better travel insurance than the platinum but the platinum gets 5x points and have reasonable travel insurance. Any thoughts on that?

The Platinum Card’s earnings are considerably stronger (by my valuations 7.5% vs 3.6%) and as long as you’re not booking one-way fares, the Platinum Card’s insurance is as good as the insurance that the Ritz card offers (in my opinion).

I current have Chase Bonvoy Boundless that I’m thinking about upgrading to the Ritz card. I qualify for the 12 months+ account age & $10k+ credit limit to upgrade.

1) The terms say if I had this card within the past 30 days I won’t qualify for the Amex Bonvoy Brilliant SUB. Does this mean opened the account or actually hold the card in your wallet within 30 days? I have too many new Amex cards to open the Brilliant this year or I’d open it first and then upgrade the Chase card to the Ritz.

2) If I upgrade my Chase Bonvoy Boundless to the Ritz card, will I pay the $450 AF when I would my usual $95 AF or is it due at upgrade?

3) Will the new Ritz FNA “Free Night Award” be awarded on the upgrade date or my original Chase Boundless account anniversary?

Thank you!