TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. For more details please see the disclosures found at the bottom of every page.

Yesterday, I happened upon a scheduled Twitter chat that was covering the miles and points world and I watched as various contributors answered questions that were designed to give less experienced miles & points enthusiasts some ideas on how to get good value out of their balances. Usually, I ignore these kinds of chats but on this occasion, I watched this chat long enough to see a truly terrible bit of advice being handed out.

Question 8 in this chat was this one…

…and while it’s quite hard to give a definite answer to a question as broad as this within the limits that Twitter imposes, there are a variety of logical paths to go down if you choose to answer the “getting the most out of your travel points” part of the question.

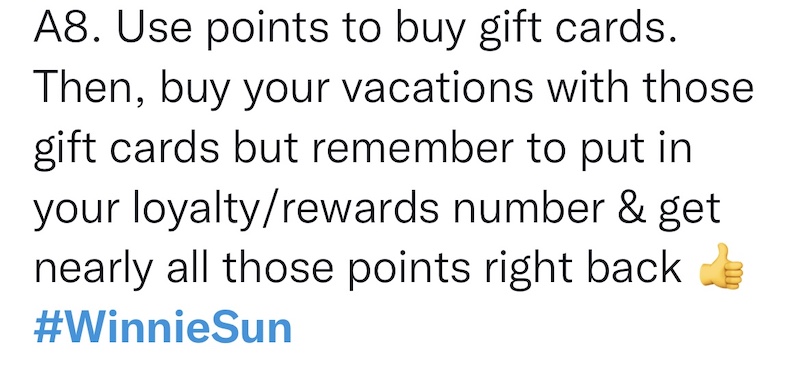

This, is not one of those logical paths:

It’s hard to know where to start with this suggestion, but I’ll give it a go.

I don’t know what points the Twitter user is suggesting we use to buy gift cards, but using points to buy gift cards is almost universally a very uneconomical use of points.

Presumably, the person who put forward this suggestion doesn’t think that we should be using hotel points to buy hotel gift cards or airline miles to buy airline gift cards, so that leaves me to conclude that this person thinks that currencies such as Chase Ultimate Rewards, Amex Membership Rewards, and Citi ThankYou points are the ones to use for gift card purchases.

Well, there’s quite a lot wrong with that.

Very limited travel options

Chase and Citi don’t offer very many travel-related gift card options so right away there’s an issue. If you plan to use either of these currencies, your booking options are incredibly limited.

Bad value

When you buy gift cards using most points currencies, you’re highly unlikely to get more than a penny per point in value, and that’s not an economical use of points.

With Citi and Chase, you’ll generally get about 1 cent per point when buying gift cards, and with Amex, you’ll usually get between 0.7 and 1.0 cents per point when buying travel-related gift cards and just 0.5 cents per point when buying Amex gift cards.

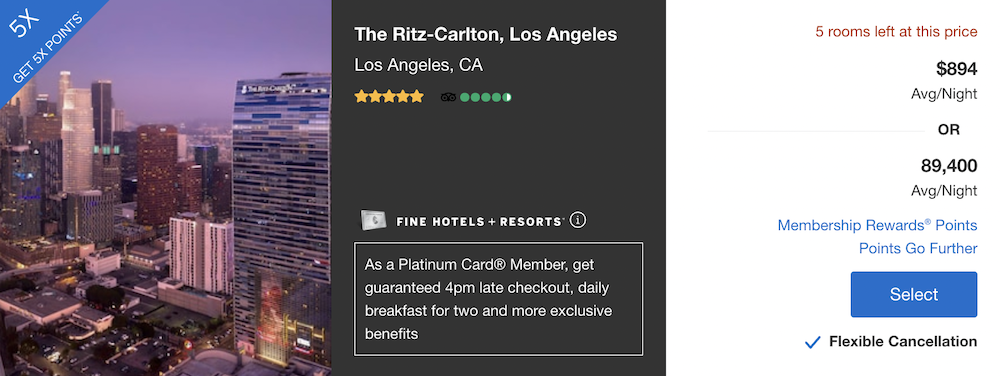

Considering you can use Chase Ultimate Rewards points to book travel through the Chase Travel℠ portal at 1.25 cents/point (1.5 cents/point if you have the Chase Sapphire Reserve Card) and considering you can book travel directly through Citi and Amex and get 1.0 cent/point in value, why would you bother going down the route of buying gift cards?

At this point, I could also point out that the points that we all love to collect are considerably more valuable when transferred over to various airline and hotel loyalty programs where they can easily offer 1.5 or 1.75 cents of value per point (sometimes a lot more than that), but I’m keeping things simple for the benefit of those who don’t want to mess around with award charts or another loyalty currency.

You may leave yourself without cover

If you use a gift card rather than a good travel-related credit card to buy travel, you’re giving up all the protections that the credit card offers. Gift cards don’t offer any consumer protection at all.

Sure, not all travel credit cards offer good insurances (Citi cards are terrible for this) and some cards will cover your trip even if you only part-pay with your card, but why throw in this extra layer of complexity into a travel booking when, as I’ve shown above, there’s no value to be had?

No, you won’t get “nearly all of those points right back”

Gift cards are a monetary instrument and so should be viewed in the same way as cash. With that in mind, ask yourself this: When was the last time you booked a trip with cash and got most of the cost of the trip back in points or miles?

I’m going to go ahead and guess that the answer that most people will give to that question is “never”.

Yes, during special events/sales there will be times when a great deal allows you to recuperate a lot of what you spend, but examples of such deals are few and far between and they’re certainly not the norm.

The idea that any loyalty program would set itself up to give back most of the value of a flight or stay in the form of points or miles is ridiculous regardless of how that flight or stay is paid for.

If this was actually true, not only would you be reading about ‘hacks’ like this every day on every miles and points blog, but you’d also see loyalty programs going bankrupt on a frequent basis.

Bottom line

Buying travel with a gift card can be an economical thing to do in very specific circumstances, but those circumstances don’t extend to gift cards purchased with points.

Buying gift cards with points is almost always a poor use of your hard-earned balances as the points that we all love to earn will get you more value when they’re used to book travel directly, or when they’re transferred over to another loyalty program and then used to book high-end stays or premium cabin flights.

Unless you’re clearing out a dormant account, please don’t use your points to buy gift cards. By doing so you’d be leaving a distressing amount of value on the table and that’s not how to make the most of the miles and points world.

Buy toaster w miles, sell toaster at a discount, buy flights