TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrollment. For more details please see the disclosures found at the bottom of every page.

I’ve held the card_name since it was first introduced, but after a number of great years during which the card never left my wallet, it’s time for us to part ways. This has been a card that I’ve loved for most of the years that I’ve held it, but the simple fact is that when I take a look at all the other cards that I hold, I cannot justify its place in my portfolio. It has to go.

The plan

I love earning Ultimate Rewards Points so I’m not about to cancel the card outright. Instead, I shall be downgrading the card_name to the card_name (review).

The annual fee that I’ll have to pay will drop from annual_fees to annual_fees, I’ll get to keep the same account number, and thanks to the other cards in my portfolio, there’s not that much that I’ll be giving up.

How I’m replacing the card_name

Earnings

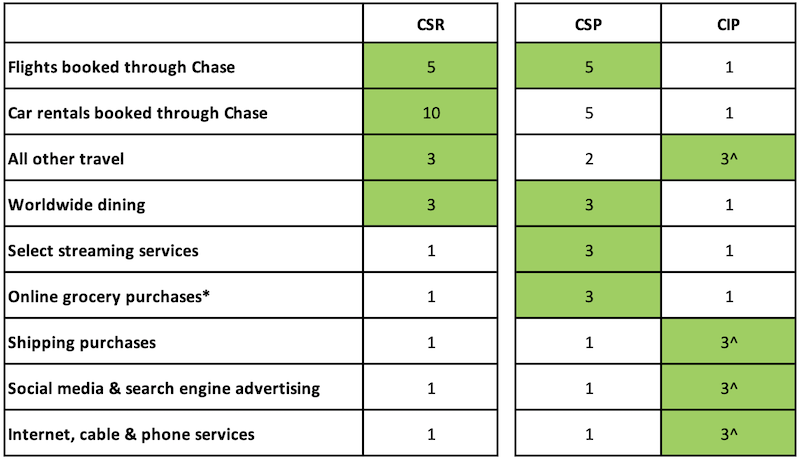

I already hold the card_name (review) and once I downgrade the card_name to the card_name, I’ll have a card paring that more than matches the earning rates that the card_name offers.

The only time when I would be better off having the card_name would be if I was booking a rental car through Chase, and as that isn’t something I’ve done more than once or twice in all the time that I’ve held the card, I don’t see this being an issue.

Key travel benefits

Priority Pass membership

As part of my credit card portfolio, I hold the Ritz-Carlton Credit Card (not open to new applicants) which gives me a Priority Pass membership just like the card_name. In fact, the Ritz-Carlton Card’s membership is actually better.

Firstly, the Ritz-Carlton Card allows me to add authorized users free of charge and each authorized user can have their own Priority Pass membership.

This beats the card_name, which charges a $75 annual fee for the same privilege.

Secondly, while the Priority Pass membership that comes with the card_name allows the member to bring two guests with them into the lounge, the membership offered by the Ritz-Carlton card comes with no guesting cap at all.

Global Entry/TSA PreCheck credit

My Ritz-Carlton credit card has me covered here too, and because I also hold the card_name (review) and the card_name (review) I still have enough Global Entry credits to cover the fees for Joanna and MJ’s memberships too.

Redeeming points through Chase

Holders of the card_name can redeem any Ultimate Rewards Points they earn at a rate of 1.5 cents/point when booking travel through the Chase Travel℠ portal, and this is one benefit that I’m not going to be able to replace fully.

By holding the card_name and the card_name I will still be able to redeem my points at a rate of 1.25 cents each should I wish to, but as no other card other than the card_name grants a redemption rate as high as 1.5 cents/point, I’m going to have to give up 0.25 cents/point every time I redeem through the UP portal.

Key travel insurances

An area in which the card_name is very strong is in the area of travel protections and insurances so this was something I looked at very closely before deciding that it was safe to downgrade to the card_name.

When booking any travel other than flights, I’ll mostly be using my card_name or my card_name as between them, they’ll cover me as well as the card_name for the following:

- Trip cancellation/interruption

- Rental car collision

- Lost luggage

- Baggage delay

They will not cover me as well as the card_name for trip delays, emergency evacuation, emergency medical and dental, or travel accident insurance, but as I don’t go on cruises (where better coverage in these areas may be useful) and as I’ve already suggested that I’ll be using a different card for flight bookings, this doesn’t really bother me.

If I’m booking airfares, I’ll be using card_name to pay for the flights (I like the 5 points/dollar the card offers me when I book directly with an airline – terms apply) and this card should serve me pretty well when it comes to covering for the card_name.

As far as the levels of cover go, the card_name will cover me just as well as the card_name for the following:

- Trip cancellation/interruption

- Trip delay

- Lost luggage

It will not cover me as well as the card_name for emergency medical and dental, baggage delay, or travel accident insurance, but it will offer me better emergency evacuation and transportation cover.

Yes, card_name requires me to put the full cost of my trip on the card to get all of these benefits while the card_name allows me to part-pay, and yes, it will not cover me on one-way bookings while the card_name will, but as neither of those issues has stopped me from using card_name for most of my flight bookings in the past few years, they’re not a reason to keep hold of the card_name now.

In fact, if I’m feeling particularly worried about a one-way booking (I rarely book one-way fares), I can always forgo the 5 points/dollar that the Platinum Card offers me and make the booking with my Ritz-Carlton card. That will cover me just as well as card_name.

Key shopping insurances

Return protection

The card_name covers cardholders for returns made within 90 days of purchase on items worth up to $500 with a maximum level of cover set at $1,000 per year.

Not a lot of cards offer a level of protection as good as this, but once again, my Ritz-Carlton Card will cover me just as well as the card_name when I’m buying something that I think I may need to return.

Extended warranty protection

This is another easy insurance policy to cover as most of the cards that I hold (other than cards issued by Citi) will cover me to the same extent as the card_name.

Bottom line

I have to admit that I really hoped that I’d find a reason to keep my card_name because I’ve developed an irrational attachment to it. I don’t know how or why this has happened – it may be down to the fact that it has been the one card never to leave my wallet in the past few years – but it’s something I have to ignore as the facts speak for themselves.

As long as I downgrade to the card_name, I’ll have enough good cards in my portfolio to cover most of what the card_name has been offering me, and as I can still justify holding all of the other cards I’ve mentioned, the card_name has to go.

![Earn 20,000 bonus Amex points on Air France/KLM bookings [Targeted] a row of seats in a plane](https://travelingformiles.com/wp-content/uploads/2024/03/air-france-new-business-class-2-741-356x220.jpg)

This only works if you do RT bookings (I never do because often I want to change one segment if the price drops or a better routing opens) and you have a RC card (which are not available anymore and also have high AF) to cover the PP restaurants.

I’m more likely to drop the Amex Plat which requires me to jump through too many hoops for nickel and dime credits, the lounge at SFO is always waitlisted, and no PP restaurants.

The Ritz-Carlton card isn’t available via a direct application, but there remains a workaround which allows people to get it so the card is still available.

what is process to get Ritz Carlton card? Yes? benefits?

I had CSR downgraded to CFU then applied for CSP since I had waited 48 months and got the 100k bonus.

MY biggest issue is Chase won’t increase my tiny credit limit of $60l so when I apply I must rearrange credit. DO not want anymore AMEX products and other good options?

Will this work with Chase British Airways VISA to then transfer to Ritz Carlton after one year? Not using AMEX products in future so looking for alternative ideas.

I too, am planning on downgrading my CSR, however, I am due to hit the 48 month mark since my initial sign up welcome bonus was deposited and curious of the strategy you would take if you were in my situation. Am I able to down to CSP and still receive a new welcome bonus or do I have to keep CSR to be eligible for welcome bonus. Thanks for your time.

Hi Nick

If you downgrade there’s no welcome bonus.

While you hold the CSR, you cannot get the welcome bonus on the Chase Sapphire Preferred as the card’s terms say the following:

“The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months. If you are an existing Sapphire customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change. You will not receive the new cardmember bonus if you change products.”

Thanks for the info. When the exact date of my points being deposited into my account occurs, do I contact chase asking for another welcome bonus or how does that process work exactly?

The only way to get a Chase welcome bonus is to open a new card that doesn’t have any restrictions attached to it. You don’t get a new welcome bonus after 48 months of holding the CSR.

As things stand, you can:

1) Keep your CSR and get a welcome bonus on any other Chase card other than the Sapphire Preferred

2) Downgrade your CSR to a Freedom Flex/Freedom Unlimited Card and then apply for a new Chase Sapphire Preferred Card (no earlier than 48 months after you got the CSR welcome bonus)

3) Cancel your CSR card and then apply for a new Chase Sapphire Preferred Card (no earlier than 48 months after you got the CSR welcome bonus)

Make sure you keep Chase’s 5/24 rule in mind when deciding if/when to apply for any cards.

I’m with you and plan to downgrade to CSP before my CSR renews next August. I considered it this year with the pathetic changes to the CSR and ending of the Doordash credits (plus Lyft Pink/Grubhub+ benefit). Thought I would hold it one year just to see if Chase made any changes since net of $250 is worth the wait IMHO ($300 travel reimbursement is a slam dunk).

I still have the CSR in my wallet but rarely use it. I use the Amex Platinum for flights and the offers (like the current 5x Amazon offer). For dining and groceries the Amex Gold gets me 4x so that is better than the 3x dining on the CSR. I only use it for misc travel (and on hotels where I get less value using one of my hotel branded cards which I basically carry for the free nights which cover the cost – even Amex Marriott at $495 has $300 back and a 50,000 certificate well worth $195). For unbonused spend I use Hilton Surpass to get to $15,000 spend for the free night (and 3x .5 or .6 cent, based on your value) isn’t that far below the value of a CSR point.

Outside of slightly better insurance the only thing my CSR offers is Priority Pass restaurants which aren’t covered by the Amex Priority Pass. However, with Amex’s greatly expanded lounge offerings I usually just hit that and also, IMHO, the Priority Pass restaurant benefit is overrated (none at my home airport which biases my opinion) and limited in nature with many constantly dropping the program.

In net it will be bye bye CSR before August unless Chase does something to improve the value.