TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Other links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

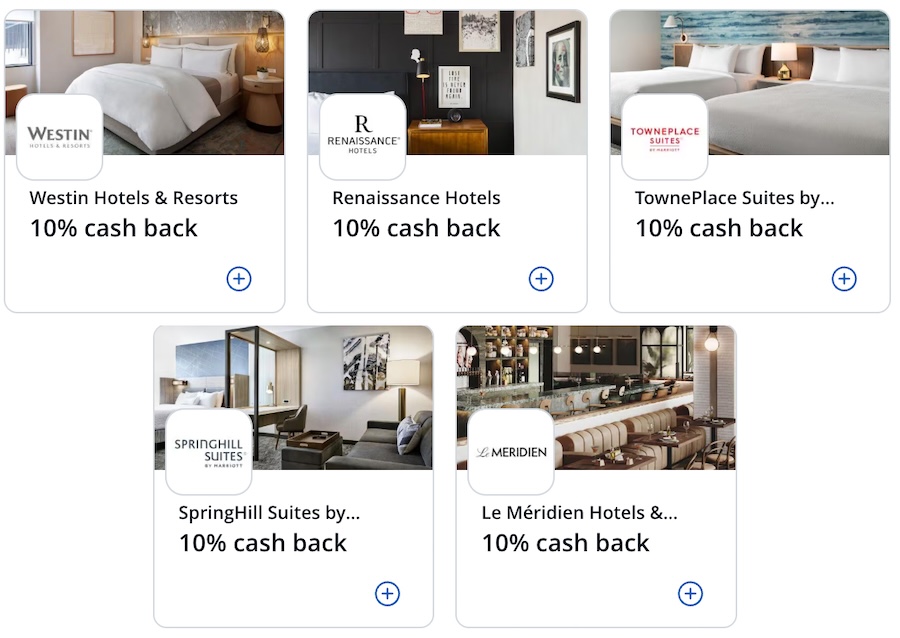

Following on from the seven deals we saw in July, Chase is now targeting select cardholders for savings on spending made with five different Marriott brands.

As usual, these deals are only available for stays that are paid for in the next few weeks, but the rebates on offer can be worthwhile, so if you have an upcoming Marriott stay, it should be worth checking your cards to see if you have been targeted.

The targeted offers

These are the brand-specific targeted offers that I can see in our Chase online accounts and all require a stay to be paid for (not necessarily completed) by 30 September 2025.

– Le Méridien Hotels & Resorts – spend $100 or more & get 10% back up to $57

– Renaissance Hotels – spend $100 or more & get 10% back up to $75

– SpringHill Suites – spend $100 or more & get 10% back up to $43

– TownePlace Suites – spend $100 or more & get 10% back up to $57

– Westin Hotels – spend $100 or more & get 10% back up to $68

Unlike the offers we saw in July, there don’t appear to be any targeted offers for Autograph or Fairfield branded properties this time around.

Broadly speaking, these offers share similar terms and conditions which you’ll see when you add them to your targeted card(s):

- Each offer can be used once only so the $100 spending target will need to be made in a single transaction (which shouldn’t be tricky).

- Payment must be made directly with the merchant (3rd party bookings or buy now and pay later bookings will not trigger the rebates).

- The terms say that the deals are “valid in-store in the US only” and online at the brand’s US website.

Full terms and conditions can be found on the targeted promotion pages (please read them).

Quick thoughts

There’s nothing spectacular here, but with a minimum spending limit of just $100 on all of these deals, most people with stays at one or more of these brands should be able to use these offers to get some kind of rebate from their stay.

Also, with the maximum rebates set to trigger at between $430 and $750 of spending (depending on the offer), a lot of people should be able to max out one or more of these deals.

Keep in mind that these offers are valid one time only, so once you’ve made a payment with a card to which this offer has been saved, you can’t earn the rebate again with the same card.

It’s also worth noting that the terms suggest that these offers are restricted to bookings in the US only, but history tells us that this isn’t a term that’s always enforced. If you have an upcoming stay at a participating brand but the property is outside of the US, it may be worth trying to trigger the offer anyway as you may get lucky.

In better news, it looks like these offers are being targeted to a wide variety of Chase consumer cards (although I don’t appear to have them targeted to a Chase Marriott co-branded card), so there should be scope to use some of these offers multiple times just by adding them to different cards*.

*Unlike Amex, Chase doesn’t limit its offers to a single card. You can load the same offer to multiple cards (if multiple cards have been targeted) and use the offer once per card.

Related: 11 reasons to love the Chase Sapphire Preferred® Card

Bottom line

Chase is targeting select cardholders for savings of 10% on spending made at various Marriott brands in the next few weeks. The rebates on offer are capped at between $43 and $75, but if you have these offers targeted to multiple cards, you may be able to max-out the same offer more than once.

![Save on select IHG stays with this new Amex offer [Targeted] a view of a city from a window](https://travelingformiles.com/wp-content/uploads/2019/07/intercontinental-los-angeles-downtown-1-218x150.jpg)