TravelingForMiles.com may receive commission from card issuers. Some or all of the card offers that appear on TravelingForMiles.com are from advertisers and may impact how and where card products appear on the site. TravelingForMiles.com does not include all card companies or all available card offers.

Some links to products and travel providers on this website will earn Traveling For Miles a commission that helps contribute to the running of the site. Traveling For Miles has partnered with CardRatings for our coverage of credit card products. Traveling For Miles and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply to all credit card welcome offers, earning rates and benefits and some credit card benefits will require enrolment. For more details please see the disclosures found at the bottom of every page.

Nowadays, an easy, almost lazy, way to criticise Hyatt is to complain about the size of its footprint compared to the large footprints enjoyed by Marriott, Hilton, and IHG. But that overlooks the fact that Hyatt has been working hard to add more and more properties to the World of Hyatt program, and that overall, it has been doing a pretty good job of expanding its footprint where it can.

In recent years, we’ve seen a significant number of Small Luxury Hotels (SLH) added to the World of Hyatt, we’re still seeing the integration of recently acquired properties into Hyatt’s all-inclusive portfolio, and we’ll soon see Mr & Mrs Smith properties being added to the World of Hyatt as well.

On top of all of that, Hyatt has a separate pipeline of hotels that it is hoping to open in the coming months and years, and should a good percentage of those plans come to fruition, the whole ‘it has a small footprint’ argument will start to carry less weight.

Amongst all that positivity, however, there is one rather big issue that needs to be addressed, and that issue involves Hyatt’s plans for expansion in the United States.

The Hyatt pipeline issue

If you look at Hyatt’s stated plans for new properties in Europe, Asia, Africa, and the Caribbean (you can see the proposed properties on this page), you’ll find that a lot of Hyatt’s full-service brands are well represented.

New Hyatt Regency properties seem to be planned for just about everywhere (let’s hope a lot of these actually open), new Andaz properties are on the way, a few new Park Hyatt properties are said to be planned, and when you add in the properties that look like they’ll fit into the Unbound Collection and the occasional Grand Hyatt that gets a mention, Hyatt’s long-term plans for properties outside of North America look solid.

From a World of Hyatt member’s point of view, however, things look a lot less promising when you look at the current pipeline of properties for the United States.

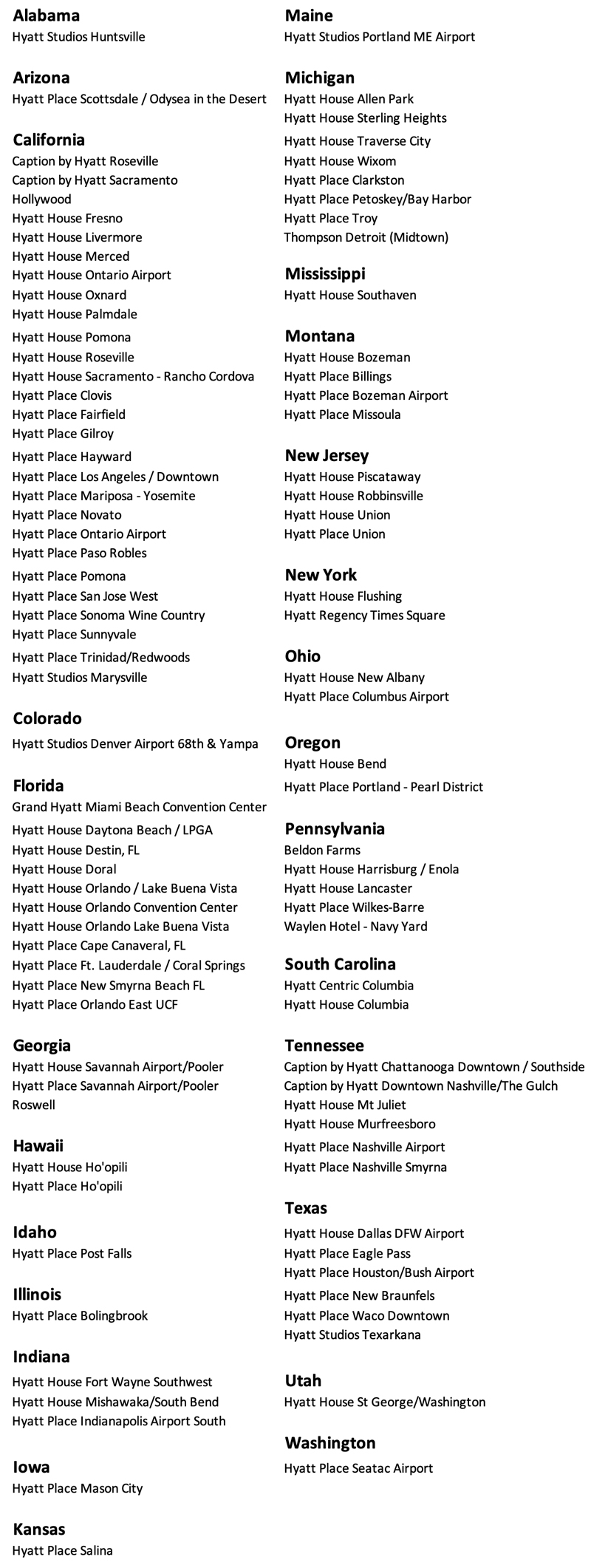

Here it is, broken down by state:

You can probably already see the issue that I’m about to point out (it’s hard to miss!) but let me state the obvious anyway.

The 98 properties that Hyatt’s pipeline page says are planned for the United States (correct at the time of writing) look like this when broken down by brand:

- Hyatt Place – 49

- Hyatt House – 38

- Caption by Hyatt – 4

- Hyatt Studios – 2

- Unknown brand* – 2

- Hyatt Centric – 1

- Grand Hyatt – 1

- Thompson – 1

*Probably Unbound Collection

Hyatt Place, Hyatt House, Hyatt Studios and Caption by Hyatt are all, in one way or another, limited-service brands, which means that not only do they not provide guests with a full suite of amenities, but they also don’t have to provide the full range of World of Hyatt benefits either (e.g. per the Hyatt rules Hyatt Place properties don’t have to upgrade top-tier Globalists).

A little incredibly, therefore, 95% of properties that Hyatt currently says that it would like to open in the United States will not have to provide all the services of a standard hotel and will not have to provide guests with all the standard World of Hyatt benefits either.

How can that be a good thing?

Yes, I know that the pipeline list is fluid, that a lot of the properties on that list won’t get opened, and that there’s probably another batch of properties that don’t yet appear on that list will eventually join the World of Hyatt … but this still, clearly, shows Hyatt’s intentions for North America (the Canada list doesn’t make for good reading either).

When people complain that Hyatt’s footprint isn’t large enough, they’re not suggesting that they don’t care what kind of properties Hyatt opens as long as it grows its portfolio.

Most World of Hyatt members want more full-service properties that will give them access to all the benefits that Hyatt says they’re entitled to, and not a stream of properties that, for the most part, can feel like dormitories for road warriors.

The problem here is clear – limited-service properties make more money for their owners (they’re usually cheaper to run that full service properties) and Hyatt knows that it can coax hotel owners into placing their properties under one of its brands if it can demonstrate that it’s keeping their costs down. Hence the ridiculous number of Hyatt Place/House properties currently showing in the pipeline.

But where does this end? Will Hyatt simply not bother opening/introducing more than a handful of full-service properties to the US market every year?

Right now, in the US, it feels like Hyatt is only looking at one side of the equation and by focusing on what potential new owners want and, apparently, not thinking about much else, it seems to be losing sight of what a large part of its US customer base actually wants.

That doesn’t sound like a very sound business model to me, but as I’m not in the hotel business and Hyatt is, perhaps I’m missing something.

I think you miss the point that these hotels are not owned by Hyatt, only operated by them. They do not dictate what type of hotel is built where. They need an owner to invest in the property and it is those owners who are deciding what type of the Hyatt brand that they want and where they will be built.

Oh I’m not missing the point. The point is that Hyatt appears to only be signing up owners who want to offer limited-service properties and not owners happy to offer anything more. A pipeline of 95% limited-service properties doesn’t really scream ‘premium hotelier’ does it?

This is very necessary. The people who complain the most about Hyatt’s footprint aren’t the ones looking for luxury hotels within the US. It’s the road warriors who can’t find a Hyatt at all in the far flung places they need to travel for work. I used to be one of them. There are plenty of Park Hyatts and Andaz locations in the major destination cities. Where hyatt has been lacking is the “decent” enough category that is dominated by Marriott and Hilton.

I’d stay at a Hyatt Place *any day of the week* before stepping into a Homewood Suites again.

I’m legitimately curious where the source for a statement like “Most World of Hyatt members want more full-service properties that will give them access to all the benefits that Hyatt says they’re entitled to, and not a stream of properties that, for the most part, can feel like dormitories for road warriors” is coming from. Any market research you want to share?

Frankly my experience is that Hyatt isn’t as good fit for my needs as it could be *precisely* because it’s much easier for me to find a Hampton Inn or Fairfield Inn or Holiday Inn Express where I need it to be than it is a Hyatt Place. (In fact that expansion list does add some Hyatt Place/Hyatt House coverage where I need it to be.)

Also, is business travel going to be back to the kind of levels required to support full-service hotels anytime soon?

https://www.cnbc.com/2023/04/24/is-business-travel-returning-no-and-its-not-going-to-say-studies-.html

https://www.forbes.com/sites/suzannerowankelleher/2023/04/24/business-travel-comeback/?sh=5e495ccf44b2

Seems to me that there’s more “shrimp and weenies” business travel and less “lobster and steak” than pre-pandemic… and there’s more demand for “dorms for road warriors” than full service business properties. I would also question if leisure demand is really enough to sustain full service if you’re talking about Hyatt Regency-style hotels vs. Hyatt Place/House. Yes, Globalists won’t get their comped suite upgrades and $8 bottles of Chardonnay and cheese and crackers in the Regency lounge. Operators see that as a blessing.

Sure there’s probably some luxury hotel stuff for high-income or aspirational travel Hyatt might want to drop in the pipeline, but this is actually something where Hyatt punches above their weight class compared to, say, Hilton, and where SLH/Mr and Mrs Smith will really help out here.

Basically I would argue the full service model of business hotel in the US is a dinosaur, and COVID-19 was the meteor that is taking it out. The mix is going more towards limited service (lower costs) + luxury (fat profit margins for stuff like spas and expensive room rates). Hyatt’s deficit in the US is more at the lower end than the higher.

Also note that some overseas markets haven’t gotten rid of as much business travel as US markets have, which explains the product mix being different outside the US.

Hyatt guests who put their heads in the beds are the commodity that Hyatt sells to the hotel owners whom partner with Hyatt to fly a Hyatt brand flag. Hyatt’s main customer is the hotel owners/investors, and those owners/investors are all about maximizing return on investment sooner than later in an environment where we heads in the beds are considered more easily replaced than hotel owners. Hyatt is presumably helping the hotel owners/investors to get a higher return on their investment by being Hyatt-affiliated — and getting a price premium that way — and by going for limited-service properties instead of full-service properties. Hyatt has become the tail on the dog, with the dog being led by the financial markets that guide hotel owners/operators to deploy their capital how they do with limited-service properties. I don’t like what it means for me as a Globalist, but I do understand why it is as it is with expansion plans.

I don’t think Hyatt is only focused on owner needs, it’s simply demand & supply!

The select service sector is where the demand is and has been for years. Even more so since CoVid when a lot of the services that differentiate a full service hotel were cut.

Select service is what the majority of people want, maybe not the majority of points travelers, but the majority of the market overall… and that’s what the hotel companies are supplying…

Assuming, however, that limited-service properties are what business travelers want and not leisure travelers (I have yet to meet a leisure traveler that wants their chosen hotel to provide fewer services), how does your theory that this is down to demand square with the fact that we keep being told that business travel is down and showing little sign of a recovery? Are you suggesting that leisure travelers are demanding more limited-service properties?

Extremely valid. My Globalist status that I intentionally work for year after year doesn’t get me anything at a Hyatt Place. I want more Hyatt RegencyHyatt/Grand Hyatt hotels where my hard-earned status means something.

Reminds me of the Courtyard by Marriott.

Some very valid points made here, after the covid, travelling has changed very much.

We used two Hyatt hotels in London (outskirts), actually a joint property. One side was Hyatt House and the other Hyatt Regency. Same front desk.

We tried both. Not a bad economical model.