TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

Over recent months, American Express has loosened the purse strings and become noticeably more generous with some of the welcome offers that we have been seeing. The standard offers haven’t always been very generous, but the targeted offers that we’ve been seeing have been great, and there’s now an excellent targeted offer for the American Express® Business Gold Card.

First, a bit about the card

Annual Fee: $375

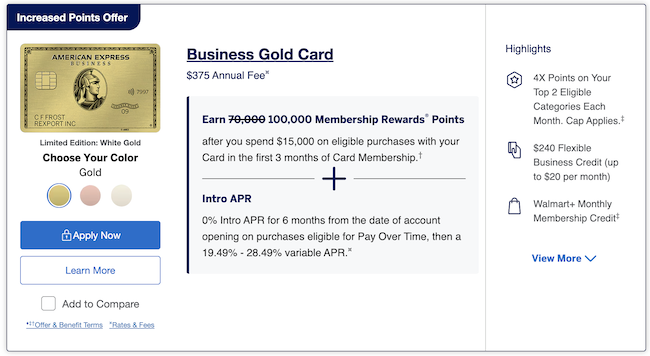

The current standard welcome offer looks like this (terms apply):

Earn 100,000 Membership Rewards points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Earning Rates (terms apply):

4 points/dollar in the 2 categories where your business spent the most each billing cycle from the list below*:

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

The 4 points/dollar earnings apply to the first $150,000 in combined purchases from these 2 categories each calendar year (1 point per dollar thereafter).

3 points/dollar on flights and pre-paid hotels booked through Amex Travel.

1 point/dollar on all other eligible spending.

Key benefits (terms apply and enrollment may be required):

- Earn up to $20 in statement credits each month after you use the Business Gold Card for eligible U.S. purchases at:

- FedEx

- Grubhub

- Office Supply Stores

- Receive a statement credit for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with your Business Gold Card (worth up to $12.95 plus applicable taxes).

- Access to the Amex Hotel Collection portfolio and associated benefits (e.g. $100 credit to spend on qualifying dining, spa and resort activities and a room upgrade upon check-in when available).

- No foreign transaction fees.

You’ll find full details of what this card offers on this American Express page.

The targeted welcome offer

When I log into my online Amex account, this is what I see under the Amex offers associated with the Business Platinum Card® from American Express:

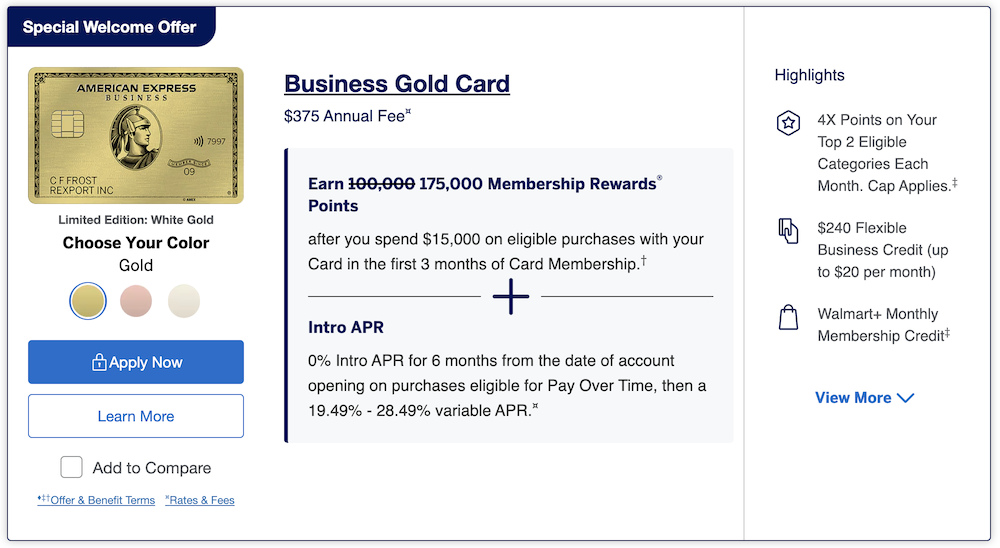

And when I click on the associated link, this is what I see:

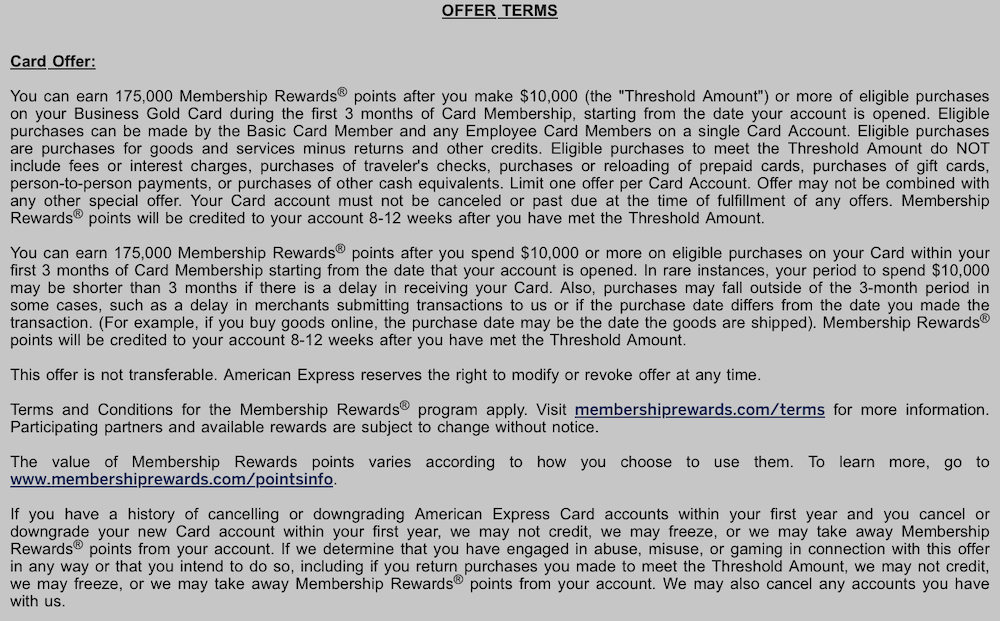

Crucially, when I click on the ‘rates and fees’ link (the offer terms link is broken) I can see that there are no terms attached to this offer that would prevent someone who has had this card in the past from earning the targeted bonus.

I value Amex points at 1.5 cents each (based on the value that I know I can get out of them with relative ease), so for me, this welcome offer is worth $2,625.

Personally, I have no real need for the Amex Business Gold Card (I have other cards that cover my spending in all the bonus categories that this card offers and that interest me), but I always have a need for extra Membership Rewards points, so I’m very tempted to apply.

Should I apply a be successful, I would view the card’s annual fee as the cost of picking up the bonus, so that would effectively see me ‘buying’ Amex Membership Rewards points at ~0.2 cents each … and that’s a bargain.

If you don’t see this in your online account

If you don’t see a 175,000 point targeted offer in your Amex online account, all is not necessarily lost.

As soon as I opened up an incognito window, loaded the American Express webpage, and looked at the bank’s business cards, another targeted offer was visible straight away, so if you can’t see my targeted offer in your accounts, you should be able to replicate this too.

Be aware, however, that this targeted offer is slightly different (worse) than the one that I can see in my online account because it requires $15,000 of eligible spending before the bonus is triggered instead of $10,000.

But that no more spending that than the standard offer currently requires, so it’s still not a terrible offer to get.

Unfortunately, this offer comes with limiting terms and conditions:

‘You may not be eligible to receive the welcome offer, intro APR offer, and intro plan fees offer if you have or have had this Card or previous versions of this Card. You also may not be eligible to receive the welcome offer, intro APR offer, and intro plan fees offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for the welcome offer, intro APR offer, and intro plan fees offer we will notify you prior to processing your application so you have the option to withdraw your application.‘

So if you’ve had this card in the past, you may be frozen out … but you can try your luck and you’ll be told if you’re ineligible before your application proceeds.

Bottom Line

With very few non-earnings benefits coming with this card, the American Express® Business Gold Card is a card that’s designed to be used on a day-to-day basis and not kept to one side, so with a hefty $375 annual fee to pay, anyone applying for this card should be very sure that they’ll be able to make the most of the earnings categories and/or be sure that they’ll get a lot of value out of the bonus points from the targeted offer before they submit an application.