TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

I’m a huge fan of flexible points currencies and while Chase Ultimate Rewards is my go-to program when I need a currency for hotel stays (I can never have too many Hyatt points), I don’t know what I would do without all the Amex Membership Rewards points that save me a small fortune on some of the flights that I have to take.

In this article, I’ve narrowed down Amex’s card portfolio to the 4 cards which I think make up the best “team” for anyone looking to maximize their Membership Rewards points earnings, and while I’m not one to suggest that someone should choose just one card ecosystem on which to concentrate, if I absolutely had to choose one ecosystem to recommend it would be Amex Membership Rewards.

Membership Rewards offers more transfer partners than any other major transferable currency, it issues cards that make the currency easy to collect, and the transfer bonuses that it frequently offers can boost a cardholder’s earnings significantly.

All of that put together makes Amex’s card portfolio one that deserves a good deal of respect.

Before I continue

Different people have different priorities, needs, and aims, so just because one card or card ecosystem works for one person, it doesn’t mean that it will work for everyone else.

The key to getting the most out of a card portfolio is understanding what you want your cards to do for you and then making sure that the cards you apply for and hold are actually doing those jobs.

Some people will say that Amex’s offering is the greatest ever, while others will claim to hate it and say that they love Chase Ultimate Rewards instead.

Some people will agree that Membership Rewards points are amazing and then disagree strongly with the cards that I’ve chosen because they prefer a different combination … and that’s ok.

All these views have merit because, as I said, different things work for different people and that means that opinions will vary.

I just happen to believe that Amex Membership Rewards is the best single option out there and I happen to believe that the cards I’ve chosen make up the best all-around Membership Rewards “team” of cards.

Narrowing down the choices

American Express issues 5 personal Membership Rewards cards and 4 Business Membership Rewards cards and I’ve narrowed this list down to 6 cards that I think should form the pool from which the 4 ideal Amex Membership Rewards cards should be chosen:

- The Platinum Card® from American Express

- American Express® Gold Card

- The American Express® Green Card

- The Amex EveryDay® Preferred Card

- The Amex EveryDay® Card

- The Blue Business® Plus Credit Card from American Express

Note: All information about the American Express® Green Card, the Amex EveryDay® Preferred Card, and the Amex EveryDay® Card has been collected independently by Traveling For Miles. The American Express® Green Card, the Amex EveryDay® Preferred Card, and the Amex EveryDay® Card are not currently available through Traveling For Miles.

Because there’s a good amount of overlap between the consumer and the business versions of the Platinum Card and the Gold card, because most people don’t run their own businesses or have side hustles, and because the consumer versions of these cards offer more customer protections, I feel comfortable in saying that most people reading this article will probably be better suited to the consumer versions of the Platinum and Gold cards, so that’s why the business versions of those cards do not appear on the list above.

The other card that that I eliminated was the the Business Green Rewards card, and that’s because it doesn’t offer much in the way of earning power or benefits and will be of very limited use to most people reading this article.

Comparing the competing cards

So how do the 6 Membership Rewards cards that I’ve selected compare?

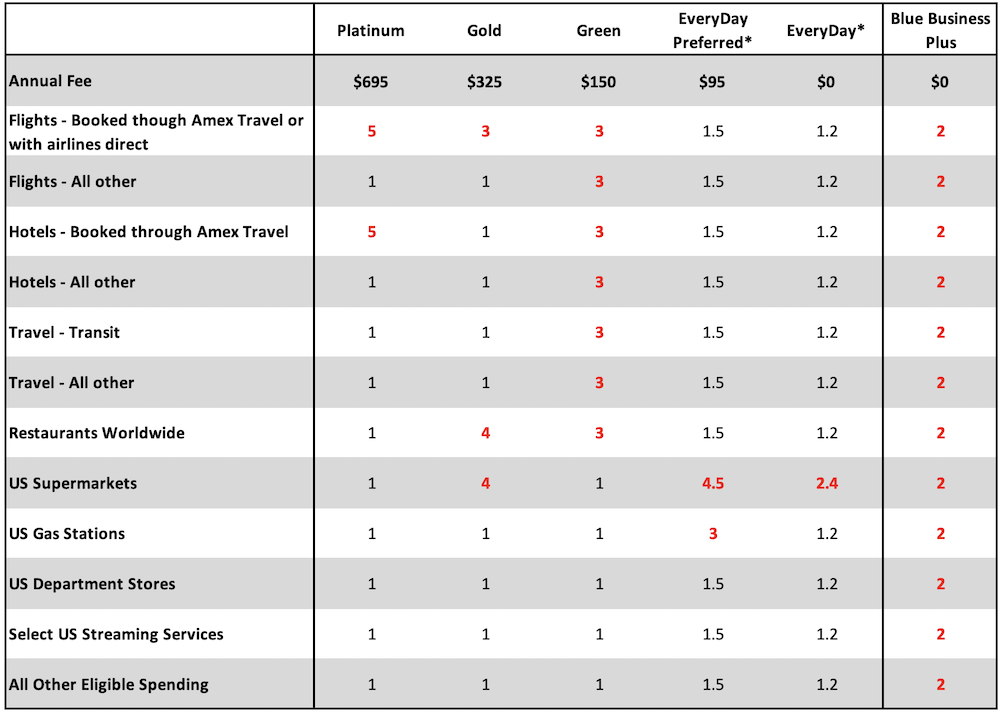

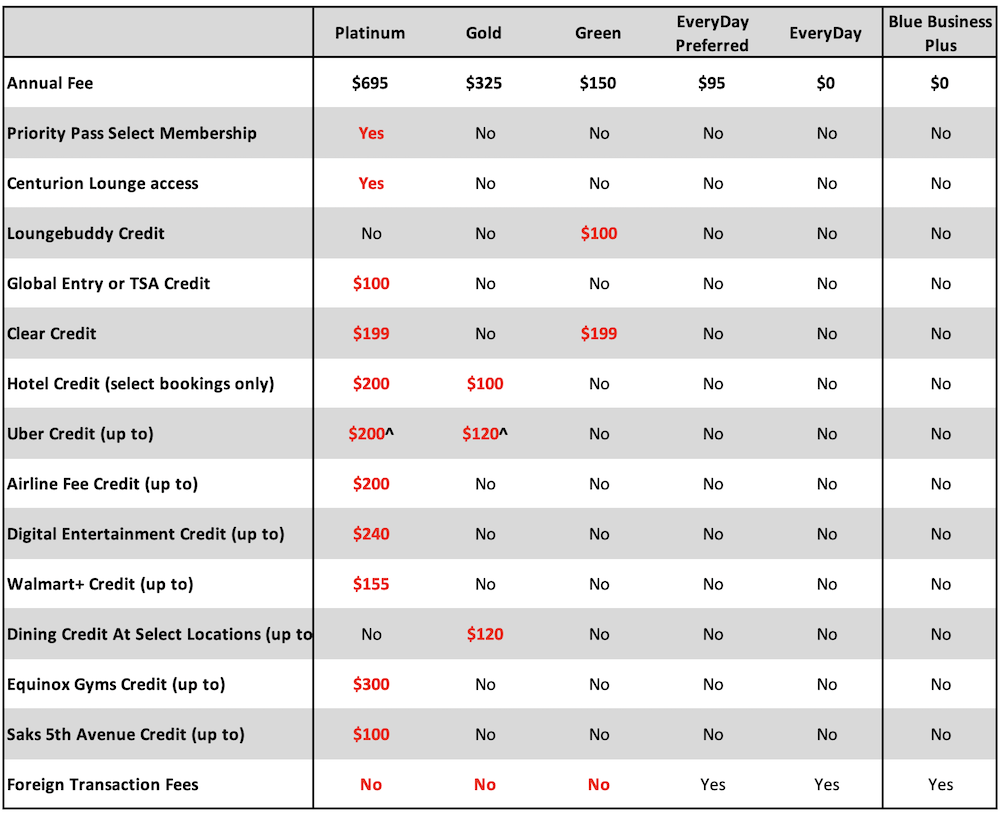

The table below shows how much each of these 6 cards costs to hold, what earnings the cards offer (terms apply)*, and the key benefits associated with each card. The items in red highlight each card’s strong points (terms apply).

Earning rates (terms apply)

For rates & fees information, see here:

*The earnings for the Amex EveryDay Preferred Card and Amex EveryDay Card assume that the cards are used 30x/billing cycle and 20x/billing cycle (respectively) to earn the 30% bonus and 20% bonus that these cards offer (respectively) when those targets are met.

Notes:

- The Platinum Card® from American Express limits the 5 points/dollar that a cardholder can earn on flights booked directly with airlines or through Amex Travel to the first $500,000 of spending per year (1 point/dollar thereafter – terms apply).

- The American Express® Gold Card caps the 4 points/dollar earnings at U.S. supermarkets to $25,000 of spending per year. Any spending at U.S. supermarkets that exceeds this cap will earn 1 point/dollar (terms apply).

- The American Express® Gold Card caps the 4 points/dollar earnings at restaurants to $50,000 of spending per year. Any spending at U.S. Supermarkets that exceeds this cap will earn 1 point/dollar (terms apply).

- The Amex EveryDay® Preferred Credit Card caps the 4.5 points/dollar earnings at U.S. Supermarkets (includes the 50% bonus) to $6,000 of spending per year. Any spend at U.S. Supermarkets that exceeds this cap will earn 1 point/dollar (terms apply).

- The Amex EveryDay® Credit Card caps the 2.4 points/dollar earnings at U.S. Supermarkets (includes the 20% bonus) to $6,000 of spending per year. Any spend at U.S. Supermarkets that exceeds this cap will earn 1 point/dollar (terms apply).

- The Blue Business® Plus Credit Card from American Express limits the 2 points/dollar earnings to the first $50,000 spent on the card. Any spending above this limit will earn 1 point/dollar (terms apply).

Key benefits (terms apply and enrollment may be required)

Deciding what is and what isn’t a key benefit is, by definition, a subjective thing so not all benefits have been listed here.

Having said that, the benefits that have been included here should be more than enough to help you see what a cardholder is being offered in return for the annual fee.

^The relevant American Express card must be added to the Uber app for this credit to be applied. Holders of the American Express Gold Card receive 12 monthly credits of $10 into the Uber app while holders of the Platinum Card receive 11 monthly credits of $15 and a $35 credit in December.

The Ideal 4 card combination

This wasn’t an easy decision to make and as I suggested earlier, I’m sure there will be a few people who will love a card that didn’t make the final list. Nevertheless, here’s my ideal 4 card Amex Membership Rewards combination:

- The Platinum Card® from American Express

- The American Express® Green Card

- The Amex EveryDay® Preferred Credit Card

- The Blue Business® Plus Credit Card from American Express

And here’s what this 4-card combination offers from an earnings perspective (terms apply):

- 5 points/dollar on flights booked directly with airlines or through Amex Travel (up to $500,000 of spending per year – 1 point/dollar thereafter)

- 5 points/dollar on hotels booked through Amex Travel/Amex FHR

- Up to 4.5 points/dollar on spending at U.S. supermarkets

- Up to 3 points/dollar on spending at gas stations

- 3 points/dollar on all other eligible travel spending

- 3 points/dollar at restaurants

- 2 points/dollar on all other eligible spending (up to $50,000 per year – 1 point/dollar thereafter)

The combined annual fee for these 4 cards is $940 but this can be offset (at least in part) by the following benefits that these cards offer (terms apply and enrollment may be required):

- Priority Pass Select Membership (Includes 2 guests, but no access to PP restaurants)

- Access to Centurion Lounges

- $240/year Digital Entertainment Credit ($20/month)

- $200/year airline fee credit

- $200/year hotel credit on select prepaid bookings made through Amex Travel

- $100/year Saks 5th Avenue credit (issued as $50 every six months)

- Up to $200/year in Uber & Uber Eats credits (offered as monthly credits for use in the United States only when the Platinum card is added to the Uber app)*

- $199/year CLEAR credit

- $300/year Equinox credit

- Access to Amex Fine Hotels & Resorts (and the extra benefits the program offers)

- No foreign transaction fees on 2 out of the 4 cards

*The Platinum Card from American Express must be added to the Uber app for this credit to be applied and holders will receive 11 monthly credits of $15 into the Uber app and a $35 credit in December.

The degree to which individual cardholders will be able to offset the combined annual fees by using the various card benefits will vary depending on each cardholder’s travel and spending patterns, but most people should be able to offset a significant percentage.

My reasoning

This is a miles & points site read by people who travel (or aspire to travel) and if you’re considering Membership Rewards points as a currency that you’d like to focus on, that suggests that you’re interested in travel too. The 4 cards that I’ve selected were chosen with this in mind.

The Platinum Card® from American Express offers the a fantastic return on airfare booked directly with airlines or through Amex Travel (on up to $500,000 of spending per year) and it offers good trip protections too.

This card is an obvious choice for anyone who books multiple flights every year.

The 3 points/dollar that the American Express® Green Card offers on all other travel spending (terms apply) cannot be beaten by any other American Express card and is only matched by one other card on the market – the Chase Sapphire Reserve® – so it’s a “must-have” card for anyone who likes to travel and who wants to earn a lot of Membership Rewards points.

The 4.5 points/dollar that the Amex EveryDay® Preferred Credit Card can offer on the first $6,000 of US supermarket spending in a year is a great rate of return for spending at US supermarkets and one that you’ll find hard to beat (this rate assumes that a cardholder puts a minimum of 30 transactions on their card in a single billing cycle in any spending category – terms apply).

Also, assuming a cardholder uses the Amex EveryDay® Preferred Credit Card for a minimum of 30 transactions (of any size and in any category) in a billing cycle and triggers the 50% bonus, it offers a valuable 3 points/dollar for gas station spending (terms apply).

As everyone has to eat (and presumably not everyone orders takeout every night), and as gas is a major monthly cost for most people, this is another reasonably obvious card to have in this team.

Note: All information about the American Express® Green Card and the Amex EveryDay® Preferred Card has been collected independently by Traveling For Miles. The American Express® Green Card and the Amex EveryDay® Preferred Card are not currently available through Traveling For Miles.

The Blue Business® Plus Credit Card from American Express is the only Business card to make it onto my list and it makes it into my final 4 because it’s hard to find a better card for non-bonused spending.

When you can earn 2 points/dollar in any category of spending on up to $50,000 of eligible spending/year (1 point/dollar thereafter – terms apply) without having to pay an annual fee, there’s no reason for most people to ever earn 1 point/dollar on domestic spending ever again.

The American Express® Gold Card didn’t make it into my final 4 because the other cards that I’ve selected mostly cover its strong points:

- The Platinum Card® from American Express is better for airfare spending.

- The American Express® Green Card is better for all other travel spending.

- The Amex EveryDay® Preferred Credit Card is better for gas station spending.

- The American Express® Green Card earns just 1 point/dollar less at restaurants.

- The Platinum Card® from American Express covers most of the key benefits offered by the American Express® Gold Card.

The no annual fee Amex EveryDay® credit card didn’t make it into the final 4 because most people will spend a significant amount of money at gas stations and at US supermarkets every year, so the annual fee that the Preferred version of this card charges should be worth it thanks to the noticeably higher earning rates that it offers in both of these categories.

Alternatives

I believe that the four cards I’ve chosen are the best four Amex Membership Rewards cards to carry (as a team), but you can tweak my selection if your spending patterns are noticeably skewed away from one (or more) of the spending categories that I have highlighted.

If, for example, you don’t spend a lot on airfare and you don’t need a Priority Pass membership, it may be a good idea to save some money by dropping the Platinum Card® from American Express and just keeping a 3-card Membership Rewards team of the American Express® Green Card, the Amex EveryDay® Preferred Credit Card and the Blue Business® Plus Credit Card from American Express.

This would reduce the total annual fees that you would have to pay to just $245/year, and although you would also miss out on quite a few benefits, you would have a set of Membership Rewards cards that will cover you very well for most of your spending.

Bottom line

American Express Membership Rewards can be a very lucrative program in which to earn points and it can be an easy program in which to earn points if you choose the right cards to match your needs and your spending patterns.

Personally, I think that the Platinum Card® from American Express, the American Express® Green Card, the Amex EveryDay® Preferred Card, and the Blue Business® Plus Credit Card from American Express make up the ideal 4-card Membership Rewards team … but what do you think?

Wow, great research and analysis. I have to admit that until I saw your side-by-side comparison I never realized that the Green card had much value. There is one card that’s kind of an oddball in the mix that I have that at times provides really good earnings in some situations: Rakuten.

On the Amex universe as a whole, I’m certainly a fan and have different cards to help maximize earnings. I do think that not just sticking with any one program is good though. Amex is strong on airlines but their hotel partners are limited and charge an awful lot of points in many cases while Chase has the king of hotel programs in Hyatt and Citi Double Cash transferring to Citi points can be pretty handy. Also, god forbid the Amex RAT closes you down it could be catastrophic if you’re only invested in MR.

I think the Green Card is probably undervalued by quite a few people and probably not discussed enough by bloggers either. As well as being a pretty well rounded travel card, it’s also very useful for Amex travel offers that don’t appear on the co-branded hotel cards.

Ordinarily, people who don’t have a Green Card are forced to load some of these offers (Hyatt, IHG, Marriott, Hilton, FHR, etc…) to a card that earns just 1 point/dollar (or possibly 2 points/dollar if they have the Blue Business Plus Card). Holders of the Green Card earn 3 points/dollar on all of these offers (assuming they have been targeted) and across a period of a year, that can add up.

On the subject of credit card universes: I completely agree that sticking with just one is a sub-optimal idea. Personally, I mostly concentrate on MR and UR with a sprinkling of Citi ThankYou thrown in and that works well for me. The fact that I love Hyatt and that Chase UR points transfer over to WoH means that I will be inextricably linked to Chase’s cards for as long as that relationship is a good one 🙂

I’ll take Gold 4x$1 for dining and groceries any day over Green.

The high AF on Plat is prohibitive unless you frequently use Amex lounges solo. Otherwise you are just paying a high AF and then jumping thru hoops to offset with monthly coupon book expenditures

Looks like my AMEX hotel card setup is impossible (Hilton Aspire, Bonvoy Brilliant, Bonvoy AMEX Biz) with this combination: 6 credit cards (Green counts as on as a hybrid), exceeds the five credit card limit. But this might be an edge case…

As @Ziggy has already said, in effect “YMMV,” and that’s very true. First of all, not everyone has a side hustle that qualified them for a Business card (no matter how many times AMEX sends me a letter saying I’m pre-approved for a business card). Secondly, the AMEX quartet varies with what else is in your wallet.

I, too, will take the Gold card’s 4x on restaurants worldwide over the Platinum’s 3x; and the Gold’s 4x on US groceries over the Platinum’s 1x. That more than makes up for the Platinum’s 2x advantage for airfare when booked through AMEX Travel in terms to total points earned on an annual basis. Besides, most of my airfare is booked directly with the airlines which eliminates *any* advantages for AMEX, period. (And I have a card that earns 5x on airfare when booked directly.) I also have a card that has the $189 CLEAR credit, the TSA credit, the $200 flight credit, and many of the other benefits I would “lose out” on with “just” a Gold card — the AMEX Hilton Aspire card, with its $550 AF (versus $695).

Hi, two points that I think may be key here:

The Platinum Card offers 5 points/dollar on spending made directly with airlines as well as on flights through Amex travel.

The article was written from the point of view of someone who just wants to focus on one ecosystem so other (non Amex) cards you may hold aren’t relevant in this instance – if I was including cards from other ecosystems, the choice of 4 cards would be very different.